Rajasthan Board RBSE Class 12 Accountancy Chapter 7 Joint Venture Accounts

RBSE Class 12 Accountancy Chapter 7 Textbook Questions

RBSE Class 12 Accountancy Chapter 7 Multiple Choice Questions

RBSE Solutions For Class 12 Accountancy Chapter 7 Question 1.

What is the name of trade structure of joint venture :

(a) Partnership

(b) Cooperative society

(c) Group of people

(d) Sole trader

Answer:

c

Joint Venture Accounting Class 12 Question 2.

The member who participate in joint venture is called :

(a) Manager

(b) Co-venturer

(c) Partner

(d) Shareholder

Answer:

b

RBSE Solutions For Class 12 Accountancy Question 3.

Joint venture account is an example of:

(a) Personal account

(b) Real account

(c) Nominal account

(d) None of these

Answer:

c

Joint Venture Account Question 4.

Maximum number of members in a joint venture here

(a) Two

(b) Twenty

(c) Ten

(d) No limit

Answer:

d

RBSE Solutions For Class 12 Question 5.

On discounting the bill from bank by a co-venturer such discount is debited to :

(a) Discount account

(b) Joint venture account

(c) Bank ac.count

(d) Co-venturer account

Answer:

b

RBSE Class 12 Accountancy Chapter 7 Very Short Answer Questions

RBSE Solutions For Class 12 English Question 1.

State any two important points of difference between joint venture and partnership.

Answer.

- Need of Registration : No need of registration in joint venture while registration is very necessary in partnership.

- Name: There is no name of joint venture, but there is a specific name of partnership.

Accounts Class 12 RBSE Solutions Question 2.

State the maximum and minimum number of ventures in joint venture.

Answer.

In Joint venture, minimum number of ventures are two and no limit of maximum number of members.

12 RBSE Accounts Solution Question 3.

When it is appropriate to keep separate books in joint venture ?

Answer.

When co-venture are living at the same place and venture business is so big, separate books in joint venture keeping is appropriate.

Joint Venture Chapter Question 4.

In which ratio profit and loss of joint venture is distributed ?

Answer.

Profit and loss of joint venture is distributed in agreed ratio if there is not shown agreed ratio in question the P & L distributed equally.

RBSE Solutions For Class 12 Accountancy Chapter 7 Question 5.

What is the nature of memorandum joint venture account ?

Answer.

Memorandum joint venture account nature is just like a Trading and Profit & Loss A/ c.

Joint Venture Questions And Answers Pdf Question 6.

When each co-venturer records his own transactions for the joint venture, which accounts will be opened by him? Give only name.

Answer.

- Joint Venture with A/ c

- Memorandum Joint Venture A/c

RBSE Solutions For Class 12 Accountancy Chapter 7 Question 7.

When dissolution of the joint venture is happen?

Answer.

Completion of special work/or period joint venture is dissolved.

RBSE Solutions For Class 12 Accountancy Chapter 7 Question 8.

Joint venture is appropriate for which type of organisation?

Answer.

Like, joint consignment of goods, joint construction of a building, bridge, hotel, joint underwriting of a particular issue of share and debentures import, export, purchase of land & building, purchase & sale of constructed building, flat, etc.

RBSE Solutions Class 12 Accountancy Question 9.

Which account is credited in joint venture for credit purchase?

Answer.

Supplier’s account is credited on credit purchase in joint venture.

Joint Venture Accounting Question 10.

When separate books of joint venture is kept which types of accounts are opened? Given names.

Answer.

- Joint Venture Account

- Joint Bank Account

- Co-venture’s Capital/Personal Account

These three accounts are opened.

RBSE Class 12 Accountancy Chapter 7 Short Answer Questions

RBSE Solution Class 12 Accountancy Question 1.

What is the joint venture?

Answer.

A joint venture is a business entity created by two or more parties, generally characterized by share ownership, share return and risks and share governance, called joint venture.

RBSE Solutions For Class 12 Accountancy Chapter 7 Question 2.

What is the memorandum joint venture account? Why is it made?

Answer.

A memorandum joint venture account outside the double entry system where the information/transaction contained in all the joint venture account held by the all parties to the joint ventures are collated. The joint venture profit is calculated and the share of profit of each parties is recorded in order to close off the account.

RBSE Solutions For Class 12 Accountancy Chapter 7 Question 3.

What is the difference between joint venture account and consignment account?

Answer.

Difference between Joint Venture and Consignment

| S.No. | Basis of Difference | Joint Venture | Consignment |

| 1. | Relation between two parties | Co-ventures are partners in joint venture. | Relationship in consignment is between principal and agent. |

| 2. | Ownership | All co-ventures are owner. | The consignor alone is the owner. |

| 3. | Capital contribution | All co-ventures contribute -to the capital. | The consignor alone contribute the capital. |

| 4. | Period | It is temporary partnership. It automatically terminates at the completion of the object. | Its period is longer than joint venture. |

| 5. | Sharing Profit & Loss | Profit is distributed among all co-ventures. | Profit belongs to the only. |

| 6. | Methods of keeping Accounts | There are four methods of keeping accounts. | There is only one method of keeping accounts. |

| 7. | Act | Here mutual agreement rule is applied. | While agency related rules are applied. |

Maths RBSE Solutions Class 12 Question 4.

State the methods of accounting for joint venture transactions.

Answer.

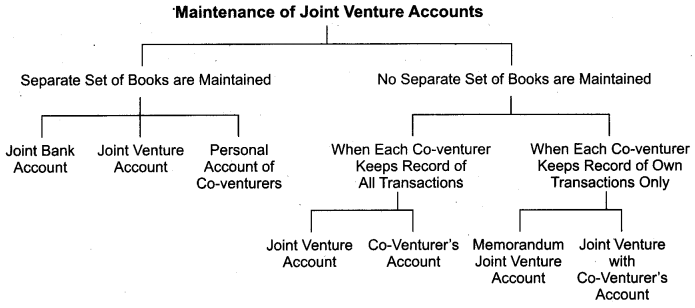

There are three method of accounting for joint ventures transaction but mainly two methods are in tradition:

- Separate set of books are maintain.

- No separate set of book are maintain:

(A) When each co-venture keeps records of all transactions.

(B) When each co-venture keeps records of own transactions only.

RBSE Solution Class 12th Accountancy Question 5.

What are the characteristics of joint venture?

Answer.

Characteristics of Joint Venture : Some important features of joint venture business are as follows:

- It is short duration special purpose partnership, parties in venture are called co-venturers.

- Co-venturers may contribute funds for running the venture of supply inventories from their regular business.

- Co-venturers share profit/loss of the venture at an agreed ratio likewise partnership.

- Generally, profit/loss of the venture is computed on completion of the venture.

- Going concern assumption of accounting is riot appropriate for joint venture accounting.

There does not arise problem of distinction between capital and revenue expenditure. Plant, machinery and other fixed assets when used in venture are first charged to venture account at cost. On Completion of venture such assets are revalued and shown as revenue of the venture.

