Rajasthan Board RBSE Class 12 Business Studies Chapter 15 Goods and Service Tax (GST)

RBSE Class 12 Business Studies Chapter 15 Textbook Exercise

RBSE Class 12 Business Studies Chapter 15 Short Answer Type Questions

Question 1.

From when has GST been implemented in India? What is the procedure for implementing it?

Answer:

Goods and service tax has been implemented in India from 1 July, 2017. After obtaining the president’s assent on four important GST Bills, the Bill became a Law. The Parliament and State legislatures needed to pass the GST Bills that will detail the central and state GST rates and the classification of goods on the basic rates. After the bill becoming law, it will apply all over the country.

Question 2.

Introduce GST briefly.

Answer:

GST is a comprehensive tax levied on manufacture, sale and consumption of goods and services at a national level, under which no distinction is made between goods and services for levying the tax. Presently, tax system has 3 types of taxes excise duty, service tax and VAT. GST is a single tax replacing all the indirect taxes. But, the Constitution does not vest the power to the central or the state government to levy a single tax on goods and services. Therefore, India will adopt a dual GST, where the center and the states will simultaneously tax goods and services.

![]()

Question 3.

Under GST, how is value addition taxed? Explain with the help of an illustration.

Answer:

GST is a tax levied on every stage of sales and is a legal extension Of VAT. In other words, GST is a tax on goods and services under which every person is liable to pay tax on his output and is entitled to get input tax credit on the tax paid on its inputs (therefore tax on value addition only), and ultimately the final consumer shall bear the tax.

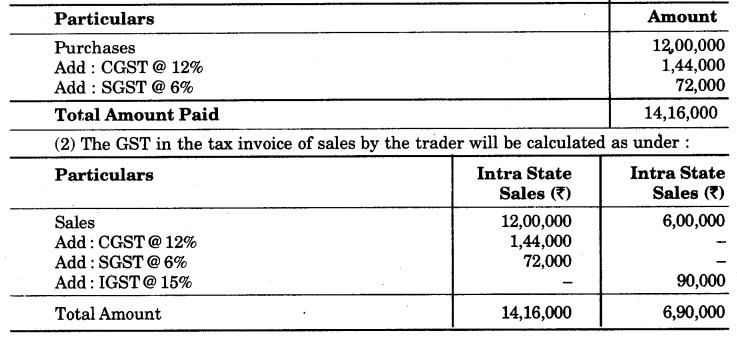

For example : Mahesh buys some goods or services worth ₹ 8000 and sells them to Hemant for ₹ 14,000. So, value added by him is ₹ 6000 and he has to pay tax on this. Suppose, CGST is @ 12% and SGST is @ 6%.

(1) On the goods or services bought by Mahesh, input tax credit for CGST and SGST will be :

Question 4.

List any four features of GST.

Answer:

Features of GST are as follows :

- GST would be applicable on “supply” of goods or services.

- It would be imposed on each stage of sales.

- GST would be based on the principle of destination-based consumption taxation.

- Taxable event in case of goods would be ‘sale’ instead of manufacture.

Question 5.

Which all existing taxes are merged in GST?

Answer:

Following taxes are merged in GST :

- Central Excise Duty.

- Additional Excise Duties.

- Service Tax.

- Excise Duty Under Medicinal & Toilet Preparation Act.

- CVD & Special CVD.

- Central Sales Tax.

- Central surcharges and cesses insofar as they relate to supply of goods and services.

- State surcharges and cesses insofar as they relate to supply of goods and services.

- Entertainment Tax (except that levied by the local bodies).

- Tax on lottery, betting and gambling.

- Entry Tax (All forms) and Purchase Tax.

- VAT/Sales Tax.

- Luxury Tax.

- Tax on advertisements

![]()

Question 6.

What is GSTN? When is it used?

Answer:

Goods and Services Network (GSTN) :

A special purpose vehicle has been set to provide a shared I.T. infrastructure and services to central and state government, tax payers and other stakeholders for implementation of GST.

The Functions of the GSTN include :

- Facilitating registration.

- Forwarding the returns to the central and the state authorities.

- Computation and settlement of IGST.

