Rajasthan Board RBSE Class 12 Accountancy Chapter 3 Accounting for Retirement and Death of Partner

RBSE Class 12 Accountancy Chapter 3 Textbook Questions

RBSE Class 12 Accountancy Chapter 3 Multiple Choice Questions

RBSE Solutions For Class 12 Accountancy Chapter 3 Question 1.

A, B and C are partners sharing profits in the ratio of 2 : 2 : 1. On retirement of B, goodwill was valued at Rs 30,000. Find the contribution of A and C to compensate B :

(a) Rs 20,000 and Rs 10,000

(b) Rs 8,000 and Rs 4,000

(c) Rs 20,000 and Rs 8,000

(d) Rs 15,000 and Rs 15,000

Answer:

(b)

RBSE Solutions For Class 12 Accountancy Question 2.

X, Y and Z were partners sharing profits in ratio of 5 : 3 : 2. Goodwill does not appear in the books, but it is agreed to be worth Rs 1,00,000. X retires from the firm and Y and Z decide to share future profits equally. X’s share of goodwill will be debited to Y’s and Z’s capital account in ratio :

(a) 1/2 : 1/2

(b) 2 : 3

(c) 3 : 2

(d) None of these

Answer:

(b)

RBSE Solutions Class 12 Accountancy Question 3.

A, B and C are partners sharing profits in the ratio 1/2, 3/10 and 1/5. B retires from the firm, A and C decide to share the future profits in 3 : 2. Calculating gaining ratio.

(a) 1 : 2

(b) 3 : 2

(c) 2 : 3

(d) None of these

Answer:

(a)

RBSE Class 12 Accountancy Solutions Question 4.

At the time of retirement of a partner, firm gets…….from the insurance company against the joint life policy.

(a) Policy value for the retiring partner and surrender value for the rest

(b) Surrender value

(c) Policy amount

(d) None of these

Answer:

(b)

RBSE 12th Accountancy Book Solutions Question 5.

B, C and D are partners sharing profits in the ratio 7 : 5 : 4. D died on 30th June, 2017 and profits for the year 2016-2017 were ? 12,000. How much share in profits will be credited to D’s account?

(a) Rs 3,000

(b) Rs 750

(c) Nil

(d) Rs 1,000

Answer:

(b)

12th RBSE Accountancy Solutions Question 6.

The balance of joint life policy account as shown in the balance sheet represents :

(a) surrender value of a policy

(b) annual premium of joint life policy

(c) total premium paid by the firm

(d) amount receivable on the maturity of the policy

Answer:

(a)

RBSE Solutions For Class 12 Accountancy Chapter 3 Question 7.

After the death of a partner, amount payable to him is received by :

(a) by government

(b) by his son

(c) by executors of deceased partner

(d) None of these

Answer:

(c)

Class 12 RBSE Accounts Solutions Question 8.

How is the premium paid on the JLP of the partners treated ? It is….to the….. accounts.

(a) credited, partner’s current account

(b) credited, profit & loss account

(c) debited, partner’s capital account

(d) debited, profit & loss account

Answer:

(d)

RBSE Solution Class 12 Accountancy Question 9.

A, B and C are partners sharing profit and loss in 5 : 3 : 2. The firm’s balance sheet as on 31-03-2017 shows reserve balance of Rs 25,000. Profit of the year Rs 50,000. Joint life policy of Rs 1,00,000. Fixed assets of Rs 1,20,000. On 1st June, C died and on same date, the executors of C will get along with capital:

(a) share in joint life policy

(b) share in reserves

(c) proportionate share of profit upto the date of death

(d) All of these

Answer:

(d)

RBSE 12 Accounts Solutions Question 10.

Joint life policy amount received by a firm is distributed in :

(a) opening capital ratio

(b) closing capital ratio

(c) old profit sharing ratio of partners

(d) new profit sharing ratio of partners

Answer:

(c)

RBSE Class 12 Accountancy Chapter 3 Very Short Answer Questions

RBSE Solutions For Class 12th Accountancy Question 1.

What is meant by retirement of a partner?

Answer.

Any partner can retire from his firm due to old age, poor health, mutual dispute etc. When any partner voluntarily or due to any other reason separates him self from the firm, then this is called retirement of a partner.

RBSE Solutions Accountancy Class 12 Question 2.

State any two modes of retirement.

Answer.

Any partner take retirement under the following ways:

- On the basis a agreement between partners.

- With the connect of partners.

RBSE 12th Solutions Accounts Question 3.

What is joint life insurance policy?

Answer.

If a life insurance policy is taken in lives of all partners called joint life insurance policy.

RBSE Accounts Solutions Class 12 Question 4.

What is surrender value?

Answer.

The surrender value is the sum of money an insurance company pays to the policyholder or annuity holder in the event his policy is voluntarily terminated before its maturity or the insured event occurs.

RBSE Solution Class 12th Accountancy Question 5.

A, B and C are partners in a firm sharing profits in the ratio of 1/2 : 3/10 : 2/10. Calculate new profit sharing ratio and gaining ratio when :

(1) A retires,

(2) B retires,

(3) C retires.

Solution.

When new profit sharing ratio is not given, it is considered that remaining partner distribute in their old profit and loss ratio.

According to this,

(1) New ratio at the retirement of A, B : C = 3 :2

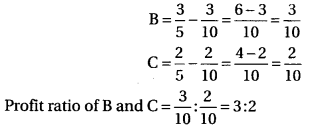

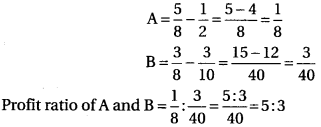

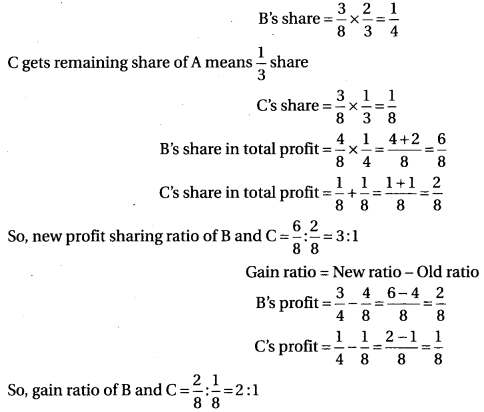

(2) New profit sharing ratio at the retirement of B

![]()

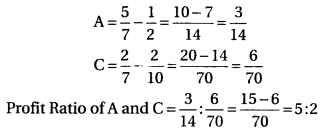

(3) New profit sharing ratio at the retirement of C

![]()

Profit’s ratio will be as follows:

(1) At the retirement of A

Profit Ratio = New Ratio – Old Ratio

(2) At the retirement of B

Profit Ratio = New Ratio – Old Ratio

(3) At the retirement of C

RBSE Solutions For Class 12 Accountancy Chapter 3 In Hindi Question 6.

A, B and C are partners in a firm sharing profits in the ratio of 2 : 1 : 2. A retires and his share is entirely taken by B. Calculate new profit sharing ratio.

Solution.

B gets A’s complete share, means B will get more \(\frac { 2 }{ 5 }\) share.

B s new profit share = \(\frac { 1 }{ 5 } +\frac { 2 }{ 5 } =\frac { 1+2 }{ 5 } =\frac { 3 }{ 5 } \)

C’s old share was \(\frac { 2 }{ 5 }\)

So, profit and loss ratio of both \(\frac { 3 }{ 5 } :\frac { 2 }{ 5 } \) = 3:2

RBSE Solutions For Class 12 Accountancy Chapter 3 Question 7.

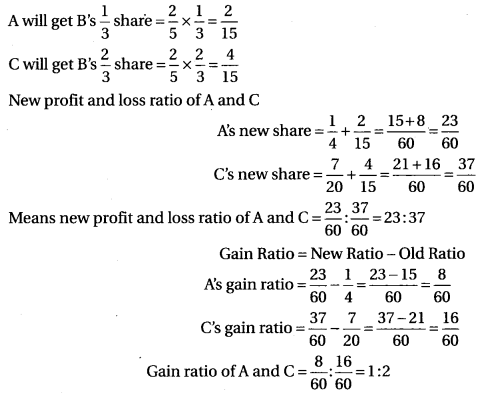

A, B and C are partners in a firm sharing profits in the ratio of 1/4 : 2/5 : 7/20. B retires and his share is taken by A and C in the ratio of 1 : 2. Calculate new profit sharing ratio and gaining ratio.

Solution.

B’s Share = \(\frac { 2 }{ 5 }\)

RBSE Solutions For Class 12 Question 8.

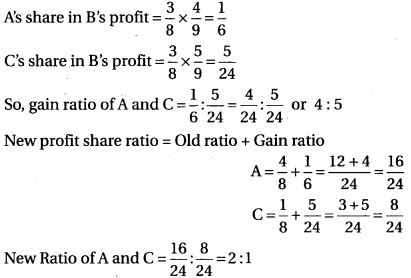

A, B and C are partners in a firm sharing profits in the ratio of 4 : 3 : 1. B retires selling his share of profit to A and C for Rs 8,100, Rs 3,600 being paid by A and Rs 4,500 by C. Calculate new profit sharing ratio and gaining ratio.

Solution.

A and C divide B’s share: 3,600:4,500 or 4:5

A and C divide B’s profit in ratio of 4:5.

RBSE Solutions For Class 12 English Question 9.

A, B and C are partners in a firm sharing profits in the ratio of 4 : 3 : 2. A retires and new profit sharing ratio of B and C will be 2 : 1. Calculate gaining ratio.

Solution.

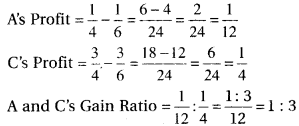

Profit Ratio = New Ratio – Old Ratio

RBSE Class 12 Accounts Solution Question 10.

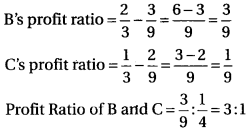

A, B and C are partners in a firm sharing profits in the ratio of 3 : 4 : 1. A retires, he surrender 2/3rd of his share in favor of B and remaining in favor of C. Calculate new profit sharing ratio and gaining ratio.

Solution.

B gets \(\frac { 2 }{ 3 }\) Share of A

RBSE Class 12 Accountancy Chapter 3 Short Answer Questions

Class 12 Accountancy RBSE Solutions Question 1.

When final payment of retiring partner is out settled at the time of retirement, write right of partners under Section 37 of Indian Partnership Act, 1932.

Answer.

According to Section 37 of Indian Partnership Act, 1932, if remaining partners continue to carry on the business without payment of final settlement amount to the retiring partner then there are two options available to the retiring partner, he is entitled

- get interest 6% per, annul on the outstanding amount till receipt of the final payment or,

- to get share in earned profit for that period in the ratio of capital, whichever is beneficial to him can be accepted by him.

RBSE Solutions 12th Accounts Question 2.

What do you mean by gaining ratio? How is it calculated?

Answer.

Gaining Ratio: It is calculated when a partner retires or dies. When a partner retires or dies his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increases is called the Gaining Ratio.

Gaining ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

If the new profit sharing ratio of the remaining partners is given in the question, gaining ratio is calculated by deducting old ratio from the new ratio.

Gaining Ratio = New Ratio – Old Ratio

Solution Of Accountancy Class 12 RBSE Question 3.

Distinguish between sacrificing ratio and gaining ratio of partners?

Answer.

Difference Between Gaining Ratio and Sacrifice Ratio

| Basis of Difference | Sacrifice Ratio | Gaining Ratio |

| Meaning | It is the ratio in which old partners have agreed to sacrifice their share in favor of the new partner. | It is the ratio which the continuing partners acquire from the outgoing partner share. |

| Time of Computation | It is calculated when a new partner is admitted. | It is calculated when a partner retires or dies. |

| Formula for Ascertainment | Sacrifice Ratio = Old Ratio – New Ratio | Gaining Ratio = New Ratio – Old Ratio |

| Objective | This ratio is computed to compensate old partners by new partner in the form of goodwill. | This ratio is computed to compensate outgoing partner by continuing partners in the form of goodwill. |

Class 12 Accountancy Solutions RBSE Question 4.

A, B and C are partners in a firm sharing profits in the ratio of 2 : 3 : 4. C retires and the goodwill of the firm is valued at Rs 45,000. Goodwill appeared in the books at Rs 27,000. Pass necessary journal entries for treatment of goodwill.

Solution.

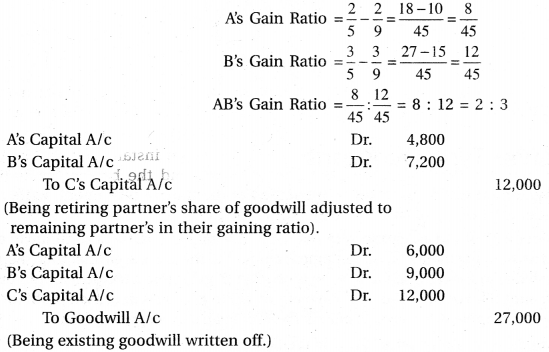

Gain Ratio = New Profit – Old Profit

Retirement Of Partner Class 12 Solutions 2021 Question 5.

A, B and C are partners in a firm sharing profits in the ratio of 5 : 3 : 2. B retires and the goodwill of the firm is valued at Rs 21,000. Pass necessary journal entries for treatment of goodwill.

Solution.

Gain Ratio = New Ratio – Old Ratio

(Being retiring partner’s share of goodwill adjusted to remaining partner’s in their gaining ratio.)

RBSE Solutions For Class 12 Commerce Question 6.

A, B and C are partners in a firm sharing profits in the ratio of 1 : 2 : 3. B retires and balance of his capital account after making all adjustment stands at Rs 1,00,000. A and C agreed to pay him Rs 1,30,000 in full settlement of his account. Pass necessary journal entries for treatment of goodwill, if the new profit sharing ratio is 1 : 3.

Solution.

Hidden Goodwill = 1,30,000 – 1,00,000 = Rs 30,000

Gain Ratio = New Profit & Loss Ratio – Old Profit & Loss Ratio

A’s Capital A/c Dr. 7,500

C’s Capital A/c Dr. 22,500

To B’s Capital A/c 30,000

(Being B’s share of goodwill adjusted in gaining ratio 1 : 3)

12 RBSE Accounts Solution Question 7.

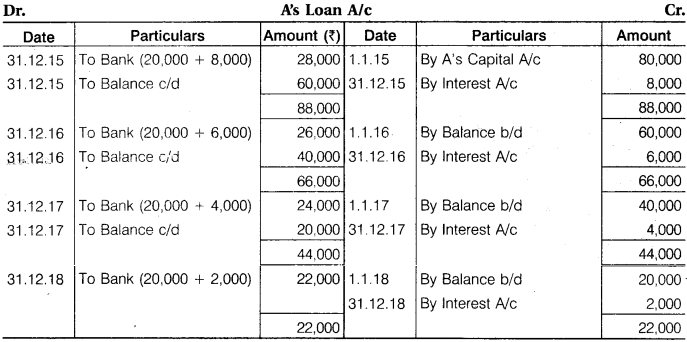

A, B and C are partners in a firm. A retires on 1st January, 2015. On the date of retirement, Rs 80,000 is due to him in all. It is agreed to pay him this amount in installments every year at the end of the year. Prepare A’s Loan account in the following cases

(i) Four yearly installments plus interest @ 10% p.a.

(ii) Three installments of Rs 25,000 including interest @ 10% p.a. on the outstanding balance and the balance including interest in the fourth year.

Solution.

(i)

(ii) A’s Loan Account

RBSE Solutions For Class 12 Accounts Question 8.

A, B and C are partners in a firm whose books are closed on March 31st each year. A died on 30-06-2017 and according to the agreement, the share of profits of a deceased partner upto date of death is to be calculated on the basis of average profits for the last five years. The net profits loss for the last 5 years have been : Rs 14,000, Rs 18,000, Rs 22,000, Rs (10,000) Loss, Rs 16,000 respectively. Calculate A’s share of the profit upto the date of death and pass necessary journal entry.

Solution.

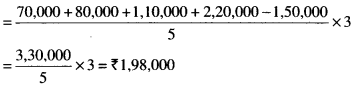

Calculation of Average Profit:

14,000 + 18,000 + 22,000 – 10,000 + 16,000 = \(\frac { 60,000 }{ 5 }\) = 12,000

Profit of 3 months = 12,000 x \(\frac { 3 }{ 12 }\) = 3,000

Share of A = 1000

Profit and Loss Suspense A/c Dr. 1,000

To A’s Capital A/c 1,000

(Share of profit transferred to his capital account.)

Class 12 Accountancy Book RBSE Question 9.

X, Y and Z are partners sharing profits in the ratio 3 : 2 : 1. X died on 10-04-2017. The sales and profit for 2016 were Rs 2,00,000 and Rs 20,000 respectively, sales from 01-01-2017 to 10-04-2017 was Rs 1,20,000. Find the share of X’s profit.

Solution.

Calculation of profit on the basis of sales

Percentage of profit on the last year sales = \(\frac { 20,000 }{ 2,00,000 }\) x 100 = 10%

Profit upto death in 2017 = 1,20,000 x \(\frac { 10 }{ 100 }\) = Rs 12,000

As share in this profit = 12,000 x \(\frac { 3 }{ 6 }\) = Rs 6,000

So, As profit will be Rs 6,000.

Class 12th RBSE Accountancy Solutions Question 10.

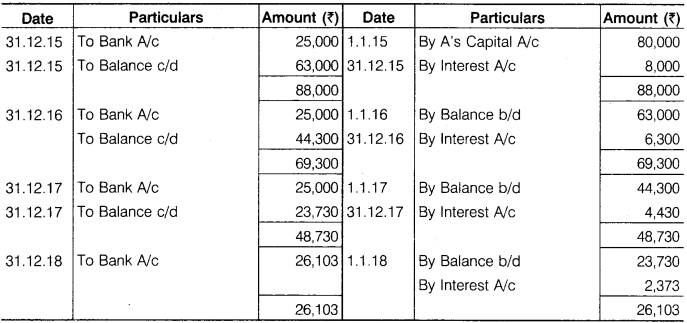

A, B and C are equal partners in a firm. They were insured separately for Rs 30,000, Rs 25,000 and Rs 40,000. The premium which is paid by the firm. A died and the policy money is received from the insurance company. The surrender value of the policies of B and C was Rs 3,000 and Rs 6,000. Pass necessary journal entries.

Solution.

Journal

RBSE Class 12 Accountancy Chapter 3 Essay Type Questions

Accounts Class 12 RBSE Solutions Question 1.

How is partner’s share determined on the retirement or death? Explain.

Answer.

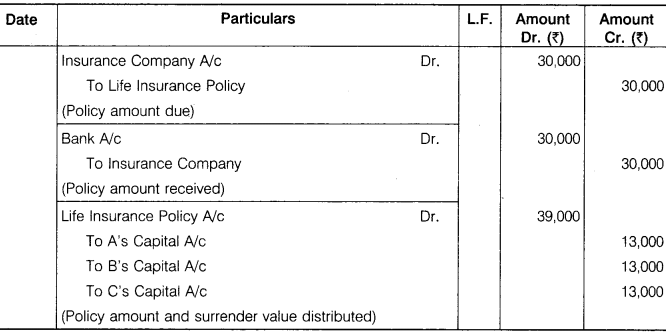

Retirement/Death of a Partner During the Accounting Year: In extra ordinary circumstances a partner retires during the accounting year. Similarly, in case of death of a partner, the amount payable to the legal heir of the deceased partner had to be determined on any date falling during the accounting year. In such situation the following adjustments are made to determine the amount payable to the retiring partner or the legal heir of the deceased partner.

1. Salary, Bonus, Commission and Fee etc.: Salary, bonus etc. of the partner from the date of last balance sheet till the date of death/retirement of the partner is credited to the capital/current account.

2. Interest on Capital: Interest on capital from the date of last balance sheet till the date of death/retirement of partner is credited to capital/current account of the partner.

3. Drawings and Interest There On : Any drawings and interest thereon if any from the date of last balance sheet till the date of the death/retirement is debited to capital/current account of the partner.

4. Life Insurance Policy: If joint or separate life policies are taken on the lives of the partners, then retiring/deceased partner’s share is calculated and his share is credited the capital/ current account. (This has already been explained in earlier)

5. Share in Firm’s Profit: Profits are calculated from the date of last balance sheet till the date of retirement Death of the partner. This can be computed by one of the following methods:

(i) On Time Basis : Either on the basis of immediately preceding year or on the basis of average of past few years, the proportionate profit from the date of last balance sheet till the date of retirement/death is calculated and credited to the capital/current account of the partner.

(ii) On Turnover Basis: The percentage of profit to the turnover in the last year is found and profit on the turnover since the date of last balance sheet till the date of retirement/death on the same percentage is arrived at. The deceased or retired partner’s share is then calculate on the basis of profit sharing ratio and credited to the capital/current account of the partner.

- On the basis of time.

- On the basis of turnover for the period from 1st January to 31st August, 2016 is Rs 80,000.

6. Share in Goodwill: This would be calculated as per rules explained in this chapter and would be credited/debited to capital/current account of the partner.

7. Share in Gain/Loss Arising out of Revaluation of Assets and Liabilities : This would be calculated as per rules explained in this chapter and would be credited /debited to capital/current account of the partner.

8. Share in Reserves and Undistributed Profit: This would be calculated as per rules explained in this chapter and would be credited/debited to capital/current account of the partner.

Thus, following items are shown in the retiring/deceased partner’s capital account.

RBSE Solutions For Class 12 Accountancy Chapter 3 Question 2.

What problems do arise on retirement or death of a partner and how are they settled?

Answer.

Accounting Problems Arising at the Time of Retirement of Partner : Following accounting problems arise on the retirement of a partner:

- Calculation of new profit sharing ratio and gaining ratio of the continuing partners.

- Treatment of goodwill.

- Accounting treatment of revaluation of assets and liabilities.

- Accounting treatment of reserves, accumulated profits and losses.

- Payment of retiring partner.

- Adjustment of capital in proportion of profit sharing ratio.

1. Calculation of New Profit Sharing Ratio:

Case 1 : If new profit sharing ratio is not given in the question, it would be presumed that remaining partners will continue share profit/loss in their old ratio.

Case 2 : Sometimes remaining partners buy out share of the retiring partner, then new ratio would be arrived at by adding the bought out ratio in the old profit sharing ratio.

Case 3. Sometimes new profit sharing ratio is given in the question in that case, there is no need to calculate new ratio.

Gaining Ratio : It is calculated when a partner retires or dies. When a partner retires or dies his share of profit is taken over by the remaining partners. The ratio in which the remaining partners share increases is called the Gaining Ratio.

Gaining ratio is the ratio in which the remaining partners will pay the amount of goodwill to the retiring partner.

- If the new profit sharing ratio of the remaining partners is given in the question, gaining ratio is calculated by deducting old ratio from the new ratio.

Gaining Ratio = New Ratio – Old Ratio - If the new profit sharing ratio of the remaining partners are not given in the question, it will be assumed that the remaining partners continue to share profits in the old ratio. Thus, gain to the continuing partners is in the old ratio.

2. Accounting Treatment of Goodwill: The retiring or deceased partner is entitled to his share of goodwill at the time of retirement or death because the goodwill earned by the firm is the result of the efforts of all the existing partners in the past. Since a part of the future profit will be accruing because of the present goodwill and the retiring or deceased partner will not be sharing future profits. It will be fair to compensate the retiring or deceased partner for the same. At the time of retirement or death of a partner, the goodwill is evaluated on the basis of agreement among the partners.

As already discussed in the previous chapter, Accounting Standard 26 specifies the goodwill can be recorded in the books only when some consideration in money or money’s worth has been paid for it. Hence only purchased goodwill can be recorded in the books and the goodwill account cannot be raised.

As such, in case of retirement or death of a partner, the adjustments for goodwill will be made through partners’ capital account. The retiring or deceased partners’ capital account will be credited with his share of goodwill and continuing partners’ capital account will be debited in their gaining ratio. The following journal entry will be recorded:

Continuing Partners’ Capital A/c Dr. (in the gaining ratio)

To Retiring/Deceased Partners’ Capital A/c (with the share of goodwill)

(Being retiring/deceased partners’ share of goodwill adjusted to continuing partners in the gaining ratio)

When the Goodwill Account is Already Appearing in the Books : Usually, the goodwill is not shown in the books of a firm. However, if at the time of retirement or death of a partner, it appears in the balance sheet of a firm, it will be written off by debiting all the partners’ capital account in their old profit sharing ratio and crediting the goodwill account. In such a case, the following journal entry is recorded:

All partners’ capital A/c Dr. (in old ratio)

To Goodwill A/c (goodwill existing in the books)

(Being goodwill existing in the books written off)

Hidden Goodwill: Sometimes the firm agrees to settle the retiring or deceased partner’s account by payment of a lump sum amount. If such amount is an excess of his capital and share in reserves/revaluation etc. The excess will be treated as his share of goodwill.

3. Revaluation of Assets and Liabilities: At the time of retirement, the assets and liabilities are revalued and a revaluation account is prepared in the same way as is done in case of admission of a new partner. The only difference is that in case of retirement any profit or loss due to revaluation is divided among all the partners, including the retiring partner. Whereas in case of admission of a new partner, the new partner does not share such profit or loss on revaluation.

(i) On Profit Revaluation A/c Dr.

To All Partners’ Capital A/c (in OPSR)

(Being distribution of profit on revaluation)

(ii) On Loss All Partners’ Capital A/c Dr. (in OPSR)

To Revaluation A/c

(Being distribution of loss on revaluation)

When Revalued Value is Not Shown in the Books (Liabilities and Assets Shown on Old Value): This method is also called as “Memorandum Revaluation Method.” Similar to admission of a new partner, it is divide into two parts. In the first part, it is prepared as revaluation account and in the second part, the gain/loss is divided among old partners in the profit sharing ratio and the same amount is divided among remaining partners in new profit sharing ratio by passing a reverse entry. No entry is passed for the first part while following two entries are passed for the second part:

(i) To Divide Gain on Revaluation

Memorandum Revaluation A/c Dr. (in OPSR)

To Old Partners’ Capital A/c

(Being profit transferred to capital account)

Note : Reverse entry in case of loss.

(ii) To Pass Reverse Entry for Gain or to Close Memorandum Revaluation Account.

Remaining Partners’ Capital A/c Dr. (in NPSR)

To Memorandum Revaluation A/c (Being adjustment made for such profit)

Note: Reverse entry in case of loss.

4. Adjustment of Accumulated Profits/Losses: If at the time of retirement, there is any balance of general reserve. Reserve fund or any undistributed amount of profit and loss account appearing in the balance sheet, it belongs to all the partners and should be transferred to the capital account of all partners’ in their old profit sharing ratio. Following entries are passed for this purpose:

(i) For Distributing Reserve and Accumulated Profit

General Reserve A/c Dr.

P & L A/c Dr.

Investment Fluctuation Reserve A/c Dr.

Workmen Compensation Reserve A/ c Dr.

To All Partners’ Capital A/c (in OPSR)

(Being reserve and accumulated profit transferred to partners’ capital account in OPSR)

(ii) For Distributing Accumulated Losses

All Partners’ Capital A/c Dr.

To Profit and Loss A/c

To Advertisement Expenses A/c (Deferred Revenue Expenditure A/c)

(Being loss distributed)

Note: Employees provident fund is the liability for the firm, so it is not distributed among the partners.

5. Payment of Retiring Partner : The amount payable is paid to the retiring partner as per procedure mentioned in the partnership deed. Normally, one of the following methods can be used to pay the amount payable:

(1) Lump-Sum Payment System : After making all adjustments, the balance in the capital accounts of retiring partner shows the amount payable to retiring partner or in case of death of partner to his legal heir. If the financial condition of the firm is strong, the payment can be made in lump-sum cash or through bank. The following entry is passed for amount payable at the time of payment under this method:

Retiring Partner’s Capital A/c Dr.

To Cash/Bank A/c

(Being amount due to retiring partner paid)

(2) Payment Partly in Cash and Partly by Transferring into Loan Account: At the time of payment under this method, the following entry is passed

Retiring Partner’s Capital A/c Dr.

To Cash A/c

To Retiring Partner’s Loan A/c

(Being retiring partner paid partly in cash and balance transfer to his loan account)

(3) Payment by Installment: To make lump sum payment, firm must have sufficient cash or bank balance. Generally, it is not considered prudent to withdraw large sums, therefore, installment payment system is considered more practical way of payment. Under this method, the balance in the capital account of the retiring or deceased partner is transferred to a loan account in his name and this amount is paid in predetermined installments. Interest is also paid on the balance amount as per mutual agreement. At the time of payment under this method, following journal entries are parsed:

(i) On Transferring Amount Payable to Loan Account

Retiring Partner’s Capital A/c Dr.

To Retiring Partner’s Loan A/c

(Being retiring partner’s capital account balance transfer to his loan account

(ii) On Interest Falling Due

Interest A/c Dr.

To Retiring Partner’s Loan A/c

(Being for interest to his loan account)

(iii) On Payment of Installment Retiring Partner’s Loan A/c Dr.

To Cash/Bank A/c

(Being installment paid)

(4) Payment by Annuity: Under this method, the partner retired is given an annuity (annual payment) of certain amount (to be ascertained from annuity tables) till he is alive or to the executor of a deceased partner till his life. This stipulated amount payable is called an Annuity. According to this method, the balance of capital account of a partner retired or deceased is transferred to annuity suspense account. This account is credited with a certain amount of interest at a specified rate. If the partner or the executor at deceased partner dies leaving a balance in this account, it is distributed by the remaining partner in their profit sharing ratio.

This account is credited every year beginning balance at a specified rate of interest. In case, the rate of interest is not given, in the question at 6% per annul. The payment from this account is made till the death of retired partner. In case no balance is left in this account, the necessary amount is transferred to annuity account from profit and loss account.

Journal Entries

(i) On Transferring the Amount Payable to Annuity Account.

Retiring Partner’s Capital A/c Dr.

To Annuity Suspense A/c

(Being balance of retiring partner’s capital account transferred to annuity suspense account)

(ii) On Interest Falling Due Every Year on Annuity Account

Interest A/c Dr.

To Annuity Suspense A/c

(Being interest due)

(iii) On Yearly Payment of Annuity

Annuity Suspense A/c Dr.

To Bank/Cash A/c

(Being amount of annuity paid)

(iv) On Death of Retired Partner While There is Balance in Annuity Account

Annuity Suspense A/c Dr.

To Remaining Partner’s Capital A/c

(Being balance of annuity suspense account transfer remaining partner’s capital account)

(v) If the retired partner survives beyond the balance in annuity account he will continue to receive annuity from firm till his survived. In this case following entry will be passed at the end of year a part from the entry at for accounting of annuity.

Profit & Loss A/c Dr.

To Annuity Suspense A/c

6. Adjustment of Capital: After retirement of a partner, the remaining partners may decide to adjust their capital. Often the remaining partners determine the total amount of capital of the reconstituted firm and decide to keep their respective capital account in proportion to the new profit sharing ratio. The total capital of the firm may be more or less than the total of their capital at the time of retirement. The new capital of the partners are compared with the balance standing to the credit of respective partners’ capital account. It there is a surplus in the capital account, the amount is withdrawn by the concerned partner. The partner brings cash in case the balance in the capital account is less than the calculated amount.

(1) When Total Capital of the New Firm is Given : Steps involved in adjusting capital of partners as follows:

- Ascertain present capital of remaining partners (after all adjustment).

- Calculate proportionate capital of remaining partners on the basis of total capital of the new firm and new profit sharing ratio.

- Find surplus/deficit by comparing proportionate capital (step 2) and present capital (step 1).

Surplus = Present capital is more than the proportionate capital Deficit = Present capital is less than the proportional capital - Adjust the surplus by paying or by transfer to the credit side of current account of the concerned partner. In case of deficit the amount of deficiency is brought by the concerned partner or alternatively transfer to the debit side of his current account.

(a) If the adjusted present capital is more than the proportionate capital

Concerned Partner’s Capital A/c Dr.

To Cash/Bank/Concerned Partner’s Current A/c

(b) If the adjusted present capital is less than the proportionate capital

Cash/Bank/Concerned Partners’s Current A/c Dr.

To Concerned Partner’s Capital A/c

(2) Adjustment of Remaining Partners’ Capital in Their Profit Sharing Ratio When the Total Capital of the New Firm is Not Pre-Determined: In this case the total amount of adjusted capital of the remaining partners is rearranged as per agreed proportion in which they share profit of the reconstituted firm. The following steps may be adopted.

- Add the balance standing to the credit of the remaining partners’ capital account.

- The total so obtained is the total capital of the firm.

- This capital is divided according to the new profit sharing ratio.

(3) When the Retiring Partner is to be Paid through Cash Brought in by the Remaining Partners in a Manner to Make Their Capital Proportionate to their New Profit Sharing Ratio: Steps involved for adjusting the capital of partners are as follows :

- Calculate adjusted capital of remaining partners after adjustment.

- Calculate total capital of the firm as follows:

Aggregate of adjusted capital of remaining partners + Shortage of cash to be brought in by continuing partners to pay the retiring partner. - Calculate new capital of remaining partners by dividing total capital of the new firm in their new profit sharing ratio.

- Find surplus/deficit capital by comparing the new capital (step 3) with the adjusted old capital (step 1).

- Pass necessary journal entry for adjusting the surplus/deficit.

RBSE Solution Class 12 Commerce Question 3.

How is accounting done for Joint Life Insurance Policy and several life insurance policies in the books of a firm?

Answer.

Accounting Treatment of Life Insurance Policy at the Time of Death of a Partner: If a joint life insurance policy is taken on lives of all partners, then sum insured is payable on death of any one partner when separate life insurance policy are taken on lives of partners, then sum insured is payable only on the policy of that partner. However, to find out the sum payable to the legal heir of the deceased partner, the surrender value of other partners policies is also kept in mind. Principally, there is no difference in the accounting procedure whether policies taken are several or joint. It is noteworthy that firm is responsible for payment of premium to insurance company ,if the policy/policies are taken by the firm.

1. Individual or Separate Life Policy

(i) For Payment of Premium

Insurance Premium A/c Dr.

To Cash/Bank A/c

(Being insurance premium paid)

(ii) For Premium Transferred to P&L A/C Every Year

Profit and Loss A/c Dr.

To Insurance Premium A/c

(Being premium transferred to P&L account)

(iii) For Amount of Policy Due on Death of Partner

Insurance Company A/c Dr.

To Life Policy of Deceased Partner’s A/c

(Being policy amount due)

(iv) For Amount of Policy Received

Bank A/ c Dr.

To Life Policy of Deceased Partner’s A/c

(Being policy amount received)

(v) On Distribution of Deceased Partner and Policy Money of Surrender Value of Surviving Partners Among All Partners.

Life Policy of Deceased Partner A/c Dr.

Life Policies of Other Partners A/c Dr.

To All Partners’ Capital A/c

(Being total amount of policy distributed in all the partners)

Alternative Method: When insurance policy account is not to be shown in books, then with the total amount of policy, amount of deceased partner and the surrender value of surviving partners are added and the share of deceased partner is ascertained and with this amount, deceased partner’s capital account is credited and surviving partners’ capital account are debited in gaining ratio.

Remaining Partners’ Capital/Current A/c Dr.

To Deceased Partner’s Capital/Current A/c

(Being deceased partner share in policy amount credited to his capital account)

2. Joint Life Insurance Policy on the Lives of Partners : In case of joint life insurance policy accounting can be done as per any one of three different methods.

(i) Treating Premium as Trade Expenses: In this situation the following entries will be passed:

Journal Entries

(a) For Payment of Premium

Insurance Premium A/c Dr.

To Cash/Bank A/c

(Insurance Premium Paid)

(b) For Premium Transferred to P&L Account

Profit and Loss A/ c Dr.

To Insurance Premium A/c

(Premium Transferred to P&L account)

(c) For Amount of Policy Due on Death of Partners

Insurance Company A/c Dr.

To Joint Life Policy A/c

(Policy amount due)

(d) For Amount Received of Policy

Bank A/c Dr.

To Insurance Company A/c

(Policy Amount Received)

(e) For Distribution of Amount of Policy.

Joint Life Policy A/c Dr.

To All Partners’ Capital A/c

(Policy amount distributed)

(ii) When Premium is Treated as an Investment: In this case the total amount of premium paid is not transferred to profit and loss account but only the excess of premium paid over surrender value at the end of the year is transferred to profit and loss account. By following this method the balance in life insurance policy account always remains equal to the surrender value which is shown on the assets side of the balance sheet. Following entries are passed for accounting under this method:

(a) On Payment of Premium

Joint Life Policy A/c Dr.

To Bank A/c

(Being insurance premium paid)

(b) On Write Off the Amount

Profit and Loss A/c Dr.

To Joint Life Policy A/c

(Being premium transferred to P & L account)

(c) On Receiving the Amount of Policy

Insurance Company A/c Dr.

To Joint Life Policy A/c

(Policy amount due)

(d) On Receipt of sum insured

Bank A/c Dr.

To Insurance Company A/c

(Being policy amount received)

(e) On Distribution of Amount of Policy

Joint Life Policy A/c Dr.

To All Partners’ Capital A/c

(Being policy amount distributed)

(iii) When Premium is Treated as an Investment and Reserve is Correct: Sometimes, a few firms treat premium payment as an investment and simultaneously create a reserve every year. The amount calculated on the basis of surrender value i.e., excess of premium paid over surrender value is transferred to reserve account instead of profit and loss account. Following entries are passed under this method:

(a) To Paid Premium Every Year

Joint Life Policy A/c Dr.

To Bank A/c

(Being insurance premium paid)

(b) To Make Joint Life Insurance Policy Reserve Every Year

Profit and Loss Appropriation A/c Dr.

To Joint Life Policy Reserve A/c

(Being joint Life policy reserve created)

(c) To Difference in Balance of Reserve Account and Insurance Account

Joint Life Policy Reserve A/c Dr.

To Joint Life Policy A/c

(Being difference charged to reserve account)

(d) To due Insurance Amount

Insurance Company A/c Dr.

To Joint Life Policy A/c

(Being policy amount received)

(e) To Received Insurance Amount

Bank A/c Dr.

To Insurance Company A/c

(Policy amount received)

(f) To Close Joint Life Insurance Policy Reserve Account

Joint Life Policy Reserve A/c Dr.

To Joint Life Policy A / c

(Being balance of reserve account transferred to JLP account)

(g) To Divide Insurance Policy Amount in All Partners

Joint Life Policy A/c Dr.

To Partner’s Capital A/c

(Being policy amount distributed)

Accounts Solutions Class 12 RBSE Question 4.

What are the different methods of making payment due to a retiring partner? Explain.

Answer.

Payment of Amount Due to Retiring Partner: The amount payable is paid to the retiring partner as per procedure mentioned in the partnership deed. Normally one of the following methods can be used to pay the amount payable.

1. Lump-Sum Payment System : After making all adjustments, the balance in the capital accounts of retiring partner shows the amount payable to retiring partner or in case of death of partner to his legal heir. If the financial condition of the firm is strong, the payment can be made in lump sum cash or through bank. The following entry is passed for amount payable at the time of payment under this method.

Retiring Partner’s Capital A/c Dr.

To Cash /Bank A/c

(Being amount due to retiring partner paid)

2. Payment Partly in Cash and Partly by Transferring into Loan Account : At the time of payment under this method, the following entry is passed

Retiring Partner’s Capital A/c Dr.

To Cash A/c

To Retiring Partner’s Loan A/c

(Being retiring partner paid partly in cash and balance transfer to his loan account)

3. Payment by Installment: To make lump-sum payment, firm must have sufficient cash or bank balance. Generally, it is not considered prudent to withdraw large sums, therefore, installment payment system is considered more practical way of payment. Under this method, the balance in the capital account of the retiring or deceased partner is transferred to a loan account in his name and this amount is paid in predetermined installments. Interest is also paid on the balance amount as per mutual agreement. At the time of payment under this method, following journal entries are passed

(i) On Transferring Amount Payable to Loan Account

Retiring Partner’s Capital A/c Dr.

To Retiring Partner’s Loan A/c

(Being retiring Partner’s Capital Account balance transfer to his loan account)

(ii) On Interest Falling Due

Interest A/c Dr.

To Retiring Partner’s Loan A/c

(Being for interest to his loan account).

(iii) On Payment of Installment

Retiring Partner’s Loan A/c Dr.

To Cash/Bank A/c

(Being installment Paid)

4. Payment by Annuity: Under this method, the partner retired is given an annuity (annual payment) of certain amount (to be ascertained from annuity tables) till he is alive or to the executor of a deceased partner till his life. This stipulated amount payable is called an Annuity. According to this method, the balance of capital account of a partner retired or deceased is transferred to annuity suspense account. This account is credited with a certain amount of interest at a specified rate. If the partner or the executor or deceased partner dies leaving a balance in this account, it is distributed among the remaining partner in their profit sharing ratio.

This account is credited every year beginning balance at a specified rate of interest. In case, the rate of interest is not given, in the question interest is applied at 6% per annul. The payment from this account is made till the death of retired partner. In case no balance is left in this account, the necessary amount is transferred to annuity account from profit and loss account.

Journal Entries

(i) On Transferring the Amount Payable to Annuity Account.

Retiring Partner’s Capital A/c Dr.

To Annuity Suspense A/c

(Being balance of retiring partner’s capital account transferred to annuity suspense account)

(ii) On Interest Falling Due Every Year on Annuity Account

Interest A/c Dr.

To Annuity Suspense A/c

(Being interest due)

(iii) On Yearly Payment of Annuity

Annuity Suspense A/c Dr.

To Bank/Cash A/c

(Being amount of annuity paid)

(iv) On Death of Retired Partner while there is Balance in Annuity Account

Annuity Suspense A/c Dr.

To Remaining Partner’s Capital A/c

(Being balance of annuity suspense account transferred to remaining partner’s capital account)

(v) If the retired partner survives beyond the balance in annuity account he will continue to receive annuity from firm till his survival. In this case following entry will be passed at the end of year apart from the entry at for accounting of annuity.

PL A/c Dr.

To Annuity Suspense A/c

RBSE Class 12 Accountancy Chapter 3 Numerical Questions

RBSE 12th Accountancy Solutions Question 1.

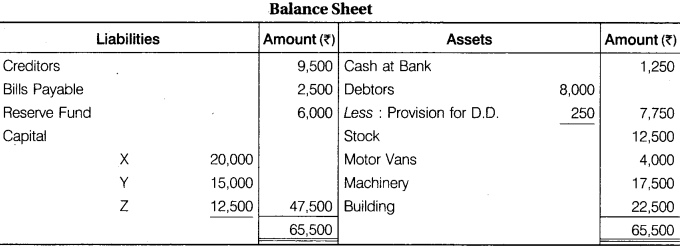

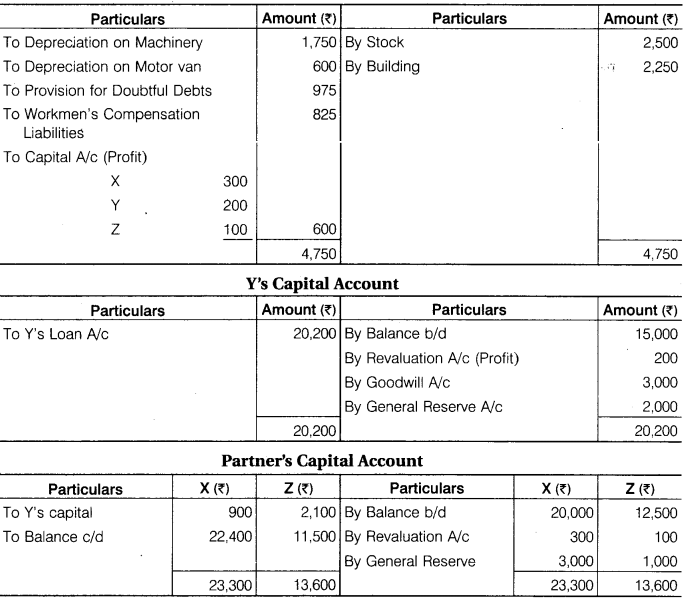

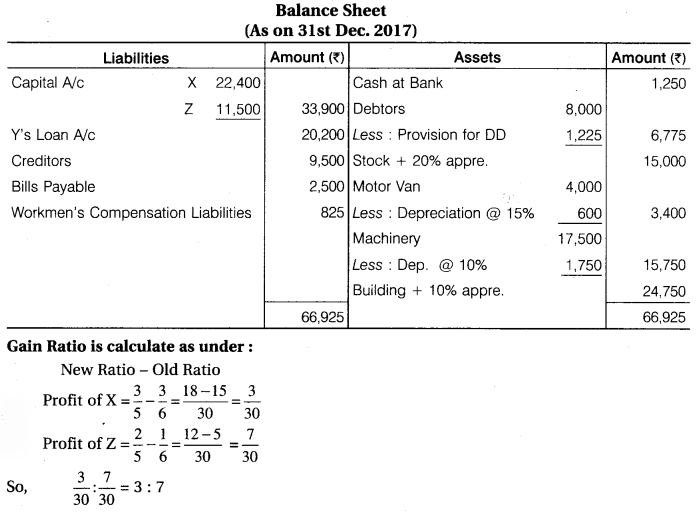

X, Y and Z were partners in a firm, sharing profits in the ratio of 1/2 : 1/3 : 1/6 respectively. The balance sheet of the firm on 31st December, 2017 stood as follows

Y retires from the firm on the above date subject to the following conditions :

(a) Goodwill of the firm be valued at Rs 9,000 and is not to be shown in the books of the firm,

(b) Machinery would be depreciated by 10% and motor vans by 15%.

(c) Stock would be appreciated by 20% and building by 10%.

(d) The provision for doubtful debts would be increased by Rs 975.

(e) Liability for workmen compensation to the extent of Rs 825 would be created.

It was agreed that X and Z would share profit in future in the ratio of 3 : 2 respectively.

You are required to prepare the Revaluation account, Capital account of partners and Balance Sheet of the firm after the retirement of Y.

Also solve if it is assumed that partners decided to show the assets and liabilities at their old book values.

Solution.

First Method: Revaluation Account

RBSE 12 Accounts Solution Question 2.

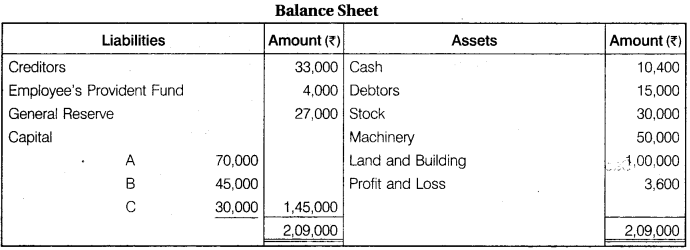

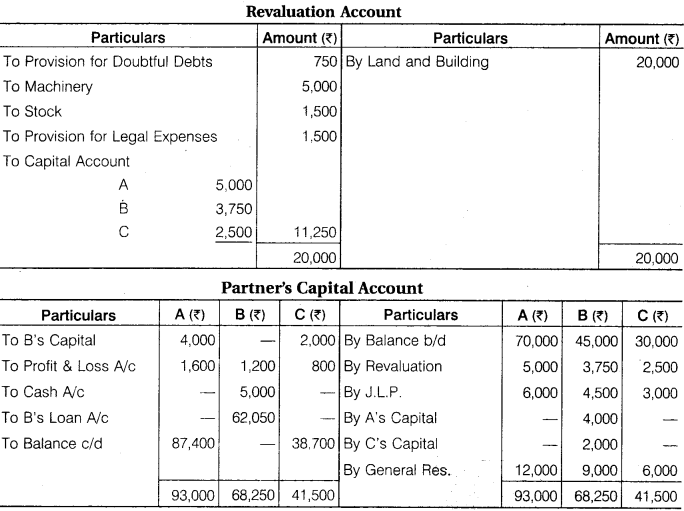

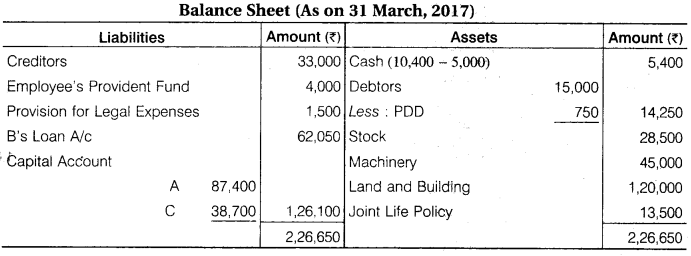

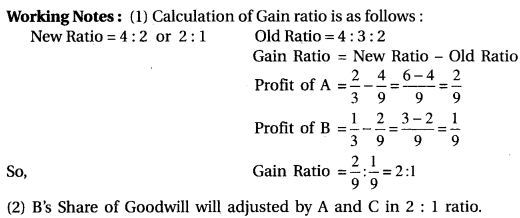

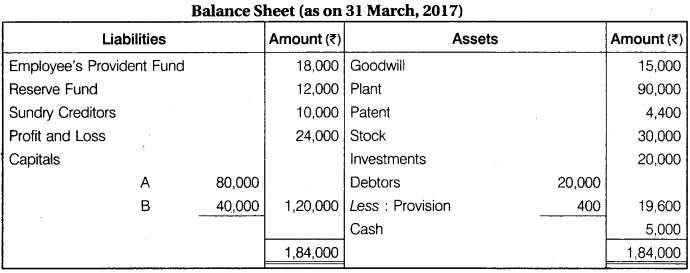

A, B and C are partners, sharing profits in the ratio of 4 : 3 : 2. Their balance sheet on 31st March, 2017 was as follows :

The firm had a joint life insurance policy for Rs 40,000. The surrender value of the policy was Rs 13,500 as on 31st March, 2017. B retires on the above date on the following conditions :

(a) Land and building are undervalued by Rs 20,000.

(b) Goodwill is to be valued at Rs 18,000.

(c) A provision for doubtful debts of 5% is to be created and machinery be written down by 10% and stock by 5%.

(d) A provision of Rs 1,500 be made in respect of legal charges,

(e) Joint life policy will appear in balance sheet. B to be paid Rs 5,000 and balance be transferred to his loan account.

Prepare Revaluation account, Partners’ Capital account and Balance Sheet of A and C.

Solution.

RBSE 12 Accountancy Solutions Question 3.

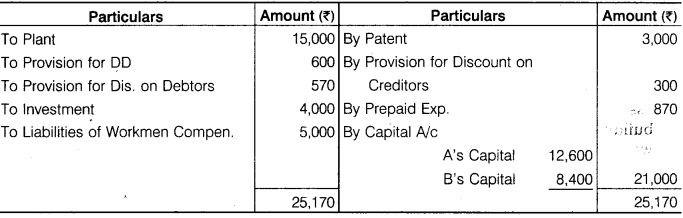

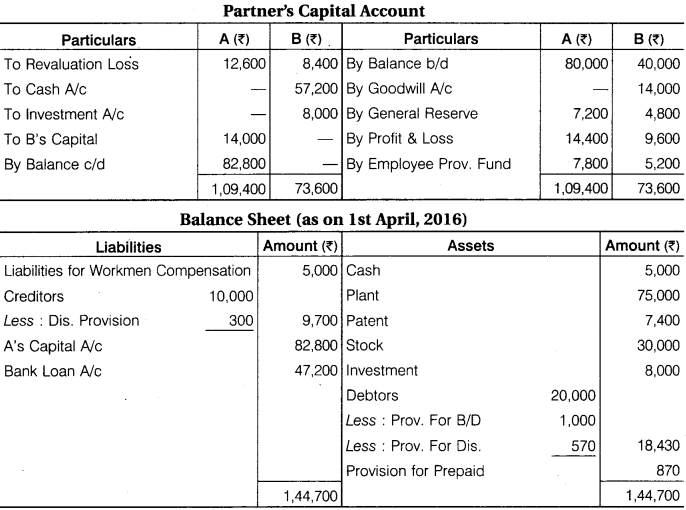

A and B are partners, sharing profits in the ratio of A 1/2, B 1/3 and transfer to reserve 1/6. Their balance sheet as at 31st March, 2017 was as follows :

B retires on 1st April, 2016. The terms were :

- Goodwill is to be valued at Rs 50,000.

- Value of patent is to be increased by Rs 3,000 but plant was found over valued by Rs 15,000.

- Provision for doubtful debts should be 5% on debtors and provision for discount should also be made on debtors and creditors at 3%.

- Out of insurance which was entirely debited to profit and loss account Rs 870 be carried forward as unexpired insurance.

- Investments were revalued at Rs 16,000. Half of these investments were taken over by B.

- There is a claim for workmen compensation to the extent of Rs 5,000. B was paid off in full.

A borrowed the necessary money from the bank on the security of plant and stock to pay off B. Prepare Revaluation account, Capital accounts and the Balance Sheet of A.

Solution.

Revaluation Account

Accountancy Class 12 Book RBSE Question 4.

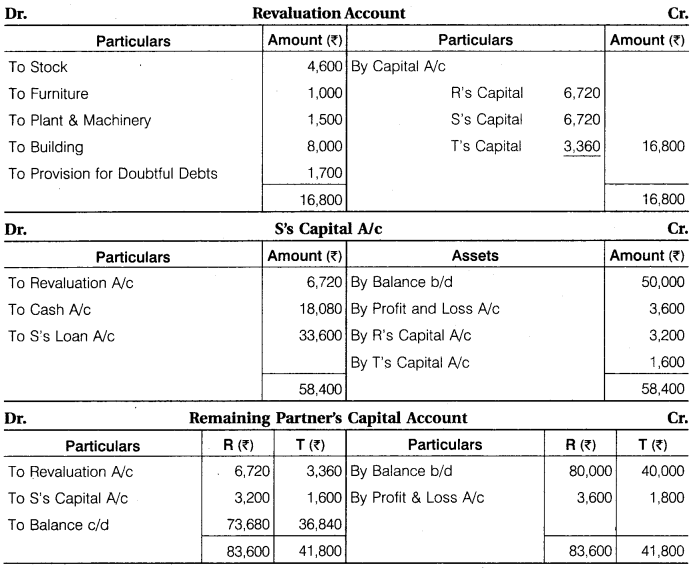

R, S and T were partners in a firm, sharing profits in 2 : 2 : 1 ratio. On 31-03-2016, their balance sheet was as follows :

S retired from the firm on 01-04-2016 and his share was ascertained on the revaluation of assets as follows : Stock Rs 40,000; furniture Rs 6,000; Plant and machinery Rs 18,000; building Rs 40,000; Rs 1,700 were to be provided for doubtful debts. The goodwill of the firm was valued at Rs 12,000. S was to be paid Rs 18,080 in cash on retirement and the balance in three equal yearly installments.

Prepare Revaluation account, Partners’ Capital account; S’s Loan account and Balance Sheet on 01-04-2016.

Solution.

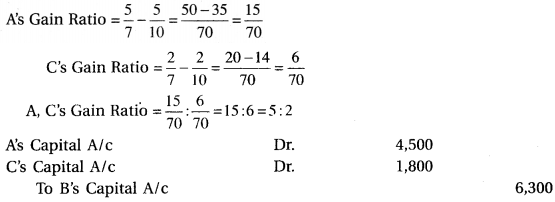

Working Note: Gain Ratio = New Ratio – Old Ratio

In the question, old ratio is given, new ratio is not given. So, if new ratio is not given adjustment of goodwill do in old ratio.

After S’s retirement, remaining partner’s profit sharing ratio will be 2 : 1.

RBSE Solution Class 12th Commerce Accountancy Question 5.

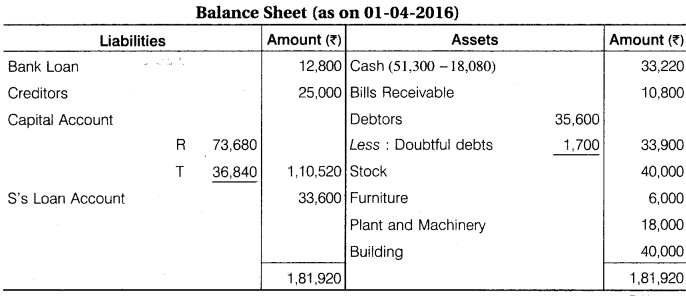

The Balance sheet of A, B and C who were sharing profits in proportion of their capital, stood as follows on 31st March, 2017 :

B retires and the following adjustment of the assets and liabilities have been agreed upon before the ascertainment of the amount payable by the firm to B :

(a) That the stock be depreciated by 6%.

(b) That the provision for doubtful debts be brought upto 5% on debtors,

(c) That the factory land and building be appreciated by 20%.

(d) That a provision of Rs 770 be made in respect of outstanding legal charges,

(e) That the goodwill of the entire firm be fixed as Rs 10,800 and B’s share of the same be adjusted into the account of A and C who are going to share in future in the proportion of 5/8 : 3/8 (No goodwill account is to be raised).

(f) That the entire capital of the firm as newly constituted be fixed at Rs 28,000 between A and C in the proportion of 5/8 : 3/8 after passing entries in their account for adjustment (i.e., actual cash to be paid off or to be brought in by the continuing partners as the case may be).

Pass the necessary journal entries to give effect to the above arrangement and prepare the Balance Sheet of A and C after transferring the amount due to B to separate loan account in his name.

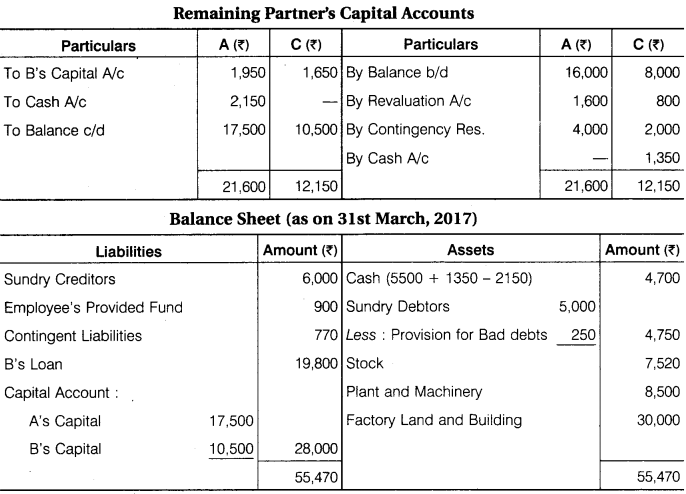

Solution.

Revaluation Account

12th Class Accountancy Solution Book RBSE Question 6.

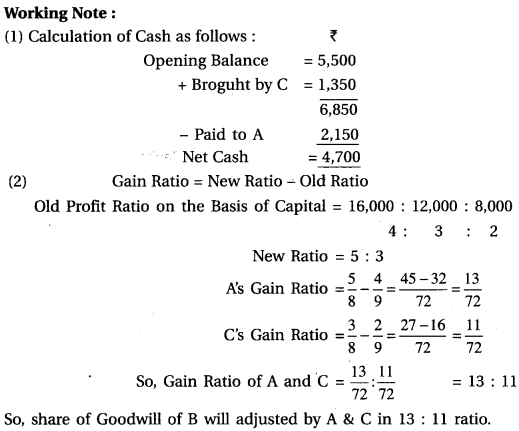

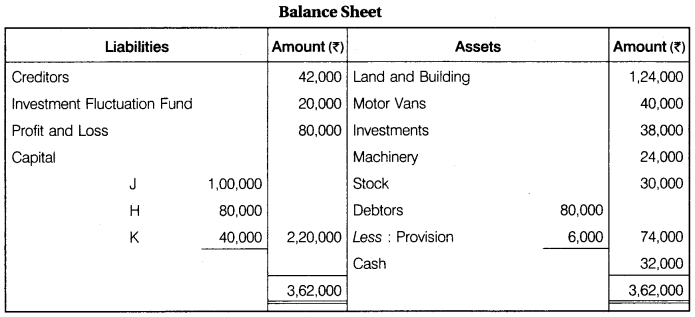

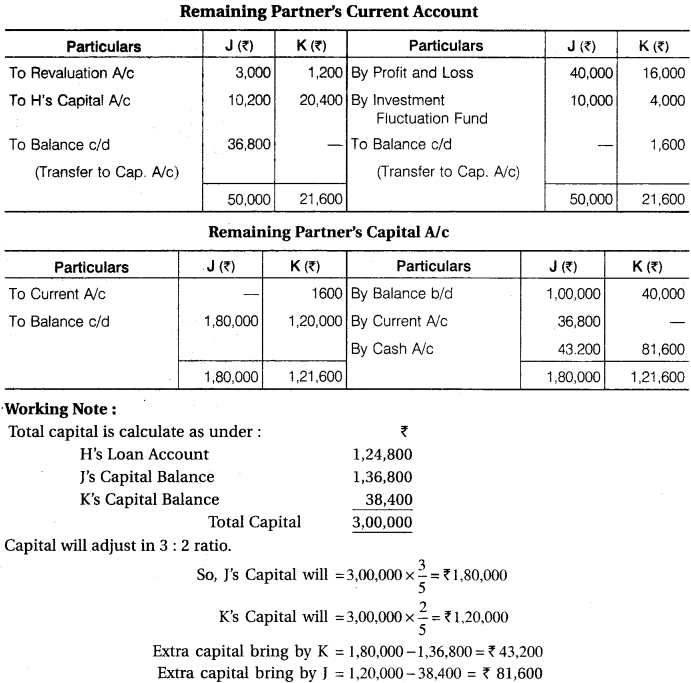

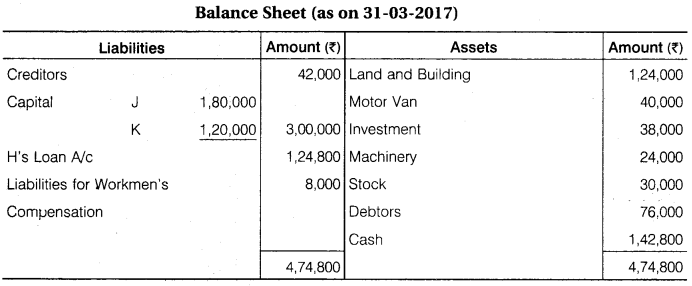

J, H and K were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 31-03-2017, their balance sheet was as follows :

On the above date H retired and J and K agreed to continue the business on the following terms :

- Goodwill of the firm was valued at Rs 1,02,000.

- There was a claim of Rs 8,000 for workmen compensation,

- Provision for bad debts was to be reduced by Rs 2,000.

- H will be paid Rs 14,000 in cash and the balance will be transferred in his loan account which will be paid in four equal yearly installments together with interest @ 10% p.a.

- The new profit sharing ratio between J and K will be 3 : 2 and their capital will be in their new profit sharing ratio.

The capital adjustments will be done by opening current accounts. Prepare Revaluation Account, Partners’ Capital Account and Balance Sheet of the new firm.

Solution.

RBSE Solutions For Class 12 Accountancy Chapter 3 Question 7.

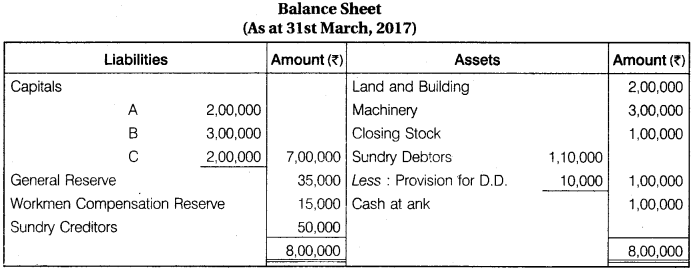

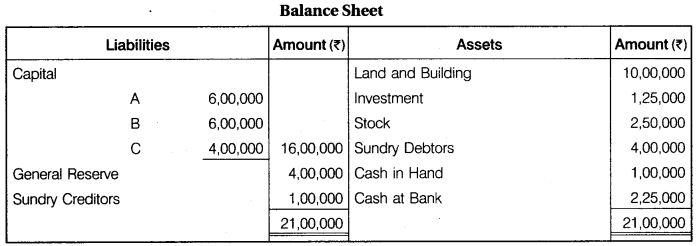

Following is the balance sheet of A, B and C as at 31st March, 2017, who have agreed to share profits and losses in proportion of their capital.

On 31st March, 2017, A desired to retire from the firm and the remaining partners decided to carry on the business. It was agreed to revalue the assets and reassess the liabilities on the following basis :

- Land and building to be appreciated by 30%.

- Machinery be depreciated by 20%.

- There were bad debts of Rs 17,000.

- The claim on account of workmen compensation was estimated at Rs 8,000.

- Goodwill of the firm was valued at Rs 1,40,000 and A’s share of goodwill be adjusted against the capital account of the continuing partners B and C who have decided to share future profits in the ratio of 4 : 3 respectively,

- Capital of the new firm in total will be the same as before the retirement of A and will be in the new profit sharing ratio of the continuing partners,

- Amount due to A be settled by paying Rs 50,000 in cash and the balance by transferring to his loan account which will be paid letter on.

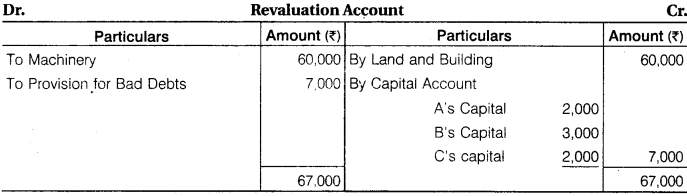

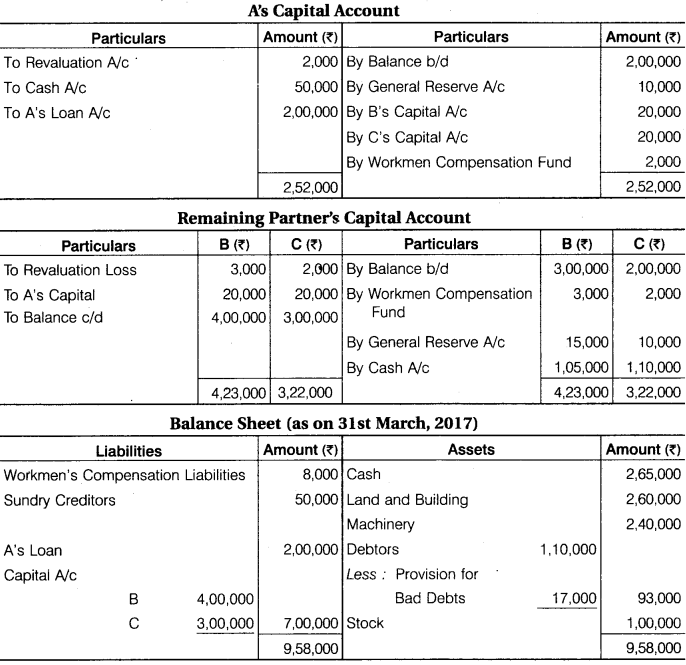

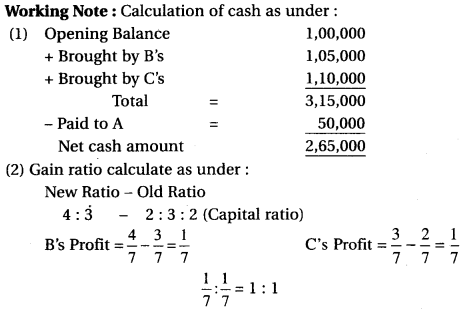

Prepare Revaluation Account, Capital Account of partners and Balance Sheet of the firm after A’s retirement.

Solution.

RBSE Class 12th Accountancy Solutions Question 8.

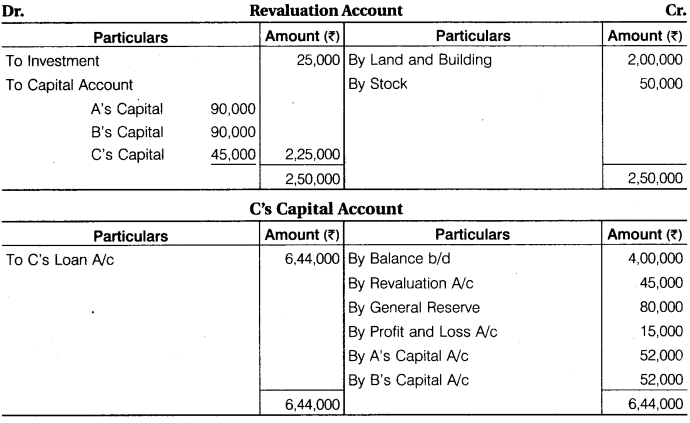

A, B and C are partners, sharing profits and losses in the ratio of 2 : 2 : 1. C retires on 31st March, 2018. The balance sheet of the firm as at 31st December, 2017 stood as follows :

In order to arrive at the balance due to C, it was mutually agreed that:

- Land and building be valued at Rs 12,00,000.

- Investment to be valued at Rs 1,00,000.

- Stock be taken at Rs 3,00,000.

- Goodwill be valued at two years’ purchase of the average profit of the past five years. Goodwill will not appear in the books of reconstituted firm,

- C’s share of profits upto the date of retirement be calculated on the basis of average profit of the preceding three years.

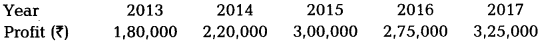

The profits of the preceding five years were as under :

- Amount payable to C is to be transferred to his loan account carrying interest 10% p.a.

You are required to prepare the Revaluation Account, Partners’ Capital Account, and the Balance Sheet as at 31st March, 2018.

Solution.

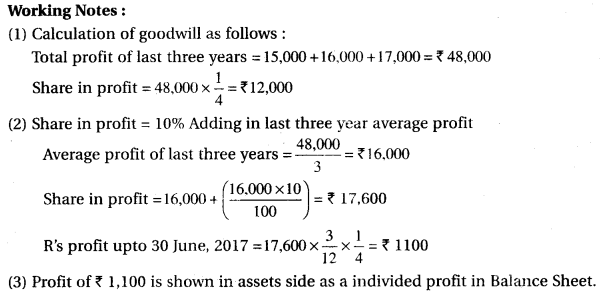

Working Note:

(1) C’s Share in Profits

Last three year’s profit = 3,25,000 + 2,75,000 + 3,00,000

Average profit of last three years profits = 9,00,000 ÷ 3 = Rs 3,00,000

Profit of three months = 3,00,000 x \(\frac { 3 }{ 12 }\) = Rs 75,000

C’s share in profit = 75,000 x \(\frac { 1 }{ 5 }\) = Rs 15,000

(2) Calculation of goodwill as follows :

On the basis of average profit of last year’s profit, 2 times

Averge profit of last 5 years = \(\frac { 3,25,000 + 2,75,000 + 3,00,000+2,20,000 + 1,80,000 }{ 5 }\)

= \(\frac { 13,00,000 }{ 5 }\)

= Rs 2,60,000

Equal to 2 years purchase = 2,60,000 x 2 = Rs 5,20,000

C’s share of goodwill = 5,20,000 x \(\frac { 1 }{ 5 }\) = Rs 10,4000

(3) Gain Ratio = Old Profit & Loss Ratio = 2:2:1

New Profit sharing ratio is not given.

C’s is retiring so gain ratio of A and B will 2 : 2 or 1 : 1 will be.

So, B and A will adjust the share of goodwill of C in equally.

Accountancy Chapter 3 Class 12 Solutions Question 9.

P, Q and R were partners in a firm, sharing profits in 2 : 2 : 1. The partnership deed provided that on the death of a partner, his executors will be entitled for the following :

- Interest on capital @ 12% p.a.

- Interest on drawings @ 18% p.a.

- Salary Rs 12,000 p.a.

- Share in the profit the firm (upto the date death) on the basis previous year’s profit.

P died on 31-05-2017. His capital was Rs 80,000 as on 31st March, 2017.

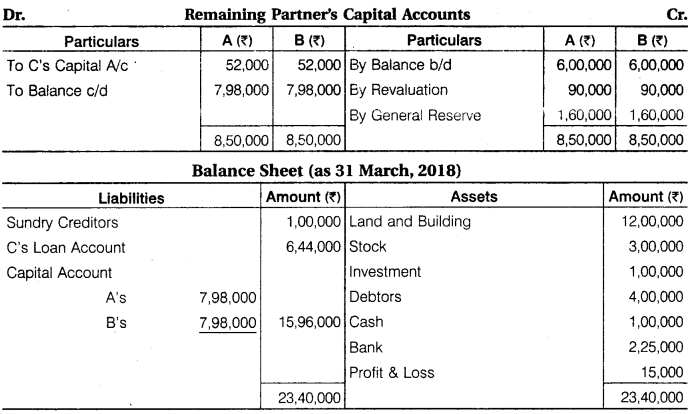

He had withdrawn Rs 15,000 and interest on his drawings was calculated as Rs 1,200. The profit of the firm for the previous year ended 31-03-2017 was Rs 30,000. Prepare P’s Capital Account to be presented to his executors.

Solution.

Working Note:

Calculation of profit as under :

Profit of 2 month = 30,000 x \(\frac { 2 }{ 12 }\) = Rs 5,000

P’s share of profit = 5,000 x \(\frac { 2 }{ 5 }\) = Rs 2,000

RBSE Solutions For Class 12 Accountancy Chapter 3 Question 10.

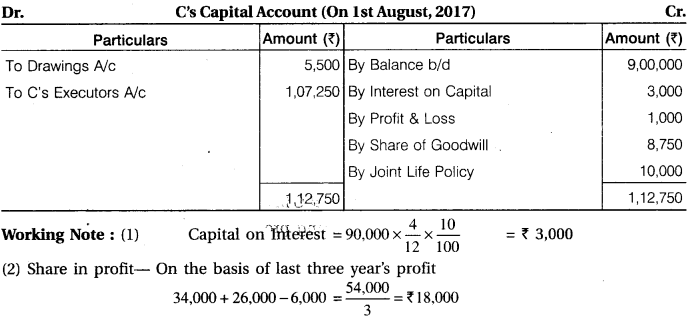

A, B and C are partners, sharing profits in the ratio of 3 : 2 : 1. They had a joint life policy Rs 60,000 and the annual premium Rs 4,000 has been charged to profit and loss account every year. Account are closed on 31st March annually. C died on 1st August, 2017 beside of his capital and insurance money, C’s legal representatives are entitled to :

- Interest on capital at 10% per annum upto the date death,

- His share profit based on average profits to the last three years,

- His share goodwill which is to be calculated at three years’ purchase of the average profit of last 4 years.

C’s capital on 01-04-2017 stood at Rs 90,000 and his drawings from that date to the date of death amounted to Rs 5,500. Profits for the last four years were Rs 16,000, Rs 26,000, Rs (6,000) Loss, Rs 34,000. Prepare C’s Capital Account.

Solution.

Maths RBSE Solutions Class 12 Question 11.

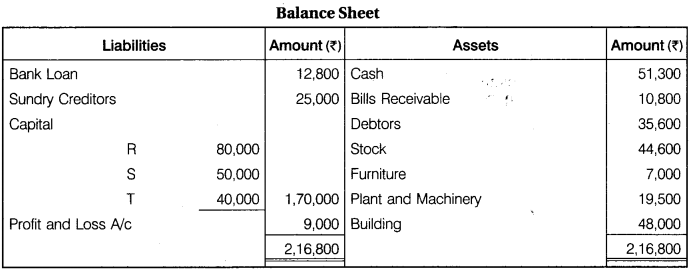

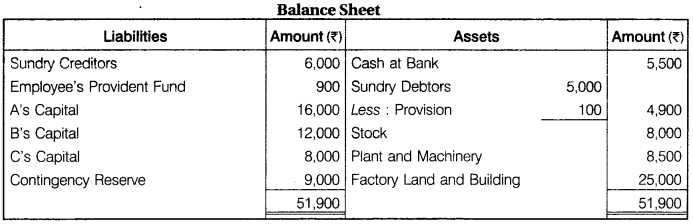

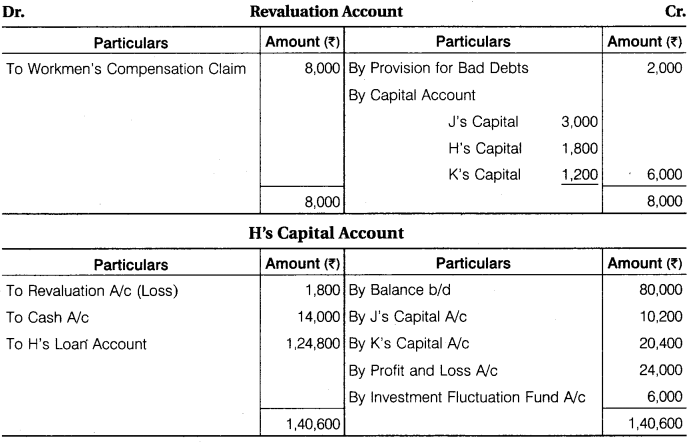

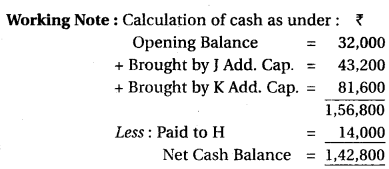

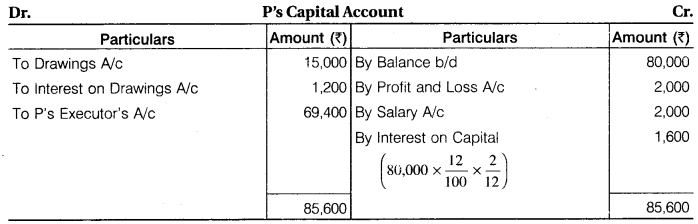

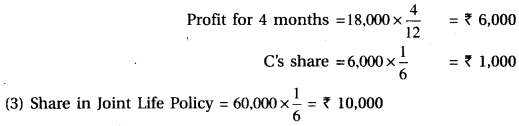

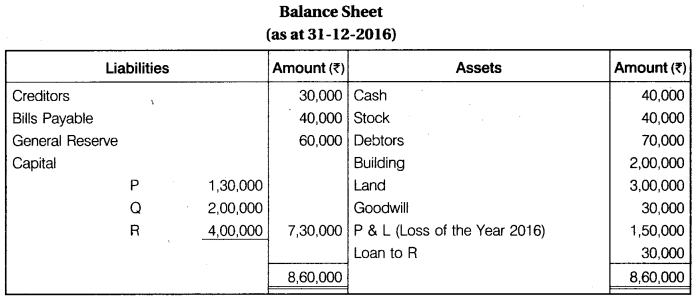

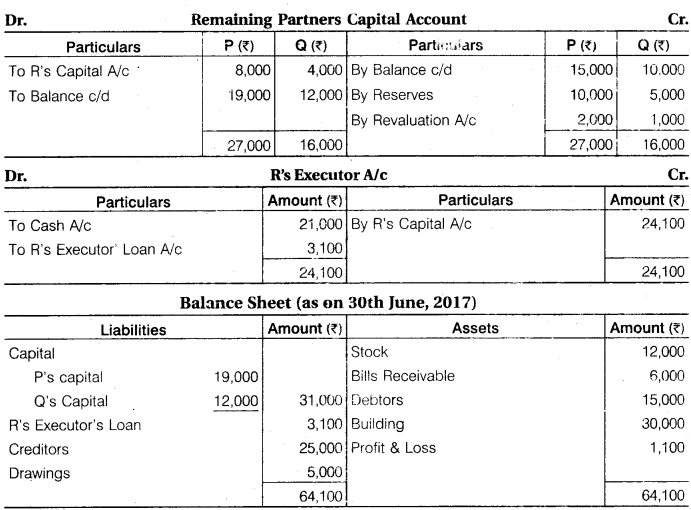

P, Q and R were partners in a firm sharing profits in the ratio 3:2:1. Their balance sheet on 31-12-2016 was as follows :

R died on 14-03-2017. The partnership deed provided for the following on the death of a partner.

(i) Goodwill of the firm was to valued at 3 years’ purchase at the average profit of last 5 years.

![]()

(ii) R’s share of profit or loss till the date of his death was to be calculated on the basis of the profits or loss for the year ending on 31-12-2016. You are required to calculate the followings :

(a) Goodwill of the firm and R’s share of goodwill at the time of his death.

(b) R’s share in the profit or loss of the firm till the date of his death.

Prepare R’s Capital account at the time of his death to be presented to his executors.

Solution.

Working Note:

(1) Valuation of Goodwill:

Goodwill of firm = On the basis of 5 years average profit 3 year purchase

R’s share in goodwill =1,98,000 x \(\frac { 1 }{ 6 }\) = Rs 33,000

(2) Because partner is dead last year, and gain loss on this year. On the basis of loss calculation in current year also show loss. So, there is no share of dead partner.

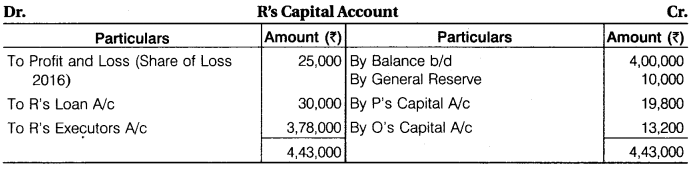

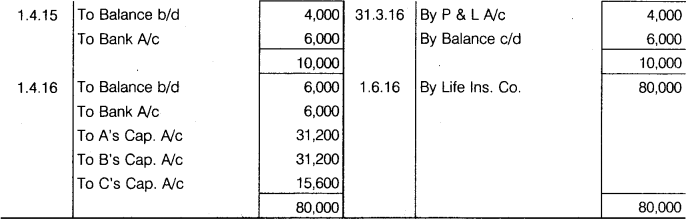

RBSE Solutions For Class 12 Accountancy Chapter 3 Question 12.

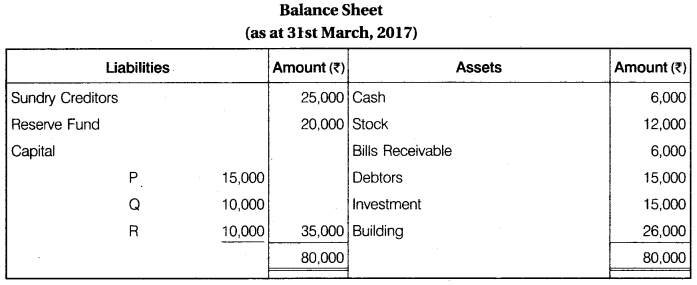

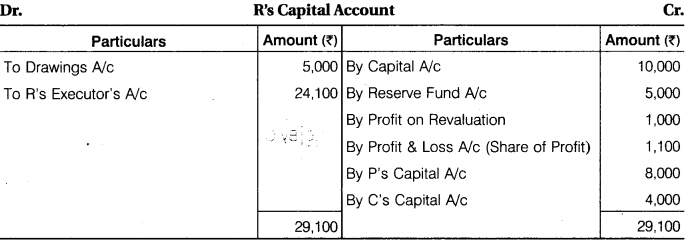

P, Q and R were partners in a firm. Their Balance sheet as at 31st March, 2017 was as follows :

The partnership deed provides that the profit be shared in the ratio 2:1:1 and that in the event death the partner, his executors will be entitled to be paid out:

- The capital to his credit at the date of balance sheet,

- His proportion of reserve at the date of balance sheet,

- His proportion of profits of the last 3 years plus 10% and

- By way goodwill, his proportion of the total profit for the three preceding years.

- Share in profit on revaluation of building which is Rs 4,000.

- The net profit of last 3 years are Rs 15,000, Rs 16,000 and Rs 17,000.

R died on 30th June, 2017. He had withdrawn Rs 5,000 upto the date of his death. The investment were sold at par and R’s executors were paid off. Prepare Partners’ Capital Account, R’s Executor’s Account and Balance Sheet of surviving partners P and Q.

Solution.

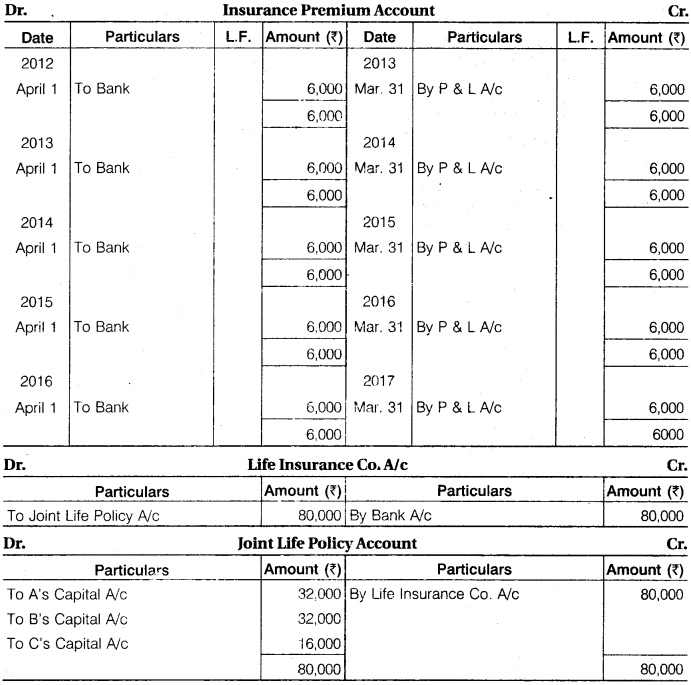

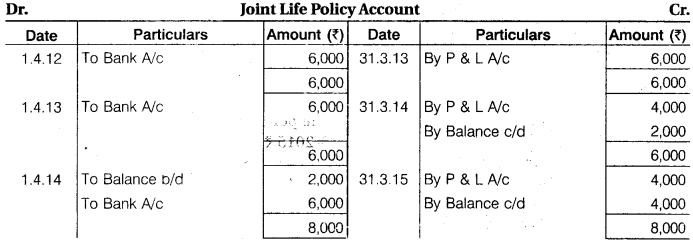

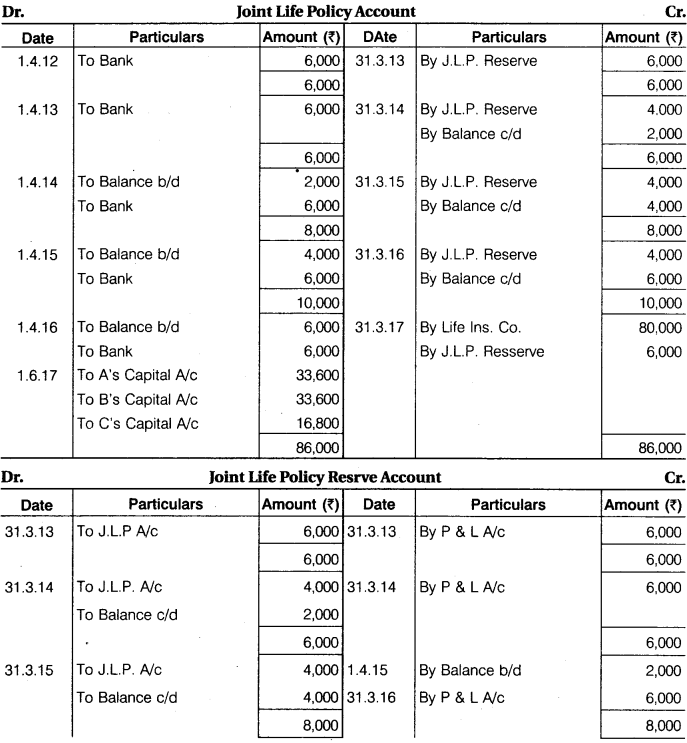

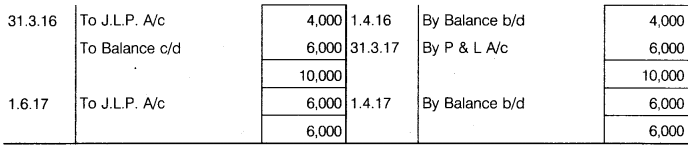

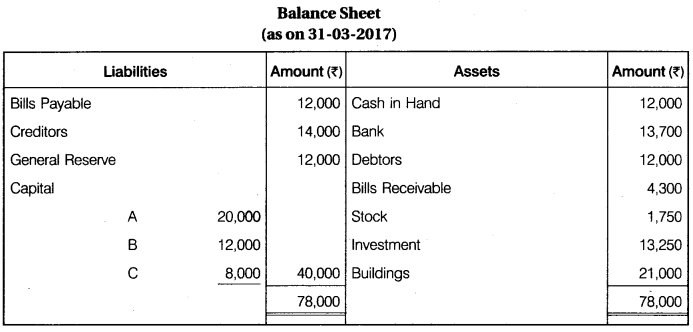

RBSE Class 12th Accounts Solution Question 13.

A, B and C are partners in a firm sharing profits in the ratio 2:2:1. The firm had taken a joint life policy Rs 80,000 on the lives all the partners on 01-04-2012. The firm pays annual premium Rs 6,000. The surrender value of the policy is as under :

31-03-2013 Nil, 31-03-2014 Rs 2,000; 31-03-2015 Rs 4,000 and 31-03-2016 Rs 6,000.

C died on 01-06-2016, prepare the necessary accounts in the books of the firm.

- If premium paid is treated as trade expenses.

- Premium paid is treated as an investment.

- Premium paid is treated as investment and reserve is created.

Solution.

(i) Premium is treated as a Trade Expenses:

(ii) Premium is treated as Investment:

(iii) Premium is treated as Investment and Make a Reserve.

RBSE Solutions For Class 12 Maths Chapter 3 Question 14.

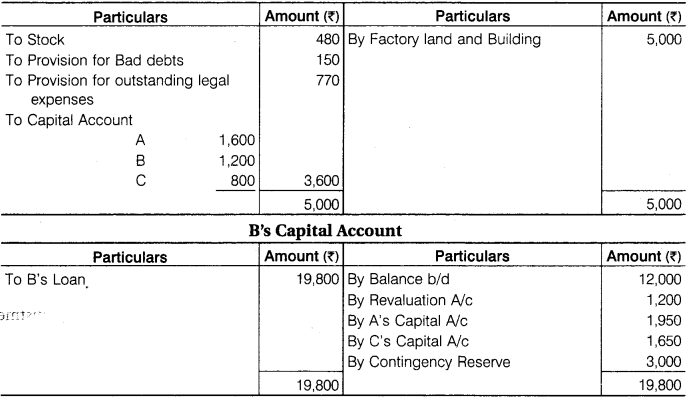

A, B and C are partners, sharing profit in 3 : 2 : 1 ratio. Their balance sheet as at 31st March, 2017 was as follows :

B died on 30-06-2017 and according to the deed of the partnership, his executors were entitled to be paid as under :

- The capital to his creditor at the time of his death and interest thereon @ 10% p.a.

- His proportionate share of general reserve,

- His share of profit for the intervening period will be based on the sales during that period. Sales were calculated as Rs 1,20,000. The rate of profit during past three years had been 10% on sales,

- Goodwill according to his share of profit to be calculated by taking twice the amount of the profit of the last three years less 20%. The profit of previous three years were Rs 8,200; Rs 9,000; Rs 9,800.

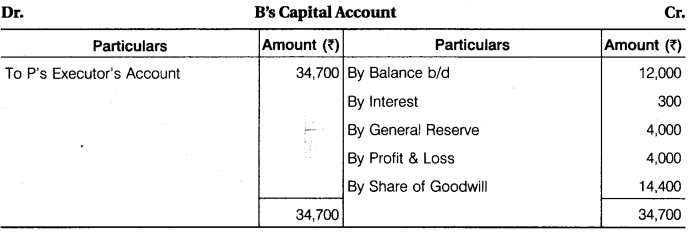

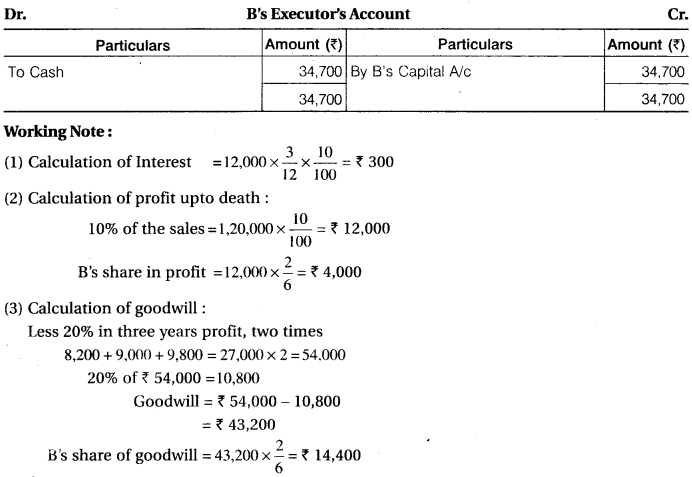

The investment were sold at par and his executors were paid out. Prepare B’s Capital Account and his Executor’s Account.

Solution.