Rajasthan Board RBSE Class 12 Economics Chapter 14 Basic Concepts of National Income

RBSE Class 12 Economics Chapter 14 Practice Questions

RBSE Class 12 Economics Chapter 14 Multiple Choice Questions

Question 1.

Net indirect taxes may be calculated from the following :

(a) Gross indirect tax – subsidy

(b) Gross indirect tax – interest

(c) Gross indirect tax – profit

(d) Gross indirect tax – subsidy

Answer:

(a)

Question 2.

Who gave the concept of circular flow of income?

(a) Francois Quesney

(b) Karl Marx

(c) Simon Kuznats

(d) None of these

Answer:

(a)

Question 3.

What is deducted from gross investment to calculate net investment?

(a) Net interest

(b) Investment

(c) Depreciation

(d) Profit

Answer:

(c)

Question 4.

Which of the following is not an example of consumption goods?

(a) Vegetables

(b) Clothes

(c) Bread

(d) Pump set for irrigation

Answer:

(d)

Question 5.

Which of the following is not an example of capital goods?

(a) Machine, buildings and tractors

(b) Dams and canals

(c) Electricity equipments and mechanism of electricity

(d) Eatables and clothes

Answer:

(d)

RBSE Class 12 Economics Chapter 14 Very Short Answer Type Questions

Question 1.

What is flow?

Answer:

When an economic variable is studied over a period of time, it is called flow.

Question 2.

What is stock?

Answer:

When an economic variable is studied at a specific point of time, it is called stock.

Question 3.

What is circular flow of national income?

Answer:

The earnings generated by productive economic actions, circulating among the business firms and families of a country, is called the circular flow.

Question 4.

Which-are the two sectors of circular flow of income model?

Answer:

Following are the two sectors of circular flow of income model

(i) First Sector – Family Sector

(ii) Second Sector – Business Sector.

Question 5.

What do you mean by intermediate goods?

Answer:

Intermediate goods are generally in the form of semi-finished goods and raw materials. The intermediate object changes through one or more stages of the production process and turns into the finished goods.

RBSE Class 12 Economics Chapter 14 Short Answer Type Questions

Question 1.

Differentiate between stock and flow.

Answer:

Difference between Stack and Flow

| S. No. | Stock | Flow |

| (i) | Stock is a measure of economic variable at a certain point. | Flow is the measure of economic variable in a certain period of time. |

| (ii) | Stock is a static concept. | Flow is a dynamic concept. |

| (iii) | There is no time period of stock. | There is a time period in flow. |

| (iv) | Stock affects the flow. | Flow affects the stock both directly and indirectly. |

| (v) | Property, workforce, capital, bank deposit, water in an overhead tank, etc are the examples of stock. | Income, expenditure of currency, capital formation, interest on capital, leakage of water in overhead tank, etc are the examples of flow. |

Question 2.

Describe in brief the difference between consumption goods and capital goods.

Answer:

| S. No. | Consumption Goods | Capital Goods |

| (i) | Consumption goods are those goods which are used by end-users to satisfy their needs and desires. | Capital goods are those goods which are used to produce other goods and services. |

| (ii) | These goods are consumed fully after purchase. | Those goods are not consumed fully after purchase. |

| (iii) | Consumption goods are not used as raw material to produce new goods. | Capital goods are used as raw material to produce new goods. |

| (iv) | Being final product, these are included in the calculation of national income. | Since these are not final goods, these are not included in the calculation of national income. |

| (v) | Food, clothes, vehicle, radio, television, books, etc. are the examples of consumer goods. |

Machines,furniture, tools, equipment buildings, dams, canal and plants for generation of electricity, etc. are examples of capital goods. |

Question 3.

Explain gross and net investment.

Answer:

Gross Investment – Increase in value of capital goods during a specific period is called gross investment. Examples of gross investment are new machine, new building, new dam, new canal, new- equipment for generation of electricity and electricity lines, etc. Already in use machines, old houses, old dams and expenditure on repairs of old canals are also included in gross investment.

