RBSE Class 12 Accountancy Model Paper 4 English Medium are part of RBSE Class 12 Accountancy Board Model Papers. Here we have given RBSE Class 12 Accountancy Sample Paper 4 English Medium.

| Board | RBSE |

| Textbook | SIERT, Rajasthan |

| Class | Class 12 |

| Subject | Accountancy |

| Paper Set | Model Paper 4 |

| Category | RBSE Model Papers |

RBSE Class 12 Accountancy Sample Paper 4 English Medium

Time: 3.15 Hours

Maximum Marks: 80

General Instructions to the Examinees

- Candidate must write his/her Roll No. on the question paper compulsorily.

- All the questions are compulsory.

- Write the answer to each question in the given answer book only.

- The questions that have internal sections, write their answers together in continuity.

- I. The questions are divided into two sections- A and B.

II. Section A is compulsory for all.

III. Section B has two parts, and each part has seven questions. Candidate has to answer all the seven questions of either of the part. -

Section Question no Marks per Questions A 1-8 1 9-14 2 15-21 4 22-33 6 B 24-25 1 26-27 2 28-29 4 30 6 - Question number 22 (Section A) and 30 (Section B) have internal choices.

Section – A

Question 1.

What do you understand by the Partnership firm? [1]

Question 2.

State the method of profit distribution in case of death of a partner. [1]

Question 3.

Write down the formula to calculate Sacrifice Ratio.[1]

![]()

Question 4.

A, B and C are partners in a firm sharing profits in the ratio of [latexs=1]\frac{1}{4} : \frac{2}{5} : \frac{7}{20}[/latex] B retires and his share is taken by A & C in the ratio of 1 : 2. Calculate New profit sharing ratio & Gaining ratio. [1]

Question 5.

At the closing of firm, where is the amount received from the sale of uncharted properties mentioned? [1]

Question 6.

What is meant by floating capital? [1]

Question 7.

When does joint venture come to an exit? [1]

Question 8.

Premium receipt from the release of debentures is credited in which account? [1]

Question 9.

A, B and C are partners in a firm, sharing profits in the ratio of 3 : 2 : 1. D is admitted for 1/6th share in profits of the firm which he acquired in equal proportions from A, B & C. Calculate New Profit Sharing Ratio. [2]

![]()

Question 10.

Briefly comment on the joint venture. [2]

Question 11.

State two differences between Transfer and Sale. [2]

Question 12.

2,000 kg. Gur sent on consignment @ ₹ Rs. 20 per kg, 100 kg. became normal loss, 1,500 kg. goods sold by consignee. Calculate the value of unsold stock. [2]

Question 13.

How will we account for the sale of property while preparing income and expense account and financial statement. [2]

Question 14.

An institute has 1125 members, each giving a donation of ₹ 10 per year. Cash advance in the year starting is ₹ 3250 and at the year end is ₹ 3250. Unpaid donation at the beginning of year is ₹ 3250 and the donation received during the year is ₹ 10,000. Calculate the unpaid donation for the year ending. [2]

Question 15.

P, Q and Rare Partners, sharing profit in ratio 3 : 2 : 1. It was agreed that

(i) R would get minimum profit of ₹ 3,00,000

(ii) Q made guarantee to the firm that he would earn minimum ₹ 4,80,000. Firm earned ₹ 15,20,000 for the current year including ₹ 3,20,000 earned by Q. Prepare Profit & Loss Appropriation Account for distribution of profit among partners. [4]

Question 16.

A B & C are partners in a firm sharing profits in the ratio of 5 : 3 : 2. B retires and the goodwill of the firm is valued at ₹ 21,000. Pass necessary journal entries for treatment of goodwill. [4]

![]()

Question 17.

Write the rules for making a recovery account at the time of dissolution (breaking up) of the firm. [4]

Question 18.

Write down the name of five subtitles under the non-current assets title. [4]

Question 19.

Pradeep and Praveen agreed to perform purchase and sale of old scooters in a joint venture. They decided to share profit or losses equally. Praveen accepted bill of ₹ 20,000 drawn by Pradeep, which was discounted by Pradeep for ₹ 19,600 from bank.

Pradeep purchased scooters for ₹ 36,000. He paid ₹ 5,000 for repairs of the scooters and they were dispatched to Praveen for sale. Praveen paid ₹ 600 freight and ₹ 400 octroi on the receipt of scooters. Praveen sold all the scooters through an agent for ₹ 60,000. The agent charges for commission and sales expenses ₹ 4,200. Final settlement was completed between both parties.

Prepare Memorandum Joint Venture Account and Joint Venture with Praveen Account in the books of Pradeep. [4]

Question 20.

100 ton coal sent on consignment for ₹ 1,300 per ton at invoice price and ₹ 800 per ton at cost price and consignor paid ₹ 20,000. Agent sold 76 ton coal and paid ₹ 8,000 for sales expenses. It is informed that 5 ton coal is found less. Calculate the value of remaining stock with agent. [4]

Question 21.

Calculate the capital of Raj Club as on 1st April 2017, from the following information:

Building ₹ 25,000, outstanding Salary ₹ 1,800, Furniture ₹ 18,000, Cash in hand ₹ 30,700, Bank overdraft ₹ 3,400, Fixed Deposit ₹ 18,000, Outstanding subscription ₹ 3,600, Creditor for Sports Material ₹ 7,200, Subscription Received in advance for next year ₹ 4,800. [4]

![]()

Question 22.

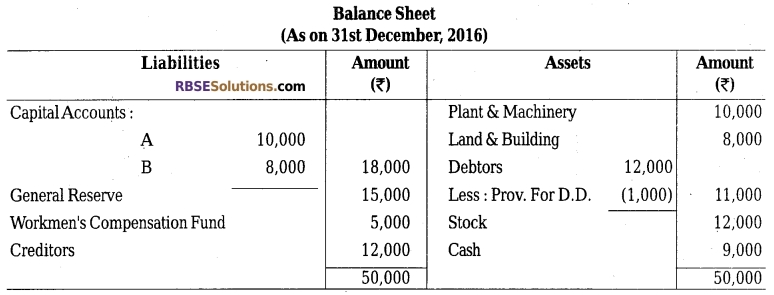

A and B are partners in a firm sharing profits in the ratio of 3 : 2. On 31st December, 2016 their Balance Sheet was as follows: [6]

They agreed to admit C into partnership for l/5th share of profits on the following terms: (i) Provision for doubtful debts be increased by ₹ 2,000.

(ii) The value of stock be increased by ₹ 4,000 and Land & Building be increased to ₹ 18,000.

(iii) The liability against workmen’s compensation fund is determined at ₹ 2,000.

(iv) C brought in as his share of goodwill ₹ 10,000 in cash,

(v) C would bring cash as would make his capital equal to 20% of combined capital of A& B, after the above revaluation and adjustments are carried out. Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the firm after C’s admission.

OR

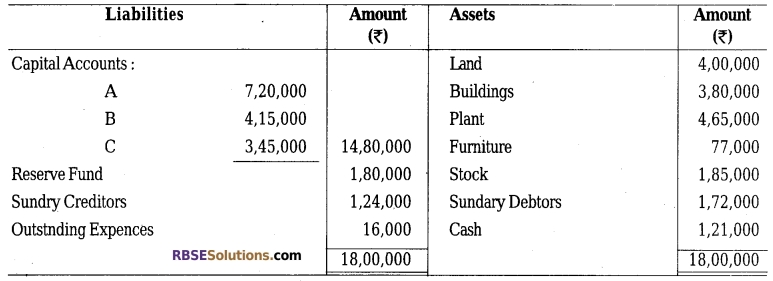

The Balance Sheet of A, B and C, who were sharing profits in the ratio of 5 : 3 : 2, is given below as on 31st March, 2017:

B retires on the above date and the following adjustments are agreed upon his retirement:

(a) Stock was valued at ₹ 1,72,000. ‘

(b) Furniture was undervalued by ₹ 3,000. ‘

(c) An amount of? 10,000 due from D was doubtful and a provision for the same was required.

(d) Goodwill of the firm was valued at ₹ 2,00,000.

(e) B was paid ₹ 40,000 immediately on retirement and the balance was transferred to his loan account.

(f) A and C were to share future profits in the ratio of 3 : 2.

Prepare Revaluation Account, Capital Accounts and Balance Sheet of the reconstituted firm. .

Question 23.

Rakesh Ltd. offered to public 12% debentures of ₹ 8,00,000, ₹ 100 each. Whole amount was payable on application on or before 1st May 2016. As per the terms of issue debentures interest was payable half yearly basis on 30th September and 31st March each year, after deducting income tax at the rate of 10%. Public offered to purchase 8,000 debentures. Company made allotment of debentures on 01st June 2016. Give journal entries in the books of the company for payment of debentures interest for the year 2016-17 and transferred it to Statement of Profit & Loss A/c. [6]

Section – B

Question 24.

What do you understand by the comparitive statement? [1]

Question 25.

How ‘items that are sold’ is calculated? [1]

![]()

Question 26.

If the total assets of a company ₹ 80,000, Non-current liability is ₹ 2,00,000 and current liability is ₹ 1,00,000,

calculate Debt Equity Ratio (2) Properitory Ratio. [2]

Question 27.

State any two characteristics of financial statement. [2]

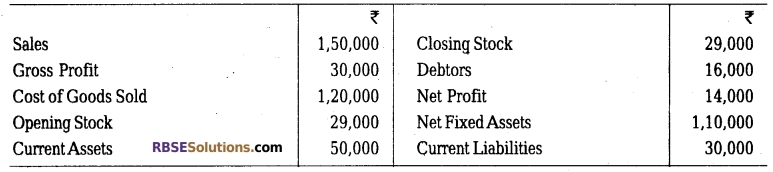

Question 28.

Make a profit & loss account from the following information [4]

Question 29.

What should be kept in mind, while accounting on a moral basis in relation to goods? [4]

Question 30.

A company had a liquid ratio of 1.5 and current ratio of 2 and inventory turnover ratio 6 times. It has total Gurrent assets of ₹ 8,00,000 in the year 2015. Find out annual sales if goods are sold at 25% profit on cost. [6]

OR

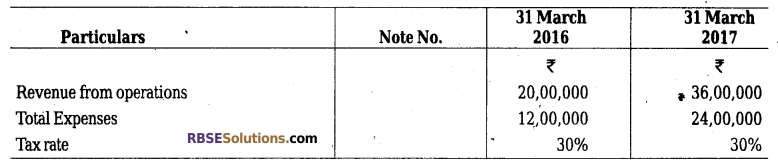

Calculate:

(i) Gross Profit Ratio

(ii) Fixed Assets Turnover Ratio

(iii) Return on Investment from the following information

![]()

We hope the given RBSE Class 12 Accountancy Model Paper 4 English Medium will help you. If you have any query regarding RBSE Class 12 Accountancy Sample Paper 4 English Medium, drop a comment below and we will get back to you at the earliest.