Rajasthan Board RBSE Class 12 Accountancy Chapter 9 Accounting for Non-Trading Organisations and Professional Persons

RBSE Class 12 Accountancy Chapter 9 Textbook Questions

RBSE Class 12 Accountancy Chapter 9 Multiple Choice Questions

RBSE Solutions For Class 12 Accountancy Chapter 9 Question 1.

The main object of non-trading organisations is :

(a) to earn profit

(b) public welfare work

(c) to do business

(d) none of these

Answer:

b

RBSE Solutions For Class 12 Accountancy Question 2.

Receipts and payments account is a……account.

(a) real

(b) nominal

(c) personal

(d) none of these

Answer:

a

Class 12 Accountancy Chapter 9 Solutions Question 3.

Income and expenditure account is a…..account.

(a) real

(b) nominal

(c) personal

(d) none of these

Answer:

b

12 RBSE Accounts Solution Question 4.

In income and expenditure account……items are shown.

(a) only revenue

(b) only capital

(c) revenue and capital both

(d) none of these

Answer:

a

12 RBSE Accountancy Solutions Question 5.

Income and expenditure account is prepared on the basis of

(a) accrual concept

(b) cash concept

(c) single entry concept

(d) none of these

Answer:

a

12th RBSE Accountancy Solutions Question 6.

Where the life membership fees will be shown in income and expenditure account and in balance sheet?

(a) in debit side of income and expenditure

(b) in assets side of balance sheet

(c) in credit side of income and expenditure

(d) in liabilities side of balance sheet

Answer:

c

RBSE 12 Accountancy Solutions Question 7.

In receipts and payments account,……items are shown.

(a) capital

(b) revenue

(c) capital and revenue

(d) None of these

Answer:

c

Class 12th RBSE Accountancy Solutions Question 8.

If opening sports funds is Rs 2,00,000. It is invested separately @ 8% p.a. interest. Expenses made Rs 15,000 during the year on sports tournament which amount of sports fund shown in the balance sheet at the end of the year :

(a) Rs 2,01,000

(b) Rs 1,99,000

(c) Rs 1,85,000

(d) Rs 2,16,000

Answer:

a

Solution Of Accountancy Class 12 RBSE Question 9.

If opening stock of stationary at the beginning Rs 5,000, at the end Rs 3,000, stationery purchased in cash during the year for Rs 20,000. How this transaction will deal in receipts and payments account?

(a) payment side Rs 22,000

(b) payment side Rs 20,000

(c) payment side Rs 28,000

(d) none of these

Answer:

b

12 Account Solution RBSE Question 10.

From the following information, calculate the amount of outstanding subscription which is shown in closing balance sheet: Opening outstanding subscription Rs 10,000, subscription received during the year Rs 20,000, in which opening outstanding subscription received Rs 6,000 and advance subscription Rs 7,000 is included. There are 50 members, each pays Rs 400 annual subscription.

(a) Rs 20,000

(b) Rs 21,000

(c) Rs 17,000

(d) Rs 13,000

Answer:

d

RBSE Class 12 Accountancy Chapter 9 Very Short Answer Questions

Ch 9 Accounts Class 12 Question 1.

State two characteristics of a non-trading concerns.

Answer.

- Set up to provide service to a specific group or the public at large.

- Managed by elected members.

Accounts Of Professional Persons Question 2.

Give any two differences between trading organisations and non-trading organisations.

Answer.

| Base of Difference | Trade Organisations | Non-Trade Organisations |

| Distribution of profit | Profit or loss is distributed among the owner of the business. | Surplus or deficit is not distributed among its members. It is adjusted in capital fund. |

| Surplus v/s Profit | The net result shown by profit and loss account is either net profit or net loss. | The net result shown by Income and expenditure account either surplus or deficit. |

Question 3.

Give the name of books-kept by non-trading organisations.

Answer.

- Cashbook,

- Ledger,

- Register of member,

- Register of Assets.

RBSE Accounts Solutions Class 12 Question 4.

Which financial statements are prepared by non-trading organisations?

Answer.

- Receipts and Payments A/c

- Income and Expenditure Account

- Balance Sheet.

Chapter 9 Accounts Class 12 Question 5.

What accounting treatment is made for life membership fees, when income and expenditure account is prepared?

Answer.

Life membership fees will shown in liabilities side of balance sheet. Because it is a capital nature receipt.

Class 12 Accounts Chapter 9 Solutions Question 6.

What do you understand by legacies?

Answer.

When the amount received by an organisation from a deceased person calls legacies. This is a capital nature receipt and shown in liabilities side of balance sheet.

Accounts Solutions Class 12 RBSE Question 7.

What do you mean by endowment fund?

Answer.

The amount obtained from the asset the use of that income will be for a specific reason given by donor and the principle asset will remain same means that will not use.

Class 12 Accountancy Solutions RBSE Question 8.

What is the accounting treatment for specific donation while preparing income and expenditure account?

Answer.

Specific donation just like a capital nature receipt so it will shown in liabilities side of balance sheet not in Income & Expenditure A/c.

RBSE 12th Accounts Solution Question 9.

How you will deal with ‘general donation’ while recording in income and expenditure account?

Answer.

General donation is a revenue nature receipt so it will shown in income side of income & expenditure account.

RBSE Solutions For Class 12 Account Question 10.

What do you mean by income and expenditure account?

Answer.

Income & Expenditure Account is a nominal nature account, it shows organisation’s surplus or deficit. In it all revenue income and revenue expenditure are shown related to financial year with doing necessary adjustments.

Question 11.

How will you treat sale of an asset while preparing income and expenditure account and closing balance sheet?

Answer.

At the preparing of Income & Expenditure Account depreciation and profit/loss on it at the sale of asset will be shown in Income & Expenditure Account and preparing balance sheet in opening balance of asset by adding value of purchasing asset will be deducted from the selling value of asset.

Question 12.

Write the name of such two items and examples which do not appear in receipts and payments account.

Answer.

- Depreciation on fixed assets.

- Outstanding income and outstanding expenses at the end of financial year.

Question 13.

If tournament fund is Rs 50,000 and tournament expenses are Rs 32,000, how it is treated in income and expenditure account and closing balance sheet?

Solution.

The remaining account of tournament fund (50,000 – 32000 = 18000) will shown in liabilities side of balance sheet as “Tournament fund” not shown in income & expenditure account.

Question 14.

Write any two differences between receipts and payments account and cash book.

Answer.

| Base of Difference | Receipts & Payments A/c | Cash Book |

| Basis | It is prepared on the basis of cash book. | It is prepared on the basis of each cash receipt and cash payment. |

| Period | It is prepared at the end of accounting year. In other words, it is a summary of cash book. | It is prepared on daily basis. |

Question 15.

List any two features of an income and expenditure account.

Answer.

- Only revenue nature receipts and payment are shown in it related financial year.

- It is a nominal account rules is followed while preparing it “Debit all expenses and losses and credit all income and gains”.

RBSE Class 12 Accountancy Chapter 9 Short Answer Questions

Question 1.

How will you treat “subscription” in case of accounts of a club?

Answer.

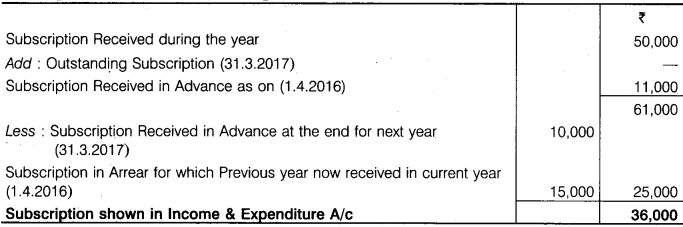

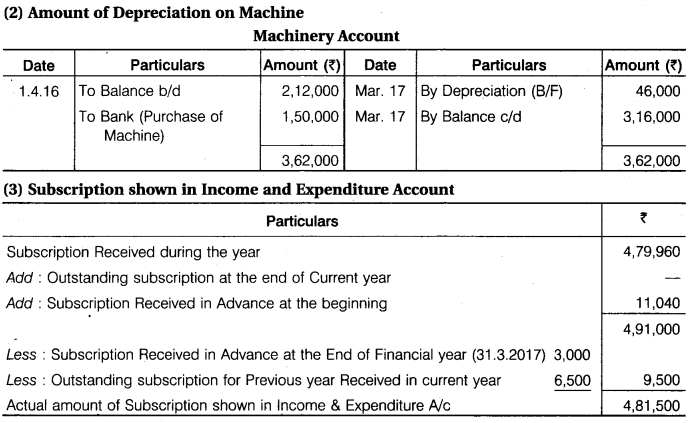

Subscription Shown in Income & Expenditure Account

Question 2.

From the following information, calculate amount of subscriptions, which will be shown in income and expenditure account:

| 01-04-16 | Subscription in arrears Subscription received in advance |

Rs 15,000 Rs 5,000 |

| 31-03-17 | Subscription in arrears Subscription received in advance Subscription received during the year 2016-17 |

Rs 6,000 Rs 10,000 Rs 50,000 . |

Solution.

