RBSE Class 12 Accountancy Model Paper 1 English Medium are part of RBSE Class 12 Accountancy Board Model Papers. Here we have given RBSE Class 12 Accountancy Sample Paper 1 English Medium.

| Board | RBSE |

| Textbook | SIERT, Rajasthan |

| Class | Class 12 |

| Subject | Accountancy |

| Paper Set | Model Paper 1 |

| Category | RBSE Model Papers |

RBSE Class 12 Accountancy Sample Paper 1 English Medium

Time: 3.15 Hours

Maximum Marks: 80

General Instructions to the Examinees

- Candidate must write his/her Roll No. on the question paper compulsorily.

- All the questions are compulsory.

- Write the answer to each question in the given answer book only.

- The questions that have internal sections, write their answers together in continuity.

- I. The questions are divided into two sections- A and B.

II. Section A is compulsory for all.

III. Section B has two parts, and each part has seven questions. Candidate has to answer all the seven questions of either of the part. -

Section Question no Marks per Questions A 1-8 1 9-14 2 15-21 4 22-33 6 B 24-25 1 26-27 2 28-29 4 30 6 - Question number 22 (Section A) and 30 (Section B) have internal choices.

Section – A

Question 1.

State the provision given to active partner in concern of salary in the absence of partnership deed? [1]

Question 2.

What type of account is a revaluation account prepared at the retirement of a partner? [1]

Question 3.

State any one difference between sacrifice ratio and gain ratio? [1]

![]()

Question 4.

A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 3. B retires from the firm. What will be the gaining ratio between A and C. [1]

Question 5.

In which two circumstances compulsory dissolution happens? [1]

Question 6.

According to Sec. 54 which type of shares can be issued at a discount? [1]

Question 7.

Name the debentures which can be converted into equity shares? [1]

Question 8.

When does dissolution of joint venture happen? [1]

Question 9.

A, B and C are partners in a firm, sharing profits in the ratio of 3 : 2 : 1. D is admitted for 1/4th share in the firm. D acquires 1/2 of his share from A and remaining from B & C equally. Calculate Sacrificing Ratio and New Profit Sharing Ratio. [2]

![]()

Question 10.

State any four differences between joint venture and partnership? [2]

Question 11.

100 boxes costing ₹ 16,000 sent on consignment. Consignor paid ₹ 1,000 for railway freight, ₹ 2,000 for wages & consignee paid octroi ₹ 1,000 & godown rent ₹ 500 at the time of receiving the boxes. 85 boxes sold by consignor. Calculate the value of remaining unsold stock with consignor. [2]

Question 12.

X sent 500 items at @ ₹ 600 per item at invoice price which is 25% above the cost price. Consignee is allowed 20% above invoice price as additional commission. Consignee sold 400 items at ₹ 800 per item. Calculate overriding commission. [2]

Question 13.

How the amount received on legacies and life membership fees will be shown in Income and Expenditure Account and Balance Sheet of Non-trading organisation. [2]

Question 14.

Calculate the amount of medical relief fund, which will be shown in Income and Expenditure Account for the year ending 31st March, 2017 and the Balance Sheet on that date. [2]

1. Opening Balance of Medical Relief Fund ₹ 2,00,000

2. Donation received towards this fund during the year ₹ 70,000

3. Expenses paid for Medical Camp during the year ₹ 3,00,000

Question 15.

A, B and C are partners sharing profits in the ratio of 3 : 2 : 1. It was agreed that [4]

(1) C would get minimum share in profits ₹ 1,00,000.

(2) B made guarantee to the firm that he would earn minimum ₹ 1,50,000.

(3) Firm earned ₹ 5,40,000 for the current year, it included ₹ 1,20,000 earned by B. Prepare Profit & Loss Appropriation Account for distribution of profits among partners

Question 16.

X, Y and Z were partners in a firm. On 1st January, 2014 X retires and bis capital account shows a credit balance after all adjustments of ₹ 10,000. It is transferred to his Loan Account. First three years instalment of 73,000 each year including interest @ 10% p.a. on the outstanding remaining amount and the balance is paid including interest in the fourth year. Assuming accounts will be closed on 31st December every year. Prepare X’s loan Account [4]

![]()

Question 17.

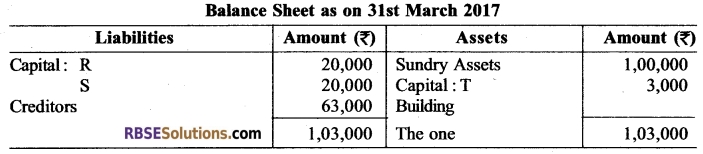

R, S and T are partners in a firm. Balance Sheet as on 31st March 2017 of the firm is as follows [4]

The firm is dissolved on 31st March 2017 due to T because insolvent. Nothing is realised from T. ₹ 40,000 is realised from the assets of the firm. Prepare necessary accounts on dissolution, when Garner Vs Murray rule applies. Loss on realisation is not brought in cash by the partners.

Question 18.

Under which headings and sub-heading will you show the following items in the Balance Sheet of a company. [4]

(i) Computer software

(ii) Loose tools

(iii) Provision for employee benefits

(iv) Unpaid dividend

(v) Building under construction

(vi) Public deposits

(vii) Guarantee given by the company

(viii) Acceptances.

Question 19.

Anil and Sunil entered into a Joint Venture sharing profits equally. Anil purchased goods worth ₹ 3 lakh under joint venture agreement, on which he paid storage rent and other expenses of ₹ 13,000 in cash. Sunil purchased goods worth ₹ 2,00,000 and paid consignment expenses ₹ 15,000. Goods are to be sold by Anil. They decided to pay 2% commission on sales to Anil. Anil sold all the goods for ₹ 6,00,000 and final payment is made to Sunil. Prepare Memorandum Joint Venture Account and Joint Venture with Sunil Account in the books of Anil. [4]

Question 20.

Lavanya of Jaipur consigned to Kush of Bhilwara 100 cases for ₹ 20,000 on cost. Consigner paid ₹ 1,000 railways freight, ₹ 2,000 wages. During the transit 10 cases were broken and remaining cases were received by Kush. He paid octroi ₹ 1,000, sales expenses ₹ 500, godown rent ₹ 500. Kush sold 80 cases at ₹ 250 per case. Commission @ 5% on sales is payable to consignee and remaining balance amount sent to consignor after deducting commission and expenses. Prepare consignment account in the books of Lavanya. [4]

![]()

Question 21.

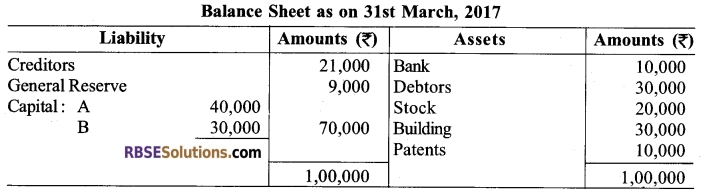

A and B are sharing profit in the ratio of 2 : 1. The Balance sheet as on 31st March 2017 is as follows [6]

They admitted C into partnership on 1 st April, 2017. New profit sharing ratio will be 3 : 2 : 1. C brings in proportionate capital after the following adjustments:

1. C brings ₹ 10,000 in cash as his share of Goodwill.

2. Building is valued at ₹ 35,000.

3. There is an old typewriter valued ₹ 2,000. It does not appear in the books of the firm. It is now to be recorded.

4. Patents are valueless.

Prepare Revaluation Account, Partners Capital A/c and the Balance Sheet of new form.

Question 22.

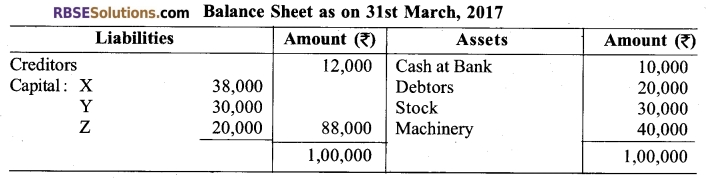

X, Y, and Z sharing profits in the ratio of 3 : 2 : 1. The Balance Sheet as on 31st March, 2017 is as follows :

Z retires on the above date and the new profit sharing ratio between remaining partners will be 5 : 4. Following terms were agreed :

1. Machinery is reduced by 10%.

2. Stock is reduced to ₹ 28,000

3. X and Y agreed that their capitals will be adjusted in their new profit sharing ratio, by bringing in or paying cash to the partners.

4. Goodwill of the firm is valued as ₹ 54,000 and adjustment in this respect be made without raising Goodwill A/c.

5. Z is paid ₹ 8,000 on the date of retirement in cash and the remaining amount is transferred to his loan account.

From the above information, prepare Revaluation Account, Capital Accounts and new Balance Sheet.

![]()

OR

S, R and T were partners in a firm. They distributed profits in the ratio of 2 : 2 : 1. As per provisions of the partnership deed, at the time of death of a partner his legal representative will be paid as follows:

1. Interest on capital will be paid @ 12% per annum.

2. Interest on Drawings will be charged @ 24% per annum.

3. Salary ₹ 18,000 per year will be paid.

4. Share in profits upto the date of death on the basis of previous year profits.

5. R died on 1st June, 2017. His capital was ₹ 60,000 on 31st March, 2017.

6. R draws ₹ 20,000 during the year from the firm.

7. Profit for the year ending 31st March, 2017 was ₹ 96,000.

8. A Joint Life Policy for ₹ 36,000 was taken by the firm, the premium of which is charged from Profit and Loss Account.

Prepare R’s Capital Account for calculating the amount payable to his legal representative

Question 23.

X company Issues 50,000 equity share of ₹ 10 each at a premium. The following amount is called by the company ₹ 4 (including ₹ 2 for premium) on application ₹ 1 on allotment, ₹ 3 on First call and Balance on final call (four months after first call). [6]

Amount due on application and allotment was daily received. One shareholder holding 1,000 shares could not pay the first call money in time. Another shareholder of 2,000 shares paid the final call money along with first call money. Interest on calls in advance and interest on calls in arrears is determined on the basis of table ‘F’ by the company.

Prepare journal entries in the books of company for the above transactions.

Section – B

Question 24.

State the difference between horizontal analysis and vertical analysis on the basis of time period. [1]

Question 25.

State any two names of active ratio. [1]

Question 26.

State any four limitations of financial statement. [2]

Question 27.

From the following informations, calculate operating ratio and operating profit ratio [2]

Revenue from operating ₹ 22,500, Revenue from operations return ₹ 2,500, cost of revenue from operation ₹ 10,000, Administrative expenses ₹ 1,700, Selling and distribution expenses ₹ 900, Depreciation ₹ 2,200.

![]()

Question 28.

Write the three sections of code of conduct in ethics explaining ethics in cash transaction. [4]

Question 29.

Write any four ethics in Accountancy. [4]

Question 30:

From the following information, calculate current ratio, quick ratio, Debt equity ratio proprietary ratio and solvency ratio.

Current liabilities ₹ 1,00,000; Capital ₹ 5,00,000; General reserve ₹ 1,00,000; Credit Balance of P & L Account ₹ 1,00,000; 10% Debentures ₹ 3,00,000; Non current Assets ₹ 7,00,000; Stock ₹ 2,00,000, Trade receivables ₹ 1,50,000; Cash and cash equivalents ₹ 50,000.

OR

From the following information calculate

1. Debt Equity Ratio, 2. Proprietary Ratio, 3. Solvency Ratio, 4. Interest Coverage Ratio

Long-term Borrowing- 5,00,000, Long-term Provisions- 7,50.000, Long-term Liabilities- 3,75,000,

Non-current Assets- 27,00,000, Current Assets- 6,75,000, Profit after Interest and Tax- 2,04,000, Rate of Income Tax- 40%, Interest on long-term Borrowings- 10%

Answer

Answer 1:

There is no such provision. So in the absence of partnership deed, no salary will be given.

Answer 2:

Its nature is nominal (unreal) account.

Answer 3:

Sacrifice ratio is calculated at the admission of a new partner while gain ratio is calculated at the death or retirement of a partner.

![]()

Answer 4:

Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio of A and C = 1 : 1

Answer 5:

- When all or all but one partner of the firm becomes insolvent.

- When business of the firm becomes unlawful.

Answer 6:

Sweat Equity Shares can be issued at a discount.

Answer 7:

Convertible Debentures.

Answer 8:

On the completion of a particular task or specific time (period).

Answer 9:

![]()

Answer 10:

Difference between Joint Venture and Partnership

| S. No. | Basis of Difference | Joint Venture | Partnership |

| 1 | Name | There is no need for firm name. | A partnership firm always has a name. |

| 2 | Objective | Its object is to do business for a specific time or task. | It is formed to carry on business. |

| 3 | Registration | Registration is not compulsory in joint venture. | Registration is compulsory in partnership. |

| 4 | Act | No specific act is there. | Partnership firm are governed by the Indian Partnership Act, 1932. |

Answer 11:

Unsold Boxes = 100 – 85 = 15 boxes

Answer 12:

Total Selling Price of 400 Items = 400 × ₹ 800 = ₹ 3,20,000

Invoice Price of 400 Items = 400 × ₹ 600 = ₹ 2,40,000

Excess Amount = ₹ 80,000

20% Overriding Commission of ₹ 80,000 = \(\frac{80,000 \times 20}{100}\) = ₹ 16,000

Answer 13:

Answer 14:

No Amount will be shown in Balance Sheet.

![]()

Answer 15:

Answer 16:

Answer 17:

Answer 18:

| Items | Heading | Sub-Heading | |

| (i) | Computer Software | Non-Current Assets | Fixed Assets Intangible Assets |

| (ii) | Loose Tools | Current Assets | Inventories |

| (iii) | Provision for E«v.oyee Benefits | Non-Current Liabilities | Short-term Provisions |

| (iv) | Unpaid Dividend | Current Liabilities | Other Current Liabilities |

| (v) | Building under construction | Non-Current Assets | Fixed-Assets-Capital work in progress |

| (vi) | Public deposits | Non-Current Liabilities | Long-term Borrowings |

| (vii) | Guarantee given by the company | Contingent liabilities and commitments (in notes to accounts) | — |

| (viii) | Acceptances | Current Liabilities | Trade Payables |

![]()

Answer 19:

Answer 20:

Answer 21:

Answer 22:

OR

Answer 23:

![]()

Answer 24:

Horizontal analysis requires comparative financial statement of two or more accounting periods while vertical analysis requires a statement of one period.

Answer 25:

- Stock turnover ratio.

- Trade receivable turnover ratio.

Answer 26:

- Financial statements are based on previous year data.

- These are based on accounting customs, concepts and individual decisions.

- Qualitative aspects are ignored.

- These are prepared on the basis of historical cost so do not consider the effect of changing value.

Answer 27:

Answer 28:

To make sure while accounting that entire accounting behaviour is legal and based on proper vouchers. The following points can be included in ethics of accounting behaviour:

1. In reference of cash received

- All cash received should be related to business.

- Entry should be based on counter file of deposit slip deposited in bank.

- Date and serial number should be mentioned on all the vouchers related to the cash received.

- All the vouchers should be signed by an authorised officer.

2. In reference of cash payment:

- Payment should be related to business.

- Record of each payment should be based on the issued printed receipt by receiver.

- All the payments should be authorised and signed by a senior officer of the organisation.

3. In reference of the goods:

- Reality of invoice should be checked at the time of purchase and sale of goods.

- It should be recorded on the basis of credit note and debit note related to purchase return and sales return.

- The amount related to the purchased and sold goods should be clearly explained.

![]()

Answer 29:

Various sources of Ethics: American ethics specialists George and John steever have stated the following ethics in Accountancy

- Philosophical System- Since ancient times, scholars have developed many philosophical systems of life and duty. These systems show different dimensions of ethical behaviour.

- Law System- The legal system of any country guides human behaviour in the society. Therefore, the rules of law are binding on the society.

- Religion – Every religion gives an expression of ethical behaviour to its followers. These teachings are considered as a very important and encouraging factor for ethical behaviour.

- Genetic Heritage – Biological evidences from the research done in modem Science suggest that the virtue of goodness, which is related to the moral conduct of a person, is his/her genetic heritage.

Answer 30:

OR

We hope the given RBSE Class 12 Accountancy Model Paper 1 English Medium will help you. If you have any query regarding RBSE Class 12 Accountancy Sample Paper 1 English Medium, drop a comment below and we will get back to you at the earliest.