Rajasthan Board RBSE Class 12 Accountancy Chapter 13 Application of Electronic Spreadsheet in Accounting

RBSE Class 12 Accountancy Chapter 13 Textbook Questions

RBSE Class 12 Accountancy Chapter 13 Multiple Choice Questions

Question 1.

Which function will be used to calculate the interest portion of on installment of loan :

(a) PPMT

(b) IPMT

(c) FAPM

(d) None of these

Answer :

(b)

Question 2.

Which formula to be used to get the sum total of cell A1, A2 and A3 :

(a) SUM = (A1 + A2 + A3)

(b) SUM = (A1, A2, A3)

(c) = SUM (A1 : A3)

(d) None of these

Answer :

(c)

![]()

Question 3.

Which of the following coordinates excel work book :

(a) Workbook

(b) Worksheet

(c) Chart

(d) Worksheet and chart

Answer :

(d)

Question 4.

For fixed the Raw and Column title in a worksheet, where by they don’t scroll, when spreadsheet is scrolled. What will be used in the following :

(a) Freeze pens command

(b) Unfreeze pens command

(c) Hold title command

(d) Marge command

Answer :

(a)

Question 5.

In windows at which place do we type values and formulae :

(a) In title toolbar

(b) Through smart screen menu command

(c) In formula bar

(d) In standard bar

Answer :

(c)

![]()

Question 6.

Data or formula can be copied by :

(a) Through cut, copy, paste command on the edit menu

(b) Through smart screen menu command

(c) Through buttons of standard toolbar

(d) All of the above

Answer :

(d)

Question 7.

Which of the following formula is incorrect :

(a) =(10 + 50)

(b) = (B7 x B1)

(c) = (B7 + 14)

(d) 14 + 15

Answer :

(d)

Question 8.

Which function will be used for calculation of fixed depreciation?

(a) SLN

(b) RRF

(c) DVD

(d) LTF

Answer :

Question 9.

What is the syntax, for calculation by diminishing balance method :

(a) = DB (Cost, salvage, life, 1)

(b) = FB (cost, 25, 1)

(c) = PFB (Cost, salvage, life)

(d) None of these

Answer :

(a)

Question 10.

Which of the following functions is used to calculate principal amount from instalment :

(a) RPT

(b) PMT

(c) PPMT

(d) IPMFT

Answer :

(c)

![]()

RBSE Class 12 Accountancy Chapter 13 Very Short Answer Questions

Question 1.

What is spreadsheet?

Answer.

A spreadsheet is a sheet of paper that shows accounting or other data in rows and columns. A spreadsheet also a computer application program that simulates a physical spreadsheet by capturing, displaying and manipulating data arranged in rows and column.

Question 2.

Write the syntax of PPMT function.

Answer.

The syntax of PPMT function :

= PPMT (rate/payment in a year, 1, year * payment in a year, amount)

Question 3.

What is the process of saving the file in a spreadsheet?

Answer.

To save a spreadsheet choose File > save as. In the file Name Box type the name of the file then click OK.

Question 4.

What is called cell and row?

Answer.

A cell is the intersection between a row and a column on a spreadsheet that starts with alt.

A row is a series of data banks laid out in a horizontal fashion in a table or spreadsheet.

Question 5.

The cost of 10 year life machine is Rs 5,00,000. Explain the calculation process of depreciation by spreadsheet.

Answer.

Cost of Machinery = Rs 5,00,000

Life of Machinery = 10 year

Assumed : Salvage value = Rs 1,000

= SLN (Bl, B2, B3)

then:

| A | B |

| Cost of Machine | 5,00,000 |

| Salvage | 1,000 |

| Life | 10 |

| Depreciation value | |

| Period | |

| 1 | 4,99,000 |

![]()

Question 6.

Explain the calculation of compound interest by example.

Answer.

Calculation of Monthly Compound Interest : In calculation of compound interest, interest calculated on amount of principal and interest. Formula will be :

Example: If Rs 10,000 invested for 10 year on the 5% compound interest. Interest is calculated on monthly.

Principal Amount x (1 + Interest/compounding period in year) A (Compounding period x years)

Show by following picture :

| B7 | fx = B2*(1 +B3/B4) ^ (B4*B5) | ||

| A | B | C | |

| 1 | |||

| 2 | Principal | 10,000 | |

| 3 | Annual Interest Rate | 5% | |

| 4 | Compounding Periods Per Year | 12 | |

| 5 | Years | 10 | |

| 6 | |||

| 7 | Amount Earned | 16,470 | |

| 8 | |||

| 9 | |||

RBSE Class 12 Accountancy Chapter 13 Short Answer Questions

Question 1.

Explain the basic elements of M.S. Excel.

Answer.

The basic elements of M.S. Excel are as follows :

- Work Book: Each file of excel is known as Work Book. There can be many work sheet in any work book. We can store information in an organised way in a single work book. A work book opens with their worksheet by default and maximum 255 worksheets can be there.

- Worksheet : Worksheet can be called a window made of rows and columns. It is used for financial document or project planning of an organisation. Worksheet is used with mouse so it is easy to format.

- Row: Row is a horizontal block made by cell. Which runs from left to right in a worksheet.

- Column: It is a vertical block of cells which runs in entire worksheet there are 16,384 columns in a worksheet.

- Cell: The smallest unit of Excel is called cell.

- Formula: It is a sequence of standard, name, cell references functions and operators entered in a cell which give a new value together.

- Function: Function’s are predefined formulas which makes sometimes complex calculations and for this it uses a particular value in a particular sequence to get a result.

![]()

Question 2.

Describe the key features of the spreadsheet.

Answer.

