Rajasthan Board RBSE Class 12 Accountancy Chapter 2 Admission of a New Partner

RBSE Class 12 Accountancy Chapter 2 Textbook Questions

RBSE Class 12 Accountancy Chapter 2 Multiple Choice Questions

RBSE solutions for class 12 accountancy chapter 2 Question 1.

Super profit is :

(a) Normal Profit – Average Profit

(b) Average Profit – Normal Profit

(c) Normal Profit + Average Profit

(d) None of these

Answer.

(b)

RBSE solutions for class 12 accountancy chapter 2 in hindi Question 2.

A and B are equal partners with the capital of Rs 16,000 and Rs 12,000. C a new partner comes in for 1/4 share and brings capital Rs 15,000. Find the value of the firm’s goodwill.

(a)Rs 60,000

(b)Rs 11,200

(c)Rs 17,000

(d)Rs 43,000

Answer.

(c)

RBSE solutions for class 12 accountancy Question 3.

Total assets and liabilities of the firm are Rs 70,000 and Rs 10,000. Average profit is Rs 8,000. NRR 10%. Calculate super profit.

(a)Rs 1,000

(b)Rs 2,000

(c)Rs 3,000

(d)Rs 4,000

Answer.

(b)

RBSE solution class 12 accountancy Question 4.

For getting share in profits, a new partner brings :

(a) capital

(b) loan

(c) goodwill

(d) None of these

Answer.

(c)

RBSE solutions class 12 accountancy Question 5.

For getting share in assets of firm, a new partner brings :

(a) capital

(b) loan

(c) goodwill

(d) subsidy

Answer.

(a)

RBSE solutions for class 12 accountancy chapter 1 Question 6.

Nature of revaluation account is :

(a) personal Account

(b) nominal account

(c) real account

(d) None of these

Answer.

(b)

RBSE solutions for class 12 accountancy chapter 3 Question 7.

When the partners decide to change the value of assets and liabilities, then which account prepared is :

(a) revaluation account

(b) realization account

(c) memorandum revaluation

(d) none of these

Answer.

(a)

accounts class 12 RBSE solutions Question 8.

All undistributed losses are transferred to capital account of the old partners in the ratio of :

(a) new profit sharing ratio

(b) gaining ratio

(c) old profit sharing ratio

(d) sacrificing ratio

Answer.

(c)

RBSE solutions for class 12 english Question 9.

Nature of goodwill is

(a) cat goodwill

(b) dog goodwill

(c) rat goodwill

(d) all of them

Answer.

RBSE solutions for class 12 accountancy chapter 5 Question 10.

A and B are partners sharing profit in ratio of 2 : 1. They admit C for 1/3 share in profits, then sacrificing ratio of A and B is :

(a) 2:3

(b) 1:2

(c) 2:1

(d) 1:1

Answer.

(c)

RBSE Class 12 Accountancy Chapter 2 Very Short Answer Questions

RBSE solutions for class 12 maths chapter 2 Question 1.

In which ratio amount of goodwill is divided among the old partners when new partner brings cash for goodwill?

Answer.

In sacrifice Ratio.

RBSE solution class 12th accountancy Question 2.

Write one difference between super profit and average profit.

Answer.

Super profit is calculated by deducting of general profit from average profit difference called super profit. While average profit calculated average of some year profit (Less Loss).

RBSE solutions accountancy class 12 Question 3.

What is meant by reconstitution of partnership?

Answer.

Reconstitution of a partnership firm under which existing agreement comes to an end once a new one comes into existence called reconstitution of partnership firm.

RBSE solutions 12th accounts Question 4.

What is the nature of revaluation account?

Answer.

Revaluation accounts nature is real account.

RBSE solutions for class 12 accountancy chapter 7 Question 5.

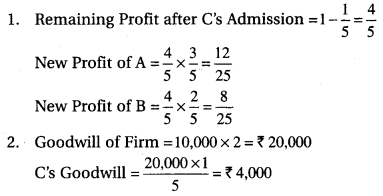

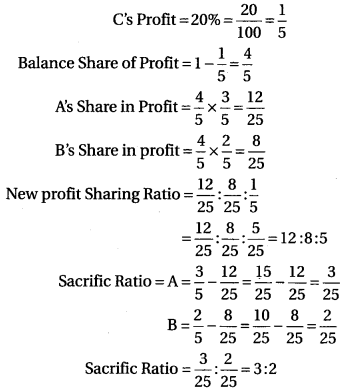

A and B are partners in a firm, sharing profits in the ratio of 3 : 2. C is admitted for 20% share in profits of the firm. Calculate new profit sharing ratio and sacrificing ratio.

Answer.

A and b are performs is a firm sharing profits in the Ratio of 3 : 2. C is admitted for 20% share in profits of the firm. Calculate New profit sharing Ratio and sacrifice Ratio.

RBSE class 12th accounts solution Question 6.

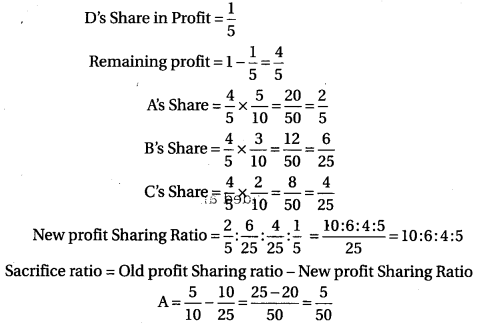

A, B and C are partners in a firm, sharing profits in the ratio of 5 : 3 : 2. D is admitted for 1/5th share in profits of the firm. Calculate new profit sharing ratio and sacrificing ratio.

Answer.

solution of accountancy class 12 RBSE Question 7.

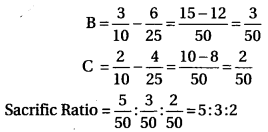

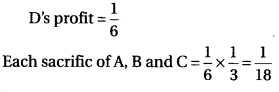

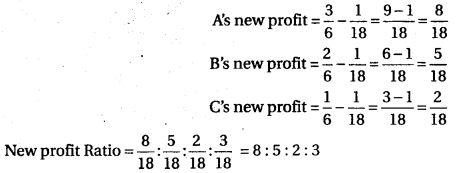

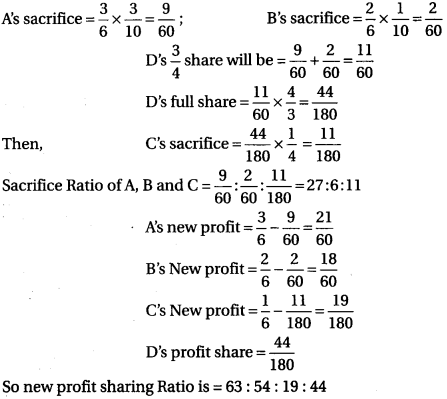

A, B and C are partners in a firm, sharing profits in the ratio of 3/6 : 2/6 : 1/6. D is admitted for 1/6th share in profits of the firm. Calculate new profit sharing ratio and sacrificing ratio.

Answer.

accounts solutions class 12 RBSE Question 8.

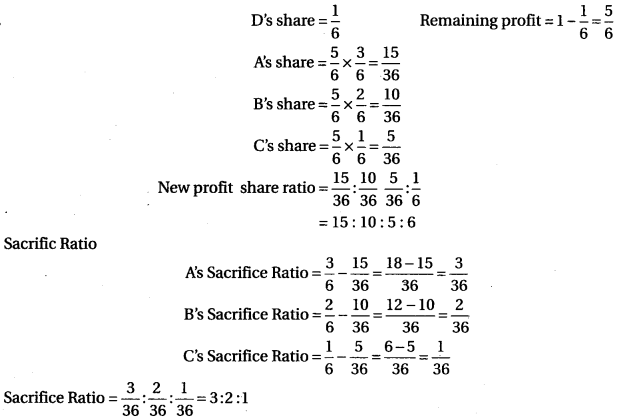

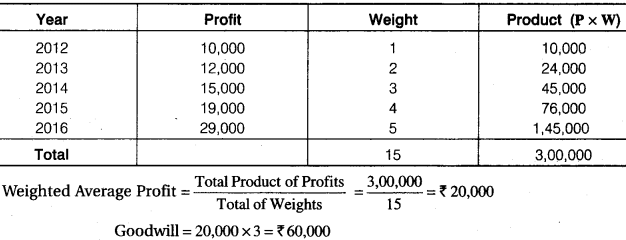

A and B are partners in a firm, sharing profits of the firm. C is admitted for 1/4th share in profits of the firm. Calculate new profit sharing ratio and sacrificing ratio.

Answer.

class 12 accountancy chapter 2 solutions Question 9.

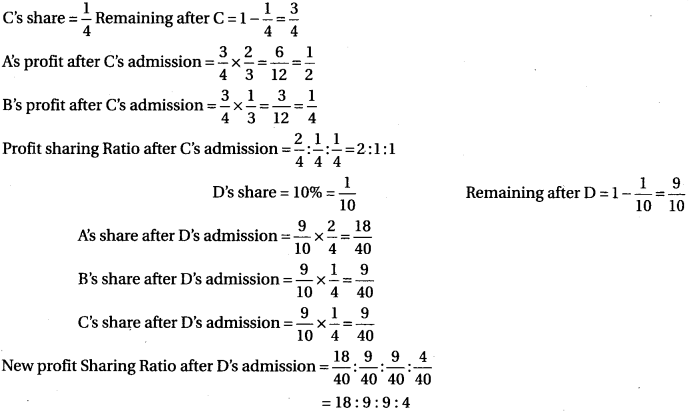

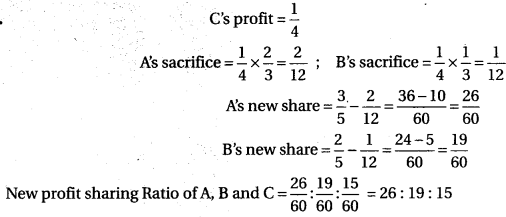

A and B are partners in a firm, sharing profits in the ratio of 2 : 1. C is admitted for 1/4th share in profits of the firm. After admission of C, D is admitted for 10% share in profits of the firm. Find new profit sharing ratio after admission of D.

Answer.

accountancy class 12 chapter 2 Question 10.

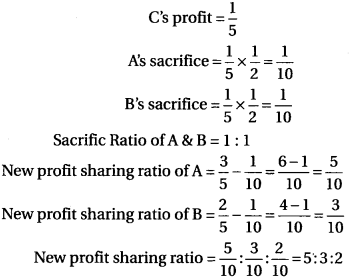

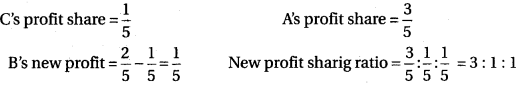

A and B are partners in a firm, sharing profits in the ratio of 3 : 2. C is admitted for 1/5th share in profits of the firm which he acquired in equal proportions from both A and B. Calculate new profit sharing ratio and sacrificing ratio.

Answer.

class 12 accountancy chapter 2 solution Question 11.

A, B and C are partners in a firm, sharing profits in the ratio of 3 : 2 : 1. D is admitted for 1/6th share in profits of the firm which he acquired in equal proportions from A, B and C. Calculate new profit sharing ratio.

Answer.

class 12 chapter 2 accounts solutions Question 12.

A and B are partners in a firm, sharing profits in the ratio of 3 : 2. C is admitted for 1/4th share in profits of the firm which he acquired from A and B in the ratio of 2 : 1. Calculate new profit sharing ratio.

Answer.

RBSE solutions for class 12 maths Question 13.

A and B are partners in a firm, sharing profits in the ratio of 3 : 2. C is admitted for 1/5th share in profits of the firm which he acquired entirely from B. Calculate new profit sharing ratio.

Answer.

class 12 maths RBSE solutions Question 14.

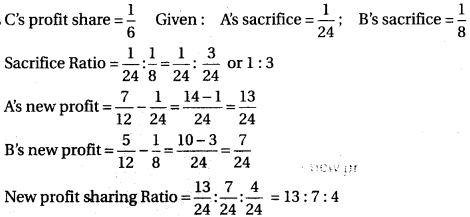

A and B are partners in a firm, sharing profits in the ratio of 7 : 5. C is admitted for 1/6th share in profits of the firm. C acquires 1/24 from A and 1/8 from B. Calculate new profit sharing ratio and sacrificing ratio.

Answer.

maths RBSE solutions class 12 Question 15.

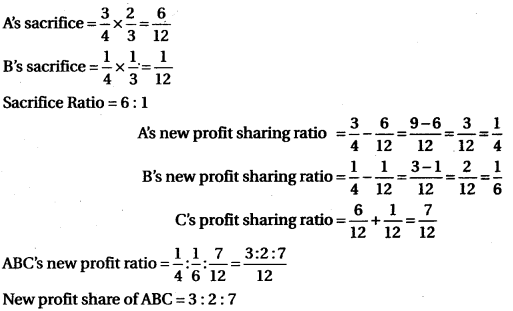

A and B are partners in a firm, sharing profits in the ratio of 3 : 1. A new partner C is admitted, A surrenders 2/3 of his share and B surrenders 1/3 of his share in favor of C. Calculate new profit sharing ratio and sacrificing ratio.

Answer.

RBSE solutions class 12 maths Question 16.

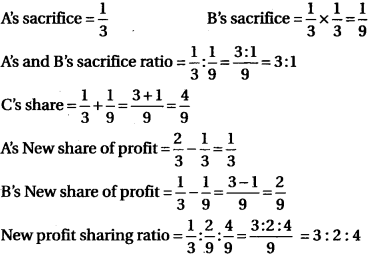

A and B are partners in a firm, sharing profits in the ratio of 2 : 1. A new partner C is admitted. A surrenders 1/3 from his share and B surrenders 1/3 of his share in favor of C. Calculate new profit sharing ratio and sacrificing ratio.

Answer.

RBSE solution class 12 maths Question 17.