Thus, accounting approach for measurement of venture profit is totally different.

RBSE Class 12 Accountancy Chapter 7 Essay Type Questions

RBSE Solutions For Class 12 Commerce Question 1.

What is the meaning of the joint venture? Write the differences between joint venture and partnership?

Answer.

Meaning of Joint Venture

A joint ventre is a very short duration “business” (generally, confined to a single transaction, like buying some surplus stores and selling them) entered into by two or more persons jointly. Joint venture may be described as a temporary partnership between two or more persons without the • use of the firm name, for a limited purpose. In other words, under joint venture two or more persons agree to undertake a particular venture (e.g., joint consignment of goods, joint construction of a building, joint underwriting of a particular issue of shares of debentures) and to share the profits and losses thereof in an agreed ratio (if agreement is silent on this point then in equal ratio).

Venture may be for the construction of a building or a bridge for the supply of certain quantity of materials or labour and even for the supply of technical services. The persons who have so agreed to undertake a joint venture are known as “Joint Ventures” or “Co-venturers”. If the co-venturers are in business, then they often supply goods from their regular business for the venture. This limited partnership automatically expires on the completion of the venture for which it was formed.

Difference between Joint Venture and Partnership

| S.No. | Basis of Distinction | Joint Venture | Partnership |

| 1. | Scope | It is limited to a specific venture. | It is not limited to a specific venture. |

| 2. | Persons involved | The persons carrying on business are called Co-venturers. | The persons carrying on business are called Partners. |

| 3. | Ascertainment of profit/loss | The profit/Losses are ascertained at the end of specific venture (if venture continues for a short period) or on interim basis annually (if venture continues for a longer period). | The profits/losses are ascertained on an annual basis. |

| 4. | Act governing | No specific act is there. | Partnership firm are governed by the Indian Partnership Act, 1932. |

| 5. | Name | There is no need for firm name. | A partnership firm always has a name. |

| 6. | Separate set of books | There is no need for a separate set of books. The accounts can be maintained even in one of the co-venturer’s books only. | Separate set of books have to be maintained. |

| 7. | Accounting | Accounting for joint venture is done on liquidation basis. | Accounting for partnership is done on going concern basis. |

| 8. | No. of Member | There is no maximum limit of member but should atleast minimum two. | Minimum 02 or Maximum 20 while in banking may maximum member 10. |

| 9. | Registration | Registration is not compulsory. | While registration is compulsory in partnership. |

RBSE Solutions Accountancy Class 12 Question 2.

Explain with example, methods of accounting for joint venture?

Answer:

(1) When Separate Set of Books are Maintained

When size of the venture is fairly big the co-venturers keep separate set of books of account for the joint venture. Joint venture transactions are separate from their regular business activities. In the books of joint venture the following accounts are opened

- Joint bank account

- Joint venture account

- Personal accounts of the co-venturers or co-venturer’s accounts :

(1) Joint Bank Account : The co-ventures open a separate bank account for the venture transactions by making initial contributions. The bank account is generally operated jointly. Expenses are met from this joint bank account. Also sales or collections from transactions are deposited to this account. However sometimes the co-venturers may make direct payments and direct collections. On completion of the venture the joint bank account is closed by paying the balance to co-venturers.

(2) Joint Venture Account: This account is prepared for measurement of venture profit. This account is debited for all venture expenses and is credited for all sales or collections. Venture profit/loss is transferred to co-venturer’s accounts.

(3) Co-venturer’s Accounts : Personal accounts of the venturers are maintained to keep

record of their contributions of cash, goods or meeting venture expenditure directly and direct payment received by them on venture transactions. This account is also closed simultaneously with the closure of joint bank account.

Example:

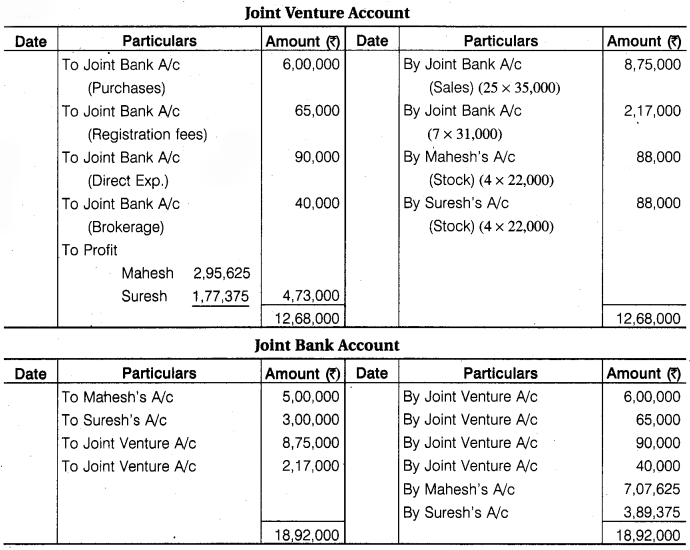

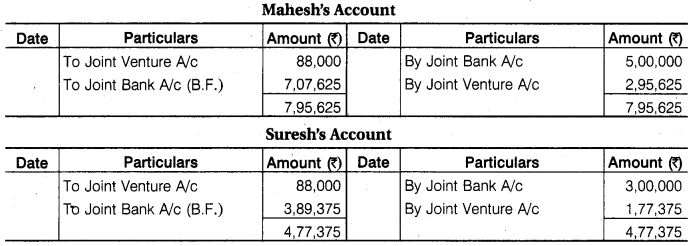

Mahesh and Suresh of Jaipur entered in a joint venture for a land development scheme. They opened a Bank Account in the joint name by depositing Rs 5,00,000 and Rs 3,00,000 on 1 Jan., 2017 respectively. They decided to share of profit and loss in the ratio 5 : 3.

A part of Land purchased for Rs 6,00,000 and Rs 65,000 was paid for its registration charges, Rs 90,000 were paid for the expenses of development of land. The land was divided in 40 plots.

The plots were sold as under: 25 plots at Rs 35,000 each, 07 Plots at Rs 31,000 each, brokerage were paid Rs 40,000. The remaining plots were taken at a price Rs 22,000 by both equally.

Prepare necessary account in the books of Joint Venture.

Solution:

(2) When Separate Books are Not maintained for Joint Venture

When all co-venturers are not living at the same place and venture business is not so big enough than separate books of accounts for joint venture may not be kept. In such a situation co-venturers can record the transactions of joint venture in their own books also for this purpose one of the methods described hereafter may be adopted:

- Each co-venturer records in his books only those transactions concluded by himself (Memorandum joint venture method).

- Each co-venturer records all the transactions of joint venture including transactions concluded by other co-venturer.

1. Each Venturer Recprds only those Transactions concluded by Himself Only:

(i) Under this method of accounting, each co-venturer open joint venture with … account in his books of accounts. This account is individual account in nature. At the end of the venture business, balance of this account shows the amount due to or due from such co-venturer.