Gross investment = Net investment + Depreciation

Net Investment – To calculate net investment, we deduct depreciation on physical capital goods. If depreciation of physical capital goods, i.e. depreciation is deducted from gross investment, it will give us net investment. Production and productive capacity improves only along with increase in net investment.

Net investment = Gross investment – Depreciation.

Question 4.

Explain in brief the meaning of depreciation.

Answer:

Decline in the value of capital assets is called depreciation. Due to depreciation, productive efficiency of machines, buildings, dam canals and equipment for generation of electricity declines. This is due to use of capital goods in the process of production. In this way, depreciation is one reason for decrease in value of capital asset. Therefore, to calculate net investment, we deduct the value of depreciation from gross investment.

Depreciation = Gross investment – Net investment.

Question 5.

Explain the concept of normal residents.

Answet:

A normal resident of a country can be defined as a person, who ordinarily resides in a country and whose centre of interest also lies in that country. Normal residents means, those persons, who have been granted the citizenship of that country. National income is said to be the total of all the incomes of the normal residents of a country. Since we differentiate between the economic activities of normal residents and non-residents, therefore, the concept of normal residents is important in the calculation of national income.

RBSE Class 12 Economics Chapter 14 Essay Type Questions

Question 1.

Explain in detail the circular flow of income with the help of a suitable diagram.

Answer:

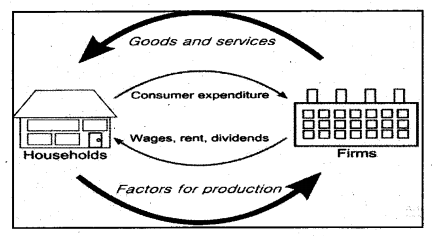

Circular flow of income was first introduced by Francois Quesney, an agricultural economist, in 1758. Karl Marx again published Quesney’s economic table. There are various sectors of an economy like family (consumer), professional (producer) and government, etc. All these sectors are entirely interdependent. Dependence of different sectors on one another can be understood by circular flow of income. Production of goods and services is possible because of productive economic activities of the factors of production.

According to Enter’s theorem, production takes place due to distribution among the factors of production. Distribution of production among factors of production in this way is called factor income. People of the country spend this factor income on goods and services. In this way, income earned through productive services is circulated between households and business firms in a continuous rotation. This is known as circular flow of income.

Model

Model is a’simplified version of complex realities. As with the help of clay or plastic model, we can easily understand the working of human body, similarly, we can understand the flow of income between, households and business firms through circular flow of income. Circular flow of income model assumes the following points:

- Total production of country is through business firms only.

- Business firms sell the entire goods produced. Nothing is residual in the form of unsold or raw material.

- Government exists in the country, but it neither imposes taxes nor provides any subsidy.

- Economy of country is considered to be a closed economy when there is no import and export in the country.

When the economy of a country is open, the sectors of economy for circular flow of income include – households, business firms, capital market, government and rest of the countries. In a simple model of circular flow of income, there are two sectors:

- Household Sector

- Business Firm Sector

Thus, the means of production in a country move towards the business/companies from the family. In exchange for the means by commercial firms, money is paid in the form of returns.

Question 2.

Write short notes on :

(a) Consumption goods

(b) Capital goods

(c) Intermediate goods.

Answer:

(a) Consumption goods : Consumption goods are those goods which are used by end-users to satisfy their needs and desires.These goods are consumed fully after purchase. Consumption goods are not used as raw material to produce new goods. Being final product, these are included in the calculation of national income. Food, clothes, vehicle, radio, television, books, etc. are the examples of consumption goods.

(b) Capital goods : Capital goods are those goods which are used to produce other goods and services. Those goods which are used in production process are called capital goods.

Capital goods are used as raw material to produce new goods. Machines, furniture, tools, equipment, buildings, dams, canal and plants for generation of electricity, etc. are examples of capital goods. Development of a country depends upon production of capital goods. Capital goods are used for production, so these are also known as producer goods.

(c) Intermediate goods : Goods which are within the boundary of production are called intermediate goods. In simple words, those goods which can be used for the production of other goods in the form of raw material are known as intermediate goods. Intermediate goods are normally in the form of semi-produced goods or raw material. Intermediate goods are processed through more than one process to convert them into final product. Cotton, thread are intermediate goods for readymade clothes.

Question 3.

Differentiate between :

(a) Stock and Flow

(b) Gross and net investment

Answer:

(a) Stock and flow

| S. No. | Stock | Flow |

| (i) | Stock is a measure of economic variable at a certain point of time. | Flow is the measure of economic variable in a certain period of time. |

| (ii) | Stock is a static concept. | Flow is a dynamic concept. |

| (iii) | There is no time period of stock. | There is a time period of flow. |

| (iv) | Stock affects the flow. | Flow affects the stock both directly and indirectly. |

| (v) | Property, workforce, capital, etc. are the examples of stock. | Income, expenditure of currency, capital formation, interest on capital, etc. are the examples of flow. |

(b) Gross and net investment-

(i) Gross Investment – Increase in the value of capital goods during a specific period is called gross investment. Examples of gross investment are new machine, new building, new dam, new canal, new equipment for generation of electricity and electricity lines, etc. Already in use machines, old houses, old dams and expenditure on repairs’of old canals are also included in gross investment.

Gross investment = Net investment + Depreciation

(ii) Net Investment – To calculate net investment we deduct depreciation on physical capital goods from gross investment. If depreciation of physical capital goods i.e., depreciation is deducted from gross investment, it will give us net investment. Production and productive capacity improves only along with increase in net investment.

Net investment = Gross investment – Depreciation

RBSE Class 12 Economics Chapter 14 Other Important Questions – Answers

RBSE Class 12 Economics Chapter 14 Multiple – Choice Questions

Question 1.

Circular flow includes :

(a) Actual Flow

(b) Currency (Monetary) flow

(c) both (a) and (b)

(d) none of these

Answer:

(c)

Question 2.

For equilibrium between four regional economies of income, which of these is a necessary condition ?

(a) C + I + G + (X – M)

(b) C + I + G

(c) C + I

(d) none of these

Answer:

(a)

Question 3.

This is include in circular flow:

(a) raw material

(b) machinery

(c) intermediate goods

(d) final goods and services

Answer:

(d)

Question 4.

When any economic variable is studied at a certain point of time, it is called :

(a) stock

(b) flow

(c) circular flow

(d) none of these

Answer:

(a)

Question 5.

When a variable is studied over a period of time, it is called :

(a) stock

(b) flow

(c) circular flow

(d) none of these

Answer:

(b)

Question 6.

Who first propounded the concept of circular flow ?

(a) Adam Smith

(b) Marshall

(c) Keynes

(d) Francois Quesney

Answer:

(d)

Question 7.

Who re-published Francois Quesney’s economic table ?

(a) Karl Marx

(b) Marshall

(c) Adam Smith

(d) Keynes

Answer:

(a)

Question 8.

How many sectors are there in the circulation of simple income ?

(a) one

(b) two

(c) three

(d) four

Answer:

(b)

Question 9.

All those goods/services that can be used in consumption or production are called :

(a) final goods

(b) intermediate goods

(c) capital goods

(d) consumer goods

Answer:

(a)

Question 10.

The expenditure done by a producer on capital goods in a certain period of time is called :

(a) Gross investment

(b) Net investment

(c) National Income

(d) None of these

Answer:

(a)

RBSE Class 12 Economics Chapter 14 Very Short Answer Type Questions

Question 1.

What is flow?

Answer:

The economic variables that are related to a period of time, are called flows.

Question 2.

Which of the following are capital goods : television, tractor, pump set or food?

Answer:

Tractor and Pumpset are capital goods.

Question 3.

Define Intermediate Goods.

Answer:

Goods that are used as raw materials in the production of other items are called intermediate goods.

Question 4.

Where do families and firms sectors deposit their savings?

Answer:

Families and firms sectors deposit their savings in capital market.

Question 5.

What is meant by productive goods ?

Answer:

All such goods which are used in the production process are called productive goods.

Question 6.

What do you mean by a closed economy?

Answer:

The economy which does not conduct any kind of imports and exports.

Question 7.

Which are the flow of stocks from the following

- Income of family

- Consumption expense of family

- Assets

- Cement Production

Answer:

Income of Family, Consumption expense of family and Cement production are flow of stock and assets are stock.

Question 8.

What do you mean by stock?

Answer:

The amount of a variable whose measurement is taken at a certain point of time.

Question 9.

What problems arise from the inclusion of the value of the intermediate item into national income ?

Answer:

Dual computation problem arises.

Question 10.

In the calculation of national income, why only the final goods and services are included ?

Answer:

Because of this, there is no possibility of double counting.

Question 11.

The final goods can be divided into how many parts?

Answer:

The final goods can be divided into two parts-

- Consumption goods

- Capital goods.

Question 12.

What is the formula of finding out net investment?

Answer:

Net Investment = Gross investment – Depreciation.

Question 13.

What is given by the family sector to the firms?

Answer:

Factor services are provided by the family sector to the firms.

Question 14.

What are consumer goods?

Answer:

Goods that are used by consumers for final consumption are called consumer goods.

Question 15.

Give any one example of direct tax.

Answer:

Income Tax.

Question 16.

Who gave the idea of income circular flow of income ?

Answer:

Francois Quesney.

Question 17.

In the open economy of a country, how many sectors of circular income are there ?

Answer:

Five.

Question 18.

Which are sectors included in the circular flow of income in the open economy of a country?

Answer:

- Family

- Business Firms

- Capital-Market

- Government

- Rest of the world.

Question 19.

What are the two sectors of the circular flow model of a simple income?

Answer:

First sector – Family Sector

Second Sector- Business Sector.

Question 20.

What do you mean by family sector ?

Answer:

The meaning of family sector is the sector which is the owner of the resources of production- labour, land, capital, etc.

Question 21.

What do you mean by business sector?

Answer:

Business sector is the sector that produces with the help of means of production(Labour, Land, Capital, etc.) supplied by the family.

Question 22.

What is the meaning of actual flow?

Answer:

The flow of means of production from’ families to commercial firms and flow of consumer goods and services from commercial firms to families is called actual flow.

Question 23.

What do you mean by monetary flow?

Answer:

The flow of money as payment of means from commercial firms to the family sector, and the flow of consumption expenditure from the family to business firms is called monetary flow.

Question 24.

What is the importance of national income?

Answer:

National income is an indicator of the progress of the country.

Question 25.

What is given by family sector to firms ?

Answer:

Family sector supplies factor services to firms.

RBSE Class 12 Economics Chapter 14 Short Answer Type Questions (SA-I)

Question 1.

From where does the information about the economic achievements of a country come from?

Answer:

The information about the economic achievements of a country comes from the national income.

Question 2.

What does national income reveal ?

Answer:

National income shows the effect of the government policies and programs of that country.

Question 3.

What does national income represent?

Answer:

National income reflects the state and progress of a country’s economy.

Question 4.

What period does the flow of national income relate to?

Answer:

This flow relates to 1 year duration from 1st April to 31st March.

Question 5.

What is Eiler’s Theorem?

Answer:

According to Eiler’s Theorem, the complete distribution of all the production is done among the means of production.

Question 6.

What are the various sectors of an economy of a country?

Answer:

The various sectors of an economy of a country are family (consumer), business (production) and government.

Question 7.

What is the meaning of price depreciation?

Answer:

In a financial year, during the production process, the decrease in value due to the general wear and tear of capital goods and the expected decline due to expected non- prevelance is called depreciation.

Question 8.

What are the capital goods?

Answer:

Capital goods are the fixed assets of the producer which include raw materials left at the year-end, semi-finished goods, and stock of finished goods.

Question 9.

What is the meaning of consumer goods?

Answer:

The objects that consumers use for their ultimate consumption are called consumer goods like pen, soap, etc.

Question 10.

What ido you mean by the circular flow of national income?

Answer:

The exchange of revenue or goods and services between different sectors of the economy is called the circular flow of national income.

Question 11.

What is monetary flow?

Answer:

Monetary flow is the exchange of monetary income among various sectors of economy.

Question 12.

What do you mean by monetary investment?

Answer:

When the manufacturers invest their money in cash, it is called monetary investment.

Question 13.

How many types of investment are there?

Answer:

There are two types of investment –

- Gross Investment

- Net Investment.

Question 14.

What do you mean by gross investment?

Answer:

Increase in value of capital goods including substitution of depreciation during a specific period is called gross investment.

Question 15.

Give examples of gross investment.

Answer:

Examples of gross investment include new machine, new building, new dam, new canal, new equipment for generation of electricity and electricity lines, etc.

Question 16.

Write down the formula of gross investment.

Answer:

Formula of Gross Investment

Gross Investment = Net investment + Depreciation.

Question 17.

What is net investment?

Answer:

When depreciation is deducted from gross investment, it will give us net investment.

Question 18.

What is the formula of net investment?

Answer:

Net Investment = Gross Investment – Depreciation.

Question 19.

What is the formula of depreciation?

Answer:

Formula of Depreciation-

Depreciation = Gross Investment – Net Investment.

Question 20.

What is the meaning of Domestic Territory?

Answer:

Domestic Territory means goods and services produced or economic activities undertaken within a country’s territory.

Question 21.

What is the difference between domestic income and national income?

Answer:

Domestic Income:

It is the sum total of factor incomes generated within the domestic territory of a country.

National Income

It is the sum total of factor incomes earned by normal residents of a country during a given year.

RBSE Class 12 Economics Chapter 14 Short Answer Type Questions (SA-II)

Question 1.

What do you mean by consumption goods?

Answer:

Consumption goods are those goods which are used by end-users to satisfy their needs and desires. These goods are consumed fully after purchase. Consumption goods are not used as raw materials to produce new goods. Generally, business firms store consumption goods for delivery to end-users. Being a final product, these are included in the calculation of national income. The examples of consumer goods are food, cloth, vehicles, radio, television, books, etc. Consumption goods include services, non-durable and durable goods, etc.

Question 2.

Distinguish between domestic product and national product. When can domestic product be more than the national product?

Answer:

The sum total of all factor incomes generated or produced during an accounting year within the domestic territory of a country is termed as domestic income or domestic product of a country. On the other hand, the sum total of all factor incomes earned by the normal residents of a country, irrespective of the fact that in which part of the world this income is generated, during an accounting year, is called National Income or national product of a country.

National Product = Domestic Product + Net Factor Income from Abroad

If Net Factor Income from Abroad (i.e. income paid to abroad is more than income received) is negative, the domestic product is more than the national product.

Question 3.

Distinguish between Real Gross Domestic Product and Nominal Gross Domestic Product. Which of these is a better index of welfare of the people and why?

Answer:

(i) Nominal GDP is the market value of all final goods ‘and services produced in a geographical region usually a country. On the other hand, Real GDP is a macroeconomic measure of the value of output, economically adjusted for price changes. The adjustment transforms the Nominal GDP into an index for quantity of total output.

(ii) Nominal values of GDP from different time periods can differ due to changes in quantities of goods and services and/or changes in general price levels. Values for Real GDP are adjusted for difference in price levels, while figures for Nominal GDP are not adjusted.

Real GDP is a better index of welfare of the people. When Real GDP rises, flow of goods and services tends to rise, other things remaining constant. This means greater availability of goods per person, implying higher level of welfare.

Question 4.

Explain the problem of double counting in estimating national income, with the help of an example. Also explain two alternative ways of avoiding this problem.

Answer:

Counting the value of goods or services more than once while estimating NI is the problem of double counting.

Example : Suppose, a farmer produces wheat worth ₹ 1,000. He sells this to the baker who converts the wheat into bread and sells it to the grocer for ₹ 2,000. The value of total output here would be ₹ 3,000 and this includes the value of wheat two times.

Methods of avoiding double counting are :

(a) Value of final goods only to be included.

(b) Use value added method.

RBSE Class 12 Economics Chapter 14 Long Answer Type Questions

Question 1.

Explain the following

(a) Concept of Domestic territory Ob) Concept of Normal Residents

(c) Concept of Net Factor income from abroad

(d) Concept of Net Indirect taxes.

Answer:

(a) Concept of Domestic TerritoryConcept of domestic territory is important in the calculation of national income. Domestic territory means goods and services produced or economic activities undertaken in a domestic territory. In this way, economic activities performed outside the geographical boundary of the country are not included in domestic territory.

(b) Concept of Normal Residents A normal resident of a country can be defined as a person, who ordinarily resides in a country and whose centre of interest also lies in that country. Normal residents mean, those persons, who have been granted the citizenship of that country. National income is said to be the total of all the income of the normal residents of a country. Since we differentiate between the economic activities of normal residents and non-residents, therefore, the concept of normal residents is important in the calculation of national income.

(c) Concept of Net Factor Income from Abroad Net factor income from abroad is the difference between the income received from abroad by the normal residents of a country for rendering factor services and the income paid for the factor services rendered by non-residents within the domestic territory of a country. In other words, the normal residents of India earn income from abroad in the form of wages, rent, interest, profit etc. On the other hand, foreigners who are normal residents of other countries, also earn income from India. The difference between the two is called net factor income from abroad.

(d) Concept of Net Indirect Taxes Valuation of production in the country is made as per market price. To calculate production at market rates, we add factor cost and indirect taxes. Indirect taxes like GST is added in factor cost and subsidy is deducted. In this way, net indirect taxes is calculated by deducting subsidy from gross indirect taxes.

Net indirect taxes = Gross indirect tax – Subsidy.

Question 2.

What precautions should be taken while calculating national income by Income Method?

Answer:

The precautions to be taken while calculating national income by Income Method are :

- Transfer payments such as scholarships, old age pension, etc. should not be included as they are not associated with any movement of goods/services at all. Retirement pension however, is an exception because it is the payment by employers in lieu of employee’s services received earlier.

- Any illegal incomes like those from smuggling, black marketing, etc. are obviously excluded.

- Income from sale of second-hand goods is not included in national income, because it involves only change in the ownership now; their original sale value having already been accounted for in the year when they were first sold. However brokerage/ commission on even second-hand goods sale is included since that has been earned in the current year itself.

- Indirect taxes raise the market price of goods, thus they should be included while calculating national income at market price.

- Money received from sale of shares, bonds, etc. should not be included because there is no corresponding flow of goods/services in this.

- Windfall gains like winning from lotteries, etc. should not be included as these are unearned incomes.

- Production for self consumption should be included in national income.

- Imputed rent of owner-occupied houses should be included.

- Gift tax, wealth tax, etc. being paid out of past savings should not be included.

Question 3.

Write down some of the limitations of using GDP as an index of welfare of a country.

Answer:

- National income figures do not reflect the size of the country’s population, etc. If the national income of the country is increasing, even then, the level of welfare can be lowered, if the population is growing at a much faster rate.

- There may be a higher national income due to the concentration of some resources in the country. For example, due to abundant sources of oil, many Arab countries have high national income, but most of their population is lagging behind.

- National income is not an account for the price level. People can earn, but due to high prices, they are not able to maintain high level of life. The national income is obviously an insufficient index to this extent.

- Higher national income of the country can be due to some very rich businessmen like Ambani, Tata, etc. In such a situation, some people say that 20% of will have a great life, while 80% of people will continue to struggle because they only have to give 20% of GNP.

- National income in the country also does not indicate the level of employment. People will not be in a position to enjoy a high level of life if the unemployment level is very high in the economy.

- National income also does not consider the structure of manufactured goods. If the goods produced in a country include protective goods such as radars, war planes, etc., then higher national income will not increase welfare.

- Increase in national income will lead to industrialization and urbanization which will increase the problem of air, water and noise pollution. This, in turn, causes environmental degradation, which greatly harms the welfare of the society. Thus, GDP is not directly related to economic welfare, and an increase in GDP does not necessarily reflect this growth in the economic prosperity of the people.