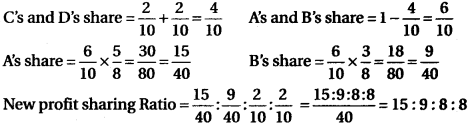

A, B and C are partners in a firm, sharing profits in the ratio of 5 : 3 : 2. D is admitted for 2/10 share in profits of the firm. C will retain his original share. Calculate new profit sharing ratio.

Answer.

RBSE solutions for class 12 Question 18.

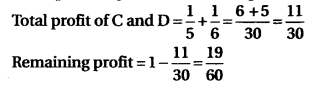

A and B are partners in a firm, sharing profits. They admitted C and D for 1/5th and 1/6th shares in profits respectively. Calculate new profit sharing ratio.

Answer.

RBSE solutions for class 12th accountancy Question 19.

A, B and C are partners in a firm, sharing profits in the ratio of 3 : 2 : 1. D is admitted as a new partner. D acquires 1/4 of his share from C and A surrenders 3/10 of his share and B surrenders 1/10 of his share for D’s share. Calculate new profit sharing ratio and sacrificing ratio.

Answer.

RBSE Class 12 Accountancy Chapter 2 Short Answer Questions

RBSE solutions for class 12 commerce Question 1.

Sate the rights acquired by a newly admitted partner.

Answer.

- To get profit share in the firm: New or incoming partner is entitled to share of the firms profit.

- To get share in firm’s assets: At the dissolution of firm new partner is also entitled to get share in the total assets of the firm.

class 12 accountancy RBSE solutions Question 2.

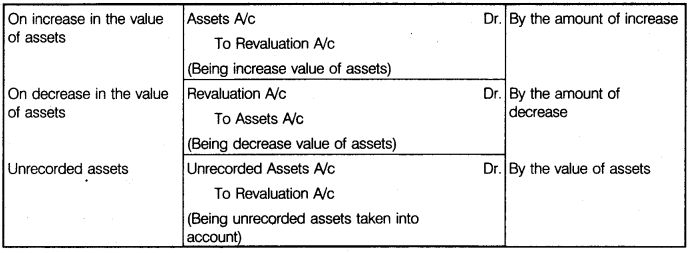

Why profit and loss adjustment account or revaluation account is prepared?

Answer.

Revaluation of assets and liabilities is done with the help of a new account called “Revaluation Account.” Sometimes, this account is called as “Profit and Loss adjustment account”. This account is a nominal account in nature. Therefore, if there is a loss due to revaluation, revaluation account is debited and if the revaluation results in a profit, the revaluation account is credited.

RBSE solutions class 12 Question 3.

Goodwill of the firm is valued at three years purchase of average profits of last five years.

The firm earned the following profits during last five years Rs 30,000, Rs 25,000, Rs 40,000, Rs 35,000, Rs 20,000. Calculate the value of goodwill of the firm.

Solution.

Average Profit = \(\frac { 30,000 + 25,000 + 40,000 + 35,000 + 20,000 }{ 5 }\) = \(\frac { 1,50,000 }{ 5 }\) = Rs 30,000

Goodwill = Average Profit x No. of Years Purchased = 30,000 x 3 = Rs 90,000

revaluation account format class 12 Question 4.

Goodwill of the firm is valued at two years purchase of average profits of last four years. The firm earned the following profits during last four years 2013 – Rs 10,000, 2014 – Rs 16,000, 2015 – Rs 6,000 (Loss), 2016 – Rs 12,000. Calculate the value of goodwill of the firm.

Solution

Average Profit = \(\frac { 10,000 + 16,000 – 6,000 + 12,000 }{ 4 }\) = \(\frac { 32,000 }{ 4 }\)

= Rs 8,000

Goodwill = 8000 x 2

= Rs 16000

RBSE solutions maths class 12 Question 5.

Profits of the firm for last four years

2013 – Rs 20,000 (including Rs 4,000 speculative profits)

2014 – Loss Rs 2,000 (after charging an abnormal loss of Rs 16,000)

2015 – Rs 17,000 (closing stock overvalued by Rs 2,000).

2016 – Rs 19,000 (including profit on sale of machine Rs 2,000)

Calculate goodwill of the firm is valued three times of average profits of last four years.

Solution

Average Profit = \(\frac { 16,000 + 14,000 – 17,000 + 17,000 }{ 4 }\) = \(\frac { 64,000 }{ 4 }\)

= Rs 16,000

Goodwill = 16000 x 3

= Rs 48,000

12 RBSE solutions Question 6.

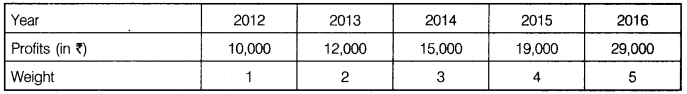

Profits of the firm for last five years

Calculate value of goodwill on the basis of three years’ purchase of weighted average profits.

Solution.

RBSE solutions for class 12 accountancy chapter 4 Question 7.

Capital of the firm is Rs 2,00,000. Normal rate of return is 10% and average profit of the firm is Rs 30,000. Goodwill is to be valued at three years’ purchase of super profits.

Solution.

Normal Profit = Capital Employed x Normal Rate of Return

= 2,00,000 x \(\frac { 10 }{ 100 }\) = Rs 20,000

Average Profit = Rs 30,000

Super Profit = Average Profit – Normal Profit

Super Profit = 30,000 – 20,000 = Rs 10,000

Goodwill = Super Profit x No. of Year’s Purchase

= 10,000 x 3 = Rs 30,000

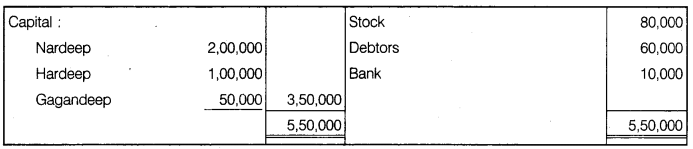

RBSE solutions for class 12 accounts Question 8.

Capital of the firm is Rs 1,80,000. Average profit of the firm is Rs 24,000. Normal rate of return is 12%. Calculate value of goodwill by capitalization method.

Solution.

![]()

Goodwill = Capitalized Value of Profits – Capital Employed

= 2,00,000 – 1,80,000

= Rs 20,000

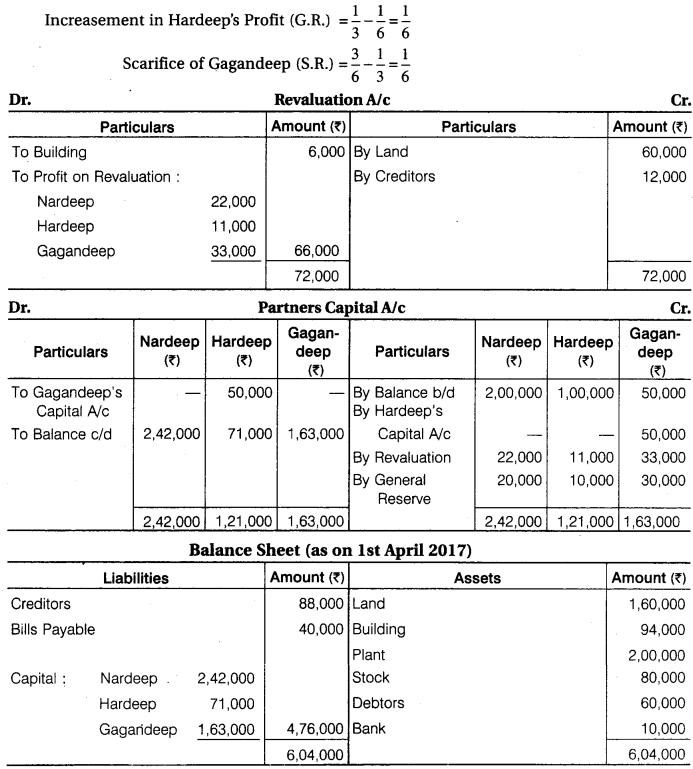

RBSE solutions of class 12 maths Question 9.

A and B are partners in a firm. Capital employed of the firm is Rs 5,00,000. Normal rate of return is 10% and average profit of the firm is Rs 80,000. Salary of each partner is Rs 8,000 p.a. Calculate value of goodwill according to capitalization of super profit method.

Solution.

Average Profit = 80,000

NRR = \(\frac { 5,00,000 \times 10 }{ 100 }\) = 50,000

Actual Average Profit = 80,000 – 16,000 (Partners Salary) = 64,000

Super Profit = 64,000 – 50,000 = 14,000

![]()

RBSE solution maths class 12 Question 10.

Adjusted capital of X and Y is Rs 30,000 and Rs 25,000 respectively. Z brings in Rs 25,000 as capital for 1/4 share of profits in the firm. Calculate value of goodwill.

Solution.

Total capital of firm on the basis of Z’s capital = \(\frac { 25,000 \times 4 }{ 1 }\) = Rs 1,00,000

Goodwill of the Firm = Total Capital – Old Partner’s Adjustment Capital – Z’s capital

= 1,00,000 – 55,000 – 25,000

= 1,00,000 – 80,000

= Rs 20,000

So, goodwill is Rs 20,000.

RBSE solution class 12 english Question 11.

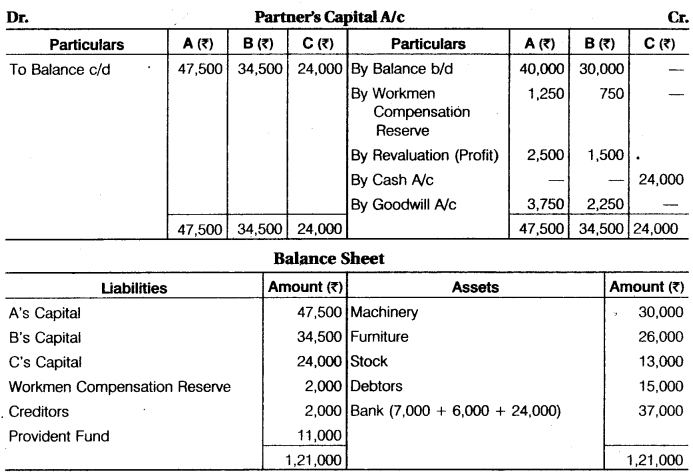

Balance of Capital account of A and B were Rs 40,000 and Rs 30,000 respectively. For the year ended 31-12-2016. Balance of general reserve stood at Rs 20,000. C is admitted on 01-01-2017 for 1/3rd share in profits. C brings in Rs 50,000 for his share of capital. Calculate value of goodwill.

Solution.

Adjusted capital of old partner = 40,000 + 30,000 + 20,000 (General Reserve) = Rs 90,000

Total capital of firm on the Basis of C’s capital = \(\frac { 50,000 \times 3 }{ 1 }\) = 1,50,000

Goodwill = 1,50,000 – 90,000 – 50,000 = Rs 10,000

RBSE solution class 12 commerce Question 12.

Super Profit of a firm is Rs 10,000. The present value of an annuity of Rs 1 for five years at 10% per annum may taken at 3.791. Find the value of goodwill of the firm.

Solution.

Goodwill = Super Profit x Present Value of Annuity

= 10,000 x 3 • 791

= Rs 37,910

Question 13.

Purchase consideration of a business is determined at Rs 3,50,000. Assets were Rs 4,00,000 and liabilities worth Rs 80,000. Find the value of goodwill of the firm.

Solution.

Net Asset = Assets – Liabilities = 4,00,000 – 80,000 = Rs 3,20,000

Goodwill = Purchase Consideration – Net Assets = 3,50,000 – 3,20,000 = Rs 30,000

Question 14.

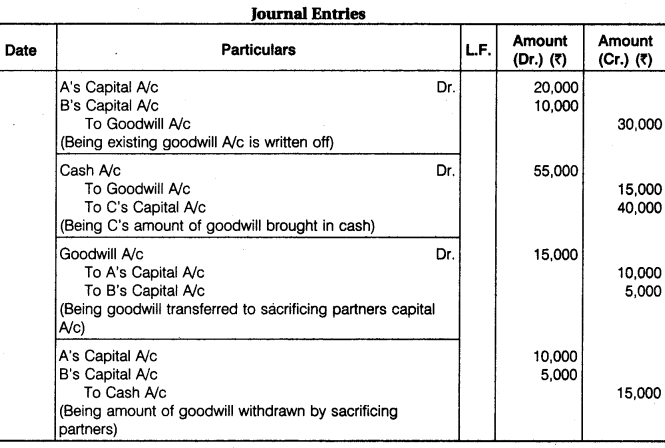

A and B are partners in a firm, sharing profits in the ratio of 2 : 1. They admitted C as a new partner. C brought in Rs 40,000 for his share of capital and Rs 15,000 as goodwill for 1/6th share in profits of the firm. Goodwill withdrawn by A and B from the firm. On C’s admission goodwill appeared in the books of the firm at Rs 30,000. Record necessary journal entries.

Solution.

Remaining profit After ‘C’ = \(1-\frac { 1 }{ 6 }\) = \(\frac { 5 }{ 6 }\)

A’s and B’s Sacrifice Ratio = 2:1

Question 15.

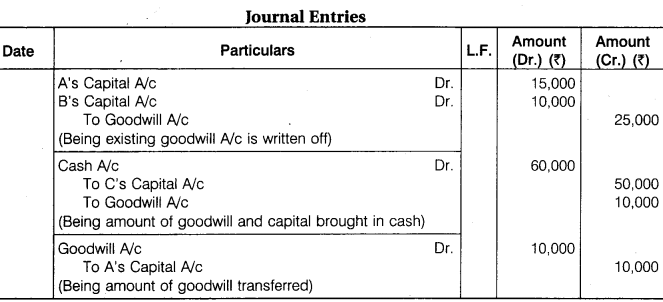

A and B are partners in a firm, sharing profits in the ratio of 3 : 2. They admitted G as a new partner for 1/5th share in profits of the firm. C acquires his entire share from A. C brought in Rs 50,000 as his capital and Rs 10,000 as goodwill. On C’s admission goodwill appeared in the books of the firm at Rs 25,000. Record necessary journal entries.

Solution.