The following are the key features of spreadsheet:

- Many types of data can be managed and used in a large quantity.

- Data can be shown with the help of graph on chart.

- Data can be brought and sent in spreadsheet through software.

- Data’s calculation can be done speed.

- All calculation’s done by using the formula once.

- Spreadsheet can be used for different uses.

Question 3.

Explain the importance of spreadsheet in Accountancy.

Answer.

Importance and Uses of MS Excel Spreadsheet:

Microsoft Excel spreadsheet software has become an integral part of most business organisations across the world. MS Excel is used for various purposes by business establishments. Some organisations use this spreadsheet software for generating memos, track sales trends and other business data. Microsoft Excel spreadsheets software come with million rows of data and automate number crunching, but this popular spreadsheet software is capable of doing more than just figures. MS Excel has a simple interface that allows users to easily understand this software and also perform basic activities.

Ms Excel offers a grid interface that allows the users to organise any type of information that require. One of the major advantages of MS Excel spreadsheet software is its flexibility feature.

Question 4.

Differentiate a spreadsheet and work book.

Answer.

1. Spreadsheet is an electronic sheet. It is an electronic table divided in rows and columns which can be used for the following:

- to prepare a balance sheet

- to prepare profit and loss accounts

- to prepare charts and graphs

- to make quick calculations.

- self operated functions like addition, subtraction, multiplication, division and to find percentage.

![]()

2. Work Book: Each file of Excel is known as work book, there can be many work sheet in any work book. We can store the information in an organised way in a single work book. A work book open’s with three work sheets and maximum work sheet can be 255.

Question 5.

Explain the following functions with example :

(i) PMT

(ii) SUM

(iii) IPMT

Answer.

(i) PMT: The Excel PMT function calculates constant periodic payment require to pay of a loan with a constant interest rate over a specific period.

PMT (Rate/Payment in a year, 1 years * payment in a year amount)

Example: If interest rate is 10% and monthly installment is payable and loan amount is Rs 10,000 and payment period is 5 years. Then the calculation of principal amount is monthly installment will be calculated by this formula:

PMT (10/12, 5*12,10,000)

By this formula installment will be Rs 1291.37.

(ii) SUM : Organisations are added by this function. Here value, all address or cell range can be given. It can be understood in the following way with the help of spreadsheet:

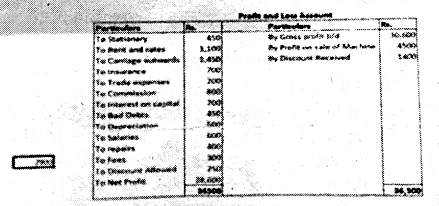

All items are related to salary from L5 to L7. The total in L19 = sum (L5 : L7) is shown. Expenses items are from G5 to G17 and total is shown in C16. Next to it pure profit’s calculation is done in G18 by deducting C16 from L19. Profit loss account is shown with the following diagram:

(iii) IPMT: It is sued to calculate interest during a specific period of a loan. It can be done by the following formula, in an example :

= IPMT (10/12; 1, 5 * 12, 1,00,000) = IPMT (B1)/B3, A7, B2*B3,B4)

Question 6.

Mahesh takes loan Rs 5,00,000 on the rate for 5% for purchase a car. Its paid in 10 year on the basis of quarterly. Calculate quarterly installment in spreadsheet.

Answer.

Interest = 5%, Principal = Time = 10 year.

| A | B | C | D |

| Loan Data | |||

| Principal Amt | 5,00,000 | ||

| Loan Term | 10 | = PMT (84/85,B3*4, – B2) | |

| Interest Rate | 5% | = 7,500 | |

| Payment for year | 4 | ||

| Installment |

RBSE Class 12 Accountancy Chapter 13 Other Important Questions

Question 1.

What is back stage view in Excel? State its main tasks.

Answer.

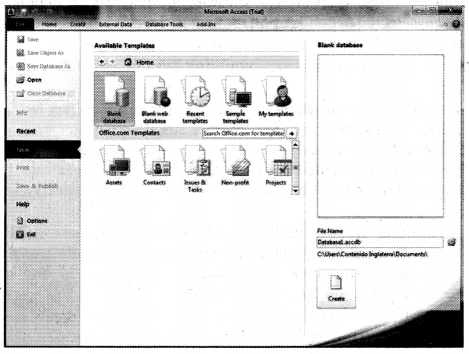

Back Stage View in Excel

The back stage view has been introduced in Excel 2010 and acts as the central place for managing your sheets. The backstage view helps in creating new sheets, saving and opening sheets, printing and sharing sheets and so on.

Getting to the back stage view is easy. Just click the file tab located in the upper left corner of the excel ribbon. If you already do not have any opened sheet then you will see a window listing down all the recently opened sheets. If you already have an opened sheet then it will display a window showing the details about the opened sheet as shown below. Back stage view shows three columns when you select most of the available options in the first column. First column of the back stage view will have the following options :

- Save : If an existing sheet is opened it would be saved as it is, otherwise, it will display a dialogue box asking for the sheet name.

- Save As : A dialogue box will be displayed asking for sheet name and sheet type. By default it will save in Sheet 2010 format with extension, xlsx.

- Open : This option is used to open an existing excel sheet.

- Info : This option displays the information about the opened sheet.

- Recent : This option lists down all the recently opened sheets.

- New : This option is used to open a new sheet.

- Print : This option is used to print an opened sheet.

- Save & Send : This option saves an opened sheet and displays options to send the sheet using email, etc.

- Help : You can use this option to get the required help about Excel 2010.

- Options : Use this option to set various options related to Excel 2010.

- Exit : Use this option to close the sheet and exit.