- Matching the tax payment details with the banking network.

- Providing analysis of tax payer’s profile.

Question 7.

Name any four documents required for GST registration.

Answer:

Four documents required for GST registration are as follows :

- Proof of constitution such as Partnership Deed in case of partnership, Registration Certificate in case of cooperative society, MCA-21 in case of companies.

- Bank account details.

- Authorised signatories’ details.

- Details of proof of place of business, like municipal tax receipt, electricity bill copy, rent agreement, etc.

RBSE Class 12 Business Studies Chapter 15 Long Answer Type Questions

Question 1.

Explain briefly the GST law along with its features.

Answer:

GST is a value added tax levied on manufacture, sale and consumption of goods and services. Presently tax system has 3 types of taxes – Excise Duty, Service Tax and VAT. GST is a single tax replacing all these indirect taxes.

GST = One Country, One Tax, One Market

GST is a destination, based tax applicable on all transactions involving supply of goods and services. GST in India comprises of Central Goods and Services Tax (CGST)-levied and collected by the Central Government, State Goods and Service Tax (SGST)-levied and collected by the state government, Union Territory Goods and Service Tax (UTGST)-levied and collected by the Union Territories and Integrated Goods and Service Tax (IGST) on inter-state supplies of taxable goods and services. IGST will approximately be a sum total of CGST and SGST/UTGST and will be levied by the centre on all inter-state supplies.

GST is a tax on goods and services under which every person is liable to pay tax on his output and is entitled to get input tax credit on the tax paid on its inputs (therefore tax on value addition only), and ultimately the final consumer shall bear the tax.

Salient Features of GST :

- GST would be applicable on supply of goods or services.

- It will be imposed on each stage of sales.

- GST would be based on the principle of destination – based consumption taxation.

- Taxable event in case of goods would be sale instead of manufacture.

- It would be a dual GST, with the centre and the states simultaneously levying it on a common base.

- The administration of central GST would be with the centre, and of the state GST, with the state.

- For Interstate transactions, IGST is levied by the Central government.

- Import of services would be treated as inter-state transactions and would be subject to IGST.

- The tax payers would need to submit periodic returns to the central and the state GST authority.

- GST would replace the following taxes currently levied and collected by the centre:

- Central Excise Duty.

- Duties of Excise (Medicinal and Toilet Preparations).

- Additions Duties of Excise (Goods of Special Importance).

- Additional Duties of Excise (Textile and Textile Products).

- Additional Duties of Customs (CVD).

- Special Additional Duties of Customs (SAD).

- Service Tax.

- Cesses and surcharge related to supply of goods or services.

- State taxes that would be subsumed within the GST are :

- State VAT.

- Central Sales Tax.

- Purchase Tax.

- Luxury Tax.

- Entry Tax (all forms).

- Entertainment Tax (except that levied by the Local bodies).

- Taxes on advertisements.

- Taxes on lotteries, betting and gambling.

- State cesses and surcharges related to supply of goods or services.

- GST would apply to all goods and services except alcohol for human consumption.

- GST on five specified petroleum products (crude, petrol, diesel, ATF & natural gas) would be applicable from a date to be recommended by the GSTC.

- Tobacco and tobacco products would be subject to GST. In addition, the centre would continue to levy Central Excise Duty.

- All exports and supplies to SEZs and SEZ units would be zero-rated.

- For categorisation of goods, Harmonised System of Nomenclature Code will be used.

- The GST council has decided that threshold exemption would be an annual turnover of ₹ 20 lakh for both GST and SGST.

- For services, the present coding system will be used.

![]()

Question 2.

Explain the procedure for getting registration under GST.

Answer:

Even though GST will be collected by both central as well as state governments, but the taxpayer who is liable to be registered, has to make single application for online registration and to file only one return. GST computer system will automatically furnish the information of registration to central as well as state authorities. Any person who is presently registered with the state under VAT, will be issued GST registration automatically but before being issued registration number he will be issued the temporary registration number.