A’s Sacrifice = \(\frac { 1 }{ 5 }\)

New profit of A = \(\frac { 3 }{ 5 } -\frac { 1 }{ 5 } =\frac { 2 }{ 5 } \)

Question 16.

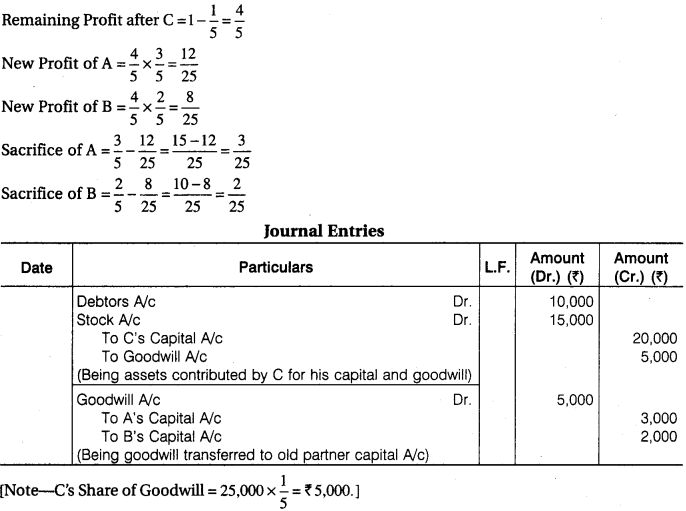

A and B are partners in a firm sharing profits in the ratio of 3 : 2. They admitted C as a new partner for 1/5th share in profits of the firm. On the date of C’s admission goodwill was valued at Rs 25,000. C contributed the following assets to his capital and his share of goodwill. Debtors Rs 10,000 and Stock Rs 15,000. Record necessary journal entries.

Solution.

Question 17.

A, B and C are partners in a firm sharing profits in the ratio of 3 : 2 : 1. They admitted D as a new partner for 1/7th share in profits of the firm. D brought in Rs 1,00,000 as his capital and Rs 45,000 as goodwill. Record necessary journal entries.

Solution.

In this position Old Profit Share Ratio and Sacrifice Ratio will equal.

Cash A/c Dr. 1,45,000

To D’s Capital A/c 1,00,000

To Goodwill A/c 45,000

(Being amount of capital out goodwill brought in cash)

Goodwill A/c Dr. 45,000

To A’s Capital A/c

To B’s Capital A/c

To C’s Capital A/c

(Being goodwill transferred to old partners capital a/c)

Question 18.

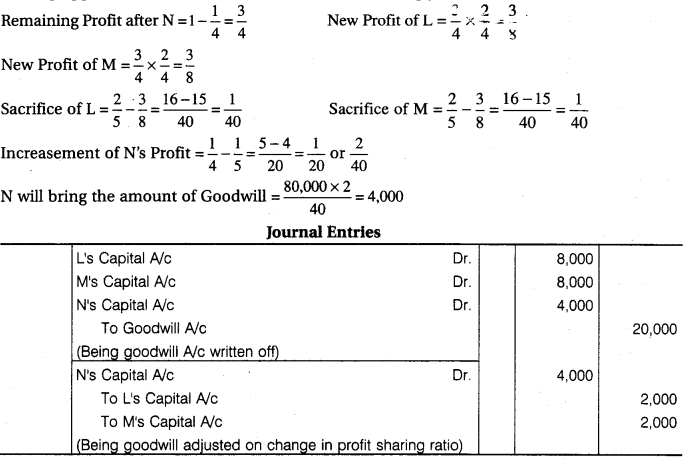

L, M and N are partners in a firm sharing profits in the ratio of 2 : 2 : 1. They decided that N will get 1/4th share in future profit. Goodwill of the firm was valued Rs 80,000. Goodwill already appeared in the books Rs 20,000. Pass necessary journal entries.

Solution.

Question 19.

X, Y and Z were partners sharing profits in the ratio of 5 : 3 : 2. They decided to share future profits in the ratio of 2 : 3 : 5 with effect from 01-04-2017. They decide to record the effect of the following without affecting their book value.

1. Profit and Loss A/c Rs 24,000,

2. Advertisement Suspense A/c Rs 12,000.

Pass the necessary adjustment entry.

Solution.

It means Y’s share of Profit No Change and Sacrifice of X is equal to gain to Z = \(\frac { 3 }{ 10 }\)

Total Amount of Adjustment = 24,000 + 12,000 = 36,000

Z’s Share = \(\frac { 36,000 \times 3 }{ 10 }\) = 10,800

Z’s share received before = 36,000 x \(\frac { 2 }{ 10 }\) = Rs 7,200

Difference amount = 3,600

Journal Entry

Z’s Capital A/c Dr. 3,600

To X’s Capital A/c 3,600

(Being adjustment made)

RBSE Class 12 Accountancy Chapter 2 Essay Type Questions

Question 1.

What is meant by admission of a partner? Explain and illustrate the different methods of calculation of goodwill.

Answer.

Admission of Partner : Admission of a partner means new partner being admitted in the firm.

Methods of calculation of goodwill : The different methods of calculation of goodwill are:

1. Year’s purchase method :

(i) Average Profit Base

(A) Simple Average Method : Actual average profits of past few years earned by the firm called Future Maintainable Profit or Expected Profits.

Points to be Noted :

(a) if net profit&show an Increasing or decreasing trend, calculate weighted, average in place of simple average.

(b) income from non-trading investments should be deducted from net profits.

(c) Abnormal profit of any year, say profit on sale of land or speculation profit should be deducted from the profit of that year.

(d) Abnormal loss or abnormal expenses should be added in net profit.

(e) Fair remuneration of the proprietor is also to be deducted from average profits.

After making above adjustments such adjusted profits should be considered for valuation of goodwill. These are called Average Maintainable Profits.

Average Profit = \(\frac { Total\quad adjusted\quad profits }{ No.of\quad year } \)

Actual average profit = Average profit – Remuneration of partners

Goodwill = Actual average profit x No. of years purchases

Example :

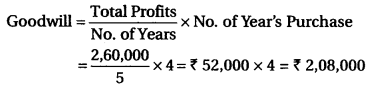

Calculate the amount of goodwill at four year’s purchase of the last five year’s average profit. The profits of the last five year were Rs 40,000, Rs 50,000, Rs 60,000, Rs 50,000 and Rs 60,000.

Solution.

Total profits for five years = 40,000 + 50,000 + 60,000 + 50,000 + 60,000 = Rs 2,60,000

Now,

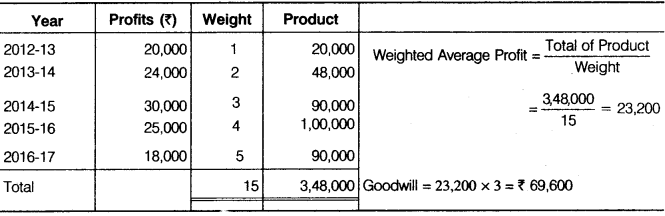

(B) Weighted Average Profit : Under the weighted average profit method, each year’s profit is multiplied by the number of assigned weights, i.e., 1, 2, 3, 4 etc. and the value is ascertained. The products are added and divided by the total of weights to arrive at the average profit. The weighted average profit so arrived at multiplied by the agreed “Number of years’ purchase to arrive at the value of goodwill.”

Weighted Average Profit = \(\frac { Total\quad Products\quad of\quad profits }{ No.of\quad year } \)

Goodwill = Weighted Average Profit x Agreed Number of Years’ Purchase

It may be noted that more weightage is assigned to the recent profits because it represents profits for the latest year and it is likely that in the following years same trend will continue. This method is considered better than the simple average profit method because it gives more weightage to the profits of recent years. This method is particularly effective when the profits show a rising or falling trend.

Example:

The profits of a firm for last 5 years were as follows :

Calculate the Value of goodwill on the basis of ‘Three years’. Purchase of Weighted Average Profit based on weights 1,2,3,4 and 5 respectively to the profits for 2012-13,2013-14,2014-15, 2015-16 and 2016-17.

Solution.

(ii) Super Profit Base: Excess of annual profit or future maintainable profit over normal profit of a business is called Super Profit.

Super Profit = Average Profit – Normal Profit

Method of calculating average profit has already been described. In order to find out normal profit of a business, following two important points are necessary to be known:

- Capital inverted in the business during the year.

- Normal rate of return keeping in view the profit and rate of interest available in the similar type of business.

Normal profits are calculated by implementing this rate of return on capital invested.

Hence, the following step by step procedure is adopted to compute the super profit of the firm.

(a) First of all calculate annual average profit (future maintainable profit).

(b) Calculation of Normal Profit = \(\frac { Capital\quad Invested\quad \times \quad Normal\quad Rate\quad of\quad Return }{ 100 } \)

(c) Super Profit = Average Profit – Normal Profit

Capital employed = Assets employed – Outside Liabilities

Normal rate of return = Rate of Interest + Risk Factor

Goodwill = Super profit x No. of year purchase

Example :

A partnership firm earned net profits during the last five years as follows:

1st year Rs 45,000

2nd year Rs 50,000

3rd year Rs 55,000

4th year Rs 70,000

5th year Rs 80,000

The capital investment of the firm is Rs 5,00,000. A fair return on the capital having regard to the risk involved is 8%. Calculate the value of goodwill on the basis of 3 years purchase of average super profits earned during the above mentioned period.

Solution.

Actual Average Profit of 5 years = \(\frac { Rs 45,000 + Rs 50,000 + Rs 55,000 + Rs 70,000 + Rs 80,000 }{ 5 }\)

= \(\frac { Rs 3,00,000 }{ 5 }\)

= Rs 60,000

Normal Profit = Rs 5,00,000 x \(\frac { 8 }{ 10 }\) = Rs 40,000

Super Profit = Rs 60,000 – Rs 40,000 = Rs 20,000

Goodwill = Super Profit x No. of Years Purchase

= Rs 20,000 x 3 = Rs 60,000

2. Capitalization Method:

Under this method, goodwill can be calculated in two ways :

(i) By capitalizing the average profit

(ii) By capitalizing the super profit

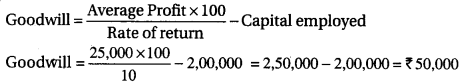

(i) Capitalizing the Average Profit Method: Under this method, first of all we calculate the average profit and then we assess the capital needed for earning such average profit on the basis of normal rate of return. Such capital is also called Capitalized Value of Average Profit. It is calculated as under.

Capitalized Value of Average Profit = Average Profit x \(\frac { 100 }{ Normal\quad Rate\quad of\quad Return } \)

Goodwill = Capitalized Value of Profit – Capital Employed

Example :

Average profit of a firm is Rs 25,000 and capital is Rs 2,00,000. Normal rate of return is 10% calculate the value of goodwill by capitalization of average profit method.

Solution.

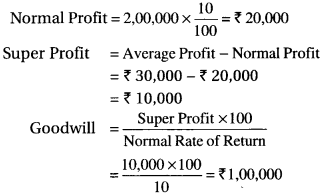

(ii) Capitalization of Super Profit Method : Under this method, first of all we calculate the super profit and then we assess the capital needed for earning such super profit on the basis of normal rate of return. Such capital is actually the amount of goodwill. Following formula is used to calculate goodwill:

Goodwill = Super Profit x \(\frac { 100 }{ Normal\quad Rate\quad of\quad Return } \)

Super profits are calculated in the same manner as calculated in super profit method.

Example :

Rama Brothers earn an Average Profit of Rs 30,000 with a capital of Rs 2,00,000. The normal rate of return in the business is 10%. Using capitalization of Super Profits Method work out the value of goodwill of the firm.

Solution.

3. Hidden Goodwill Method:

Sometimes, the value of goodwill is hidden in the question. In such cases, the amount of goodwill is calculated on the basis of total capital of the firm and the profit sharing ratio of the partners.

Example :

A and B are partner in a firm. Their capital account balance is Rs 15,000 and 25,000. Undistributed reserve is Rs 10,000 in Balance Sheet. C admitted as a new partner he brings Rs 25,000 as a capital. Calculate the goodwill amount from the above information.

Solution.

Total capital on the Basis of C’s capital

= 25,000 x \(\frac { 4 }{ 1 }\) = Rs 1,00,000

Adjusted capital of A and B = (15,000 + 5,000)+(25,000 + 5,000) = Rs 50,000

C’s Capital = 25,000

Goodwill of firm = 1,00,000 – (50,000 + 25,000) = Rs 25,000

Goodwill = Rs 25,000

4. Purchase Consideration Method :

In this method, purchasing of the business purchase consideration is surplus from Net Assets (Assets – Liabilities) value thats called goodwill:

Goodwill = Purchase consideration – Net Assets

Net Assets = Assets – Liabilities

Example :

In a business their are Rs 3,00,000 of assets and Rs 75,000 of liabilities. Purchase consideration was fixed on Rs 2,60,000. What will be value of goodwill.

Solution.

Net Assets = Assets – Liabilities

= 3,00,000 – 75,000 = Rs 2,25,000

Goodwill = Purchase consideration – Net Assets

= 2,60,000 – 2,25,000 = Rs 35,000

Goodwill = Rs 35,000

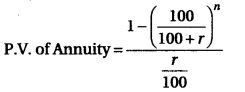

5. Annuity Method:

Under this method present value of an annuity is calculate for a fixed period and on fixed rate of interest. Present value may be calculated with the help of annuity tables. Following formula may also be used :

r stands for annual rate of interest,

n stands for number of years.

Example :

Average profit = Rs 40,000, Capital employed = Rs 2,00,000 Normal rate of return = 10%, present value = Rs 2.487 Calculate value of goodwill by Annuity Method

Solution.

Normal Profit = Capital Employed x N.R.R.

= 2,00,000 x \(\frac { 10 }{ 100 }\) = Rs 20,000

Super profit = Average Profit – Normal Profit

= 40,000 – 20,000 = Rs 20,000

Goodwill = 20,000 x 2.487 = Rs 49,740

Question 2.

What is revaluation account? Why is it prepared? What entries are passed for revaluation of assets and re-assessment of liabilities of admission of a new partner?

Answer.