(ii) For every payment made for joint venture purchase of goods and any other expenses joint venture with … account is debited. Similarly, for sale proceeds and other income of joint venture this account is credited.

(iii) For any cash remittance to other co-venturer above account is debited and on cash receipts this account is credited.

(iv) On termination of joint venture each co-venturer sends the copy of joint venture with …. account” to other co-venturer. Then a memorandum joint venture account is opened.. This account is nominal in nature.

(v) Amounts paid for purchase of goods for joint venture and all expenses made for joint venture are debited to memorandum joint venture account. Similarly, all sales proceeds and other incomes are credited to this account. Debit balance of this account shows the loss and credit balance shows the profit of the joint venture.

(vi) For the distribution of profit shown by joint venture account, joint venture with… account will be debited and profit and loss account will be credited. In case of loss, reverse entry

will be made.

Example:

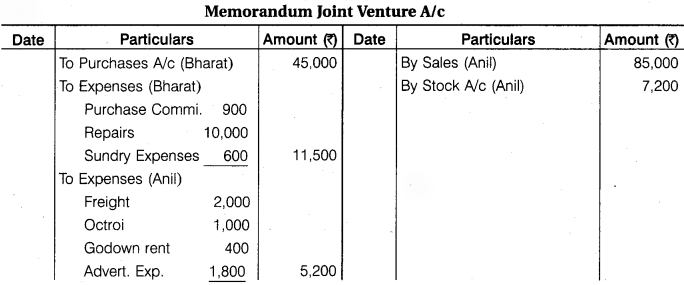

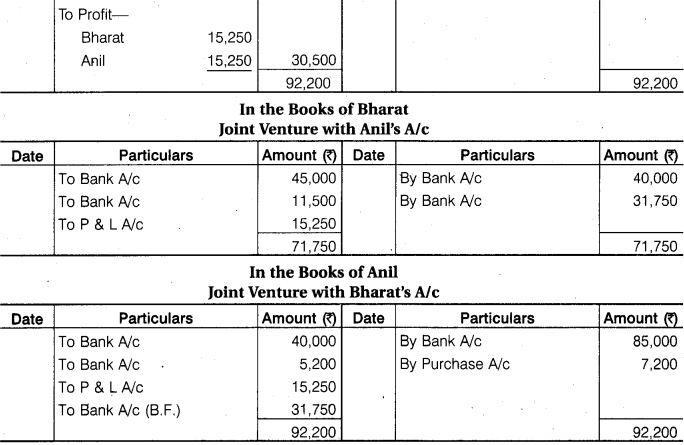

Bharat of Delhi and Anil of Bhilwara entered into Joint Venture to purchase and sale of old machines. It was decided to share profit or losses equally.

Anil remitted Rs 40,000 to Bharat. Bharat purchased old machines worth Rs 45,000 and paid 2% purchases commission, Rs 10,000 for its repairs and Rs 600 for other sundry expenses. Then he dispatched machines to Bhilwara.

Anil took the delivery of the machinery paying Rs 2,000 freight, Rs 1,000 octroi. He sold to some machines for Rs 85,000 and kept remaining one for himself at an agreed value of Rs 7,200. His other expenses were godown rent Rs 400 and Rs 1,800 advertisement and selling expenses. Final settlement was made on joint venture.

Prepare Memorandum Joint Venture Account and Anil’s Account in the books of Bharat and Bharat’s Account in the books of Anil.

Solution:

2. Each Co-venturer Records All the Transactions of Joint venture Including Transactions Concluded by the Other Co-venturers : Under this method of accounting for joint venture, each co-venturer records all the transactions of joint venture in his own books of accounts. For this purpose they open two accounts in their books which are joint venture account and other co-venturer’s personal account. In such a situation, joint venture account is nominal account in nature and it shows the profit or loss on joint venture. Each co-venturer sends his transactions details to others on time to time, so that others can record the transactions of senders, in their respective books of accounts. At the end, the co-venturer’s account are settled.

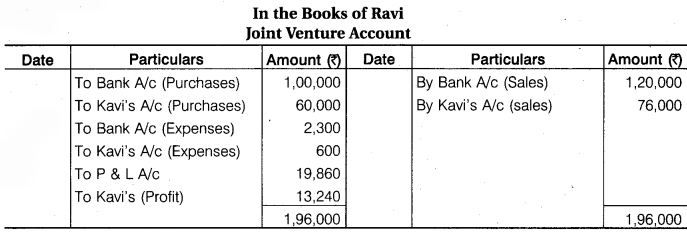

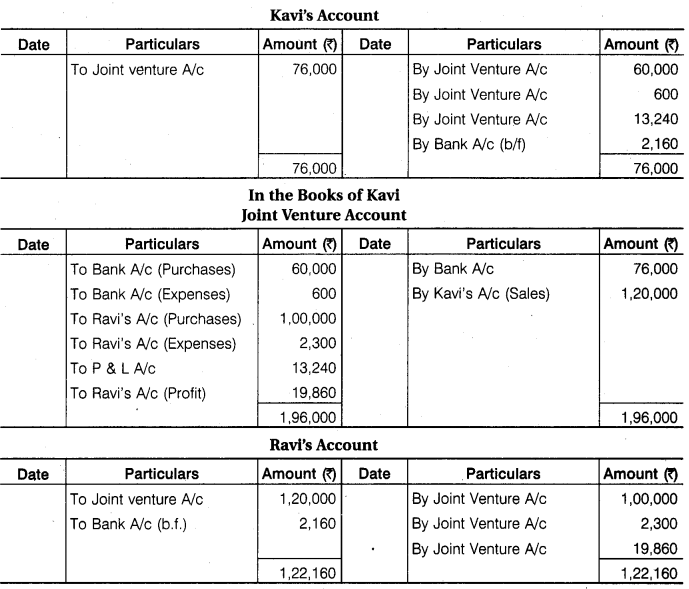

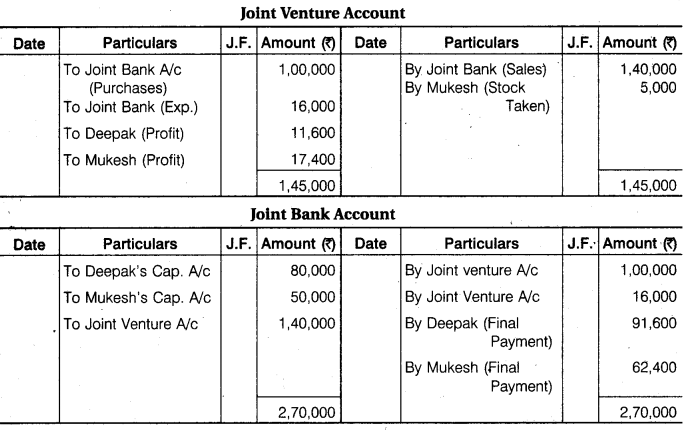

Example : Ravi and Kavi entered in joint venture to purchase and sales of cloth and decide to distribute profit or loss in 3 : 2 ratios. Ravi purchased cloth Rs 1,00,000 and paid Rs 1,000 freight, Rs 200 insurance expenses, Rs 800 carriage and Rs 300 sundry expenses. Kavi purchased cloth Rs 60,000 and paid Rs 400 godown rent, Rs 100 insurance premium and Rs 100 carriage. Ravi sold the cloths worth Rs 1,20,000 and Kavi sold cloths for Rs 76,000. Prepare necessary accounts in the books of both co-venturers.

Solution:

RBSE Class 12 Accountancy Chapter 7 Numerical Questions

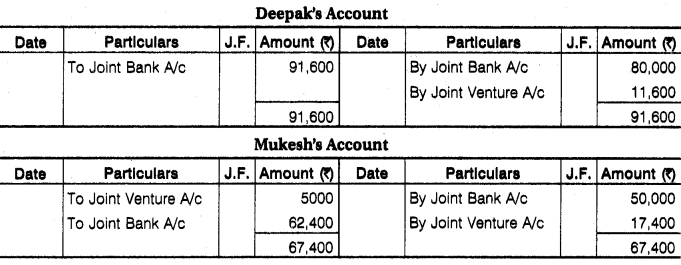

Joint Venture Account Format Question 1.

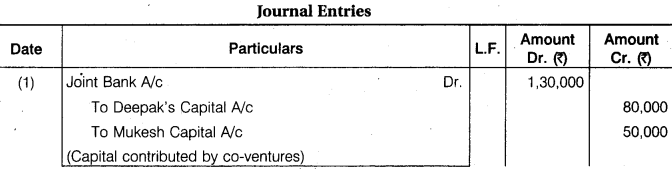

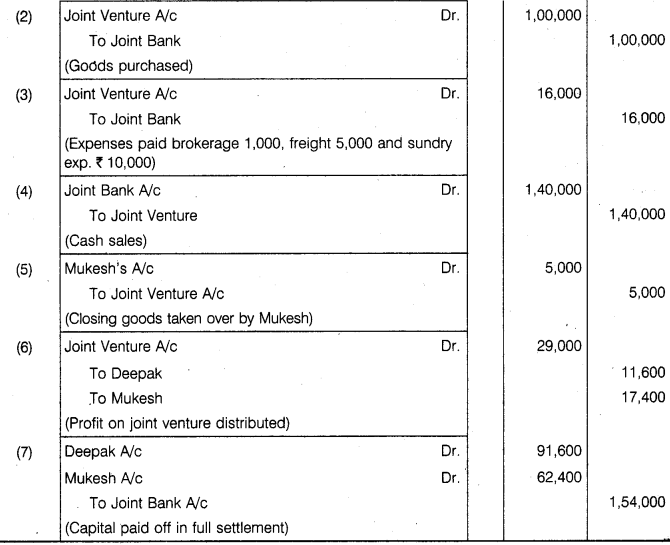

Deepak and Mukesh entered into joint venture for purchase and sale of furniture. They opened a separate bank account contributing Deepak Rs 80,000 and Mukesh Rs 50,000. It was also decided to share profit and losses in 2 : 3 ratio.

They purchase goods for Rs 1,00,000; paid brokerage Rs 1,000 and freight Rs 5,000 and paid sundry expenses Rs 10,000.

Three months sales Rs 1,40,000. Remaining stock was taken by Mukesh for Rs 5,000. Give necessary journal entries and prepare Joint Venture, Joint Bank and Co-venturer’s Account.

Solution:

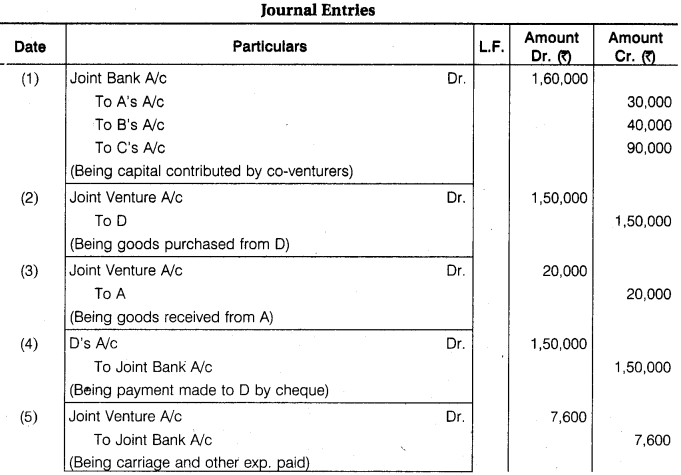

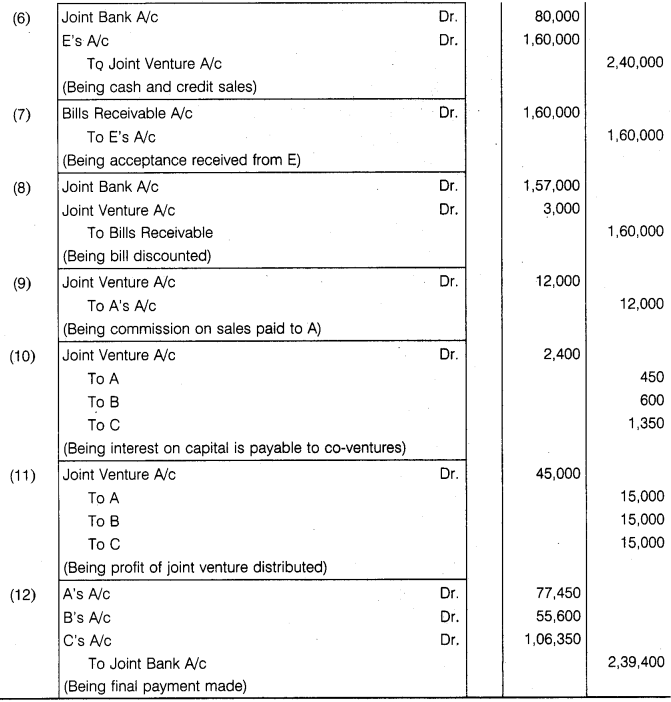

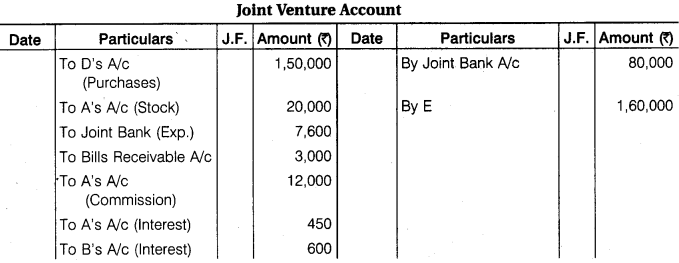

Joint Venture Accounts Question 2.

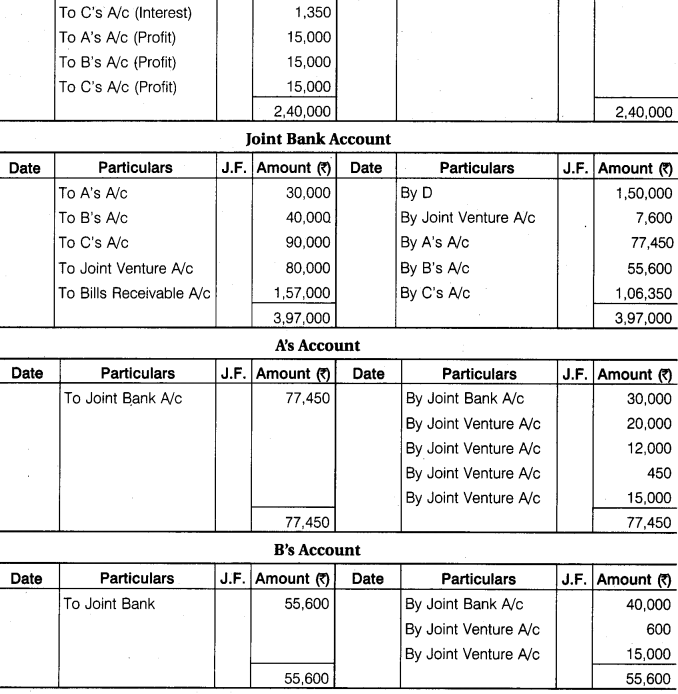

A, B and C entered into a joint venture sharing profit equally. They opened a separate bank account in State Bank on 1st January, 2017. They deposited Rs 20,000, Rs 40,000 and Rs 90,000 respectively. It is also decided to allow interest on such deposits @ 3% p.a., goods purchased from D worth Rs 1,50,000. Stock took from A worth Rs 20,000. They paid of D by cheque and paid for carriage and other expenses Rs 7,600. A sold some goods for Rs 80,000 in cash and remaining goods sold to E at credit for Rs 1,60,000. E accepted the bill for same amount. It was discounted from bank for Rs 1,57,000. Initial capital of co-venturers returned on 30th June, 2017. It is decided to allow the commission on sales @ 5% to A for his services.

Give the Journal Entries in the books of Joint Venture and also prepare necessary accounts. It is assumed that final settlement has made on 31st July, 2017.

Solution:

RBSE Solutions For Class 12th Accountancy Question 3.

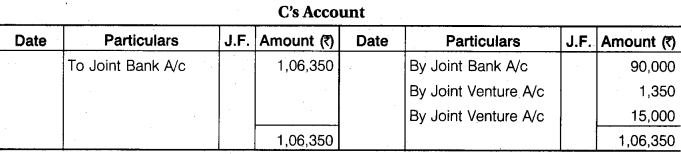

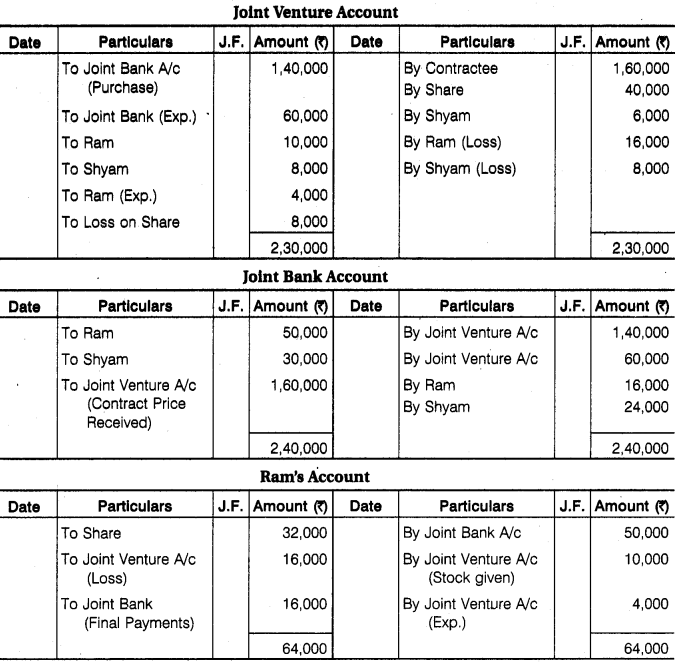

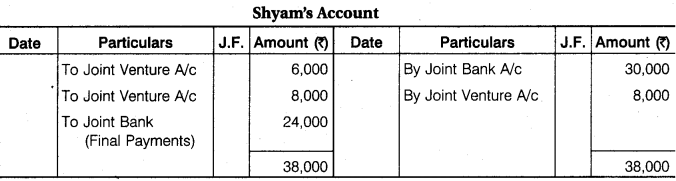

Ram and Shyam doing business separately as a building contractors. They undertake jointly to construct a building for newly started joint stock company for a contract price of Rs 2,00,000 payable Rs 1,60,000 by installment in a cash and Rs 40,000 in fully paid share of the company. A joint bank account is opened. Ram and Shyam deposited Rs 50,000 and Rs 30,000 in the bank respectively. They will distribute profit or losses in the proportion of 2:1. The transactions of joint venture were as follows :

Purchase of material Rs 1,40,000, Wages paid Rs 60,000, Ram gave material from his stock Rs 10,000, Shyam gave material from his stock Rs 8,000, Architect’s fees paid by Ram Rs 4,000. Accounts are settled.

The contract was completed and contract price was received. Ram took all the shares for Rs 32,000 and Shyam took remaining stock for Rs 6,000.

Open the necessary accounts in the books of joint venture.

Solution:

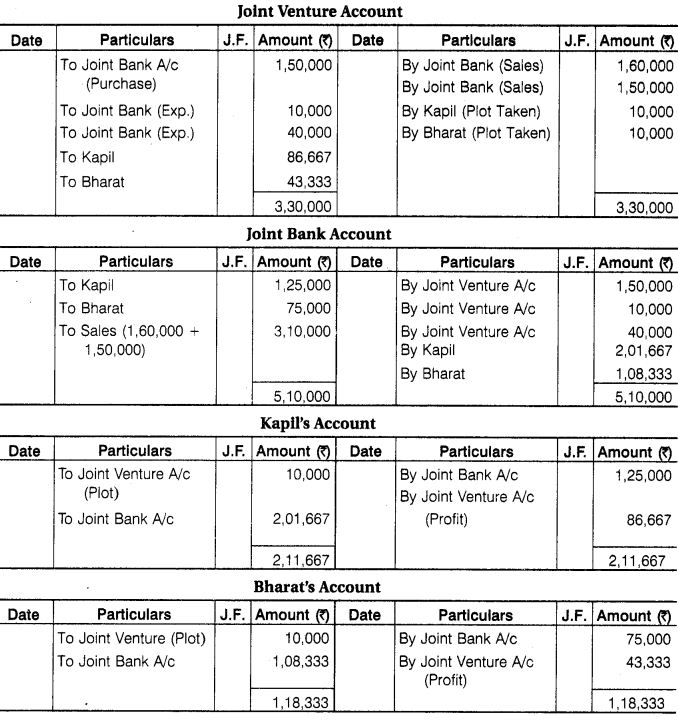

Joint Venture Accounting Problems And Solutions Pdf Question 4.

Contractor Kapil and Engineer Bharat started joint venture for a Urban Development Project. The opened joint bank account separately. Kapil deposited Rs 1,25,000 a piece of land for Rs 1,50,000 and Bharat deposited Rs 75,000 and they share profit-losses in 2 : 1 ratio. They purchased and paid legal expenses Rs 10,000; land development expenses paid Rs 40,000. The land was divided in 20 plots. The plots were sold as under :

08 plots at Rs 20,000 each; 10 plots at Rs 15,000 each. The remaining 2 plots were taken at cost price by both Kapil and Bharat equally.

Open necessary accounts in the books of joint venture.

Solution:

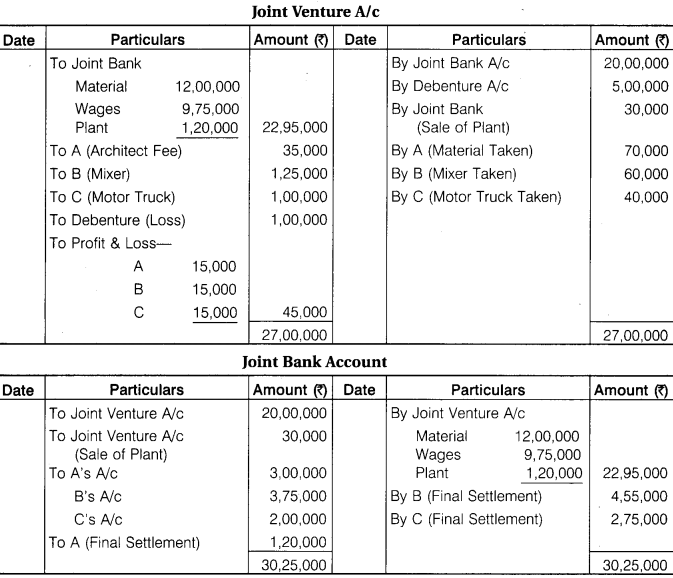

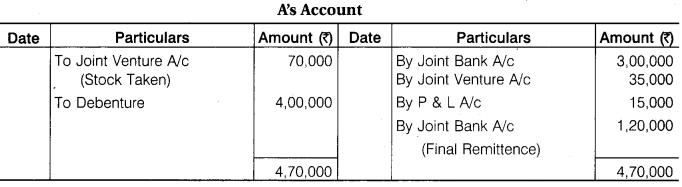

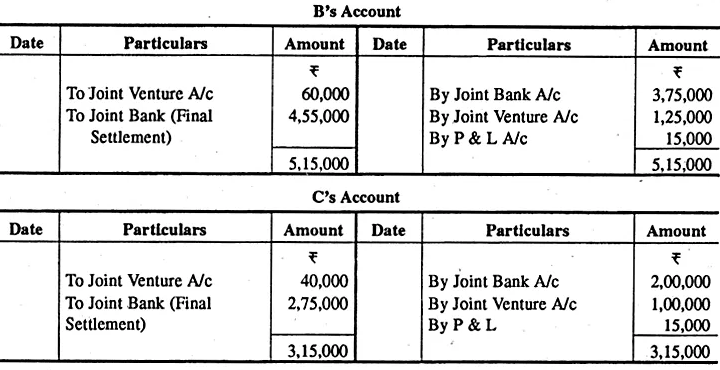

RBSE Solutions 12th Accounts Question 5.

‘A’, ’B’ and ‘C’ are doing business as a building contractor. They undertake jointly for the construction of building for newly started joint stock company for a contract price of Rs 25,00,000, payable Rs 20,00,000 in cash and Rs 5,00,000 in debentures of company. Their profit sharing ratio is 1 : 1 : 1.

They opened a separate joint bank account and amount deposited into bank by ‘A’ Rs 3,00,000, ‘B’ Rs 3,75,000 and ‘C’ Rs 2,00,000. The transactions of joint venture were as follows :

Purchases of material Rs 12,00,000, Wages paid Rs 9,75,000, Purchase of plant Rs 1,20,000, Architect’s fees paid by ‘A’ Rs 35,000, Concrete mixer by B Rs 1,25,000 and a Motor truck is given by C worth Rs 1,00,000. A took material for Rs 70,000 and B took concrete mixer for Rs 60,000 after construction work is completed.

Plant sold for Rs 30,000, contract price received and A took debentures 20% less than cost price. Joint venture is completed. Prepare necessary accounts in the books of joint venture.

Solution:

RBSE Solutions For Class 12 Accounts Question 6.

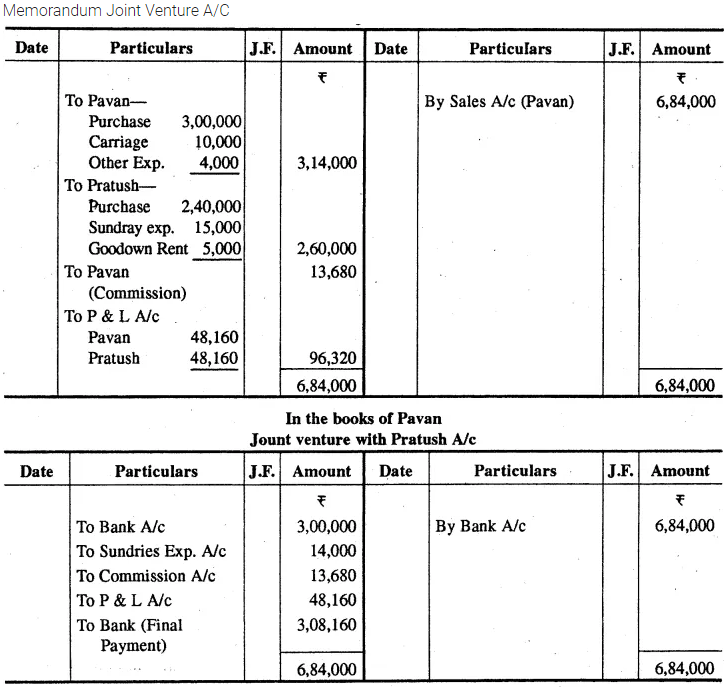

Payan and Pratush entered in joint venture with sharing profit and losses equally. Payan sent to goods worth Rs 3,00,000 and paid carriage & freight Rs 10,000 and other expenses Rs 4,000. Pratush sent goods worth Rs 2,40,000 and paid consignment expenses and sundry expenses Rs 15,000 and go down rent Rs 5,000. Goods to be sold by Payan. They decided 2% commission on sales. Payan sold all the goods for Rs 16,84,000. Prepare Memorandum joint Venture Account and Joint Venture with Payan Account in the books of Pratush and Joint Venture with Pratush Account in the books of Payan, Final payment is made through bank draft.

Solution:

Class 12 Accountancy RBSE Solutions Question 7.

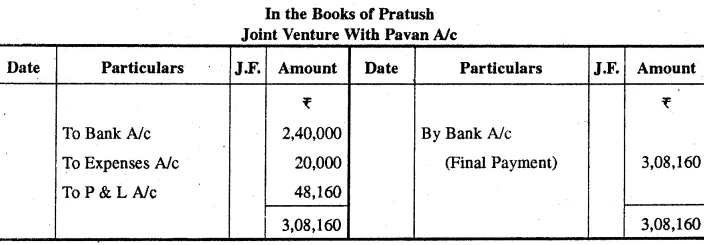

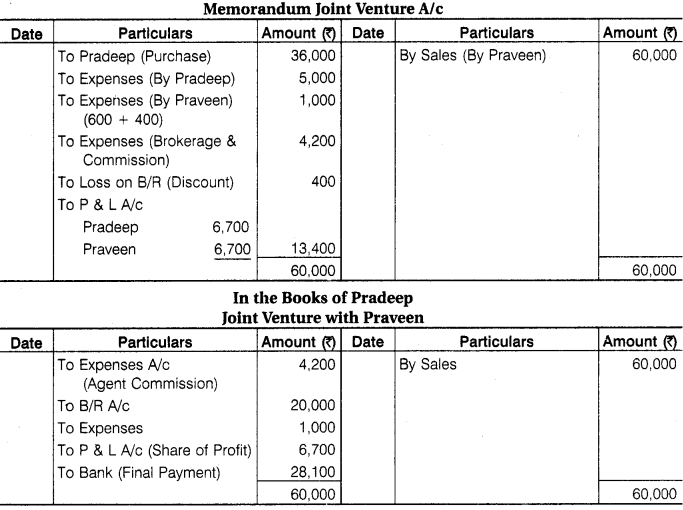

Pradeep and Praveen agreed to purchase and sale of old scooter in a joint venture. They decided to share profit or losses equally. Praveen accepted bill of Rs 20,000 drawn by Pradeep, which was discounted by Pradeep for Rs 19,600 from bank.

Pradeep purchased scooters for Rs 36,000. He paid Rs 5,000 for repair of the scooter and were dispatched to Praveen for sale. Praveen paid Rs 600 freight and Rs 400 octroi on the receipt of scooters.

Praveen sold all the scooters through an agent for Rs 60,000. The agent charges for commission and sales expenses Rs 4,200. Final settlement was completed between both parties.

Prepare Memorandum Joint Venture Account and Joint Venture with Praveen’s Account in the books of Pradeep.

Solution:

RBSE Solution Class 12 Commerce Question 8.

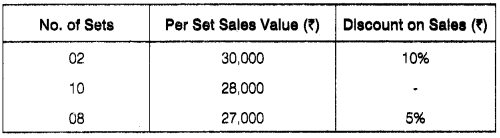

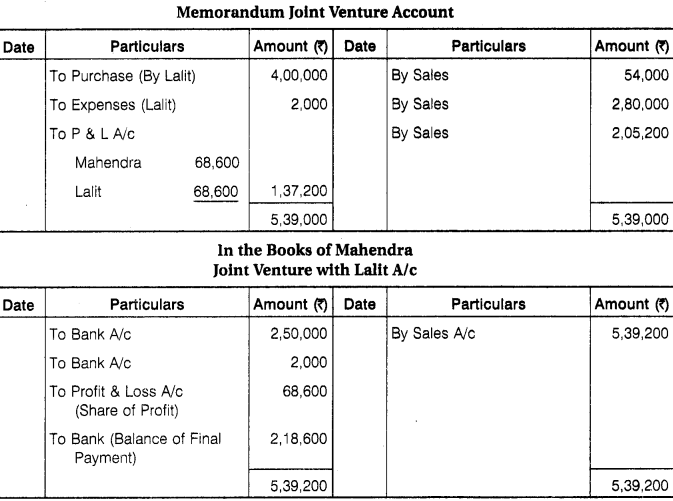

Mahendra and Lalit agreed to purchase and sale of T.V. sets. They decided to share profit or loss equally. Mahendra sent to a bank draft of Rs 2,50,000 in favour of Lalit.

Lalit purchased 20 T.V, set @ Rs 20,000 each and paid freight Rs 2,000. Mahendra received all sets and sold T.V. set as follows :

Mahendra sent draft for remaining balance to Lalit. In the books of Mahendra, prepare Joint Venture with Lalit’s Account and Memorandum Joint Venture Account.

Solution:

RBSE Solutions Of Class 12 Accountancy Question 9.

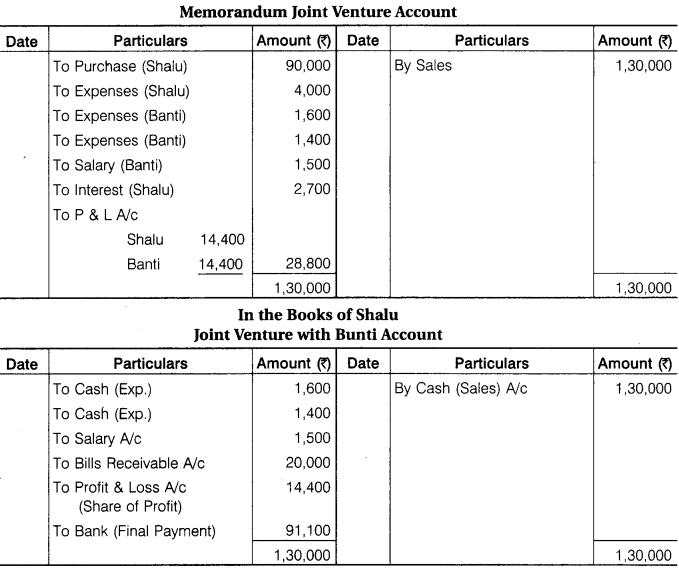

Shalu and Bunti entered in joint venture to purchase and sale of imported goods. Shalu take the responsibility for purchase and Bunti for sale. It was decided that Shalu will get interest @ 12% p.a. on the purchase price of goods and Bunti get salary of Rs 500 per month. Shalu draw a bill of Rs 20,000 on Bunti for 3 months which was accepted by Bunti. Shalu imported goods worth Rs 90,000 and sent to Bunti. Shalu paid carriage expenses Rs 4,000 in dispatching goods. Bunti paid Rs 1,600 freight and Rs 1,400 for selling expenses. Bunti sold all the goods for Rs 1,30,000. Whole process completed in three months. Prepare necessary ledger accounts in the books of both parties. The profit was distributed equally.

Solution:

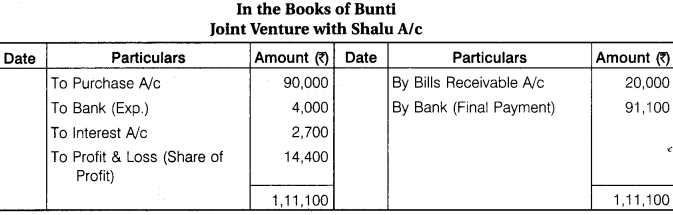

RBSE Solutions Maths Class 12 Question 10.

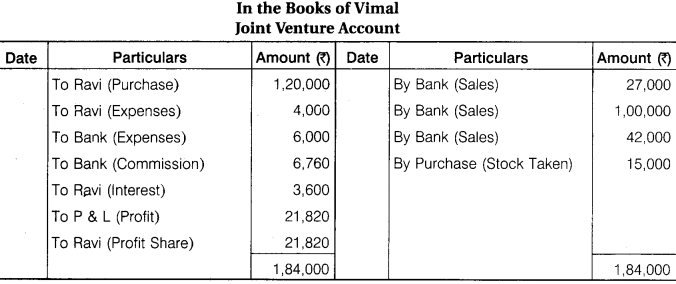

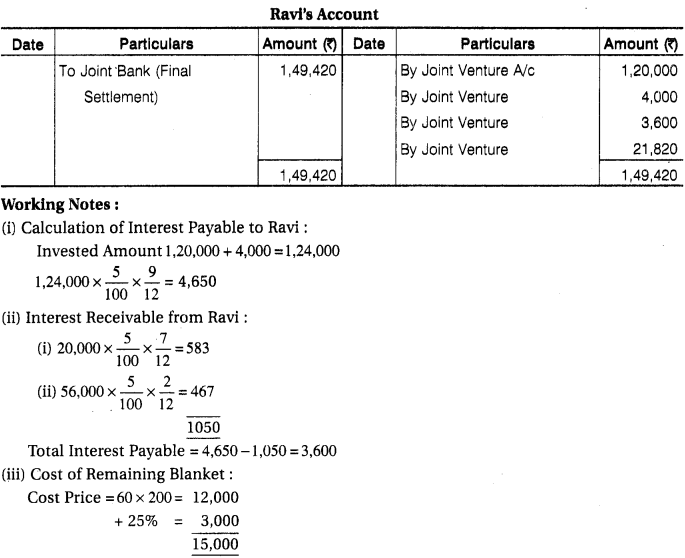

Ravi and Vimal entered in joint venture for purchase and sales of blankets. Ravi will purchase goods and Vimal undertook the sales. They decided to pay 5% interest p.a. to Ravi on his investment and also charge interest at same rate on amount received by him. Vimal will get 4% commission on sales. Profit and losses are shared equally.

Ravi purchased on 1 January 2017, 2000 blanket Rs 60 per blanket. He paid packing charges and other expenses Rs 4,000. Vimal paid freight Rs 6,000 and sold to blanket as follows :

On 1 February 2017, 300 blanket @ Rs 90 each, on 1 July, 2017, 1000 blanket @ Rs 100 each, on 1 October 2017, 500 blanket @ Rs 84 each.

Vimal sent to Ravi Rs 20,000 on 1 March, 2017 and Rs 56,000 on 1 August, 2017. Remaining blanket took by Vimal on cost plus 25% above. On 1 October 2017, final settlement was made.

Assume that each party record all transactions, prepare necessary accounts in the books of both parties.

Solution:

RBSE Solutions Class 12 Question 11.

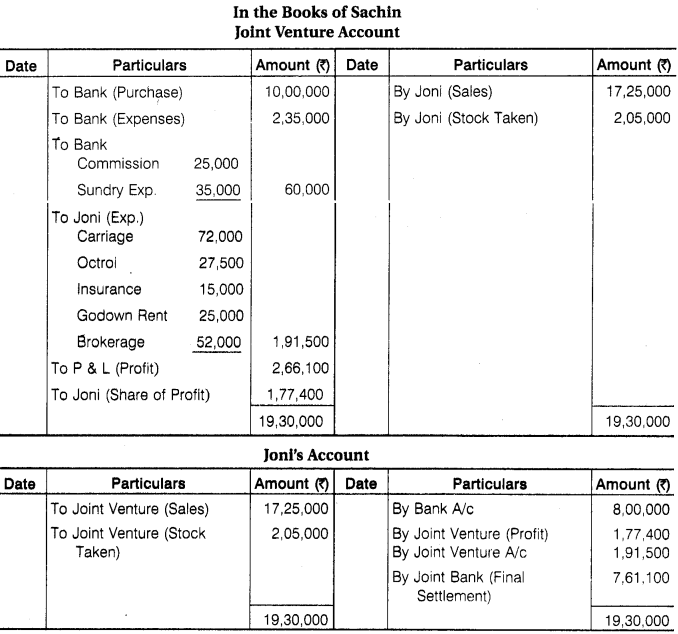

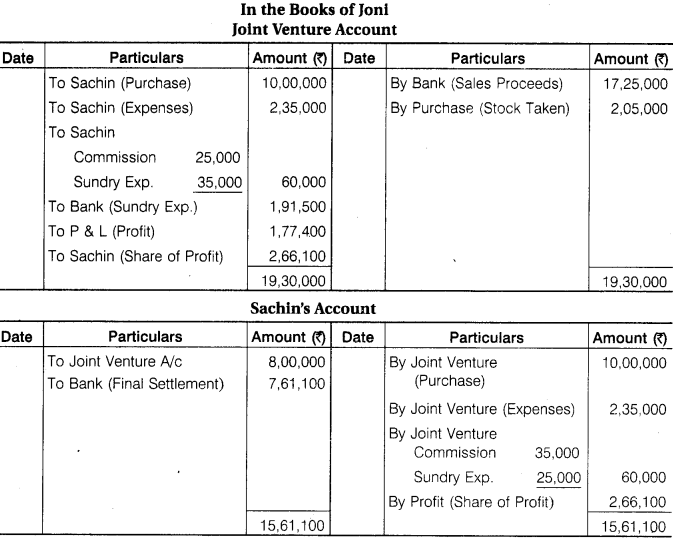

Sachin and Joni entered in joint venture for purchase and sale of goods. They share profit and loss in the ratio of 3 : 2. For starting the work Joni sent bank draft to Sachin for Rs 8,00,000. Sachin purchased goods worth Rs 10,00,000 and make expenses to convert into salable form Rs 2,35,000, Sachin make expense as follows :

Total commission 2.5% and sundry expenses Rs 35,000, Joni took the delivery and paid carriage Rs 72,000, Octroi Rs 27,000, Insurance Rs 15,000, Godown rent Rs 25,000 and brokerage Rs 52,000. Joni sold most of the goods for Rs 17,25,000. Remaining goods kept by himself for Rs 2,05,000. Prepare necessary ledger accounts in the books of both parties, assuming that all transactions are entered by both parties.

Solution: