Rajasthan Board RBSE Class 12 Economics Chapter 23 Government Budget and Economy

RBSE Class 12 Economics Chapter 23 Practice Questions

RBSE Class 12 Economics Chapter 23 Multiple Choice Questions

Question 1.

Balanced budget means :

(a) Total revenue > Total expenditure

(b) Total revenue < Total expenditure

(c) Total revenue = Total expenditure

(d) Total income = 0

Answer:

(c)

Question 2.

Which one is not an item of revenue receipts ?

(a) Tax income

(b) dividends

(c) Grants

(d) Non-tax revenues

Answer:

(c)

Question 3.

To reduce the purchasing power of the public, the main instrument of the government is :

(a) Rebate in taxation

(b) Imposition of new taxes

(c) Increasing Government Expenditure

(d) Providing subsidy

Answer:

(b)

Question 4.

The budget in which past expenses are not included is :

(a) General budget

(b) Deficit budget

(c) Supplementary Budget

(d) Zero-Base Budget

Answer:

(d)

Question 5.

Whose supremacy is proved by passing of budget by the parliament every year?

(a) President

(b) Prime Minister

(c) Parliament

(d) Finance Minister

Answer:

(c)

RBSE Class 12 Economics Chapter 23 Very Short Answer Type Questions

Question 1.

Revenue receipts are divided into two parts. Name them.

Answer:

- Tax revenues and

- Non-tax revenues.

Question 2.

Write the formula to find out revenue deficit.

Answer:

Fiscal deficit = Total expenditure (Revenue expenditure + Captal expenditure) – Total receipts other than borrowings (Revenue receipts + capital receipts other than borrowings).

Question 3.

Write down the period of budget in India.

Answer:

Period of budget in India is from Is 1st April to 31st March.

Question 4.

Who is the pioneer of zero-based budget ?

Answer:

The pioneer of zero based budget is Teter A. Pyer” of America.

RBSE Class 12 Economics Chapter 23 Short Answer Type Questions

Question 1.

What do you mean by general budget ?

Answer:

General budget is also called traditional budget. The main objective of this type of budget is to establish the financial control of legislature on executive. In other words, to control government expenses rather than inducing fast development. This budget includes expenditure done on wages and salaries, instruments, machines, etc.

Question 2.

Why has budget been compared with a magic box ? Explain.

Answer:

The origin of the word ‘Budget’ is traceable to the French word “Bougette”, which means a small leather bag. In 1733, in England, the word ‘budget’ was used to denote ‘a magic box’. Budget is a statement of the estimates of the Government Receipts and Government Expenditure during the period of financial year. The contents of budget are kept secret till it is not presented before the parliament of a country. Statements are kept in a leather bag which is opened in front of parliament. Therefore, budget has been compared with a magic box which is opened in front of the parliament.

Question 3.

What are surplus budgets ?

Answer:

When Government Receipts are more than the Government Expenditure in the presented budget, the budget is said to be a Surplus budget. In other words, a surplus budget implies a situation wherein the Government Revenue is in excess of Government Expenditure.

Symbolically : Surplus budget = Estimated government receipts > Estimated government expenditure.

Question 4.

What do you mean by primary deficit ?

Answer:

Primary deficit is the difference between fiscal deficit and interest payment. It is estimated as under :

Primary deficit = Fiscal deficit – Interest Payment

PD = FD – IP

(Here, PD = Primary deficit, FD = Fiscal deficit, IP = Interest payment)

In, other words, primary deficit indicates government borrowings on account of current year expenditure and current year receipts of the government.

Question 5.

If Total Revenue Deficit is ₹ 700 crores and Total Revenue Expenditure is ₹ 800 crores, calculate Revenue Receipts.

Answer:

Revenue Deficit = 700 crore

Revenue Expenditure = 800

scrore Revenue Receipts = ?

Revenue Deficit = Revenue Expenditure – Revenue Receipts

Revenue Receipts = Revenue Expenditure – Revenue Deficit

= ₹ 800 crore – ₹ 700 crore = ₹ 100 crore.

Therefore, Revenue receipts is ₹ 100 crore.

RBSE Class 12 Economics Chapter 23 Essay Type Questions

Question 1.

What do you understand by budget deficit ? Discuss its different concepts.

Answer:

Budget deficit (also called government deficit) refers to a situation, in which Budget Expenditures of the government are greater than the Budget Receipts.

Budget Deficit = Total Expenditure – Total Receipts

With reference to the budget of the government of India, there are three important types of Budget Deficit. These are :

- Revenue Deficit

- Fiscal Deficit

- Primary Deficit

According to Prof Dalton, “A budget deficit exhibits excess of expenditure on income in a given period of time.”

(i) Revenue deficit: Revenue deficit is related to the Revenue Expenditure and Revenue

Receipts of the government. This does not include items of Capital Receipts and Capital Expenditure. Thus, revenue deficit is the excess of Revenue Expenditure over Revenue receipts.

RD = RE – RR, when RE > RR

(Here, RD =; Revenue Deficit, RE = Revenue Expenditure; RR = Revenue Receipts)

(ii) Fiscal deficit : Fiscal deficit is an estimated accounting for all the Receipts and Expenditures of the government. Fiscal deficit is the excess of Total Expenditure (Revenue + capital) over Total Receipts (Revenue + Capital other than borrowings). It is estimated as under :

Fiscal deficit = Total expenditure (Revenue expenditure + capital expenditure) – Total receipts other than borrowings (Revenue receipts + capital receipts other than borrowings)

FD = BE – BR other than borrowing, where BE > BR other than borrowings

(Here, FD = Fiscal deficit, BE = Budget expenditure, BR = Budget receipts)

(iii) Primary Deficit : Primary deficit is the difference between Fiscal Deficit and Interest Payment. It is estimated as under :

Primary Deficit = Fiscal Deficit – Interest Payment PD = FD – IP

(Here, PD = Primary deficit, FD = Fiscal deficit; IP = Interest payment)

In other words, primary deficit indicates government borrowings on account of current year expenditures and current year receipts of the government.

Question 2.

While defining the budget, explain its importance.

Answer:

The origin of the word ‘Budget’ is traceable from the French word “Bougette”, which means a small leather bag. In 1733, in England, the word “budget’ was used to denote a magic box. Budget is a statement of the estimates of the Government Receipts and Government Expenditure during the financial year. Thus, the government budget is basically an annual exercise relating to Revenue and Expenditure policy of the government. By managing the various components of budgetary revenue and budgetary expenditure, the government tries to achieve economic stability along with a faster rate of GDP growth.

Importance of budget : The main objective of budget is to provide direction to the economy of the country. The economy of country is affected by the budget of the government. The main objectives of the budget are as follows :

Objectives of Budget

- Economic growth has been the main objective of all the governments of all countries at all times. By government budget, not only development is affected, but direction of development is also determined by the budget.

- Budget has an important role in increasing production. Government may grant tax rebate and other incentives like tax holidays to boost up production.

- Normally, with the help of budget, government levies new taxes and borrows from the public to reduce the purchasing power for controlling price level.

- Accelerating the economic and social development of the country and redistribution of income and wealth is also an objective of the budget of the country.

- To provide direction to the level of production and structure of production. Tax concessions and incentives are helpful in promotion of production.

- By regulating the provisions of budget, control on inflation and deflation is done. All these are necessary for economic stability.

- The objective of welfare state is attained through budget.

- Various tasks such as prevention of economic inequality, implementation of various policies for social security, formation of schemes for economic development, etc. are performed through provisions made by the budget.

From the above definitions, it is clear that budget has two sides. On one side, there is expected revenue of government, and on the other side, expected expenditure of the government. In a democratic set up, government presents the budget in the parliament and after its approval the works are performed as per its proposals.

Question 3.

What do you mean by Revenue Receipts and Revenue Expenditure ? Explain.

Answer:

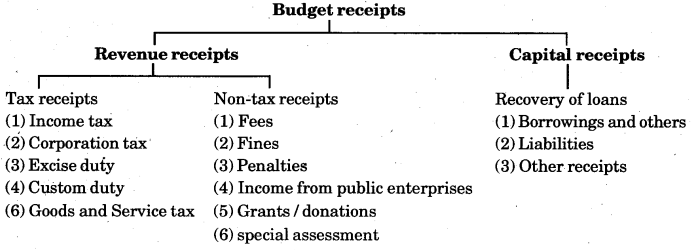

Budget receipts refer to the estimated money receipts of the government from all sources during the fiscal year. Broadly, the budget receipts are classified as :

(a) Revenue receipts

(b) Capital receipts

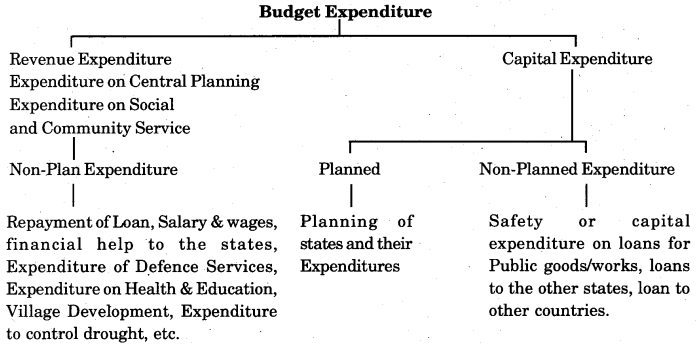

Budget expenditure refers to an estimated expenditure of the government relating to its development as well as non-development programmes during the fiscal year. Revenue budget of government has the following two broad divisions :

(a) Revenue Receipts

(b) Revenue expenditure

Here, we wll discuss revenue receipts and revenue expenditure :

(a) Revenue receipts : Revenue receipts of the government may be defined as those money receipts which do not create a liability for the government and also do not lead to reduction in assets of the government. Revenue Receipts are further classified into Tax Receipts and Non-Tax Receipts.

Tax receipts include-income tax, corporation tax, gift tax, customs duty, etc. Non-tax receipts include fees, fines, grants, special assessment, income from public enterprises, etc.

(b) Revenue expenditure : Revenue expenditure refers to an estimated expenditure of the government in a fiscal year which does not create assets or cause a reduction in liabilities. Revenue expenditure includes wages bill of the government, interest payments, expenditure on subsidies, defence purchases, etc.

Question 4.

What do you understand by budget ? Why is gender budget useful ?

Answer:

The origin of the word ‘Budget’ is traceable to the French word “Bougette”, which means a small leather bag. In 1733, in England, the word ‘budget’ was used to denote a magic box.

Budget is a statement of the estimates of the Government Receipts and Government Expenditures during the period of financial year. Thus, the govenment budget is basically an annual exercise relating to the Revenue and Expenditure policy of the government.

Gender budgeting is a way for government to promote equality though fiscal policy. Government makes provision of definite amount in context to schemes and programmes for women welfare and development and for promoting women empowerment every year in the budget. The provisions of budget affect men and women differently.

RBSE Class 12 Economics Chapter 23 Other Important Questions – Answers

RBSE Class 12 Economics Chapter 23 Multiple – Choice Questions

Question 1.

Fiscal policy includes :

(a) Public expenditure

(b) Tax

(c) Deficit financing

(d) All of these

Answer:

(a)

Question 2.

The origin of the word ‘budget’ is from :

(a) Bougette

(b) Budget

(c) Buddet

(d) Buckett

Answer:

(a)

Question 3.

Which of the following is a non – tax receipt ?

(a) Gift tax

(b) Sales tax

(c) Donations

(d) Excise duty

Answer:

(c)

Question 4.

By which medium are the government incomes, expenses and loans estimated ?

(a) Budget

(b) Fiscal policy

(c) Monetary policy

(d) None of these

Answer:

(a)

Question 5.

Who presents the budget in the parliament ?

(a) Prime Minister

(b) President

(c) Home Minister

(d) Finance Minster

Answer:

(d)

Question 6.

Which Finance minister presented the 2017-18 Budget ?

(a) Rajnath Singh

(b) Suresh Prabhu

(c) Arun Jaitley

(d) Amit Shah

Answer:

(c)

Question 7.

A budget is a balanced budget when :

(a) Total expenditure = Total receipts

(b) Total expenditure < Total receipts

(c) Total expenditure > Total receipts

(d) None of these

Answer:

(a)

Question 8.

(a) Total expenses > Total receipts

(b) Total expenses < Total receipts

(c) Total expenses = Total receipts

(d) None of these

Answer:

(a)

Question 9.

Time of financial year is :

(a) 1st April to 31st March

(b) 1st january to 31st December

(c) 1st July to 30th June

(d) 1st february to 31st January

Answer:

(a)

Question 10.

Formula of revenue defecit, is :

(a) Revenue expenses – Revenue receipts

(b) Revenue receipts – Revenue expenses

(c) Revenue receipts + Revenue expenses

(d) Revenue receipts × Revenue expenses

Answer:

(a)

RBSE Class 12 Economics Chapter 23 Very Short Answer Type Questions

Question 1.

What do you mean by propotionate tax ?

Answer:

The tax imposed in the ratio of Income is called propotionate tax.

Question 2.

State any one objective of government budget.

Answer:

Through its revenue and expenditure policy presented in the budget, the government strives to achieve high rate of GDP growth and economic stability.

Question 3.

What is the period of financial year in India ?

Answer:

1st April to 31st March.

Question 4.

What do you mean by lump-sum tax ?

Answer:

Those taxes that are not dependent upon the Income are called lump-sum tax.

Question 5.

What is the effect of tax on disposable income and consumption ?

Answer:

Both Disposable income and consumption decrease due to the levying of tax.

Question 6.

What is meant by budget?

Answer:

It is a statement of expected Receipts and Expenditure of the government over the period of a financial year, from April 1 to March 31st.

Question 7.

Define balanced budget.

Answer:

Balanced budget is that budget in which Government Receipt is equal to the 1 Government Expenditure.

Question 8.

Define surplus budget.

Ans.

Surplus budget is that budget in which Government Receipts are more than the Government Expenditure.

Question 9.

Define Deficit Budget.

Answer:

Deficit budget is the situation when the Total Expenditure exceeds the Total Receipts of government.

Question 10.

What is Value Added Tax ?

Answer:

Value added tax is an indirect tax which is imposed on ‘value added’ at the various stages of production.

Question 11.

Why is Payment of Interest a Revenue Expenditure ?

Answer:

Payment of interest is treated as a Revenue Expenditure because it neither reduces liability of the payer nor adds to his assets.

Question 12.

What are the sources of government loans ?

Answer:

Following are the sources of government loans:

- General public

- Reserve Bank of India

- Rest of the world.

Question 13.

If primary deficit is ₹ 6900 and interest payment is ₹ 600, then deficit is.

Answer:

Deficit = Primary deficit + interest payment

= ₹ 6900 + ₹ 600

= ₹ 7500.

Question 14.

A government budget shows a primary deficit of Rs. 4,400 crore. The revenue expenditure on interest payment is ₹ 400 crore. How much is the fiscal deficit ?

Answer:

Primary deficit = Fiscal deficit – Interest payment

₹ 4,400 crore = Fiscal deficit – ₹ 400 crore

Fiscal deficit = Primary deficit + interest payment

= 4,400 crore + ₹ 400 crore Fiscal deficit

= ₹ 4,800 crore.

Question 15.

What is meant by public income (P).

Answer:

Income received by the state is called public income (P).

Question 16.

What do you mean by grants?

Answer:

Financial help given by a state to another state is called grant.

Question 17.

Write two features of tax.

Answer:

- It is a compulsory payment.

- It is not related with profit.

Question 18.

Write two objectives of tax.

Answer:

- Revenue receipts

- Regulation of economy.

Question 19.

State two limitations of Progressive tax.

Answer:

- Their base is arbitary.

- They have an unfavourable effect on capital accumulation.

Question 20.

What is a specific tax ?

Answer:

The tax imposed according to the quantity or weight of items is called specific tax.

Question 21.

What was the idea of J. B. Say on Public expenditure ?

Answer:

He believed that the level of Public expenditure and taxes should be minimum.

Question 22.

What do you mean by Public Expenditure ?

Answer:

Expenditure done by central* state and local governments is called public expenditure.

Question 23.

What is meant by Production Expenditure ?

Answer:

The expenditure through which there is an increase of National Income, directly or indirectly.

Question 24.

What is meant by Tax evasion ?

Answer:

Situation where one gets freedom from tax liability without even paying the amount.

Question 25.

What should be the tax rate in case of elastic demand of Income ?

Answer:

The tax rate should be low.

Question 26.

Which tax policy lessens the dissimilarity of Income ?

Answer:

Direct Progressive tax rate policy.

Question 27.

State two objectives of public loan.

Ans.

- To fulfil the Public construction works.

- Optimum utilization of resources.

Question 28.

What is the effect of Public loans on Private Sector ?

Answer:

Favourable effect.

Question 29.

What do you mean by Debt repudiation ?

Answer:

Not paying the actual amount as well as the interest amount of loan.

Question 30.

What is loan conversion ?

Answer:

It means converting old loans into new loans.

Question 31.

Who presents the Budget in the parliament ?

Answer:

Finance Minister.

Question 32.

What was the special point in the 2017-18 Budget ?

Answer:

2017-18 budget also included the Rail Budget for the first time.

Question 33.

When does Finance Minister present the budget in the parliament ?

Answer:

On the last day of February.

Question 34.

Write the full form of FRBM Act.

Answer:

Fiscal Responsibility and Management Act.

Question 35.

What is progressive tax ?

Answer:

Progressive tax is that tax that causes relatively less real burden on the poor and more on the rich, (or – that tax whose rate increases with increase in income.)

Question 36.

How is revenue deficit calculated ?

Answer:

Revenue deficit = Revenue expenses – Revenue receipts.

Question 37.

Write the main elements of fiscal policy.

Answer:

(a) Tax

(b) Public expenditure

(c) Public debt.

Question 38.

Write the formula for primary deficit.

Answer:

Total Primary deficit = Total Fiscal deficit – Net Interest liability.

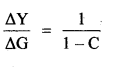

Question 39.

State the formula to find out the Government Expenditure

Answer:

Question 40.

State the formula of tax multiplier.

Answer:

![]()

Question 41.

Is Tax multiplier positive or negative ?

Answer:

Tax multiplier is negative.

Question 42.

What is the main item of capital receipts ?

Answer:

Main item of capital receipts is public debt.

Question 43.

Define non-tax receipts.

Answer:

Income received from sources other than tax.

Question 44.

State one characteristic of Revenue Receipts.

Answer:

There is no decrease in financial assets through Revenue Receipts.

Question 45.

What is the effect of tax on disposable Income and consumption?

Answer:

They both decrease.

Question 46.

Which is smaller – Government Expenditure multiplier or tax multiplier?

Answer:

Government Expenditure Multiplier is smaller.

Question 47.

How is Budget deficit financed ?

Answer:

It can done through imposition of taxes, taking loans or printing currency notes.

Question 48.

What does Revenue deficit depict ?

Answer:

It states the excess government Revenue Expenditure over Revenue receipts.

RBSE Class 12 Economics Chapter 23 Short Answer Type Questions (SA-I)

Question 1.

Define tax.

Answer:

Tax is a compulsory payment to the government. In this, the tax payers cannot expect any direct benefits in return.

Question 2.

What is Direct tax ?

Answer:

A direct tax is that tax the final burden of which falls on that very person who is liable of paying it to the government.

Question 3.

What is an Indirect tax ?

Answer:

Indirect tax is a tax on goods and serivces. Those who are liable to pay this tax, need not bear the final burden of this tax.

Question 4.

What is Progressive tax ?

Answer:

Progressive tax is a tax that causes relatively less real burden on the poor and more on the rich (its rate increases proportionately with income).

Question 5.

What is value added tax ?

Answer:

Value added tax is an indirect tax which is imposed on ‘value addition’ at the various stages of producton.

Question 6.

Define regressive tax.

Answer:

Regressive tax is a tax that causes relatively more real burden on the poor and less on rich.

Question 7.

What is Government budget ?

Answer:

Government budget is a statement of the estimates of the Government Receipts and Government Expenditure during the period of financial year. It unveils/reveals fiscal policy of the government, focusing on growth and stability of the economy.

Question 8.

Write two objectives of government budget.

Answer:

Following are the two objectives of government budget:

- High rate of GDP growth: Through its revenue and expenditure policy, the government strives to achieve a high rate of GDP growth. It makes investment expenditure on infrastructure.

- Balanced Regional growth: While allocating funds for infrastructural development, focus is placed on the development of backward regions of the country.

Question 9.

In government budget, define Revenue deficit.

Answer:

Revenue deficit in government budget shows excess of Revenue Expenditure over Revenue Receipts.

Revenue Deficit = Revenue Expenses – Revenue Receipts

Question 10.

What do you mean by fiscal deficit ?

Answer:

Fiscal deficit is the excess of Total Expenditure over Total Receipts. It is estimated as under:

Fiscal deficit = Total expenditure – Total receipts other than borrowings.

Question 11.

Define Primary Deficit.

Answer:

Primary Deficit is the difference between Fiscal Deficit and Interest Payment. It is estimated as under:

Primary deficit = Fiscal deficit – Interest payment

PD = FD – IP

Primary deficit indicates government borrowing on account of current year expenditure and current year receipts of the government.

Question 12.

What do you mean by Revenue Receipts ?

Answer:

Revenue receipts are those money receipts which do not create a liability for the government and also do not lead to reduction in assets of the government.

Question 13.

What do you mean by Capital Receipts.

Answer:

Capital receipts are those money receipts of the government which either create a liability for the government or cause a reduction in its assets.

Question 14.

What do you mean by Capital Expenditure ?

Answer:

Capital expenditure refers to the estimated expenditure of the government in a fiscal year which creates assets or causes a reduction in liabilties.

Question 15.

What do you mean by plan expenditure ?

Answer:

Planned expenditure refers to that expenditure which relates to the specified plans and programmes of development and assistance of the central government to the state governments. It includes both Revenue Expenditure and Capital Expenditure.

Question 16.

What do you mean by non-plan expenditure ?

Answer:

Non-planned expenditure refers to the expenditure which is not related to the specified plans and programmes of development, and is also not related to the assistance of the central government to state governments.

Question 17.

Why is recovery of loans classified as capital receipts ?

Answer:

The central government offers loans to the state governments to cope up with the emergent situations. When these loans are recovered, assets of the government are reduced. Accordingly, these are classified as Capital Receipts.

Question 18.

Why is Payment of Interest classified as Revenue Expenditure?

Ans.

Payment of interest does not create any asset for the government and also does not cause any reduction in liability of the government. Therefore, it is classified as Revenue Expenditure.

Question 19.

Why is expenditure on subsidies termed as an important item of Revenue Expenditure ?

Answer:

Expenditure on subsidies do not cause any reduction in liability of the government and also does not create any asset for the government. Revenue expenditure refers to the estimated expenditure of the government in a fiscal year which does not create assets or causes a reduction in liablities. Therefore, expenditure on subsidies is termed as an important item of Revenue Expenditure.

Question 20.

Write the objectives of fiscal policy.

Answer:

Following are the objectives of fiscal policy :

- Contributing resources for economic development.

- Allocation of resources

- Removing the inequalities does in distribution of income and wealth.

Question 21.

Why is tax received by government not considered as Capital Receipt ?

Answer:

Taxes received by the government do not create a liability for the government and also do not cause reduction in assets of the government which are two characteristics of Capital Receipts. Therefore, tax received by government is not considered as capital receipt.

Question 22.

Why payments of loans is called Capital Expenditure?

Answer:

Payment of loans is said to be a capital expenditure because it creates assets for the government and also causes reduction in liabilities of the government.

Question 23.

Differentiate between public goods and private goods.

Answer:

Those goods whose benefit is for everyone are called public goods, like roads and hospitals. Private or personal goods are those goods whose benefit is not for the public but for the individuals, like personal car.

Question 24.

What do you mean by Capital Expenditure ?

Answer:

Capital Expenditure refers to the estimated expenditure of the government in a fiscal year which creates assets or causes a reduction in liabilities, like-expenditure on land and building, purchase of shares, etc.

Question 25.

What do you mean by non-development expenditure?

Ans.

When government spends on government services, it is termed as non-development expenditure.

For example : expenditure for administration and expenditure for defence equipment.

Question 26.

Write two characterstics of taxes’.

Answer:

Following are the two characteristics of taxes :

- It is a payment given by public to the government which is compulsory.

- Payments received by taxes is used for social welfare and for public benefit.

Question 27.

What is the significance of measuring fiscal deficit ?

Answer:

The significance of measuring fiscal deficit is that it reflects total borrowings of the government during the financial year. Accumulated borrowings over the year reflect accumulated burden of National debt which is to be borne by the future generations.

Question 28.

Give one point of difference between Revenue Expenditure and Capital Expenditure.

Answer:

Revenue expenditure does not create government assets, while capital expenditure creates government assets.

RBSE Class 12 Economics Chapter 23 Short Answer Type Questions (SA-II)

Question 1.

What do you mean by Plan expenditure and Non-plan expenditure ? Explain.

Answer:

Plan expenditure refers to that expenditure which relates to the specified plans and programmes of development and assistance of the central government to the state governments. Non-plan expenditure refers to the expenditure which is not related to the specified plans and programmes of development, and it is also not related to assistance given by central government to the state governments.

Question 2.

Write four measures to reduce budget deficit.

Answer:

- Government should work to reduce Government Expenditures.

- Government should work to increase Revenue Receipts.

- Government should work to increase Non-Tax Revenues.

- Government should disinvest those public companies which are running in loss.

Question 3.

Explain Government’s Capital Receipts and Capital Expenditures.

Answer:

Capital Receipts are those money receipts of the government which either create a liability for the government or cause a reduction in its assets. Examples of capital receipts are recovery of loans, borrowings, other liabilities and other receipts. Capital expenditure refers to the estimated expenditure of the government in a fiscal year which creates assets or causes a reduction in liabilities. Examples of capital expenditures are expenditure on land and building, expenditure on machinery and equipment, purchase of shares and loans by the central government to the state governments or state corporations.

Question 4.

Mention two measures of reducing Government Deficit.

Answer:

Following are the two measures of reducing government deficit:

- Disinvestment by way of selling its ownership of public enterprises.

- Government should try to receive more and more revenues with the Help of effective policies.

Question 5.

Explain ‘Balanced budget’, ‘Surplus budget’ and ‘Deficit budget’.

Answer:

- Balanced budget : A budget is said to be a balanced budget when estimated receipts (revenue and capital) are equal to the estimated expenditures.

- Surplus budget: When estimated receipts are more than estimated expenditure in the presented budget, the budget is said to be a Surplus Budget.

- Deficit budget: When estimated expenditure exceeds estimated receipts in the budget, the budget is said to be Deficit Budget.

Question 6.

Differentiate between Public goods and Personal goods.

Answer:

- Consumption or use public goods is done by public together and use of personal goods is done individually.

- In consumption of public goods arises the problem of freeloading, whereas in personal goods, if payment is not made by an individual, he will be restricted from using that good or product.

Question 7.

What do you mean by Government Budget ? How many types of government budgets exist ?

Answer:

Government budget is a statement of the estimates of the government receipts and government expenditure during the period of the financial year. It unveils / reveals fiscal policy of the government, focusing on growth and stability of the economy. There are two types of government budget:

- Revenue budget

- Capital budget

Question 8.

Differentiate between Revenue Budget and Capital Budget.

Answer:

Revenue budget, also called ‘revenue account’, includes ‘Revenue Receipts’ and ‘Revenue Expenditure’ of the government, or we can say that revenue account shows current receipts of the government and related expenditure.

Question 9.

What do you mean by Non-tax receipts ? Mention their sources.

Answer:

Non-tax receipts are those receipts which arise from sources other than taxes. There are three main sources of non-tax receipts in India :

- Interest receipts

- Income from public enterprises

- Foreign grants and donations.

Question 10.

Differentiate between Revenue Receipts and Capital Receipts.

Answer:

Revenue receipts are those money receipts which do not create a liability for the government and also do not lead to reduction in assets of the government.

Capital receipts are those money receipts of the government which either create a liability for the government or cause a reduction in its assets.

Question 11.

What is meant by tax ? Write down its characterstics.

Answer:

Tax is a compulsory payment made by an individual, household or a firm to the government without expectation of anything in return. Examples of tax are Income tax, Corporation tax, custom duty, excise duty and goods and service tax.

Question 12.

Write the main features of tax.

Answer:

Following are the main features of tax :

- Tax is a compulsory payment by the people of the country to the government.

- Revenues collected by tax is spent for public welfare and benefits.

- Tax is a mandatory payment. If not paid in time, fines are imposed.

Question 13.

What do you mean by direct and indirect tax ? Distinguish between them.

Answer:

Direct tax is the one, the final burden of which is borne by the person on whom it is imposed. For example, income tax is imposed on the income of a person and he himself bears its burden.

indirect tax is the one the final burden of which can be shifted to other persons. Goods and Service tax, excise duty, custom duty are the examples of indirect tax.

Direct taxes are compulsory to be paid, while Indirect taxes are not compulsory to be paid.

Question 14.

What are the objectives of imposing different taxes ?

Ans.

- Increasing the government income by Revenue Receipts.

- Maintaining the balance of international trade.

- Arrangement of capital for public welfare expenditure and for daily administration services.

- For the arrangement of national security.

Question 15.

How can the gulf between capital expenditure and capital receipts be reduced without borrowings ? Suggest two ways.

Answer:

- The government can resort to disinvestment, selling its stake in public sector enterprises.

- The government can sell its surplus land.

Question 16.

What is primary deficit ? What does it show ?

Answer:

Primary deficit is the difference between Fiscal Deficit and Interest Payment. In other words, primary deficit indicates government borrowings on account of current year expenditure and current year receipts of the government.

Primary deficit shows borrowing requirements of the government inclusive of Interest Payment on the accumulated National Debt.

Question 17.

What do you mean by fiscal deficit ?

Answer:

Fiscal deficit is estimated as the difference between Total Expenditure and Total Receipts (other than borrowings).

Fiscal deficit = Total expenditure – Total receipts (other than borrowings.)

Question 18.

Does non plan-expenditure contribute to the social welfare ?

Answer:

Yes, non-plan expenditure does contribute to the social welfare. Most of the non- planned expenditure consists of expenditure on subsidies and the maintenance of law and order in the country. Both these categories of expenditure are welfare-oriented.

Question 19.

What do you mean by Government Expenditure ?

Answer:

Expenditures on different items made by government in one financial year is called Government Expenditure. These are of two types – Revenue Expenditure and Capital Expenditure.

Question 20.

Write down the objectives of government expenditure.

Answer:

Following are the objectives of government expenditure :

- High rate of GDP Growth.

- Balanced regional growth.

- Allocation of resources.

- Redistribution of income and wealth.

Question 21.

Government raises its expenditure on producing public goods. Which economic value does it reflect? Explain.

Answer:

When the government raises its expenditure on producing public goods, it has two implications in term of its economic value. First, it raises the level of social welfare, and second, it is expected to generate employment, so that the growth process becomes inclusive.

Question 22.

What do you mean by Revenue and Capital Expenditure ?

Answer:

Revenue expenditure refers to the estimated expenditure of the government in a fiscal year which does not create assets or cause a reduction in liabilties. Capital expenditure refers to the estimated expenditure of the government in a fiscal year which creates assets or causes a reduction in liabilties.

Question 23.

What do you mean by plan and non-plan expenditure ?

Answer:

Plan expenditure refers to that expenditure which relates to the specified plans and programmes of development and the assistance of the Central government to the State governments. It includes both Revenue and Capital Expenditure.

Non-plan expenditure refers to the expenditure which is not related to the specified plans and programmes of development, as well as not related to the assistance of the Central Government to State Governments.

Question 24.

What do you mean by development expenditure and non-development expenditure ?

Answer:

Development expenditure are those expenses, which are made for the basic infrastructural development and for the public welfare programmes. For example, construction .of roads and hospitals.

Non-development expenditure are those expenses, which are made for the salaries of government employees, purchasing of defence equipments, payment of pension, etc.

Question 25.

How does public expenditure help in capital formation ?

Answer:

Government increases public expenditure by making Deficit Budget. By this, currency comes into the market and increases the public income. This income is used by the public for Consumption and Savings. The income which is left from consumption helps in the capital formation.

Question 26.

Can there be a Fiscal Deficit without a Revenue Deficit ?

Answer:

Obviously yes, because fiscal deficit is worked out by accounting for both the Revenue and Capital Receipts and expenditures of the government, so that, even when Revenue Receipts and revenue expenditure are in a state of balance, there could be an excess of Capital Expenditure over Capital Receipts, causing fiscal deficit.

Question 27.

What are the objectives of government for taking loans ?

Answer:

Government takes loans for :

- facing the economic crisis of the country.

- the production of goods for public consumption.

- optimum utilization of natural resources.

- capital requirements of development works.

- filling the temporary deficit of the government budgets.

Question 28.

Write two disadvantages of foreign loans.

Answer:

Following are the two disadvantages of foreign loans :

- Foreign loans’ burden is more than the internal loans since for their repayment important assets are mortagaged.

- When developing countries require loans, then foreign countries providing loans exploit the developing countries by putting pressure of demands.

Question 29.

Mention the important items of Revenue Expenditure.

Answer:

Following are the important items of revenue expenditure :

- Wage bill of the government

- Interest payment.

- Expenditure on subsidies

- Defence purchases.

Question 30.

Show government budget receipts with the help of a chart.

Answer:

Question 31.

Mention the important items of Capital Expenditure.

Answer:

Following are the important items of Capital Expenditure :

- Expenditure on land and building

- Expenditure on machinery and equipment

- Purchases of shares

- Loans by the central government to the state governments.

Question 32.

What do you mean by supplementary budget ?

Answer:

If amount approved in the budget gets exhausted even before 31st March, then, in such situation, the government submits a supplementary budget before the parliament and the additional amount is demanded.

Question 33.

Show the structure of government budget with the help of chart.

Answer:

Question 34.

What do you mean by ‘Fiscal discipline’ ?

Answer:

Fiscal discipline refers to a state of an ideal balance between Revenues and Expenditure of the government. It calls for a necessary check on the expenditure in view of the limited revenues of the government.

RBSE Class 12 Economics Chapter 23 Essay Type Questions

Question 1.

Define government budget. Explain its objectives.

Answer:

Government budget is a statement of the estimates of the Government Receipts and Government Expenditure during the period of the financial year. It unveils/ reveals fiscal policy of the government, focusing on growth and stability of the economy. Thus, the government budget is basically an annual exercise relating to revenue and expenditure policy of the government.

Following are the objectives of the government budget:

- Economic Growth : Economic growth has been the main objective of all countries at all times. It not only affects development, but also determines the direction of development.

- Increasing Production : Government may grant tax rebate and other incentives like tax holidays to boost up production.

- Controlling Price Level: With the help of budget, government levies new taxes and borrows from the public to reduce their purchasing power.

- Promotion of Production : To provide direction to the. level of Production and structure of Production, tax concessions and incentives are required.

- Welfare State : The objective of welfare state is achieved through budget.

- Economic Stability: By regulating the provision of budget, control on inflation and deflation is done.

Question 2.

Why are budgets made ? Explain budget on the basis of Revenue and Expenditure and also on the basis of equality.

Answer:

The budget unfolds the financial performance of the government over the past one year and the financial programmes and policies of the government for the next year. Budget is a description of what happened during the past one year. Focus is placed largely on the other part of the budget, describing programmes and policies of the government for the year to come. The programmes and policies of the government are summed up as budgetary policy, also called the ‘fiscal policy’ of the government. Thus, government budget is basically an annual exercise relating to revenue and expenditure policy of the government. By managing the various components of budgetairy revenue and budgetary expenditure, the government tries to achieve economic stability along with faster rate of GDP growth.

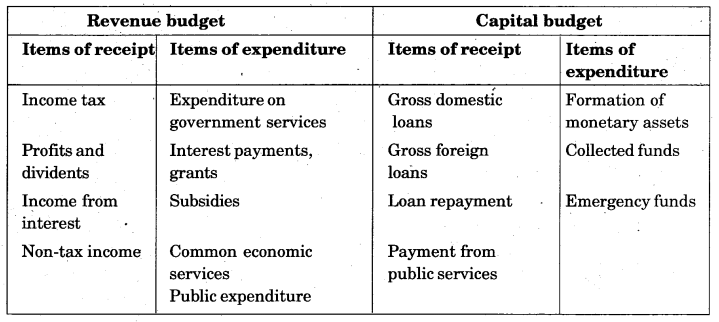

(i) Budgets on the basis of item : On the basis of nature of items, there are two types of budgets – revenue budget and capital budget:

(a) Revenue Budget : It is the first part of budget and it shows revenue income or revenue receipts. Revenue budget may be further divided into two parts : Revenue Receipts and Revenue Expenditure.

(b) Capital budget: It is shown in the second part of budget documents. All those items are included under this for which payment is essentially to be made. It is divided into two parts: Capital Receipts and Capital Expenditure.

Items of revenue budget and capital budget can be understood by the following table :

(ii) Budget on the basis of equality: On the basis of equality, there are three types of budgets:

(a) Surplus budget: When government receipts are more than government expenditure in the presented budget, the budget is said to be a surplus budget.

(b) Balanced budget : A government budget is said to be a balanced budget when government’s estimated receipts are equal to the government’s estimated expenditure.

(c) Deficit budget: When government’s estimated expenditure exceeds government’s estimated receipts in the budget, the budget is said to be a Deficit Budget.

Question 3.

Define tax. Explain different types of taxes.

Answer:

A tax is a compulsory payment made by an individual, household or a firm to the government without expecting to anything in return. The taxpayer cannot expect any service or benefit from the government in return. If a person fails to pay tax, then he is liable to face penal action.

Taxes are broadly classified as under :

(1) Progressive and regressive taxes.

(2) Value added and specific taxes.

(3) Direct and indirect taxes.

(1) Progressive and regressive taxes: Taxes are classified as progressive and regressive depending on the varying burden of taxation.

- Progressive tax: A tax is said to be progressive when the rate of tax increases along with an increase in income.

- Regressive tax : A tax is said to be regressive when it causes a greater real burden on the poor than the rich.

(2) Value-added tax and specific taxes: Taxes are classified as value-added tax or specific tax depending upon tax base.

- Value-added tax : Value added tax is an indirect tax which is imposed on ‘value addition’ at the various stages of production. Value addition refers to the difference between value of output and value of intermediate consumption.

- Specific tax: When taxes are levied on a commodity on the basis of its units, size or weight, it is called specific tax.

(3) Direct and Indirect Taxes: These taxes are classified into direct and indirect, depending on their final burden.

- Direct tax : A direct tax is one, the final burden of which is borne by the person on whom it is imposed. Example – Income Tax.

- Indirect tax: An indirect tax is one, the final burden of which can be shifted to other persons. Goods and service tax, excise duty, custom duty are examples of indirect tax.

RBSE Class 12 Economics Chapter 23 Numerical Questions

Question 1.

In one financial year, interest payment by the government is ₹ 80,000 and Fiscal Deficit is ₹ 1,25,000. Calculate Primary Deficit.

Answer:

Primary deficit = Fiscal deficit – Interest payment given

= 1,25,000 – 80,000

= 45,000.

Hence, Primary Deficit is ₹ 45,000.

Question 2.

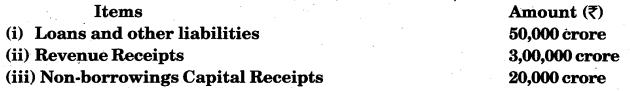

Calculate Fiscal Deficit from the following data:

Answer:

Fiscal deficit = Total expenditure

– Total receipts other than borrowings

= 2,50,000 – (15,0000 + 20,000)

= ₹ 80,000.

Question 3.

In one Government Budget, if Revenue Receipts is ₹ 500 crore, Capital Receipts is ₹ 300 crore and Revenue Deficit is ₹ 50 crore. Calculate Revenue Expenditure.

Answer:

Revenue deficit = Revenue expenditure – Revenue receipts

Revenue expenditure = Revenue deficit + Revenue receipts said

= ₹ 50 crore + ₹ 500 crore

= ₹ 550 crore.

Hence, Revenue Expenditure is Rs. 550 crore.

Question 4.

Calculate Budget Deficit from the following data.

Answer:

Budget deficit

= (Revenue expenditure + Capital expenditure) – (Revenue receipts + Capital receipts)

= (60,000 + 90,000) – (80,000 + 50,000)

= 1,50,000 – 1,30,000

= ₹ 20,000 crore.

Question 5.

Calculate Government Total Expenditure from the following data :

Answer:

Total expenditure of government

= Loans and other liabilities + Revenue Receipts + non-borrowings Capital Receipts

= ₹ 50,000 + ₹ 3,00,000 + ₹ 20,000 = ₹ 3,70,000 crore

Hence Total Expenditure is ₹ 3,70,000 crore.

Question 6.

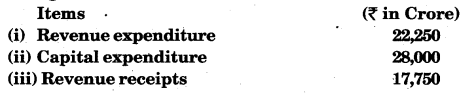

Calculate Revenue Deficit, Fiscal Deficit and Primary Deficit from the following data:

Answer:

(i) Revetiue deficit = Revenue Expenditure – Revenue Receipts

= 22,250 crore – 17,750 crore

= 4,500 crore

Hence, Revenue Deficit is ₹ 4,500 crore.

(ii) Fiscal deficit

= Revenue expenditure + Capital expenditure – Revenue receipts – Capital receipts

= 22,250 + 28,000 – 17,750 – 20,000

= 5,0250 – 17,750 – 20,000

= 12,500 crore

Hence fiscal deficit is ₹ 12,500 crore.

(iii) Primary deficit = Fiscal deficit – Interest payment

= 12,500 crore – 5,000 crore

= 7,500 crore.

Revenue deficit = ₹ 4,500 crore.

Fiscal deficit = ₹ 12, 580 crore.

Thus, Primary deficit = ₹ 7,500 crore.