Revaluation of Assets and Reassessment of Liabilities

Whenever a new partner is admitted, it becomes necessary to revalue the assets and liabilities of the firm to their true and fair values. This is done because with the passage of time, the value of certain assets might have increased, while the value of certain other assets might have decreased. Thus, the actual value of various assets and liabilities may be different from the values stated in the balance sheet. New partner should not suffer because of reduction in the value of assets nor should he be benefited by increase in the value of assets. Thus, the entire profit or loss arising from revaluation is divided between the old partners in their old profit sharing ratio.

Revaluation of assets and liabilities is done with the help of a new account called “Revaluation Account”. Sometimes, this account is called as “Profit and Loss Adjustment Account”. This account is a nominal account in nature. Therefore, if there is a loss due to revaluation, revaluation account is debited and if the revaluation results in a profit, the revaluation account is credited.

Following entries are passed for the purpose of revaluation:

Question 3.

What problems occur at the time of admission of a new partner, for which what adjustments are made? Explain.

Answer.

Adjustments Required on the Admission of a Partner: The adjustments required on admission of partner are:

- Determining new profit sharing ratio

- Goodwill

- Adjustment of profit/loss arising from revaluation of assets and reassessment of liabilities

- Adjustment of accumulated profits reserves and losses

- Adjustment of capital (if agreed)

Calculation of New Profit Sharing Ratio and Sacrificing Ratio : New or incoming partner is entitled to share future profits of the firm. In effect there is a change in the old profit sharing ratio.

Since, new or incoming partner acquires his share from old partners, therefore, it is necessary to determine new profit sharing ratio and also sacrificing ratio.

New Profit Sharing Ratio : New profit sharing ratio is the ratio in which all partners including new or incoming partner share future profits and losses of the firm.

Sacrifice Ratio: Whenever there is an admission of a new partner, old partners have to surrender some of their old shares in favor of the new partner. The ratio in which they surrender their profits is called Sacrifice Ratio. Goodwill is paid to the old partners in their sacrifice ratio because the goodwill is the amount of compensation to be paid by the new partner to the old partner for acquiring the share of profits which they have surrendered in favor of the new partner.

Calculation : Sacrifice Ratio = Old Ratio – New Ratio

Goodwill: Goodwill is nothing more then the probability that the old customers will resort to the old place. Goodwill is the present value of a firm anticipated excess earnings. It is attributable to the reputation which is acquired by an undertaking operating successfully.

Revaluation of Assets and Reassessment of Liabilities: Whenever a new partner is admitted, it becomes necessary to revalue the assets and liabilities of the firm to their true and fair values. This is done because with the passage of time, the value of certain assets might have increased, while the value of certain other assets might have decreased. Thus, the actual value of various assets and liabilities may be different from the values stated in the balance sheet. New partner should not suffer because of reduction in the value of assets nor should he be benefited by increase in the value of assets. Thus, the entire profit or loss arising from revaluation is divided between the old partners in their old profit sharing ratio.

Revaluation of assets and liabilities is done with the help of a new account called “Revaluation Account’’. Sometimes, this account is called as “Profit and Loss Adjustment Account”. This account is a nominal account in nature. Therefore, if there is a loss due to revaluation, revaluation account is debited and if the revaluation results in a profit, the revaluation account is credited.

Accounting Treatment of Reserves and Accumulated Profits or Losses : At the time of admission, if there is any general reserve, reserve fund or the balance of profit and loss account appearing in the balance sheet, it must be transferred to old partners’ capital account in their old profit sharing ratio. The new partner is not entitled to any share of such reserves or profits as these are undistributed profits earned by the old partners. For this purpose, the following journal entries are recorded

(i) For Distributing Reserves and Accumulated Profits

General Reserve A/ c Dr.

Reserve Fund A/c Dr.

Profit and Loss A/c (Credit Balance) Dr.

To Old Partners’ Capital or Current A/c

(ii) For Distributing Accumulated Losses Among Old Partners in Old Ratio : If there is any balance of P&L account appearing on the assets side of the balance sheet, the capital account of old partners are debited from the amount of this loss. The entry will be:

Old Partners’ Capital or Current A/c Dr.

To Profit and Loss A/c (Debit Balance)

(iii) For Distributing Surplus of Specific Reserves : The firm may have created some specific reserves like “Workmen’s Compensation Reserve” or “Investment Fluctuation Reserve” to meet certain future obligations. At the time of admission of a new partner, such reserves may be in excess of actual obligations.

Such excess reserves will be transferred to capital account of old partners in old ratio. The entry will be

Workmen’s Compensation Reserve A/ c Dr.

Investment Fluctuation Reserve A/ c Dr.

To Old Partners’ Capital or Current A/c

Entries for transferring the reserves and accumulated profits or losses must be passed even if the question is silent on this point.

Employee’s provident fund or employee’s saving account appearing on the liabilities side of the balance sheet are not distributed among old partners as they are not reserves but are the outside liabilities payable by the firm.

Adjustment of Capital:

- Adjustment of capital of old partners on the basis of new partners’ capital.

- Adjustment of new partner’s capital on the basis of old partners’ adjusted capital.

1. Adjustment of Old Partners’ Capital on the Basis of Capital of New Partner

- Calculate new profit sharing ratio of all partners.

- Find out total capital of the firm on the basis of new partners’ capital and his share of profit.

- Total capital.be divided in new profit sharing ratio.

- Excess capital of old partner, if any be withdrawn in cash deficiency be brought in cash or record the same as provided in the question.

2. Determination of Share of Capital of New Partner on the Basis of Capitals of Old Partners

- Find out old partners’ capital balance after making all adjustments regarding revaluation of assets and liabilities, share of goodwill brought in by new partner distributing undistributed profit and losses etc.

- Thereafter, find out residual share of profit after new partner’s share. For example, \(1-\frac { 1 }{ 4 }\)

= \(\frac { 3 }{ 4 }\) share of old partners as per above example. - Then, find out the total capital of the firm on the basis of combined adjusted capital of the old partners and their share of profit.

- New partners’ capital = Total capital of the firm x His share in profit

Question 4.

What is memorandum revaluation account? Flow does it differ from revaluation account?

Answer.

When assets and liabilities of old firm are to be shown at old value not at revalued figures memorandum revaluation account is prepared. It is a kind of statement which is prepared in two parts. In the first part, the entries regarding increase or decrease in the value of assets and liabilities are recorded. The resultant profit or loss is transferred to old partner’s capital account in old profit sharing ratio. Thereafter the entries passed are reversed in the second part of this statement. The resultant profit or loss in second part is transferred to capital account of all partners including the new partner’s in new profit sharing ratio.

Following entries passed in this condition:

In the Profit on Revaluation

1. Memorandum Revaluation A/c Dr.

To Old Partners Capital A/c

(Being profit on revaluation transferred to old partners’ capital account)

2. All partners capital A/c Dr.

To Memorandum Revaluation A/c

(Being memorandum revaluation account closed by transferring to capital account)

Instead of Both Entries one entry can pass.

3. All Partner’s Capital A/c Dr.

To Old Partner’s Capital A/c (Adjustment on revaluation made)

In case of Loss on Revaluation:

4. Old Partners Capital A/c Dr.

To Memorandum Revaluation A/c (Being loss on revaluation transferred)

5. Memorandum Revaluation A/c Dr.

To All Partners’ Capital A/c

(Being memorandum revaluation account closed)

Instead of Both Entries one entry can pass.

Old Partner’s Capital A/c Dr.

To All Partner’s Capital A/c

(Adjustment on revaluation made)

Difference between Memorandum Revaluation A/c and Revaluation A/c

| S.No. | Memorandum Revaluation | Revaluation Account |

| (1) | In this account assets and liabilities are not shown on new value. | In this account, assets and liabilities are shown on revalued value. |

| (2) | This account made only distribution of revaluation profit or loss. | This account made for effect of revaluation of assets and liabilities profit and loss distribution. |

Question 5.

State the treatment of goodwill at the time of admission of a new partner as per Accounting Indian AS-26/Indian AS-38.

Answer.

Goodwill: Goodwill is not a tangible asset like other physical assets of the business. It cannot be seen but can be felt only. It has no form. So, it is an “Intangible Asset”. It is very difficult to define it. Every businessman tries to establish his goodwill because it enables him to earn more profits. Goodwill is nothing more than the probability that the old customers will resort to the old place. Goodwill is the present value of a firm’s anticipated excess earnings. It is attributable to the reputation which is acquired by an undertaking operating successfully.

Accounting Treatment of Goodwill:

1. When the Amount of Goodwill is Paid Privately to the Old Partners: When the new partners pays the amount of goodwill in cash to the old partners privately outside the business, no entries are required to be passed. Its not an appropriate method, in which goodwill is paid privately and no entry is passed in the books of the firm because in case of any dispute arises in future, there is no any evidence that a partners had paid goodwill to the old partners.

2. When the New Partner Bring Goodwill (Premium) in Cash

(i) Bring goodwill in cash

Cash A/c Dr.

To Goodwill A/c

(Being amount of goodwill brought in cash)

(ii) The amount of goodwill will be credited to old partners in their sacrifice ratio

Goodwill A/c Dr.

To Sacrificing Partners’ Capital A/c

(Being amount of goodwill transferred to sacrificing partners’ capital account)

(iii) If the above amount of goodwill is withdrawn by old partners

Sacrificing Partners’ Capital A/c Dr.

To Cash A/c

(Being amount of goodwill withdrawn by sacrificing partners)

3. When the New Partner Does Not Bring His Share of Goodwill In Cash

New Partner’s Current A/c Dr.

To Sacrificing Partners’ Capital A/c

(Being share of goodwill of new partner is adjusted through capital acccount)

4. When New Partner Brings His Share of Goodwill in Part

(i) Amount of goodwill brought in cash

Cash A/c Dr.

To Goodwill A/c

(Being amount of goodwill brought in cash)

(ii) Amount of goodwill is transferred to sacrificing partners’ capital account

Goodwill A/c Dr. (in cash)

New Partner’s Current A/c Dr. (not cash)

To Sacrificing Partners’ Current A/c

(Being amount of goodwill is transferred to sacrificing partners’ capital account)

5. When New Partner Brings His Share of Goodwill in the Form of Assets

(i) Bring assets for share of goodwill

Assets A/c Dr.

To Goodwill A/c

(Being assets contribute by new partner for his share of goodwill)

(ii) Goodwill transferred to sacrificing partners’ capital account

Goodwill A/c Dr.

To Sacrificing Partners’ Capital A/c

(Being goodwill transfer to sacrificing partners’ capital account)

6. Accounting Treatment of Hidden Goodwill

New Partner’s Current A/c Dr.

To Sacrificing Partners’ Capital A/c

(Being amount of goodwill adjusted through sacrificing partners’ capital account)

7. Adjusted Goodwill Due to Change in Profit Sharing Ratio

Gaining Partners’ Current A/c Dr.

To Sacrificing Partners’ Capital A/c

(Being adjustment goodwill due to change in profit sharing ratio)

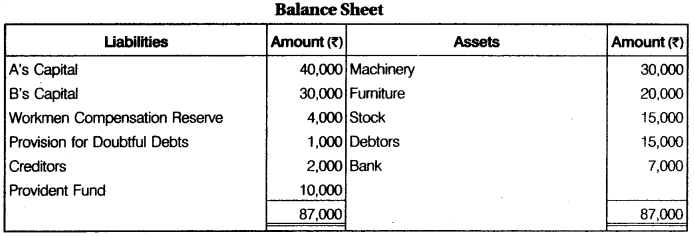

RBSE Class 12 Accountancy Chapter 2 Numerical Questions

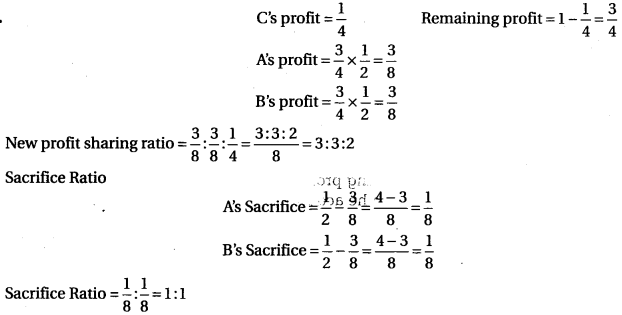

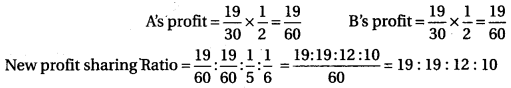

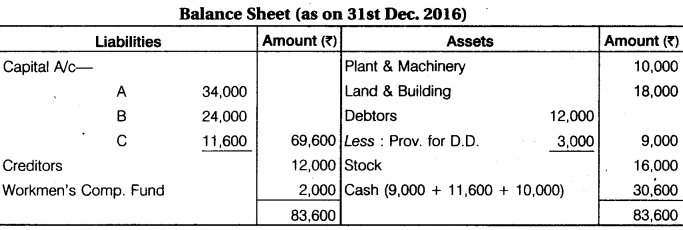

Question 1.

A and B are partners, sharing profits in the ratio of 3 : 1. They admit C for l/4th share in profits of the firm. Goodwill of the firm is valued at Rs 40,000 on the date of admission of C. Pass Journal Entries in the following cases :

(a) C pays for his share of goodwill privately to A and B,

(b) C brings his share of goodwill in cash,

(c) C brings his share of goodwill in cash. A and B withdrawn half of the goodwill,

(d) C brings Rs 6,000 in cash out of his share of goodwill,

(e) C is unable to bring his share of goodwill in cash.

Solution.

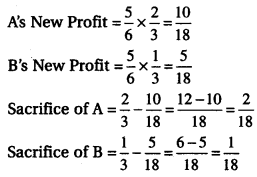

C’s share in profit = \(\frac { 1 }{ 4 }\)

Remaining profit after C = \(\frac { 3 }{ 4 }\)

![]()

Sacrifice Ratio of A and B = 3:1

New Profit Sharing Ratio of A, B and C = 9:3:4

(a) Goodwill paid to proviately so no entry will be pass in form’s book.