Subscription shown in Income & Expenditure Account as on 31st March, 2017

Question 3.

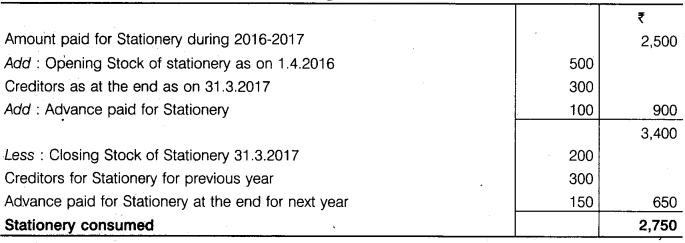

How will you deal with the following case while preparing income and expenditure account:

| Particulars | 1-4-16 (Rs) | 31-3-16 (Rs) |

| Stock of Stationery | 500 | 200 |

| Creditors of Stationery | 300 | 300 |

| Advance Paid for Stationery | 100 | 150 |

Amount paid for stationery during 2016-17 was Rs 2,500.

Solution.

Stationery Consumed shown in Income & Expenditure Account as on 31st March 2017.

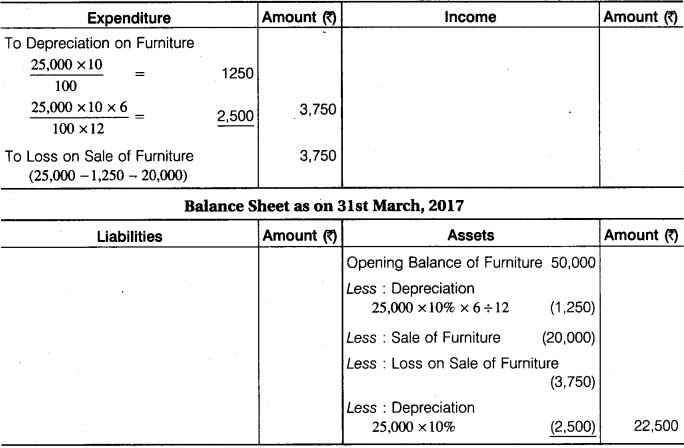

Question 4.

Book value of furniture on 1-4-16 is Rs 50,000, half of the furniture is sold at a loss of 20% on opening book value on 30-09-16, furniture is depreciated @ 10% p.a. How above items will be shown in income and expenditure account and in balance sheet on that date?

Solution.

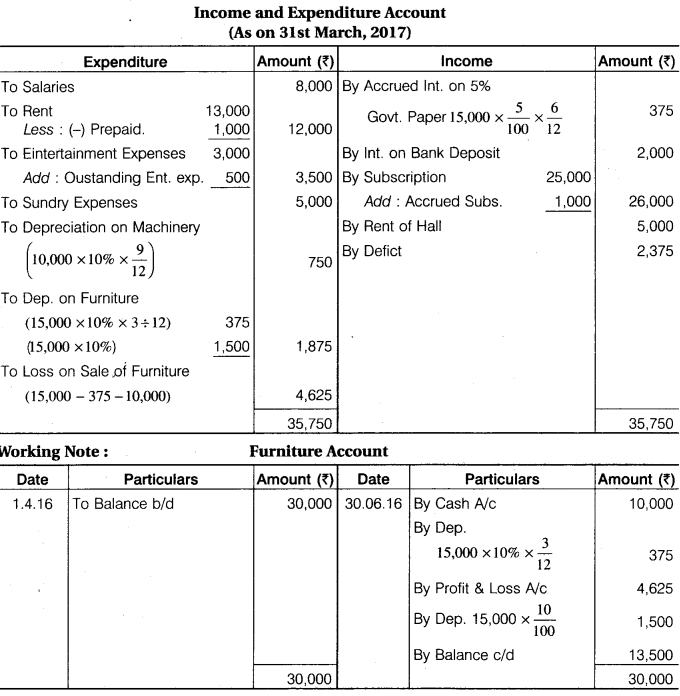

Income Expenditure Account as on 31.3.2017

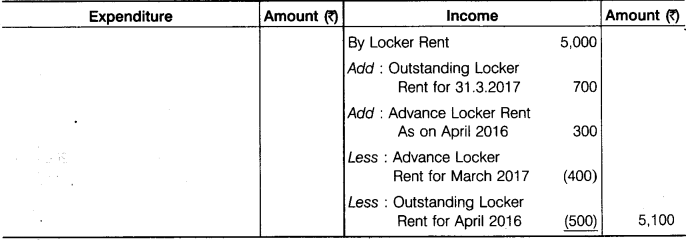

Question 5.

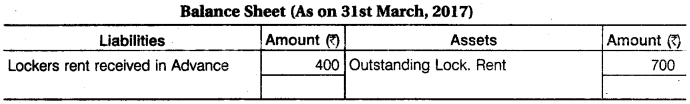

How will locker rent of a club will deal in income and expenditure account for the year ended 31st March, 2017 and balance sheet on that date?

| Particulars | 1-4-16 (Rs) | 31-3-17 (Rs) |

| Outstanding locker rent | 500 | 700 |

| Advance locker rent | 300 | 400 |

Locker rent received during 2016-17 Rs 5,000.

Solution.

Income and Expenditure Account (As on 31 March, 2017)

Question 6.

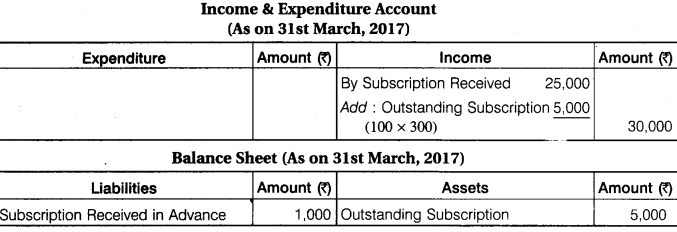

During the year 2016-17 Subscription are as follows :

2015-16 Rs 2,000,

2016-17 Rs 25,000

2017-18 Rs 1,000

There are 100 members of a club, each paying Rs 300 as annual subscription. How subscription will be shown in income and expenditure account for the year ending 31st March, 2017 and in balance sheet on that date.

Solution.

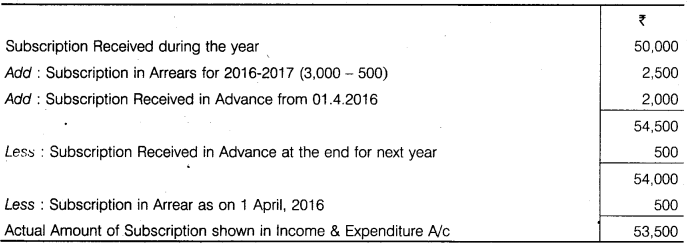

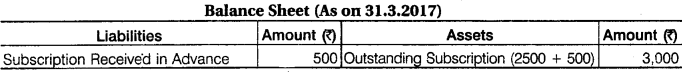

Question 7.

From the following information, how subscription will be shown in income and expenditure account for year ending 31st March, 2017 and in balance sheet on that date

| Date | Particulars | Amount (Rs) |

| 1-4-16 | Subscription in arrears | 1,000 |

| 1-4-16 | Subscription received in advance | 2,000 |

| 31-3 -17 | Subscription in arrears (including Rs 500 related to 2015-16) | 3,000 |

| 31-3 -17 | Subscription received in advance | 500 |

| 31-3 -17 | Subscription received during 2016-17 | 50,000 |

Solution.

Subscription Shown in Income & Expenditure Account

As on 31st March 2017 in Income side :

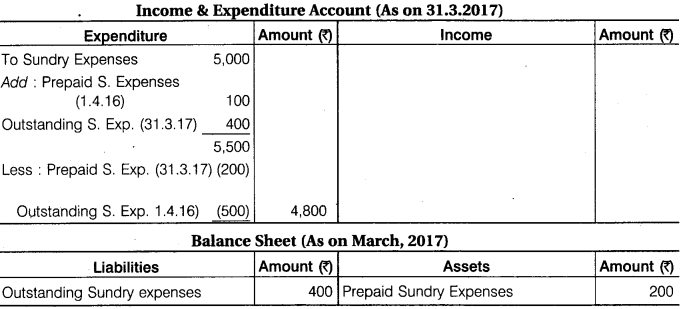

Question 8.

Calculate the amount of sundry expenses which is shown in income and expenditure account for the year ending 31st March, 2017 and balance sheet on that date. From the following information :

| Particulars | 1-4-16 (Rs) | 31-3-17 (Rs) |

| Prepaid sundry expenses | 100 | 200 |

| Outstanding sundry expenses | 500 | 400 |

Sundry expenses paid during the year Rs 5,000.

Solution.