GST registration is based on Pan Card Number. GST registration number is of 15 digits. The structure of GSTIN will be as follows :

|

State code |

PAN | Entity code | Blank digit |

check |

| 1

2 |

3 5 7 9 11

4 6 8 10 |

12

13 |

14 | 15 |

Registration work will be in the hands of the state governments and state GST departments will be doing the registration of tax payers.

Currents Status of Registered Persons :

All the existing tax payers who are currently registered under VAT or Service Tax laws, the information about them will be passed by the GST common portal to the IT system of concerned state/central tax authorities and their GSTIN will will be generated. At present, some taxpayer are registered under Central Tax or State Tax or both. Now, under GST law, a person can be registered only under SGST. He may be exempled from single registration or separate registration for multiple businesses. NSDL and GSTN both will utilise the data of the registered person.

Those persons, who are not enrolled or whose complete data is not available with tax authorities, are informed through advertisement in newspaper so they can furnish their data to the department’s website within the specified time period. If the data is not submitted within the specified time period, his registration will be postponed till he furnishes the required data.

Registration of New Tax Payers :

Every new person who wants to obtain registration, needs to apply for registration through GST Network Portal (GSTN).

Following procedure needs to be followed for registration :

(1) To apply online for registration as per the rules and to enclose scanned copy of following documents :

- Proof of constitution such as Partnership Deed in case of Partnership, Registration certificate in case of cooperative society MCA-21 in case of companies.

- Details and proof of place of business, like, municipal tax receipt, electricity bill copy, rent agreement, etc.

- Bank account details.

- Authorised signatory’s details.

- Photograph of Propreitor, Partners, Karta, MD, Managing Trustee, Person in charge in case other than the above category of person.

(2) GSTN system shall carry out preliminary verification of documents like CIN Number, PAN Number, etc. with various authorities through interportal connectivity.

(3) After preliminary verification, GSTN Portal shall carry forward such application to central/state authorities.

If the details filed by the applicant are correct, registration certificate shall be granted, and if tax authorities refuse the registration, reason for refusal will be communicated to the concerned person by the state GST officer or central GST officer.

![]()

Question 3.

What is meant by the concept of dual GST ? How is it incorporated in India ? Explain in detail.

Answer:

Many countries in the world have a single unified GST system, i.e. a single tax applicable throughout the country. However, in federal countries like Brazil and Canada, a dual GST system is prevalent, whereby GST is levied by both the federal and the state or provincial governments. India will also adopt a dual GST. Dual GST means GST where the centre and the states will simultaneously tax goods and services. The Centre will have the power to tax intrastate sales and states will be empowered to tax services. GST will extend to whole of India except the state of Jammu & Kashmir.

GST is a destination – based tax applicable on all transactions involving supply of goods and services. GST in India will comprise of:

- Central Goods and Service Tax (CGST): This GST is levied and collected by the Central Government.

- State Goods and Service Tax (SGST): This GST is levied and collected by the State Governments.

- Union Territory Goods & Service Tax (UTGST): This GST is levied and collected by the Union Territories.

- Integrated Goods and Service Tax (IGST): Inter state supplies of taxable goods/ services will be subject to Integrated Goods and Service Tax (IGST). IGST will approximately be a sum total of CGST and SGST/UTGST and will be levied by the centre on all inter-state supplies.

Input Tax Credit (ITC) of CGST and SGST/UTGST will be available throughout the supply chain, but cross utilization of credit of CGST and SGST / UTGST will not be possible, i.e. CGST credit cannot be utilized for payment of SGST / UTGST, and SGST / UTGST credit cannot be utilized for payment of CGST. However, cross utilization will be allowed between CGST / SGST/ UTGST and IGST, i.e. credit of IGST can be utilized for the payment of CGST / SGST / UTGST and vice versa.

Question 4.

Under GST, which all returns are to be filed by the businessmen ? What are the levies defined for default in filing the returns.

Answer:

After implementation of GST, businessmen have to file monthly returns. Under VAT, small traders were filing quarterly returns, and half yearly returns under service tax. Under GST, every assessee has to present the following 3 returns :

(1) Sales Return (Section 25) – (GST R-1) :

This return contains information regarding sales of goods/services made during a month. This return is filed within 10 days of the end of the month. It includes details of outbound supplies, sales at zero rate, interstate sales, purchase return, export to other countries, debit note, credit note, etc. This information is matched with return filed by the buyer under section 26, and in case of mismatch the tax payer is given a chance to rectify the mistake.

(2) Purchase Return (Section 26) (GST R-2) :

It will contain all the details of purchases of goods and services on which GST is paid by the assessee. The due date for filing GST R-2 is 15th of next month. The details filed under this return are matched with the return filed under section 25 by the seller, and any mismatch will impact input tax credit eligibility.

(3) Monthly Returns (Section 27) – (GST R-3) :

After filing sales and purchase returns on 10th and 15th of next month, the monthly summary of purchases, sales, tax amount given in GST R-l and GST R-2 returns, has to be filed online by the 20th of subsequent month.

A registered taxable person paying tax under the composite scheme shall furnish quarterly returns within 18 days after the end of relevant quarter.

Levy or Late fees – for defaulted returns (Section 33) :

A penalty of? 100 per day is applicable for late filing of GST return under section 25,26,27 and 31 with a maximum penalty of ? 5,000.

And penalty for Annual Reports (section 30) is ? 100 per day of delay with a maximum 0.25% on aggregate turnover.

![]()

Question 5.

At what point of time, the tax will be levied?

Answer:

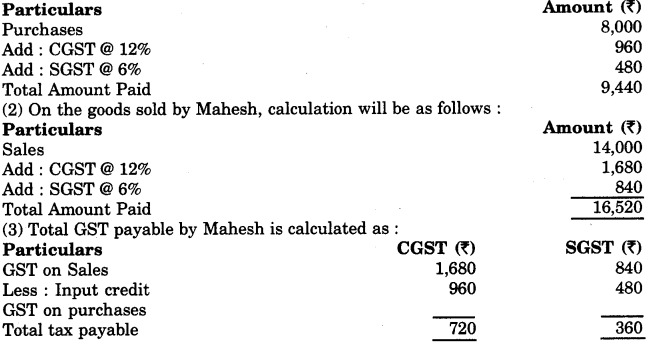

Taxable event under GST will be “supply of goods or services or both”. The incidence of tax is the foundation stone of any taxation system. It determines the point at which tax would be levied, i.e. the taxable event. The existing framework of taxable event in various statues has been resulting in litigation since decades.

Broadly, the controversies relates to issues like whether a particular transaction is a sale of goods or rendering of services or not, whether a particular process amounts to manufacture or not. The GST law resolves these issues by laying down one comprehensive taxable event, i.e. “Supply”.

GST Law, by levying tax on ‘Supply’ of goods/services, will depart from the historically

understood concepts of‘taxable event’ under the State VAT Law, Excise Laws and Service Tax laws, i.e. sale, manufacture and service respectively.

In the GST regime, the entire supply of goods/services will be taxed in an integrated manner, unlike the existing indirect taxes, which are charged independently either on the manufactured or sale of goods, or on the provisions of services.

RBSE Class 12 Business Studies Chapter 15 Practical Questions

Question 1.

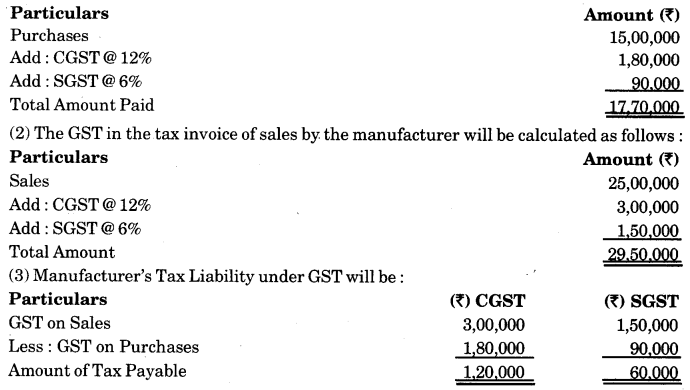

A producer in Rajasthan buys raw material worth ₹ 15,00,000 from a trader in Jaipur who sold it at the CGST rate being 12% and SGST rate 6%. The producer produces 56,000 units from this raw material by making an additionl expenditure of ₹ 8,60,000. On profit, he sold all the units produced for ₹ 25,00,000 to a registered trader and charged CGST @ 12% and SGST at 6%. Calculate the tax payable.

Answer:

(1) GST on account of purchase of the manufacturer on the invoice of purchase will be as follows :

Question 2.

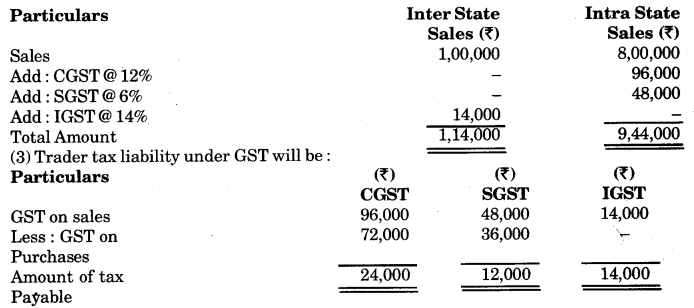

A trader of Rajasthan purchased good worth ₹ 6 lakhs from a Jaipur based trader on which CGST rate is 12% and SGST rate is 6%. The trader sells 3/4 of the output purchased to a registered trader of Rajasthan for ₹ 8 lakhs and charged CGST at the rate of 12% and SGST at the rate of 6%. Remaining goods he sells to a trader of Madhya Pradesh for ₹ 1 lakh and charged IGST of 14% on the goods sold. Calculate the tax payable.

Answer:

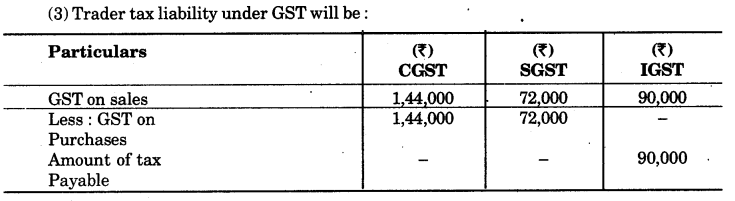

(1) GST on account of purchase of the trader on the invoice of purchase will be as follows :

(2) The GST in the tax invoice of sales by the trader will be calculated as under :

RBSE Class 12 Business Studies Chapter 15 Additional Questions

Question 1.

What are the benefits of GST?

Answer:

Benefits of GST are as follows :

- Creation of a unified national market.

- Mitigation of ill-effects of cascading.

- Elimination of multiple taxation and double taxation.

- Boost to the ‘Make in India’ initiative.

- Widening tax base and improving taxpayer compliance.

- Increase in GDP.

![]()

Question 2.

GST Registration of tax payer will be done by which government ? Draw the structure of GSTN.

Answer:

GST registration of taxpayers will be in the hands of the state governments and the state GST department will be doing the registration of the taxpayers.

Structure of GSTN will be as follows :

|

State code |

PAN | Entity code | Blank digit |

check |

| 1

2 |

3 5 7 9 11

4 6 8 10 |

12

13 |

14 | 15 |

Question 3.

Which are the taxes that GST replaces?

Answer:

The GST replaces the following taxes :

- Central Excise Duty.

- Service Tax.

- Countervailing Duty.

- Special Countervailing Duty.

- Value Added Tax (VAT).

- Central Sales Tax (CST).

- Octroi.

- Entertainment Tax.

- Entry Tax.

- Purchase Tax.

- Luxury Tax.

- Advertisement Taxes.

- Taxes applicable on lotteries

![]()

Question 4.

A trader of Madhya Pradesh purchases goods worth ₹ 12,00,000 from a trader of Gwalior (M.P.) on which CGST rate is 12% and SGST rate is 6%. The trader sells 1/3 of the goods to a trader of Giijarat for ₹ 6,00,000 and charged IGST @ 15%. Remaining goods he sells to a trader of Gwalior (M.P.) for ₹ 12,00,000 on which 12% CGST and 6% SGST is payable. Calculate the tax payable.

Answer:

(1) GST on account of purchase of the trader on the invoice of purchase will be as follows :