(b) (i) Cash A/c Dr. 10,000

To Goodwill A/c 10,000

(Being amount of goodwill brought in cash)

(ii) Goodwill A/c Dr. 10,000

To A’s Capital A/c 7,500

To B’s Capital A/c 2,500

(Being goodwill transferred to sacrificing partners capital a/c)

(c) (i) Cash A/c Dr. 10,000

To Goodwill A/c 10,000

(Being amount of goodwill brought in cash)

(ii) Goodwill A/c Dr. 10,000

To A’s Capital A/c 7,500

To B’s Capital A/c 2,500

(Being goodwill transferred to sacrificing partners capital A/c)

(iii) A’s Capital A/c Dr. 3,750

B’s Capital A/c Dr. 1,250

To Cash A/c 5,000

(Being \(\frac { 1 }{ 2 }\) amount of goodwill withdrawn by sacrificing partners)

(d) (i) Cash A/c Dr. 6,000

To Goodwill A/c 6,000

(Being amount of goodwill brought in cash)

(ii) Goodwill A/ c Dr. 6,000

C’s current A/c Dr. 4,000

To A’s Capital A/c 7,500

To B’s Capital A/c 2,500

(Being goodwill transferred to sacrificing partners capital A/c)

(e) C’s current A/c Dr. 10,000

To A’s Capital A/c 7,500

To B’s Capital A/c 2,500

(Being share of goodwill of new partners is adjusted)

Question 2.

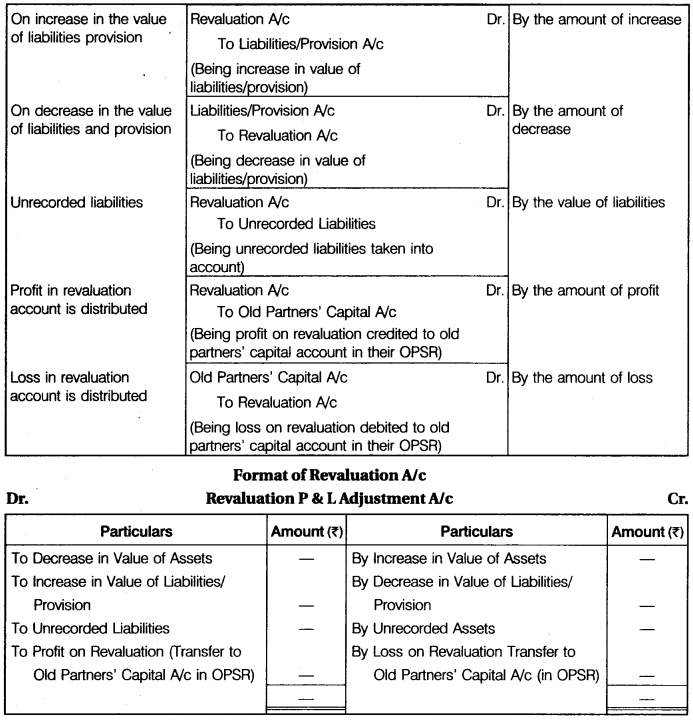

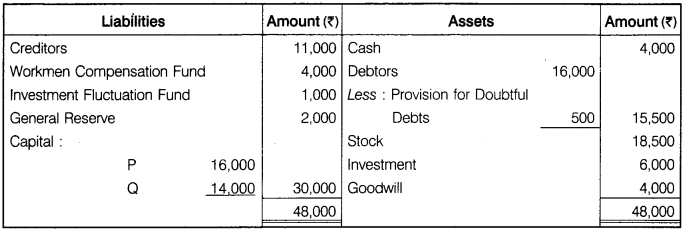

A and B shares the profits of a business in the ratio of 5 : 3. They admitted C into the firm for 1/4th share in profits which is to be contributed equally by A and B. On the date of admission of C, the balance sheet of the firm was as follows

Terms of C’s admission were as follows :

- C will bring Rs 30,000 for his share of capital and goodwill. Half of the goodwill shall be withdrawn by the old partners,

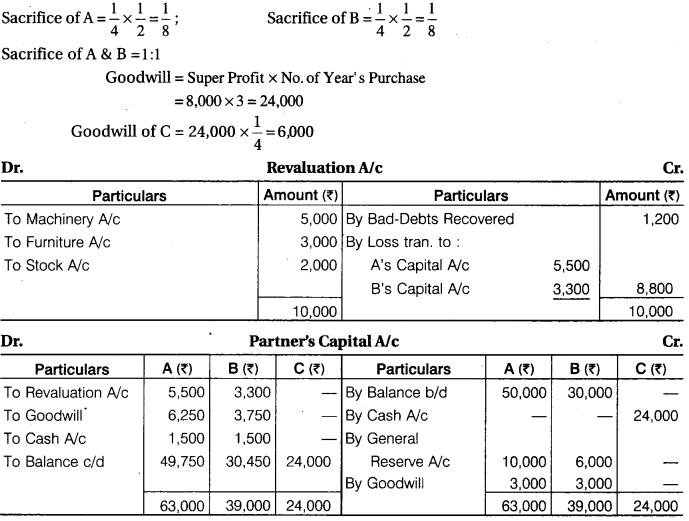

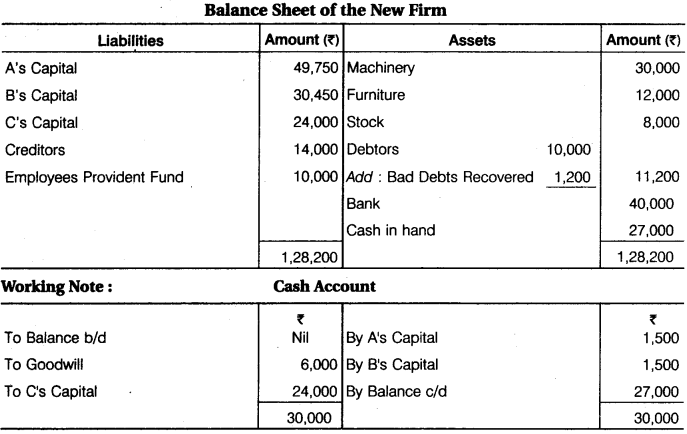

- Goodwill of the firm has been valued at 3 years purchase of the super profit Rs 8,000.

- Machinery, furniture and stock are revalued at Rs 30,000, Rs 12,000 and Rs 8,000 respectively,

- An old customer whose account was written off as bad debts has promised to pay Rs 1,200.

From the above prepare Revaluation, Account, Partners, Capital Account and Balance Sheet of the new firm. If it has been agreed that assets and liabilities are to be shown at old values. Prepare Memorandum Revaluation Account, Partners’ Capital Account and Balance Sheet.

Solution.

If assets & liabilities are shown on the basis of old values then accounts will be made as follows:

Question 3.

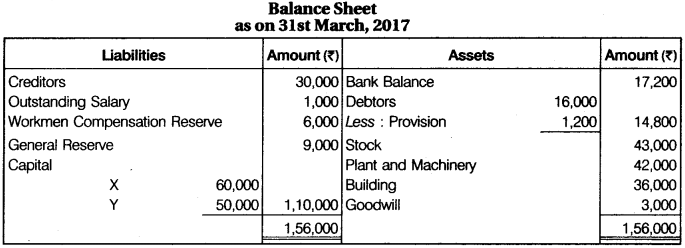

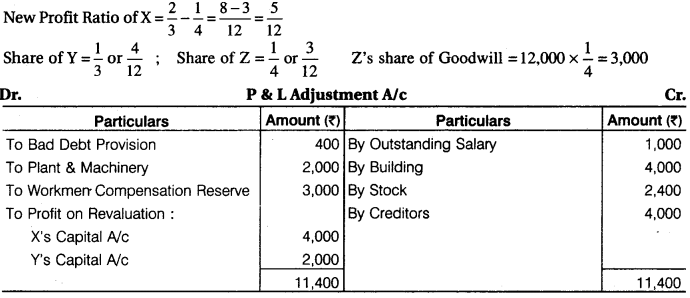

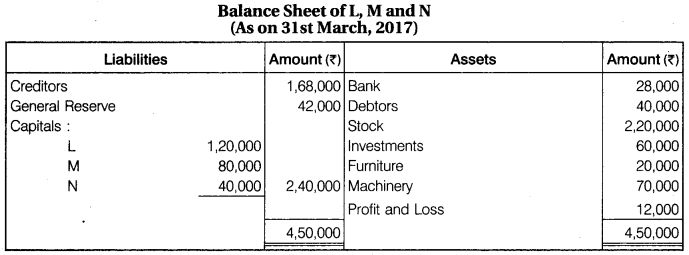

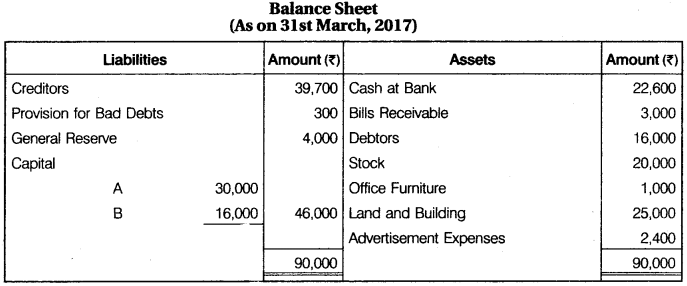

X and Y are partners sharing profit in the ratio of 2 : 1. Their balance sheet as on 31st March, 2017 is as under :

They admitted Z in the firm from 1st April, 2017 for 1/4th share, which he will receive from X. Following decisions were taken on that time :

- Z brings Rs 36,000 in cash and share of Ram Ltd. worth Rs 14,000 as his capital,

- The present value of firm’s goodwill is Rs 12,000. Z brings his share of goodwill in cash,

- Provision for bad debts on debtors be increased to 10% and outstanding salary is not required now.

- Plant and machinery overvalued by 5% and stock to be increased by Rs 2,400.

- Building undervalued by 10%.

- Sundry creditors were written back by Rs 4,000.

- Liability against workmen compensation determined at Rs 9,000.

Prepare Profit and Loss Adjustment Account, Partners’ Capital Account and Balance Sheet on the admission of Z.

Solution.

Question 4.

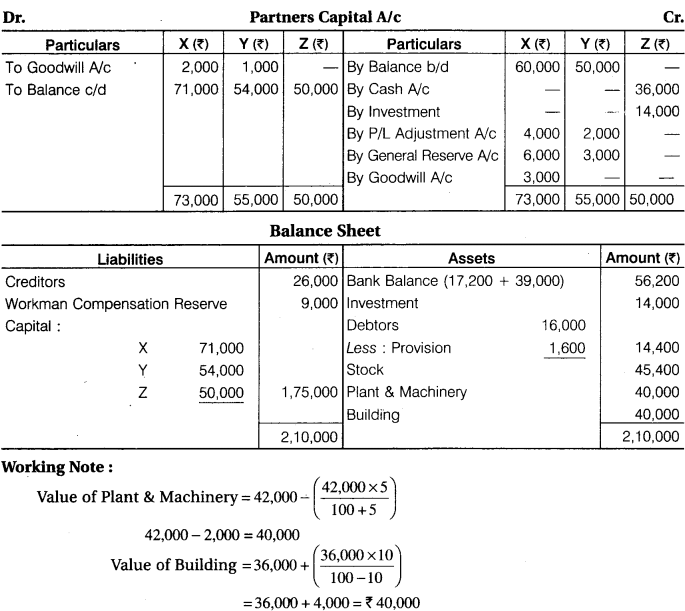

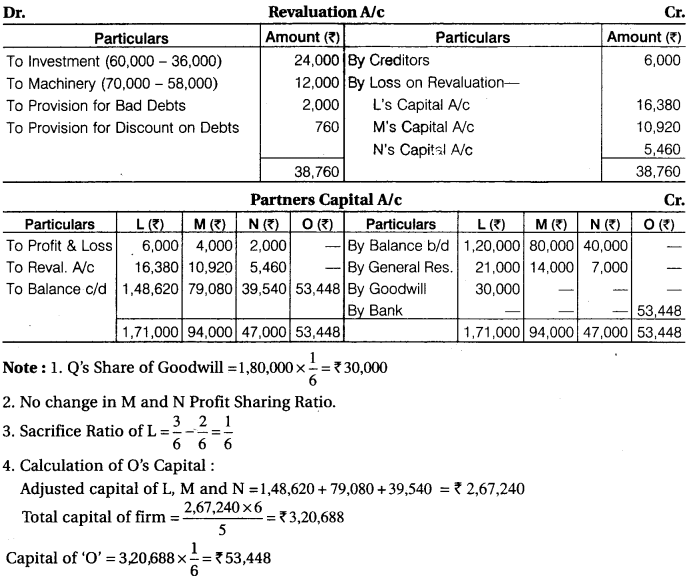

L, M and N were partners in a firm sharing profits in the ratio of 3 : 2 : 1. Their Balance Sheet on 31-3-2017 was as follows :

On the above date, O was admitted as a new partner and it was decided that :

- The new profit sharing ratio between L, M, N and O will be 2 : 2 : 1 : 1.

- Goodwill of the firm was valued at Rs 1,80,000 and O brought his share of goodwill (premium) in cash.

- The market value of investments was Rs 36,000.

- Machinery will be reduced to Rs 58,000.

- A creditor of Rs 6,000 was not likely to claim the amount and hence was to be written off.

- O will bring proportionate capital so as to give him 1/6th share in the profits of the firm,

- Provision for doubtful debts to be maintained @ 5% and provision for discount on debtors be made @ 2%.

Prepare Revaluation Account, Partners’ Capital Account and Balance Sheet of the new firm.

Solution.