Income & Expenditure Account (As on 31.3.2017)

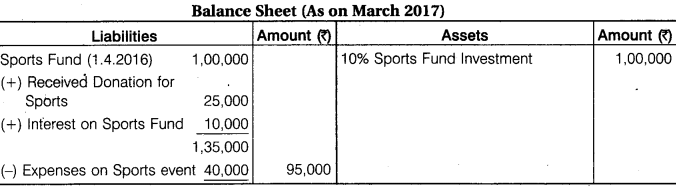

Question 9.

From the following information, calculate the amount of sports fund, which will be shown in income and expenditure account for the year ending 31st March, 2017 and balance sheet on that date.

| Particulars | Amount (Rs) |

| Sports fund 1 -4-16 | 1,00,000 |

| 10% sports fund investment 1-4-16 | 1,00,000 |

| Received donation for sports during the year 2016-17 | 25,000 |

| Interest on sports fund investments | 10,000 |

| Expenses on sports event | 40,000 |

Solution.

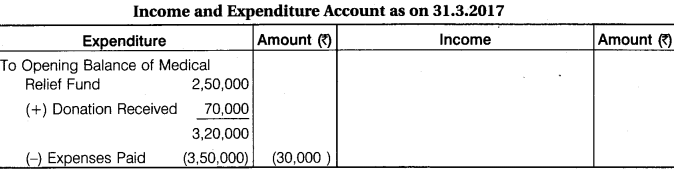

Question 10.

From the following information, calculate the amount of Medical Relief Fund, which will be shown in income and expenditure account for the year ending 31st March, 2017 and the balance sheet on that date :

| Particulars | Amount (Rs) |

| Opening balance of medical relief fund Donation received towards sports fund during the year Expenses paid for medical camp during the year |

2.50.0 70,000 3.50.000 |

Solution.

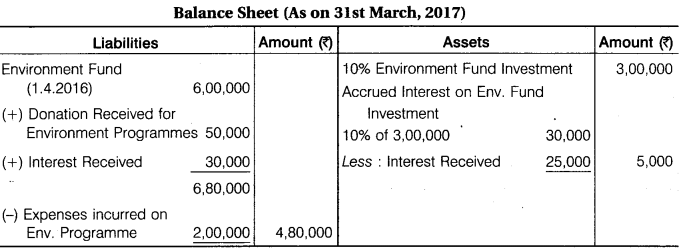

Question 11.

From the following information, calculate the amount which will be shown in income and expenditure account for the year ending 31st March, 2017 with regard to environment fund :

| Particulars | Amount (Rs) |

| Environment fund | 6,00,000 |

| 10% environment fund investment 10% | 3,00,000 |

| Expenses incurred on environment awareness during the year | 2,00,000 |

| Donation received towards the environment programmes | 50,000 |

| Interest received from fund investment | 25,000 |

Solution.

Question 12.

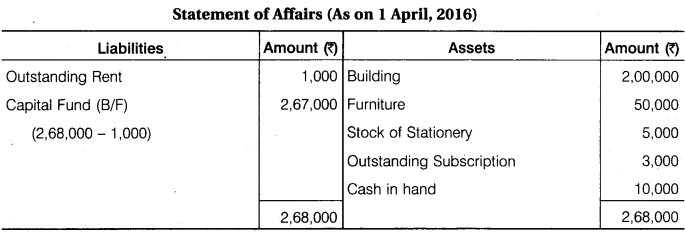

From the following information, calculate Capital Fund of a club as on 1st April, 2016.

1. Subscription outstanding on 1-4-16 Rs 3,000.

2. Opening balances of assets are stock of stationery Rs 5,000, furniture Rs 50,000, building Rs 2,00,000, rent paid during the year 2016-17 Rs 6,000, it includes Rs 1,000 of previous year. Opening cash balance Rs 10,000.

Solution.

Question 13.

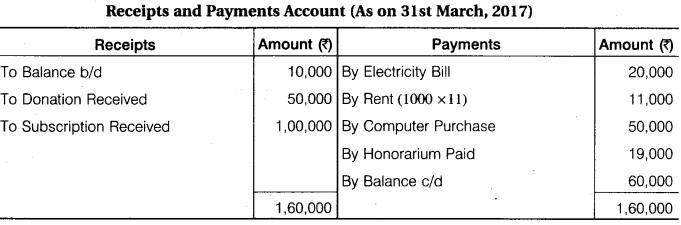

Prepare Receipts and Payments Account for the year ending 31st March, 2017 from the following information :

| Particulars | Amount (Rs) |

| Cash in hand opening | 10,000 |

| Donation received | 50,000 |

| Subscription received | 1,00,000 |

| Paid for electricity bill | 20,000 |

| Rent Rs 1,000 p.m., actually paid for 11 month during the year | |

| Purchase of computer in cash | 50,000 |

| Honorarium paid | 19,000 |

Solution.

Question 14.

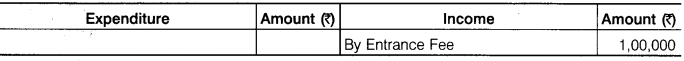

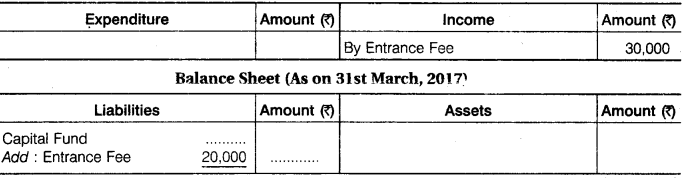

In the following cases how entrance fees will be shown at the end of the year in income

and expenditure account and balance sheet on that date :

(i) Entrance fees received Rs 1,00,000 during the year,

(ii) During the year Rs 50,000 received as entrance fees out of which 40% is to be capitalized,

(iii) During the year Rs 40,000 received as entrance fees it should be capitalized.

Solution.

Situation (i)— Income & Expenditure Account (As on 31st March, 2017)

Note: Not shown in Balance Sheet.

Situation (ii)—Income & Expenditure Account (As on 31st March, 2017)

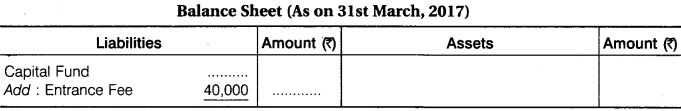

Situation (iii)— Not shown in Income & Expenditure account because entrance fee is treated as capital nature receipt, so it is shown only in liabilities side of balance sheet in adding to capital fund.

Question 15.

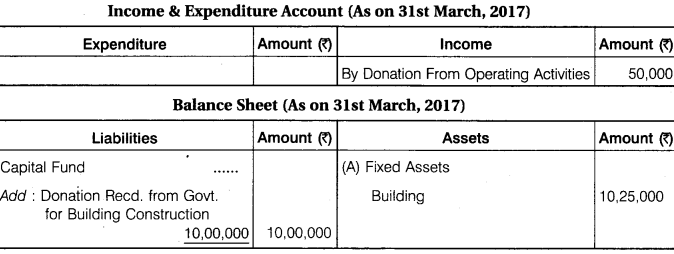

A club received aid from state government for Rs 10,00,000 for construction of building on 1-5-16 and from an other organisation received Rs 50,000 aid for operating its activities on 1-6-16. The club has completed its building upto 31 March, 2017 and spent Rs 10,25,000 on it. Now the above transactions will be shown in income and expenditure account for . the year ending 31st March, 2017 and balance sheet on that date.

Solution.

Working Note:

- Rs 10,00,000 Grant by Govt, to building construction is a special donation. So,it is a capital nature receipts it will shown in liabilities side in adding capital fund of Balance Sheet.

- Receipts of Rs 50,000 from other activities is a revenue nature income. So, it will shown in income side of Income and Expenditure Account.

- Rs 10,25,000 in Heading of Building of Assets Side, if Building is incomplete, it will shown in separately Building Fund.

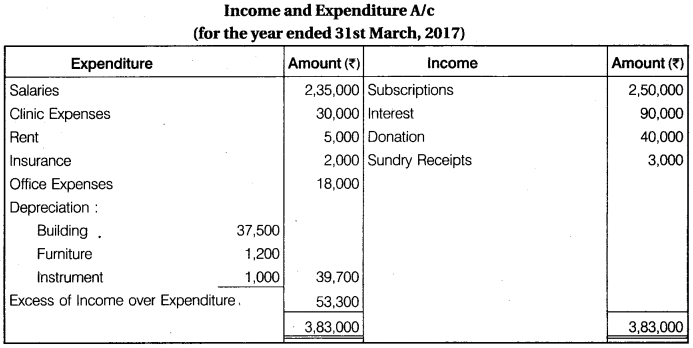

Question 16.

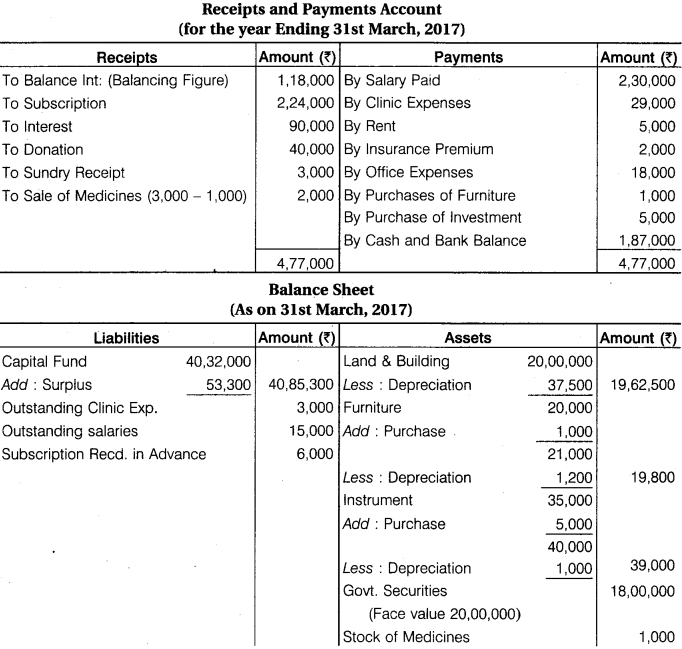

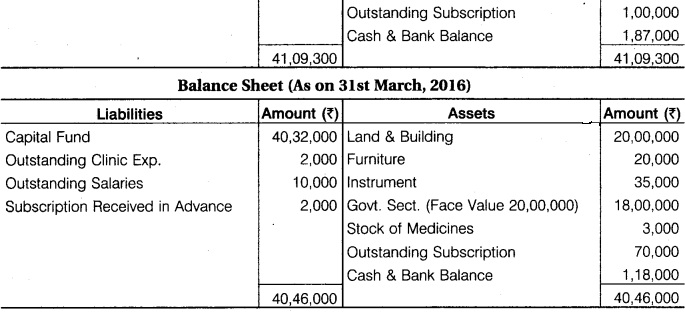

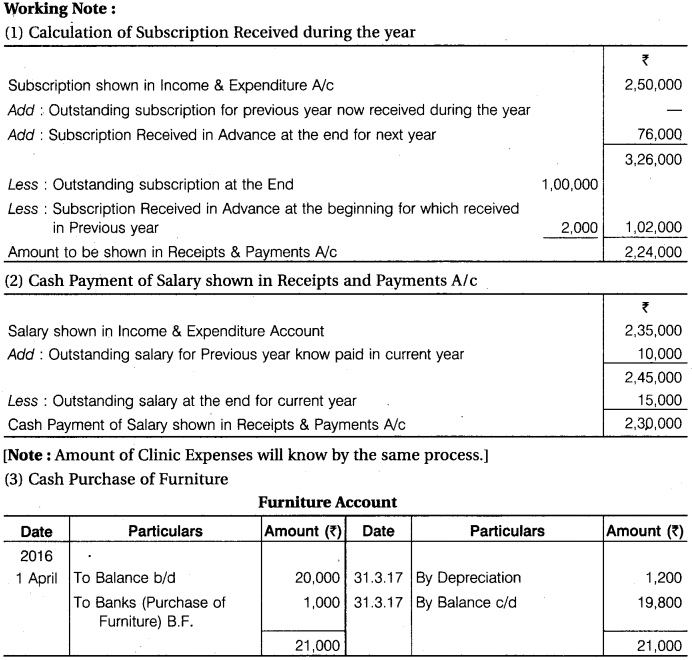

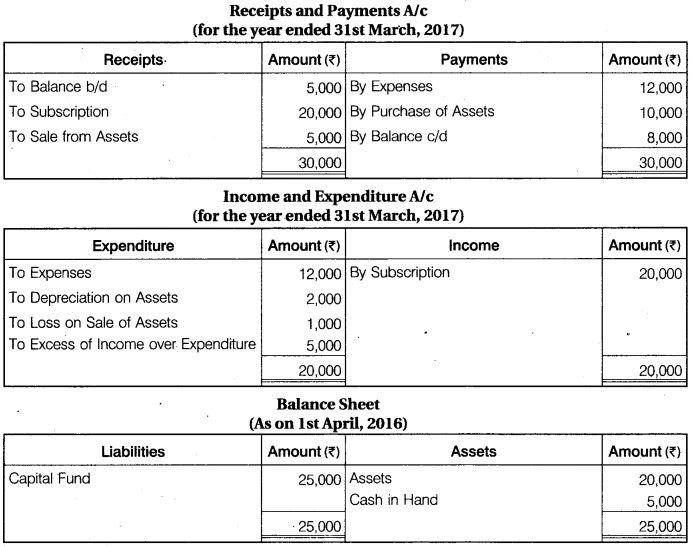

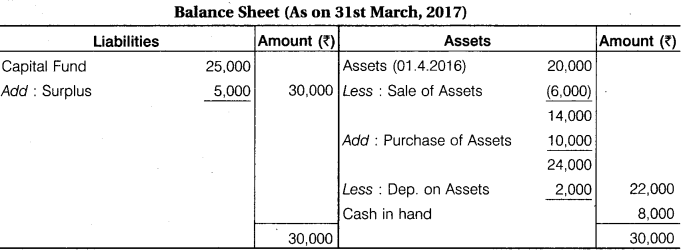

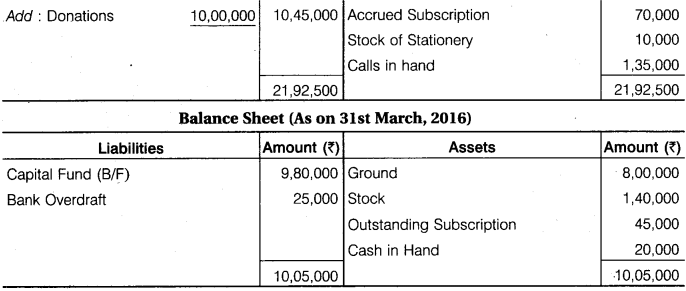

From the following receipts and payments account, income and expenditure account and opening balance sheet, prepare Closing Balance Sheet.

Solution.

RBSE Class 12 Accountancy Chapter 9 Essay Type Questions

Question 1.

Explain with illustration the method to prepare Income & Expenditure Account from Receipts & Payments A/c and other information.

Answer.

Income and Expenditure Account: Income and Expenditure Account is a nominal account. It is prepared to depict the result of not for profit organisation during an accounting period. The principles of preparation of profit and loss account applies for the preparation of income and expenditure account as well. It is prepared on accrual basis of accounting based on principle of matching concept i.e., adjustments relating to outstanding expenses, prepaid expenses, accrued income, income received in advance and depreciation are made. Incomes are shown on the credit side while expenses are shown on the debit side. There is no opening balance in income and expenditure account but the closing balance reveals surplus if there is an excess of income over expenditure and reveals deficit if there is an excess of expenditure over income.

Thus, it can be said that income and expenditure account serves the same purpose for a not for profit organisation which is served by profit and loss account for a profit earning organisation.

Steps in the Preparation of Income and Expenditure Account

Following steps may by helpful in preparing an income and expenditure account from a given receipts and payments account:

- Pursue the receipts and payments account thoroughly.

- Exclude the opening and closing balances of cash and bank as they are not an income.

- Exclude the capital receipts and capital payments as these are to be shown in the balance sheet.

- Consider only the revenue receipts to be shown on the income side of income and expenditure account. Some of these needs to be adjusted by excluding the amounts relating to the preceding and the succeeding periods and including the amounts relating to the current year not yet received.

- Take the revenue expenses to the expenditure side of the income and expenditure account with due adjustments as per the additional information provided relating to the amounts received in advance and these not yet received.

- Consider the following items not appearing in the receipts and payments account that need to be taken into account for determining the surplus/deficit for the current year:

(a) Depreciation on fixed assets

(b) Provision for doubtful debts if required

(c) Profit or loss on sale of fixed assets.

Question 2.

How will you prepare receipts and payments account?

Answer.

Steps in the Preparation of Receipts and Payments Account:

- Take the opening balances of cash in hand and cash at bank and enter them on the debit side. In case there is bank overdraft at the beginning of the year enter the same on the credit side of this account.

- Show the total amounts of all receipts on its debit side irrespective of their nature (whether capital or revenue) and whether they pertain to past, current and future periods.

- Show the total amounts of all payments on its credit side irrespective of their nature (whether capital or revenue) and whether they pertain to past current and future periods.

- Name of the receivable income and payable expenses is to be entered in this account as they do not involve inflow or outflow of cash.

- Find out the difference between the total of debit side and the total of credit side of the account and enter the same on the credit side as the closing balance of cash/bank. In case however, the total of the credit side is more than that of the total of the debit side. Show the difference on the debit as bank overdraft and close the account.

Question 3.

Differentiate the following :

- Cash book and receipts and payments account.

- Income and expenditure account and receipts and payments account.

Answer.

Distinction between Receipts and Payments Account and Cash Book : Both receipts and payments accounts and cash book record cash transactions i.e., cash receipts and cash payments. Inspite of such similarity, there are some differences between the two which are enumerated below:

| Basis of Distinction | Receipts and Payments Account | Cash Book |

| Basis | It is prepared on the basis of cash book. | It is prepared on the basis of each cash receipts and cash payments. |

| Period | It is prepared at the end of accounting year. In other words, it is a summary of cash book. | It is prepared on daily basis. |

| Part of double entry system | It is merely a summary of cash book, it is not deemed to be a part of the double entry system. | It forms part of double entry system. |

| Debit and credit sides | It has receipts and payments sides instead of debit and credit sides. | It has debit and credit sides. |

| Ledger folio column | It has no ledger folio (L.F.) column. | It has ledger folio (L.F.) column. |

| Institutions | It is prepared by not for profit organisations. | It is prepared by all organisations whether profit seeking or not for profit organisations. |

Distinction between Receipts and Payments Account and Income and Expenditure Account

| Basis of Distinction | Receipts and Payments Account | Income and Expenditure Account |

| Nature | It is a summary of the cash book. | It is like a profit and loss account of a profit seeking entity. |

| Sides | Debit side of this account records receipts and credit side records payments. | Debit side of this account records expenses and losses and credit side records incomes and gains. |

| Type of account | It is a real account. | It is a nominal account. |

| Opening balance | It starts with the opening balance of cash and bank. | It has no opening balance. |

| Closing balance | Closing balance of this account represents the closing cash in hand and at bank or overdraft at bank. | Closing balance of this account indicates either excess of income over expenditure (surplus) or excess of expenditure over income (deficit). |

| Capital and revenue items | It records receipts and payments both of capital and revenue nature. | It records income and expenditure of only revenue nature. |

| Period of income and expenses | It records all receipts and payments made during the year whether they relate to current, previous or next year. | It records income and expenditure of the current year. |

| Adjustments | Adjustments are not considered while preparing it, because it is prepared on cash basis of accounting. | It is necessary to consider adjustments while preparing it, because it is prepared on accrual basis of accounting. |

| Balance sheet | It need not necessarily be accompanied by a balance sheet because all revenue as well as capital items are included in it. | Balance sheet must accompany this account because, it includes only revenue items, whereas the balance sheet contains the remaining balances. |

| Transfer of closing balance | Closing balance of this account is transferred to the receipts and payments account of the next period. | Closing balance of this account is transferred to the capital fund in the balance sheet. |

Question 4.

Explain the procedure of preparing receipts and payments account from income and expenditure account, balance sheet and other information.

Answer.

Sometimes Income and Expenditure A/c and Balance Sheet is given and required to prepare receipts and payments account and in such a situation the following procedure may be followed:

- All expenditure whether capital or revenue irrespective of the periods are shown on the payments side.

- All receipts whether capital or revenue irrespective of the periods are shown on receipt side.

- Pick up opening and closing balance Cash and Bank A/c to the Receipt & Payment Account.

- Eliminate all adjustments made while preparing income and expenditure account.

- Purchase of assets may be calculated and shown on the payments side. For compare the values of assets at the beginning and closing of the period.

- Adjustments of prepaid exp., Advance Receipts and Outstanding Exp. should be keeping in mind regarding particular item.

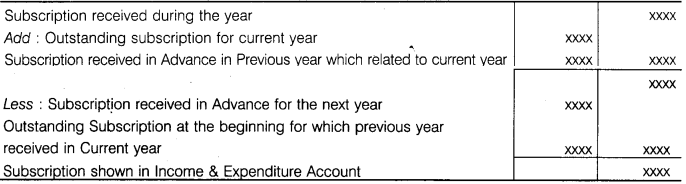

Income Side

Amount shown in income and expenditure account …………

Less: Closing outstanding subscription in current year ……….

Less: Advance subscription received in last year ……….

Add: Outstanding subscription of last year received in current year ……..

Add: Advance subscription received in current year ………….

Amount of subscription shown in receipts and payments account in current year ………..

Expenditure Items

Amount of salary shown in income and expenditure account ……………

Less : Closing outstanding of current year …………..

Less: Advance salary paid last year (related to current year) ………..

Add: Outstanding salary of last year (which is paid this year) ………..

Add: Advance salary paid in current year related to next year ………….

Amount of salary shown in receipts and payments account ……….

Amount of Stationery Consumed

Amount of stationery shown in income and expenditure account …………..

Less: Opening stock of stationery ………….

Add: Closing stock of stationery ………….

Less: Advance payment last year for stationery ………….

Add: Advance stationery paid in current year related to next year ………..

Less: Current year closing creditors of stationery …………

Add: Current year opening creditors of stationery ………..

Amount of stationery shown in receipts and payments account ………..

RBSE Class 12 Accountancy Chapter 9 Numerical Questions

Question 1.

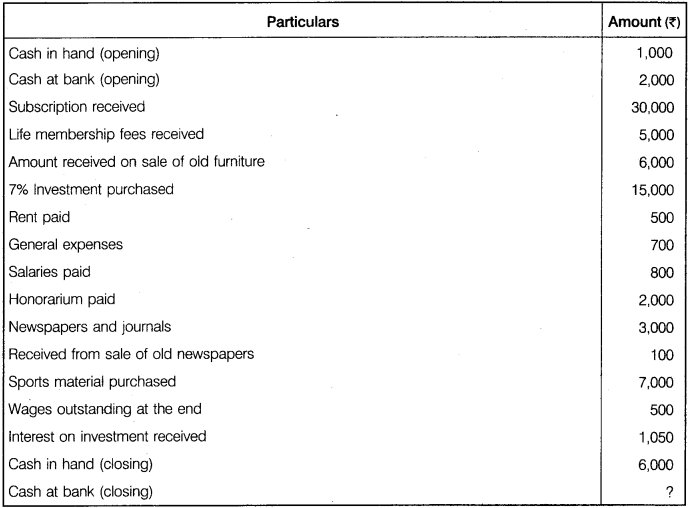

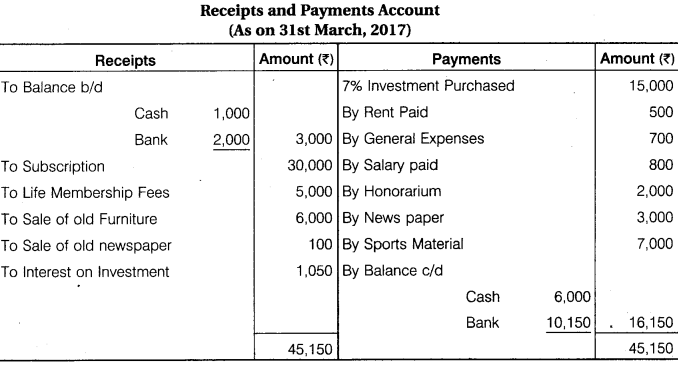

From the following particulars of a club, prepare the Receipts and Payments Account for the year ended 31st March, 2017.

Solution.

Question 2.

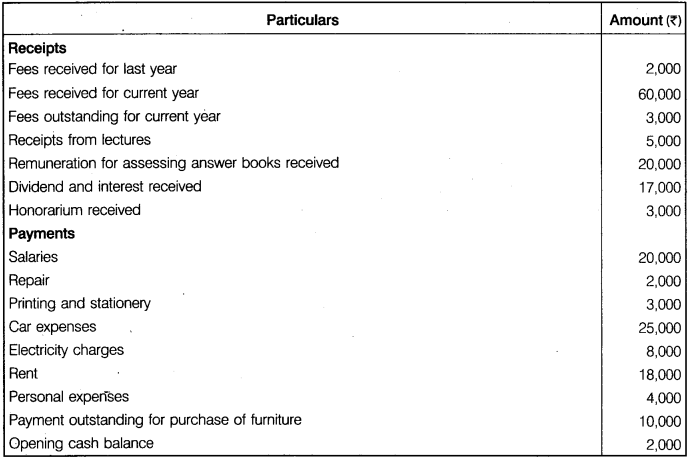

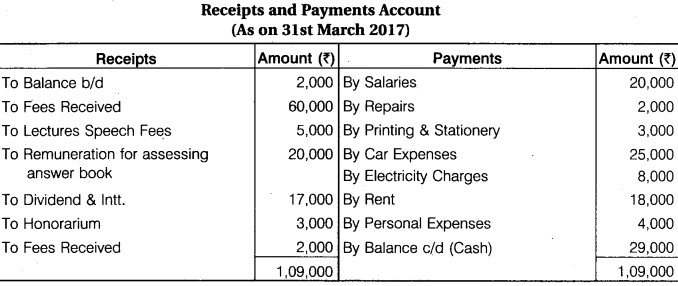

From the following information related to a chartered accountant, prepare Receipts and Payments Account for the year closing 31st March, 2017.

Solution.

Question 3.

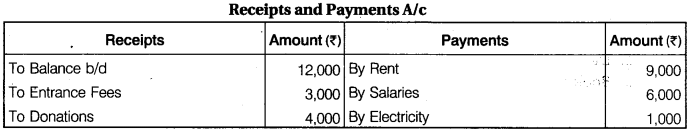

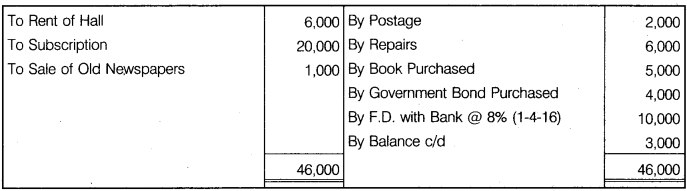

Prepare Income and Expenditure Account for the year ending 31st March, 2017, on the basis of given Receipts and Payments Account for the year ending 31 March, 2017.

Solution.

[Note: Books Purchased, Govt. Bonds, & F.D. with Bank are to be capital expenditure so will not entered in Income Expenditure Account.]

Question 4.

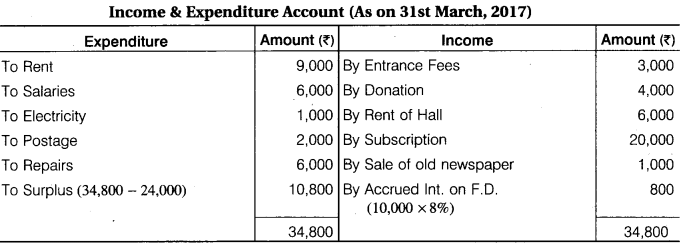

From the following information, prepare Income and Expenditure Account for the year ended 31st March, 2017.

Additional Information :

- Depreciation is charged on all assets @ 10% p.a.

- Book value of furniture on 1-4-16 Rs 30,000, half of furniture is sold on 30-06-16.

- Subscription accrued Rs 1,000 for current year.

- Entertainment expenses outstanding Rs 500 at the end.

- Rent is payable Rs 1,000 per month.

- Donation received for construction of building.

Solution.

Question 5.

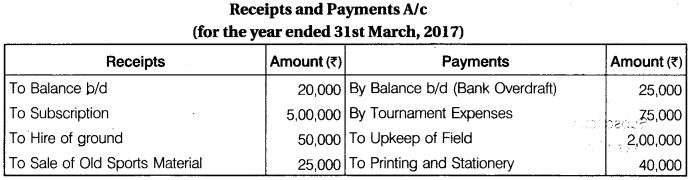

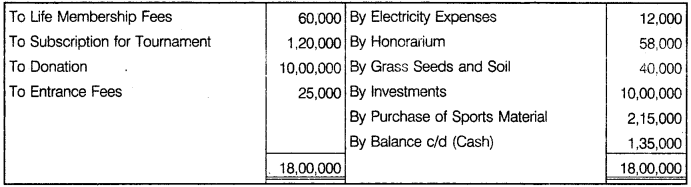

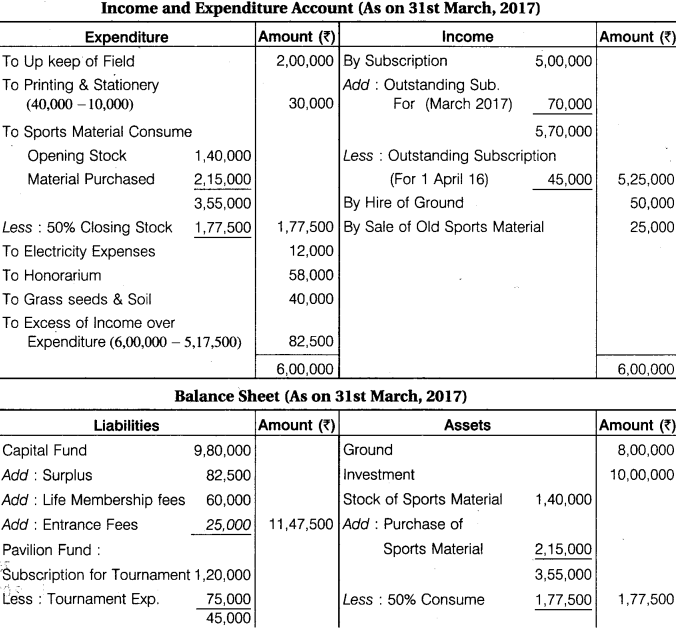

From the following information, prepare Income and Expenditure Account for the year ending 31st March, 2017 and balance sheet on that date.

Additional Information

1. Balances at the beginning of the year Sports material stock Rs 1,40,000, Playground Rs 8,00,000, Subscription receivable Rs 45,000.

2. Surplus on account of tournament and donations will be kept in reserve for the pavilion purpose. Subscription due at the end Rs 70,000. It was also decided that 50% of sports material should be written off. Stock at the end of stationery Rs 10,000. Entrance fees is to be capitalized.

Solution.

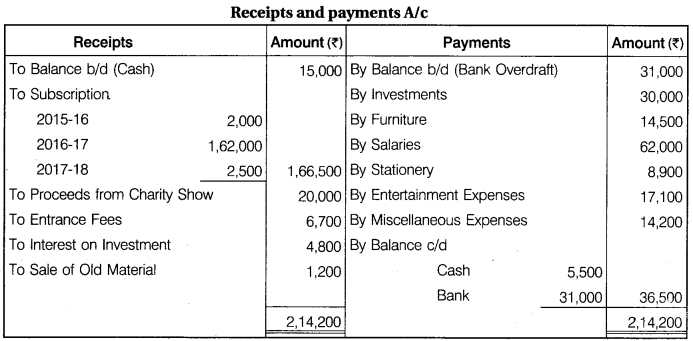

Question 6.

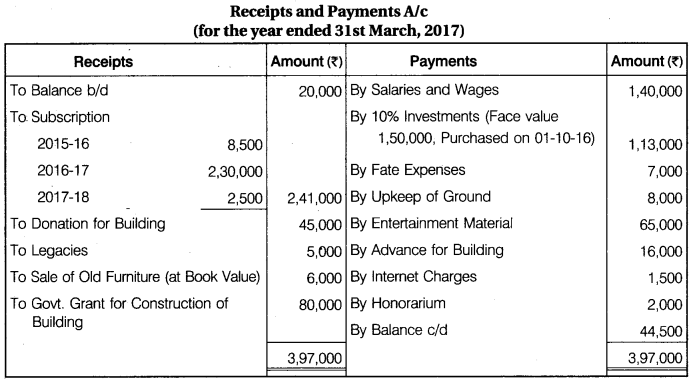

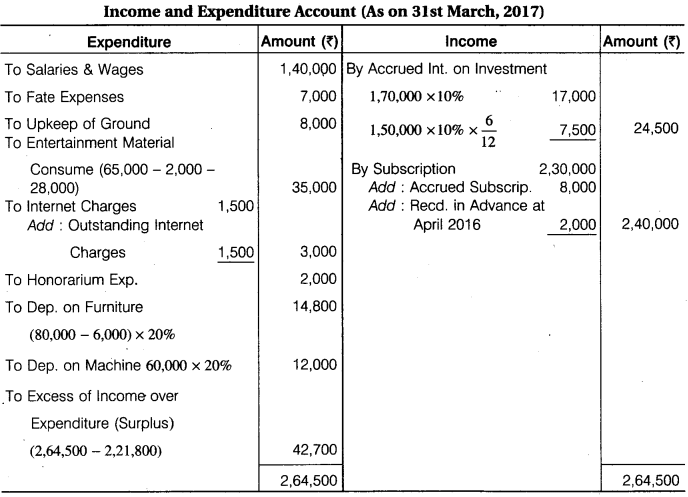

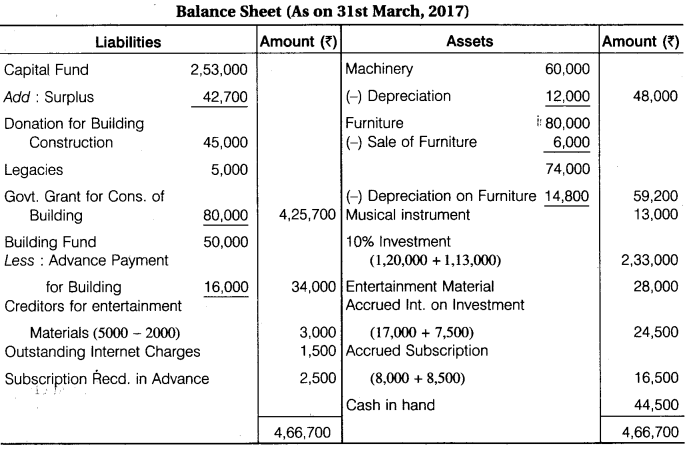

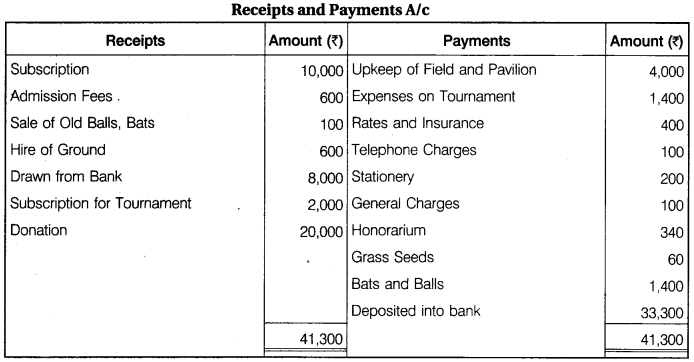

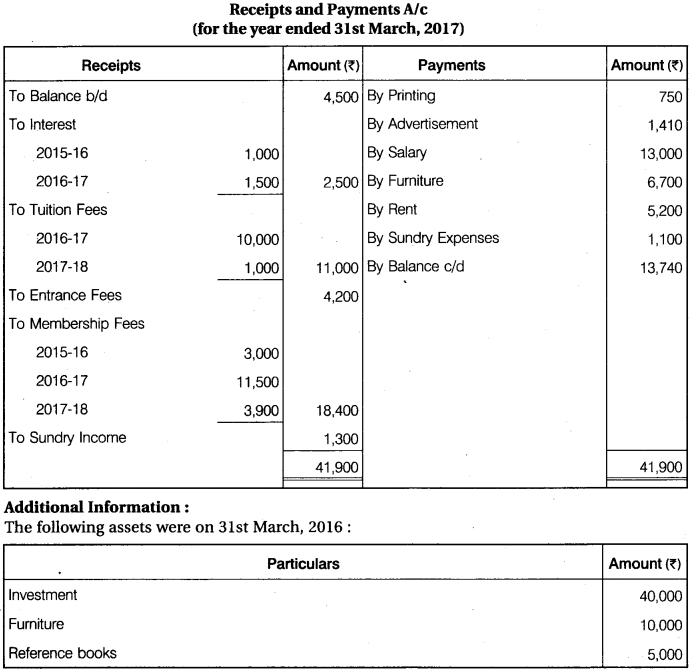

From the following receipts and payments account and additional information, prepare Income and Expenditure Account for the year ending 31st March, 2017 and Balance Sheet on that date.

Additional Information

1. On 31st March, 2016, the society has following assets and liabilities :

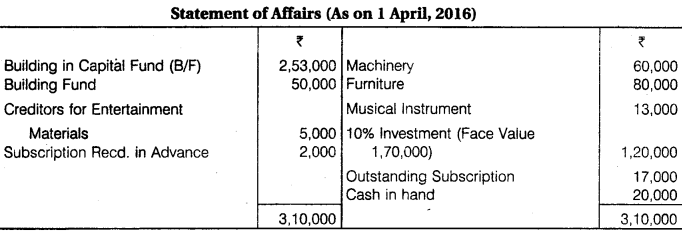

10% Investments Rs 1,20,000 (Face value Rs 1,70,000), Furniture Rs 80,000, Musical instruments Rs 13,000, Machinery Rs 60,000, Subscription in arrears Rs 17,000, Creditors for entertainment material Rs 5,000, Subscription received in advance Rs 2,000 and building fund Rs 50,000.

2. Charge depreciation @ 20% on furniture and machinery.

3. On 31st March, 2017, entertainment material was valued at Rs 28,000. Interest charges was outstanding Rs 1,500.

4. Each year subscription is paid by 100 members, each paying Rs 2,400.

5. Payments.of entertainment material includes Rs 2,000 for previous year.

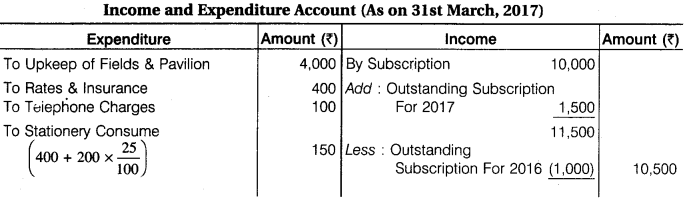

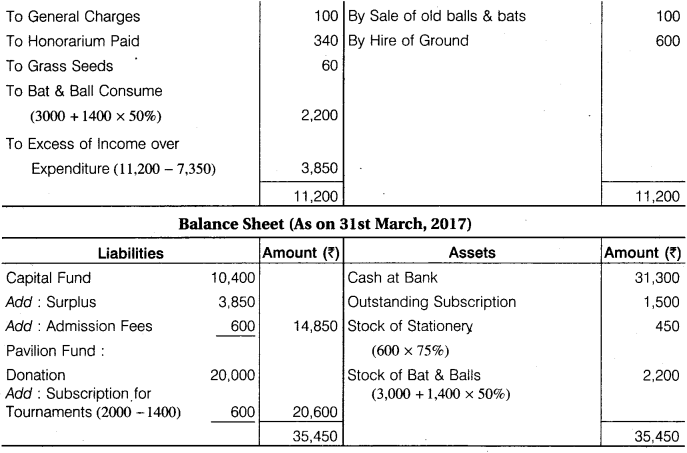

Solution.

Question 7.

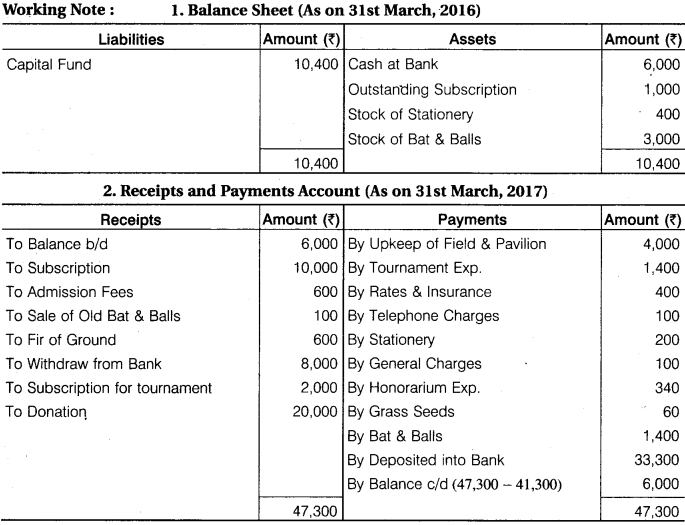

From the following information relating to a cricket club, prepare Income and Expenditure Account for the year ended 31st March, 2017 and a Balance Sheet on that date. An abstract of cash book is given below : (Cash column)

Assets with the club on 1 April, 2016 were as under :

Cash at bank Rs 6000, Stock of balls etc. Rs 3000, Stationery Rs 400, Subscription due Rs 1,000, Donation and surplus on account of tournament should be kept in reserve for a permanent pavilion. Subscription due at 31st March, 2017 amount to Rs 1,500, write off 50% of bats and balls account and 25% off stationery account. Admission fees is to be capitalised.

Solution.

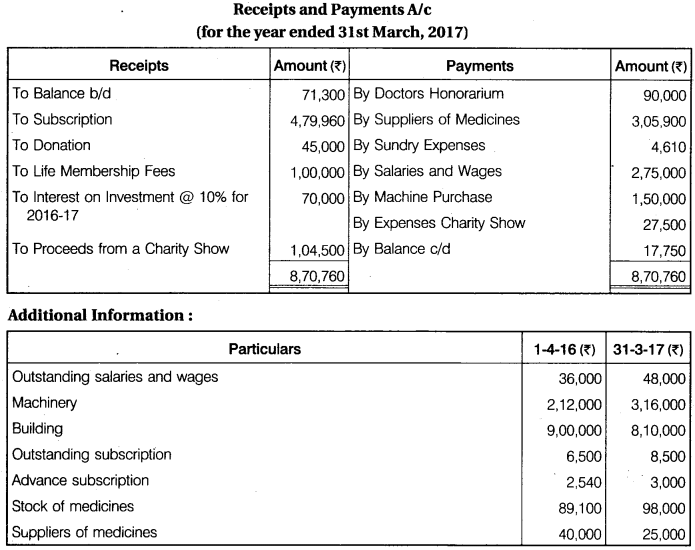

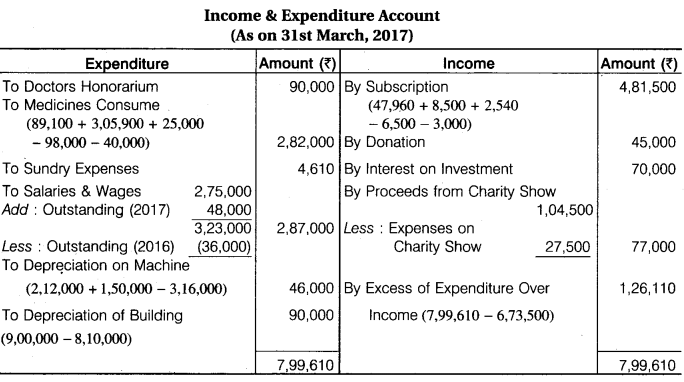

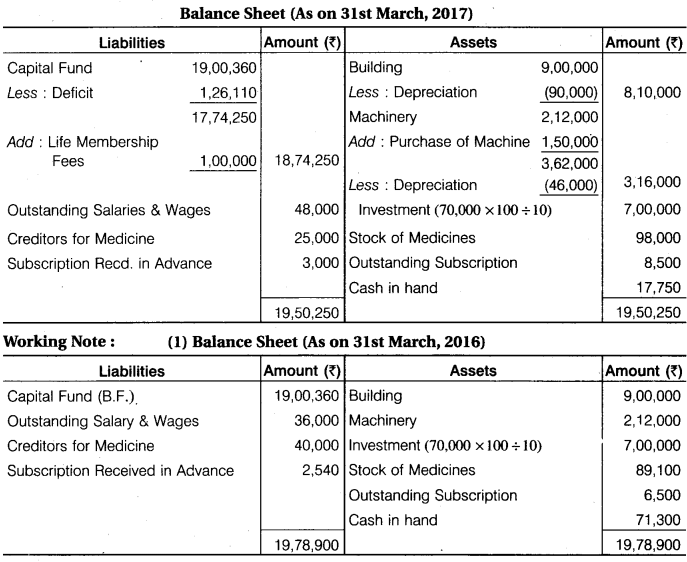

Question 8.

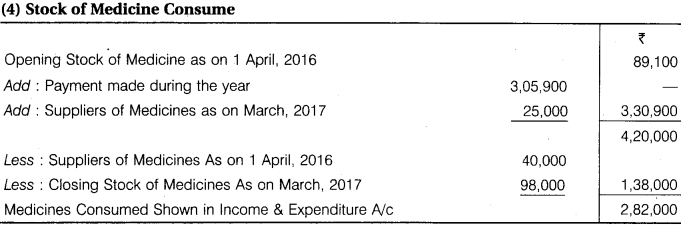

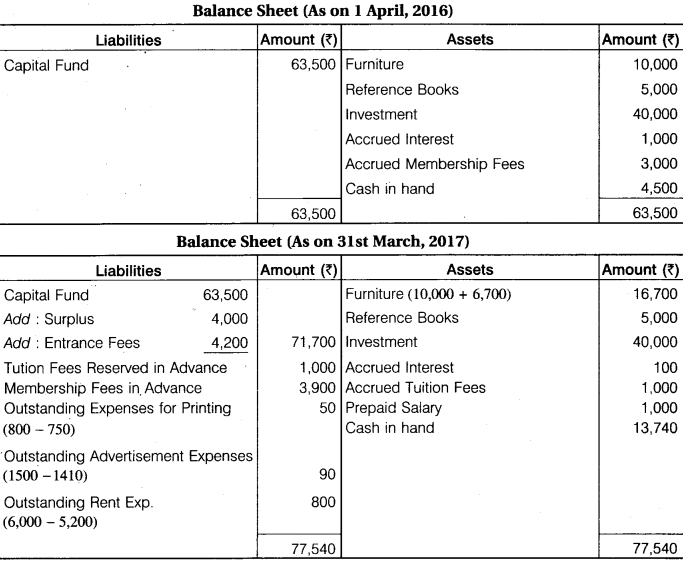

Prepare Income and Expenditure Account of a charitable hospital ending 31st March, 2017 and a Balance Sheet on that date from the following information :

Solution.

Question 9.

From the following receipts and payments account the year ended 31st March, 2017 and additional information of a society, prepare Income and Expenditure Account for the year ending 31st March, 2017 and the balance sheet for the same date.

Additional Information

1. The society has 1800 members paying annual fees of Rs 100. Subscription amounting to Rs 900 were still in arrears for 2015-16.

2. Stock of stationery at the beginning Rs 1,250 and at the end Rs 870.

3. Salary of Rs 5,500 is outstanding at the end, miscellaneous expenses Rs 1,320 (Opening) outstanding. The society had paid Rs 5,000 in 2015-16 out of which Rs 1,250 related to 2016-17 for telephone expenses.

4. Building Rs 2,45,000 and investments Rs 65,000 at the beginning of the current year, depreciate fixed assets by 5%.

5. Entrance fees to be capitalised.

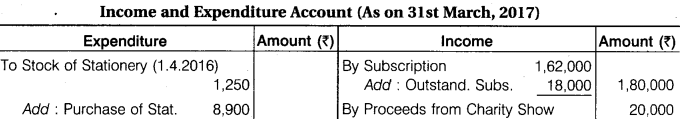

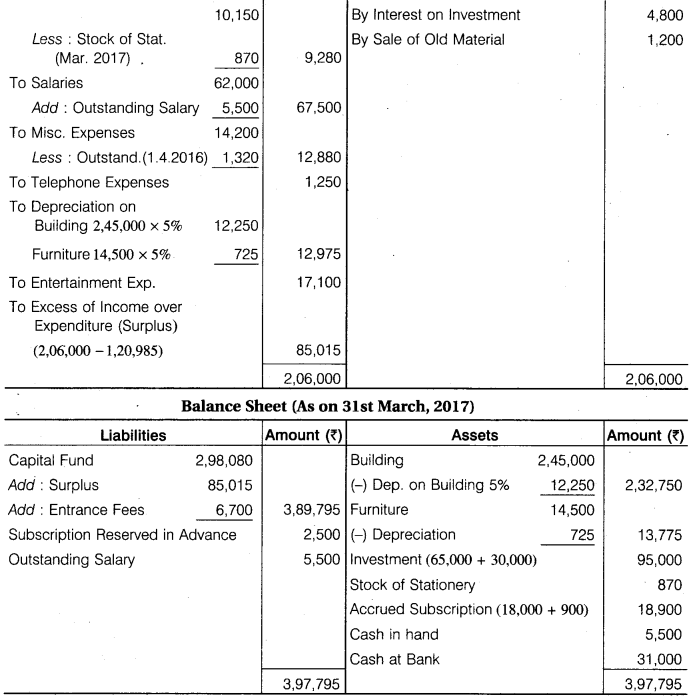

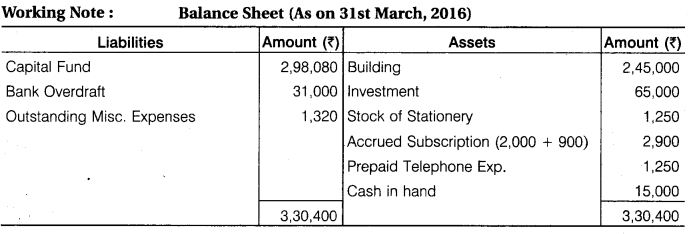

Solution.

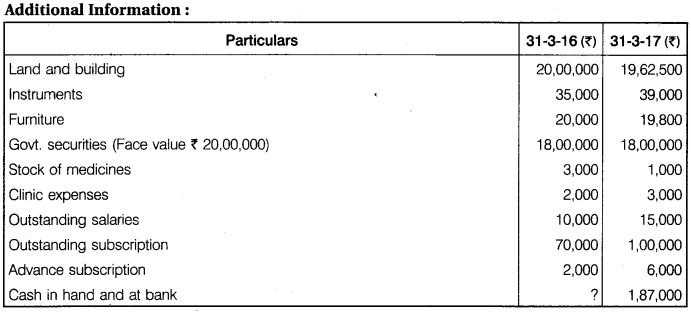

Question 10.

From the following information of a society, prepare Balance Sheet on 1 April, 2016 and 31 March, 2017.

Solution.

Question 11.

Income and expenditure account for the year ending 31st March, 2017 and additional information are given related to a society. Prepare Receipts and Payments Account for the year ending 31st March, 2017 and a Balance Sheet on that date.

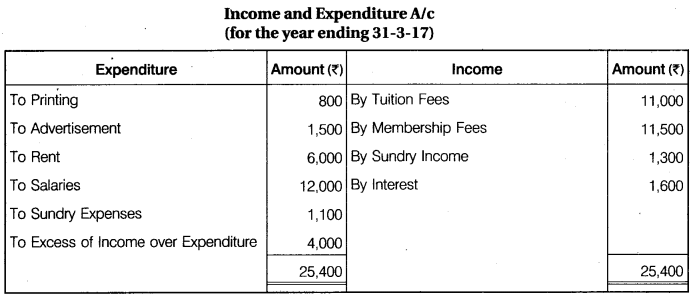

Solution.