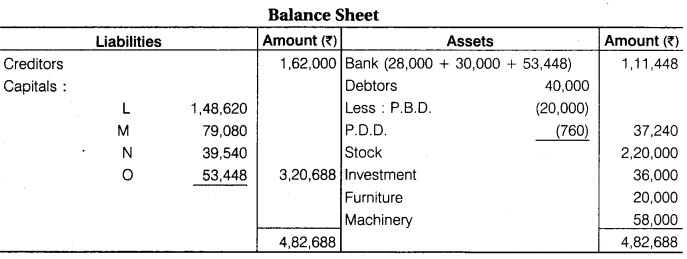

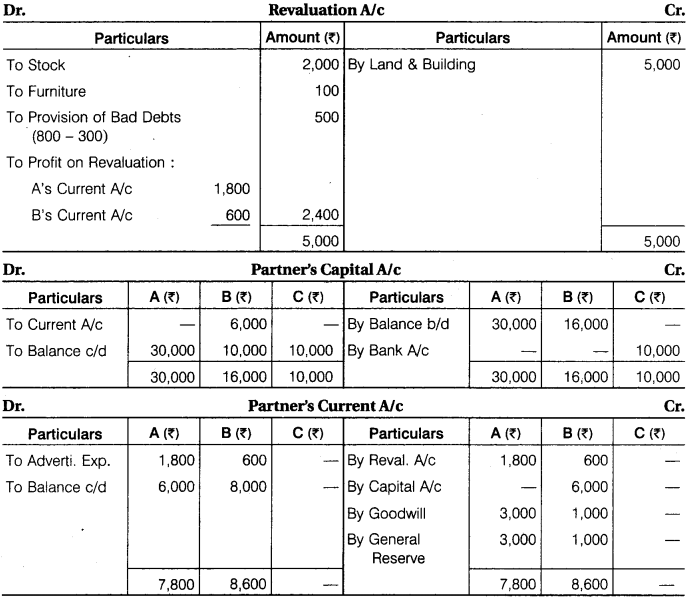

Question 5.

A and B shares the profits in the ratio of 5 : 3. They admit C into firm for a 1/4th share in the profits to be contributed equally by A and B. Before admission of C, balance sheet of the firm is as follows :

Terms of C’s admission were as follows :

- C will bring Rs 30,000 as his share of capital and goodwill,

- Goodwill of the firm has been valued at 3 times of the average super-profits of last four years. Average profits of the last four years are Rs 20,000, while the normal profits that can be earned with the capital employed are Rs 12,000.

- Furniture to be appreciated by Rs 6,000 and the value of stock is to be reduced by Rs 2,000. Provident fund be raised by Rs 1,000.

- All debtors are good,

- Liability against workmen compensation reserve is determined at Rs 2,000.

Prepare Revaluation Account, Partners’ Capital Account and the Balance Sheet of the new firm.

Solution.

Super Profit = Average Profit Normal Profit

Super Profit = 20,000 -12,000 = Rs 8,000

Goodwill = 8,000 x 3 = Rs 24,000

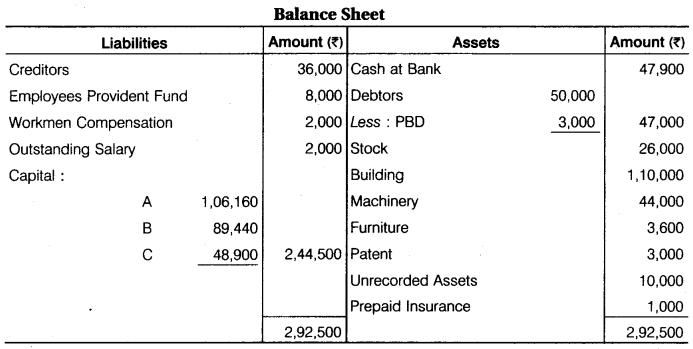

Question 6.

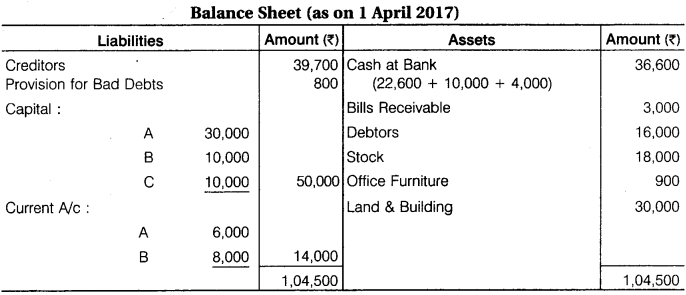

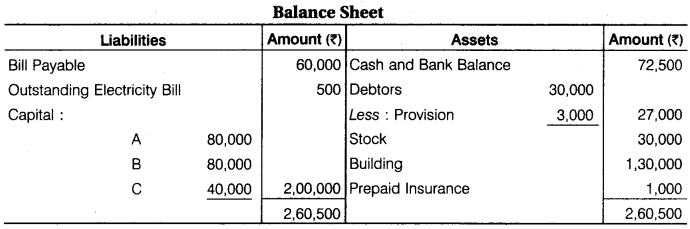

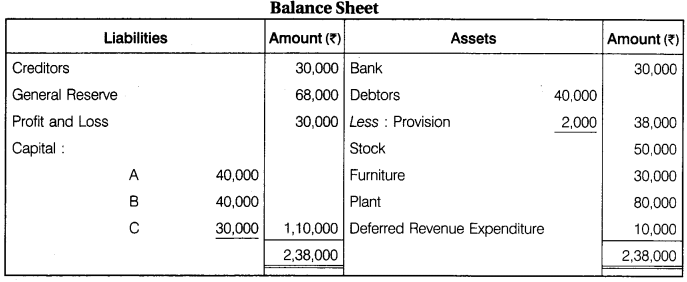

The following is the balance sheet of A and B, who are sharing profit in the proportion of 3 : 1 on 31st March, 2017.

They agreed to take C in partnership on 1st April, 2017 on the following terms :

- C will pay Rs 14,000 as his capital and goodwill for 1/5th share in the future profits.

- That the goodwill of the firm be valued at Rs 20,000.

- The stock and furniture will be reduced by 10% and the provision for doubtful debts will be created @ 5% on debtors,

- Value of Land and Building be appreciated by 20%.

- That the capital account of the partners will be readjusted on the basis of new partners capital and any excess or deficiency transferred to their current accounts.

Prepare Revaluation Account, Partners’ Capital Account and Balance Sheet of the new firm.

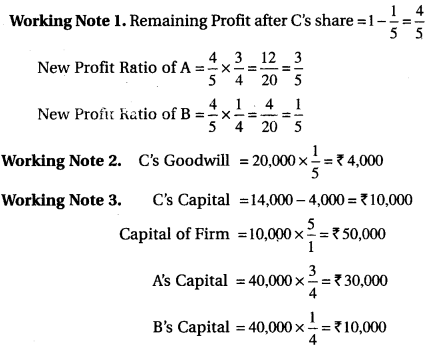

Solution.

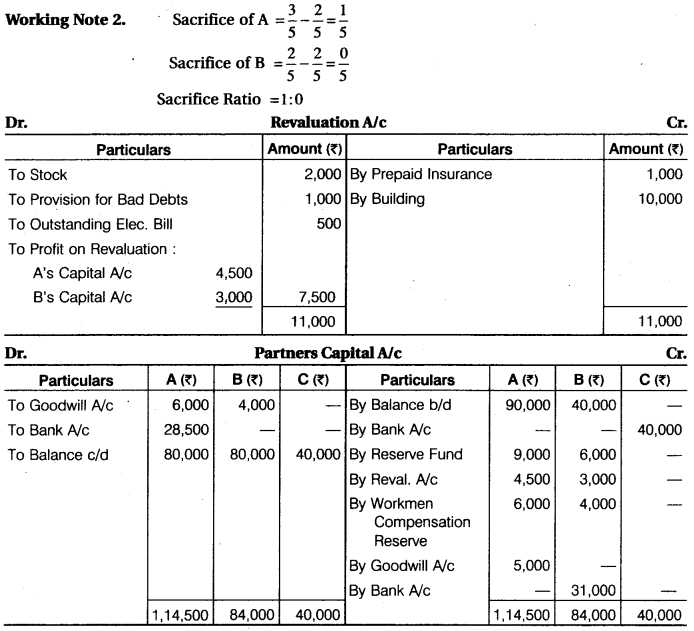

Question 7.

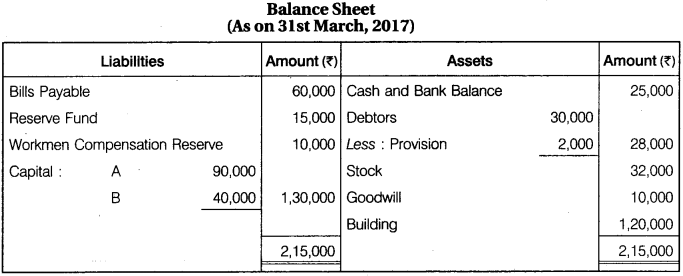

A and B distributes profit in 3 : 2 ratio. On 31st March, 2017, their balance sheet is as follows :

On 1st April, 2017, C was admitted in partnership on the following conditions :

- New Ratio of partners will be 2 : 2 : 1.

- C pays Rs 40,000 as his capital,

- Stock be decreased by Rs 2,000. Provision for doubtful debts is to be maintained upto Rs 3,000.

- C’s share in the goodwill of the firm be valued at Rs 5,000. C brings cash for goodwill.

- Prepaid insurance Rs 1,000.

- Outstanding electricity bills Rs 500.

- Building undervalued by Rs 10,000.

- The capitals of all partners will be in their profit sharing ratio.

Adjustment is to be done by cash. Prepare capital accounts and balance sheet of the new firm.

Solution.

[Note: Bank Balance = 25,000 + 45,000 + 31,000 – 28,500 = Rs 72,500]

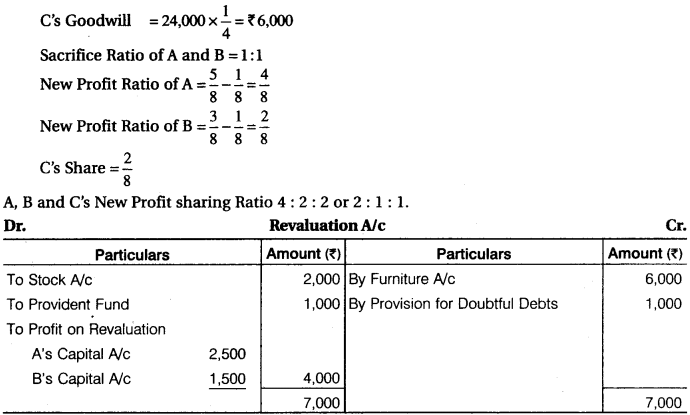

Question 8.

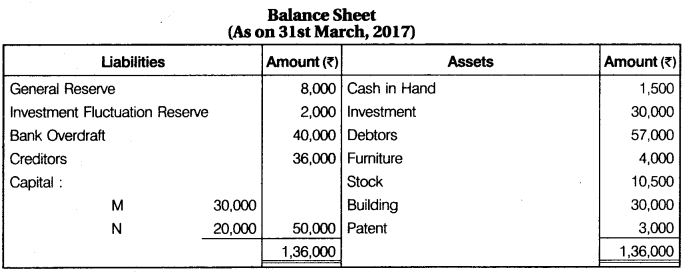

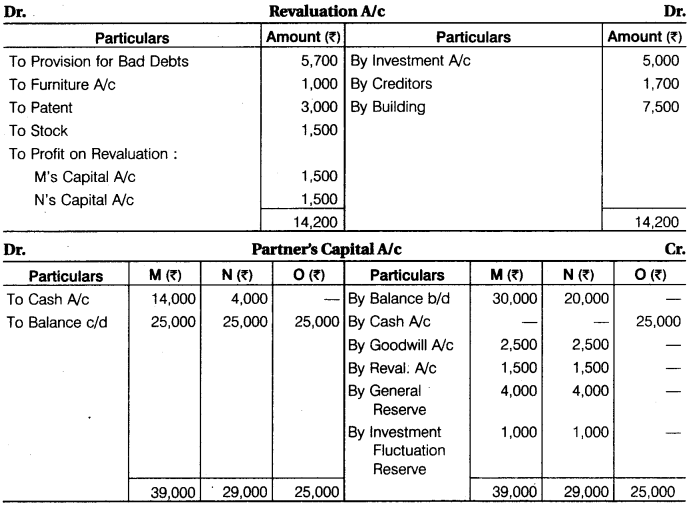

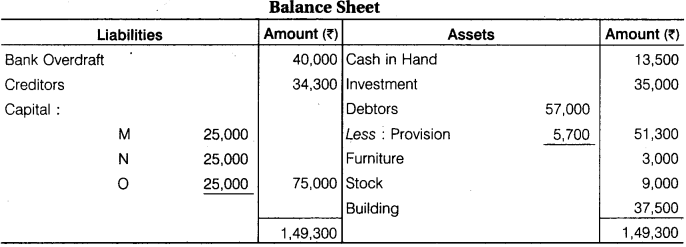

M and N are partners in the firm in equal profit sharing ratio. On 31st March, 2017, their balance sheet was as follows :

They admit O in the partnership on the following terms :

- Create provision for doubtful debts by 10% on debtors,

- Furniture will be depreciated by 25%.

- Increase the value of investment by Rs 5,000.

- O shall bring Rs 25,000 as his capital and his share in profit and loss will be 1/3rd and he will bring Rs 5,000 as his share of goodwill,

- A creditor for Rs 1,700 is dead. No liability shall arise in future on this account,

- Patents are valueless,

- Building will be appreciated by 25%. Stock is reduced to Rs 9,000.

The capitals of old partners are also to be adjusted accordingly. Prepare Revaluation Account, Partners’ Capital Account and Balance Sheet.

Solution.

[Note : Cash in Hand = 1,500 + (25,000 + 5,000) – (14,000 + 4,000) = Rs 13,500]

Question 9.

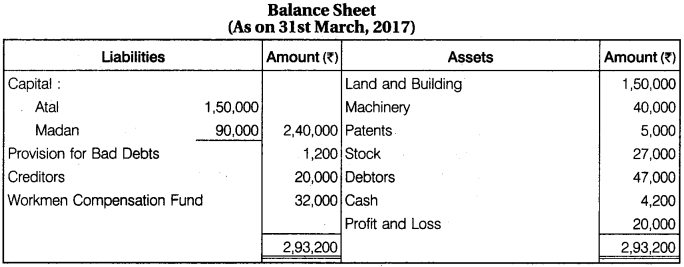

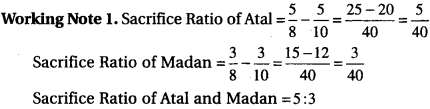

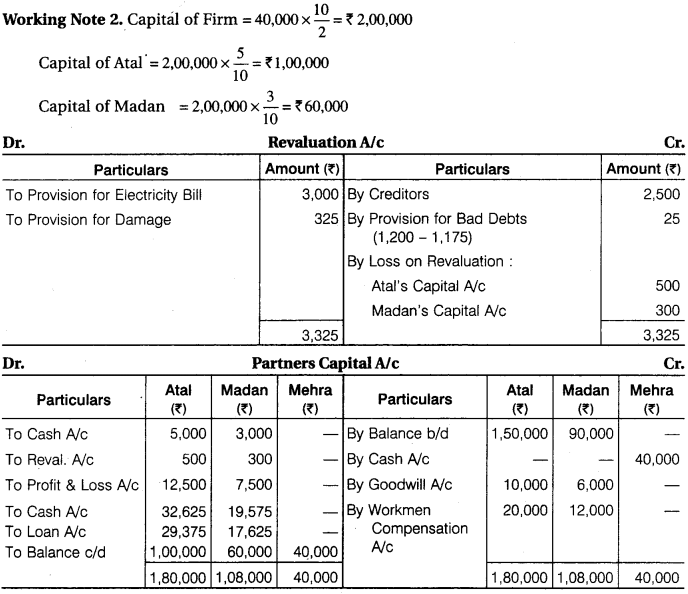

Atal and Madan were partners in a firm, sharing profits in the ratio of 5 : 3. On 31-03-2017, they admitted Mehra as a new partner for 1/5th share in the profits. The new profit sharing ratio was 5:3:2. On Mehra’s admission the balance sheet of the firm was as follows :

On Mehra’s admission, it was agreed that:

- Mehra will bring Rs 40,000 as his capital and Rs 16,000 for his share of goodwill (premium), half of which was withdrawn by Atal and Madan.

- A provision of \(2\frac { 1 }{ 2 }\)% for bad and doubtful debts was to be created,

- Included in the sundry creditors was an item of Rs 2,500 which was not to be paid,

- A provision was to be made for an outstanding bill for electricity Rs 3,000.

- A claim of Rs 325 for damages against the firm was likely to be admitted.

Provision for the same was to be made. After the above adjustments, the capitals of Atal and Madan were to be adjusted on the basis of Mehra’s capital. Actual cash was to be brought in or to be paid off to Atal and Madan as the case may be. Prepare Revaluation Account, Capital Account of the Partners and the Balance Sheet of the new firm.

Solution.

[Note : Deficiency for return of capital is shown in Partner’s Loan A/c]

Question 10.

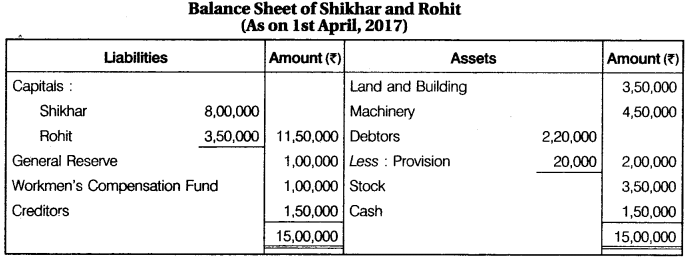

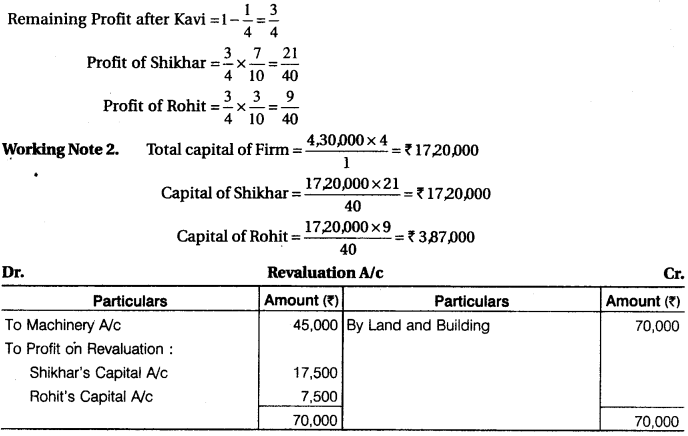

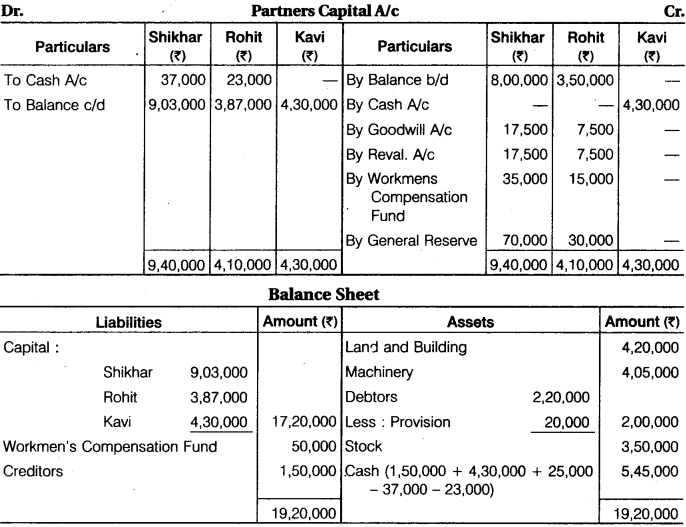

Shikhar and Rohit were partners in a firm sharing profits in the ratio of 7 : 3. On 1st April, 2017, they admitted Kavi as a new partner for 1/4 share in profits of the firm. Kavi brought Rs 4,30,000 as his capital and Rs 25,000 for his share of goodwill premium. The balance sheet of Shikhar and Rohit as on 1st April, 2017 as follows :

It was agreed that:

- The value of land and building will be appreciated by 20%.

- The value of machinery will be depreciated by 10%.

- The liabilities of workmen compensation fund was determined at Rs 50,000.

- Capitals of Shikhar and Rohit will be adjusted on the basis of Kavi’s capital and actual cash to be brought in or to be paid off as the case may be.

Prepare Revaluation Account, Partners’ Capital Account and the Balance Sheet of the new firm.

Solution.

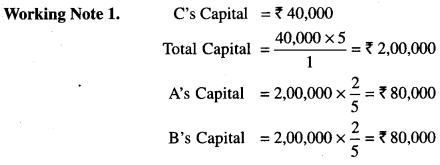

Working Note 1. Calculation of New Profit Sharing Ratio

Sacrifice Ratio of Shikhar & Rohit = 7:3

Question 11.

A and B are partners in the firm, sharing profit in the ratio of 3 : 2. On 1st April, 2017, they admit C in new firm for 1/5 share in profit. Their balance sheet was as follows :

C was admitted on the following terms :

- C is to bring capital Rs 40,000 and goodwill Rs 15,000.

- Partners agreed to share the future profits in the ratio of 5 : 2 : 3.

- Investments will be appreciated by 20% and furniture depreciated by 10%.

- One customer who owed the firm Rs 2,000 becomes insolvent and nothing could be realized from him.

- Creditors will be written off Rs 2,000.

- Outstanding bills for repair Rs 1,000 will be provided for.

- Interest accrued on investment Rs 2,000.

- Capital of the partners shall be in proportion to their profits sharing ratio.

For this, adjustment be made through cash. Prepare Revaluation Account, Capital Accounts and the Balance Sheet of new firm.

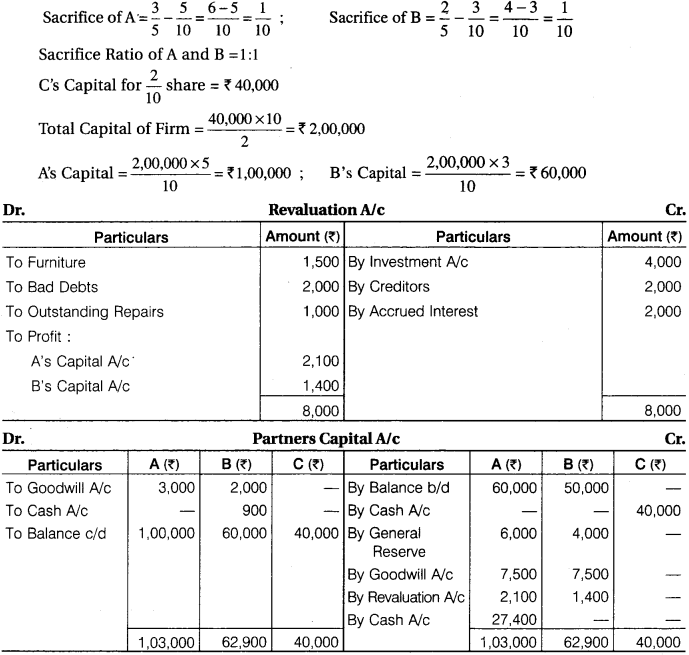

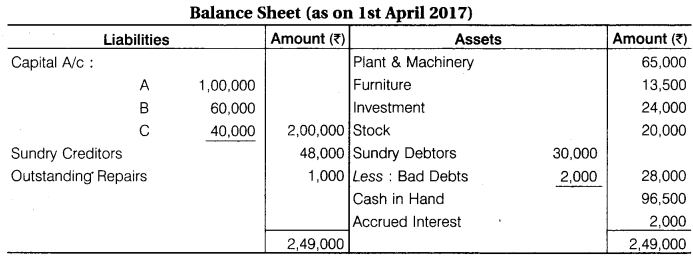

Solution.

[Note : Cash in Hand = 15,000 + (40,000 +15,000 + 27,400) – 900 = Rs 96,500]

Question 12.

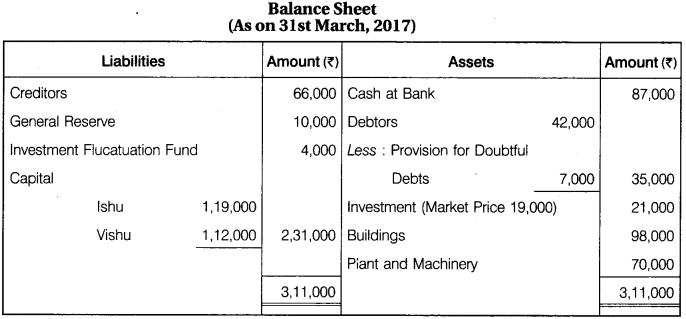

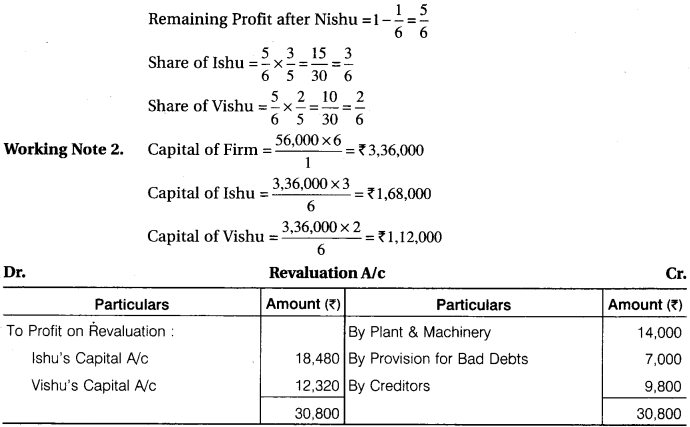

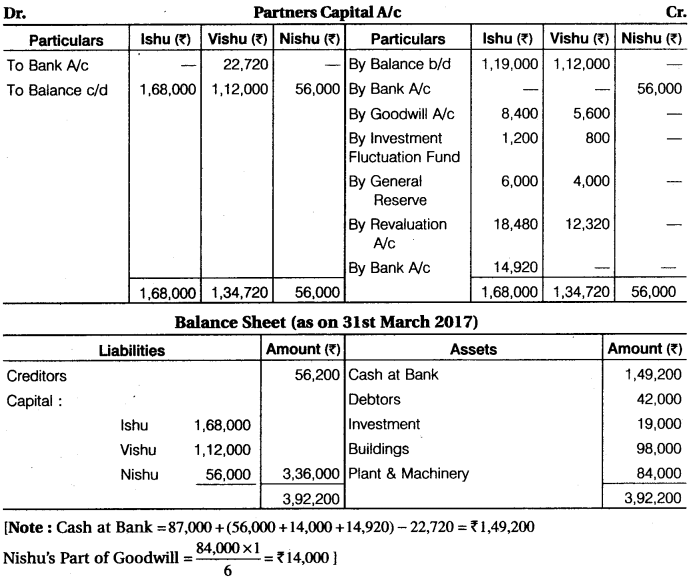

Ishu and Vishu are partners, sharing profits in the ratio of 3 : 2. Their balance sheet as on 31st March, 2017 was as follows :

Nishu was admitted on that date for 1/6th share on the following terms :

- Nishu will bring Rs 56,000 as his share of capital,

- Goodwill of the firm is valued at Rs 84,000 and Nishu will bring his share of goodwill in cash,

- Plant and machinery be appreciated by 20%.

- All debtors are good,

- There is a liability of Rs 9,800 included in sundry creditors that is not likely to arise,

- Capital of Ishu and Vishu will be adjusted on the basis of Nishu’s capital and any excess or deficiency will be made by withdrawing or bringing in cash by concerned partner.

Prepare Revaluation Account, Partners’ Capital Account and the Balance Sheet of the firm after the above adjustments.

Solution.

Working Note 1. Sacrifice Ratio of Ishu and Vishu = 3:2

Question 13.

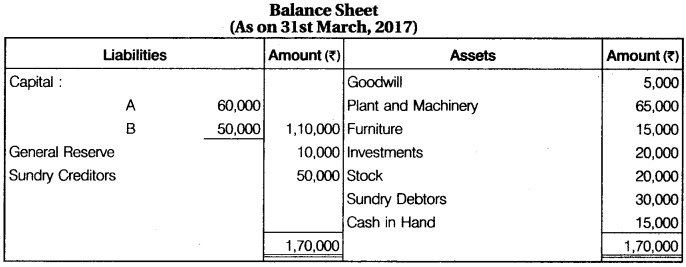

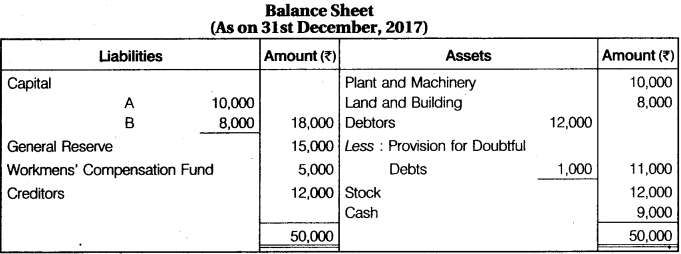

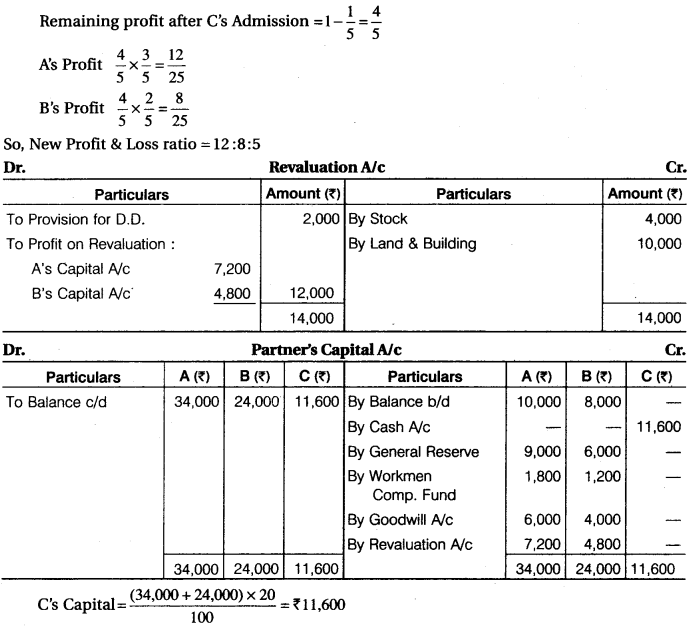

A and B, who are partners in a firm, sharing profits in the ratio of 3 : 2 on 31st December, 2017. The balance sheet was as follows :

They agreed to admit C into partnership for 1/5th share of profits on the following terms :

- Provision for doubtful debts be increased by Rs 2,000.

- The value of stock be increased by Rs 4,000 and land and building be increased to Rs 18,000.

- The liability against workmen compensation fund is determined at Rs 2,000.

- C brought in as his share of goodwill Rs 10,000 in cash,

- C would bring cash as would make his capital equal to 20% of combined capital of A and B, after the above revaluation and adjustments are carried out.

Prepare Revaluation Account, Partners’ Capital Account and the Balance Sheet of the firm after C’s admission.

Solution.

Working Note: Sacrifice ratio of A and B = 3:2

Question 14.

P and Q are partners in a firm, sharing profits in the ratio of 3 : 1. Their balance sheet was as follows :

R is admitted on 1/5th share in profit on the following terms :

- Market value of investment is taken as Rs 4,200.

- Accrued interest amounts to Rs 200.

- Provision for doubtful debts was in excess to Rs 200.

- A claim of workmen compensation for Rs 1,000 be provided,

- R is to bring Rs 10,000 as goodwill share,

- Total capital of the firm was agreed as Rs 50,000 to be adjusted in their profit sharing ratio.

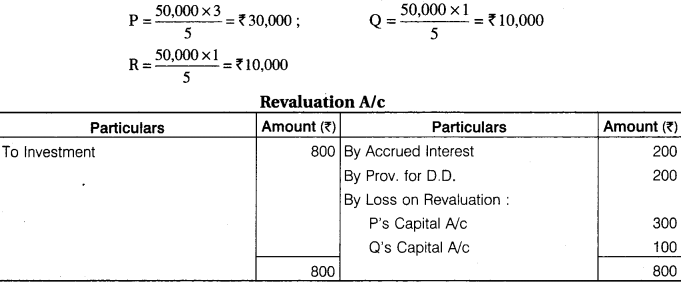

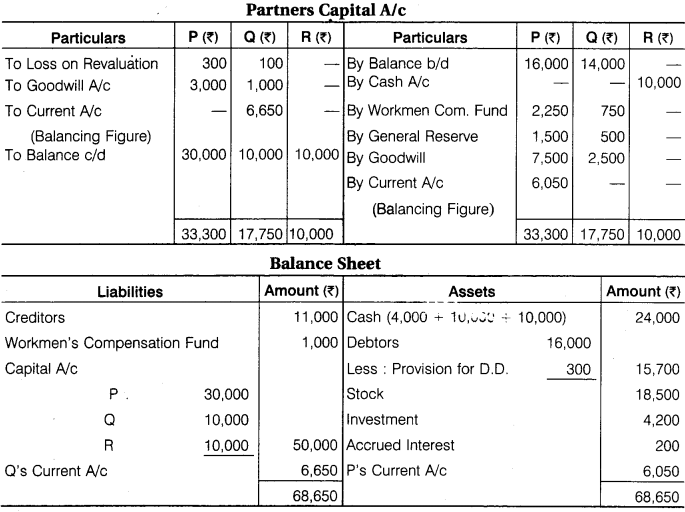

R brings his capital in cash but capital of other partners be adjusted by opening current account. Prepare Revaluation Account, Capital Account and the Balance Sheet of new firm.

Solution.

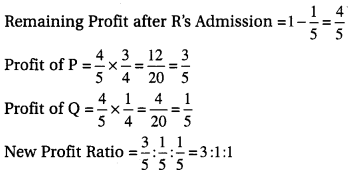

Working Note:

1. New Profit Sharing Ratio :

Sacrifice Ratio of P and Q = 3:1

2. Calculation of Capital:

Question 15.

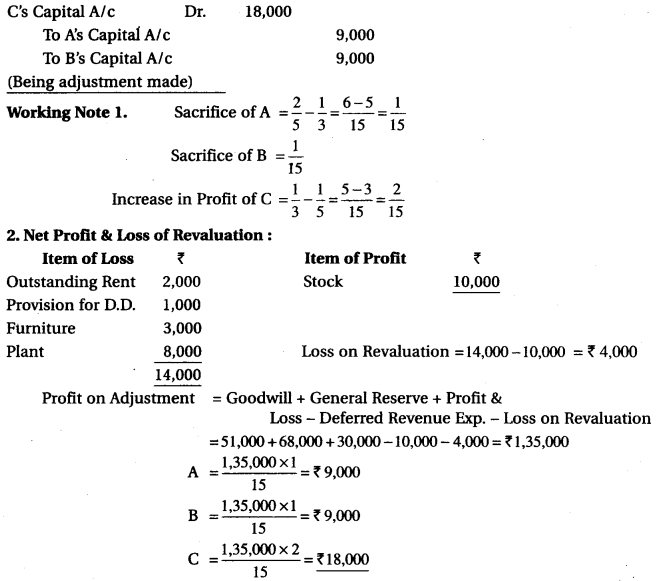

A, B and C are partners, sharing profits in the ratio 2:2:1. Their balance sheet on 31-03-2017 was as follows :

The partners agreed to share profits in the ratio 1:1:1 from 01-04-2017. They further agreed that:

- Stock be valued at 20% more,

- Doubtful debts provision be increased by Rs 1,000.

- Depreciate furniture and plant by 10%.

- Rent outstanding is Rs 2,000.

- Goodwill of the firm is valued at Rs 51,000.

Partners decided not to alter the values of assets, liabilities and reserves. They also decided not to show goodwill in the books. Pass a single entry to give the effect to above changes.

Solution.

Question 16.

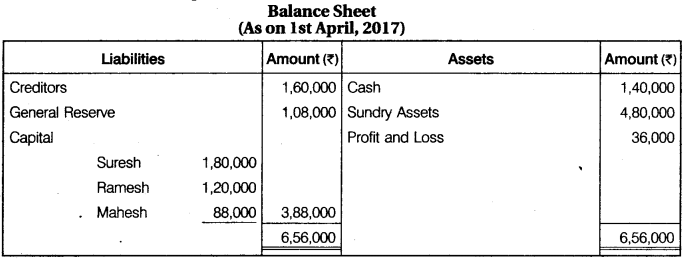

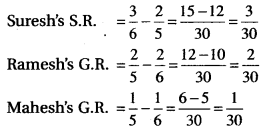

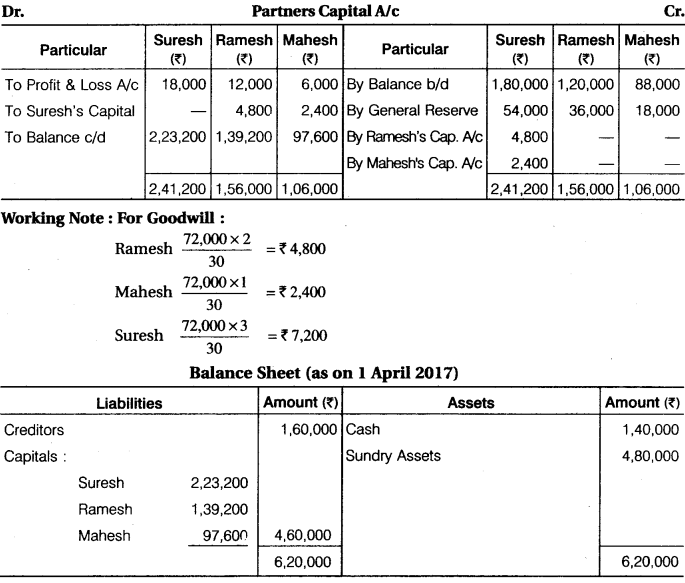

Suresh, Ramesh and Mahesh share profits in the ratio of 3 : 2 : 1 respectively. Their balance sheet as on 1st April, 2017 was as follows :

On that date they decided that Suresh, Ramesh and Mahesh will share profits in future in the ratio of 2 : 2 : 1 respectively. The goodwill of the firm was valued at Rs 72,000 on that date. Prepare Partners’ Capital Account and Balance Sheet of the firm.

Solution.

Working Notes:

Profit on Adjustment = Goodwill + General Reserve – Profit & Loss A/c =

72,000 + 1,08,000 – 36,000

= Rs 1,44,000

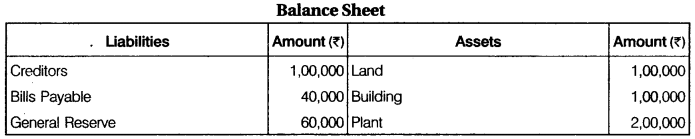

Question 17.

Nardeep, Hardeep and Gagandeep was partners in a firm sharing profits in 2 : 1 : 3 ratio. Their balance sheet as on 31.03.2017 was as follows :

From 01.04.2017, Nardeep, Hardeep and Gagandeep decided to share the future profits equally. For this purpose it was decided that :

(a) Goodwill of the firm be valued at Rs 3,00,000.

(b) Land be revalued at Rs 1,60,000 and building be depreciated by 6%.

(c) Creditors of Rs 12,000 were not likely to be claimed and hence be written off.

Prepare Revaluation Account, Partners’ Capital Account and the Balance Sheet of the reconstituted firm.

Solution.

Working Note:

New Profit Ratio of Nardeep, Hardeep and Gagandeep = 1:1:1

Question 18.

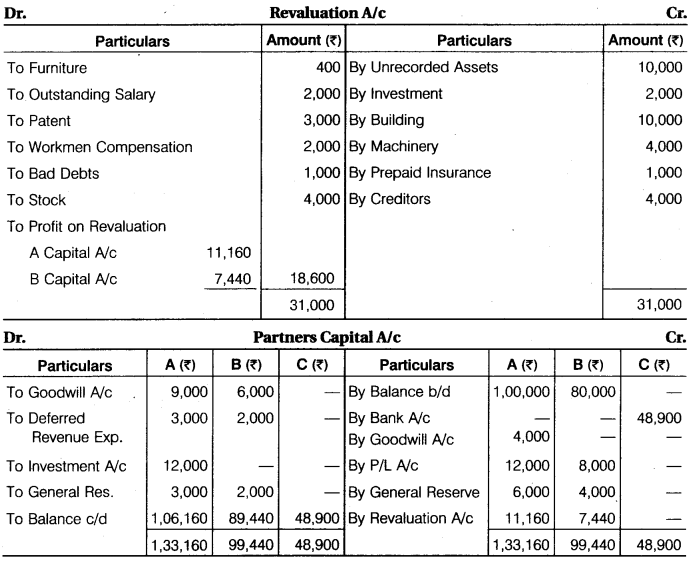

A and B are partners, sharing profit in the ratio of 3 : 2 in a firm. On 31.03.2017, their balance sheet was as follows :

They decided to admit C for 1/5th share. He takes his share entirely from A. He had to contribute the proportionate capital,

- Goodwill of the firm is valued at 2 years purchase of average profit of last 3 years which was Rs 10,000. C brings his share of goodwill in cash,

- Unrecorded assets Rs 10,000.

- Investments valued at Rs 12,000 and taken by A.

- 1/2 of general reserve withdrawn by the partners,

- Land and building appreciated by 10%.

- Plant and machinery valued at 20% more,

- Liability of workmen compensation is Rs 2,000.

- Prepaid insurance Rs 1,000.

- Bank loan would be paid off.

- A liability of Rs 4,000 included in creditors was not likely to arise,

- Bad debts Rs 3,000.

- Stock is reduced to Rs 26,000.

Prepare Revaluation Account, Partners’ Capital Account and the Balance Sheet of the new firm.

Solution.

Working Note: